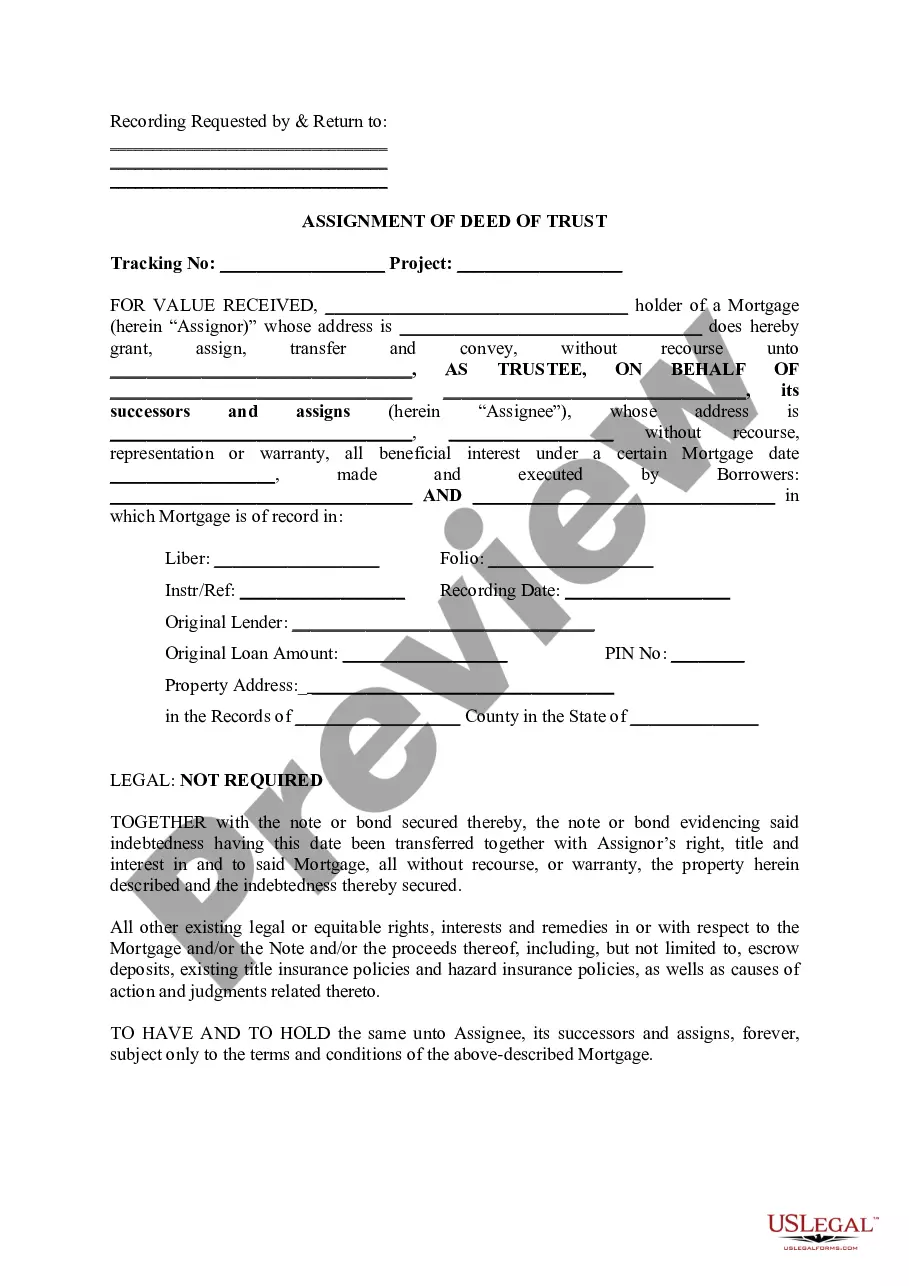

Maine Assignment of Deed of Trust

Description

How to fill out Maine Assignment Of Deed Of Trust?

Greetings to the largest repository of legal documents, US Legal Forms. Here, you will discover any template, including Maine Assignment of Deed of Trust documents, and save them (as many as you desire/require). Prepare official paperwork in just a few hours, instead of days or even weeks, without needing to spend a fortune on a legal expert. Obtain your state-specific document in just a few clicks and feel confident knowing that it was created by our state-certified legal experts.

If you’re already a registered user, simply Log Into your account and then click Download next to the Maine Assignment of Deed of Trust you wish to obtain. Since US Legal Forms is an online platform, you will always have access to your downloaded files, no matter which device you are using. Locate them within the My documents section.

If you haven't created an account yet, what are you waiting for? Follow the instructions below to get started.

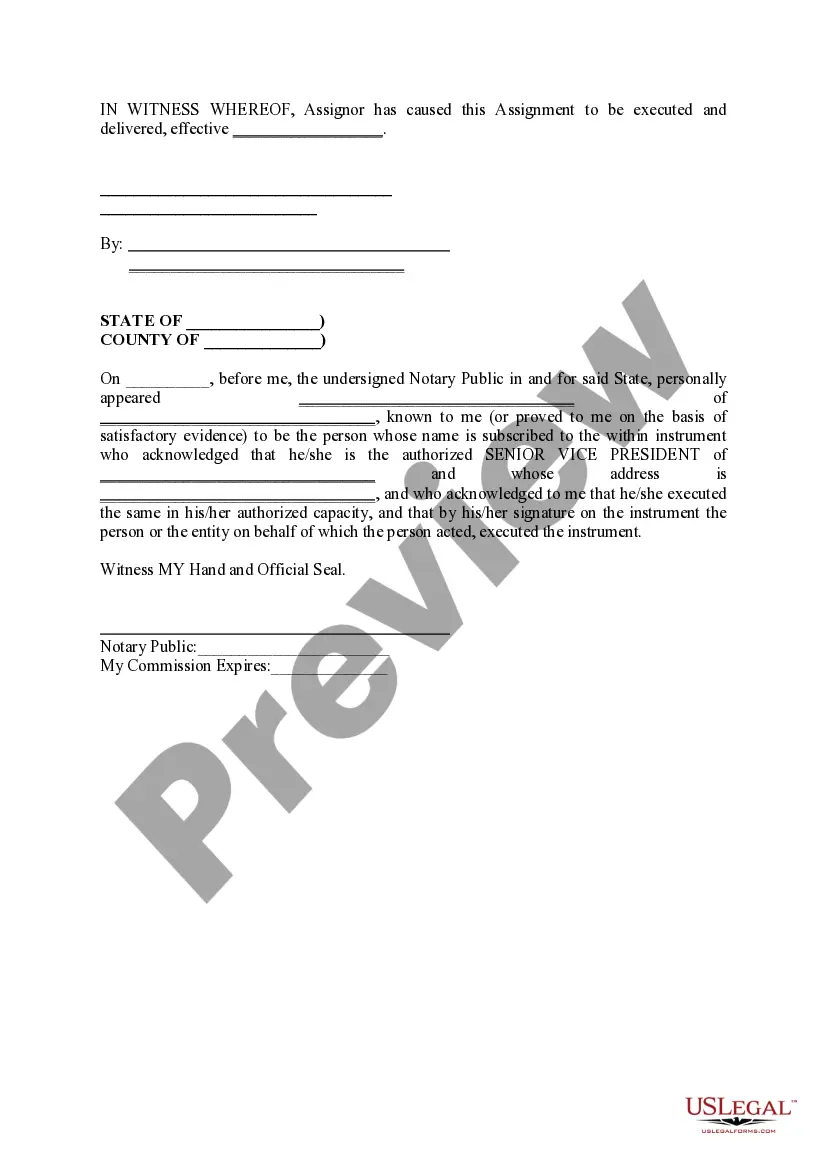

After completing the Maine Assignment of Deed of Trust, forward it to your attorney for confirmation. It’s an extra step but an essential one to ensure you are fully protected. Join US Legal Forms today and gain access to thousands of reusable templates.

- If this is a state-specific template, verify its validity in your residing state.

- Review the description (if provided) to see if it’s the right template.

- Explore additional content using the Preview feature.

- If the template meets all your needs, simply click Buy Now.

- To create your account, choose a pricing option.

- Utilize a credit card or PayPal account to subscribe.

- Download the document in your preferred format (Word or PDF).

- Print the document and fill it out with your or your business’s information.

Form popularity

FAQ

Giving the wrong legal address for the property or the wrong amount of the debt can render the deed unenforceable. In some cases, the error is easy to fix, and the court will rule the deed is enforceable.

An assignment of trust deed is a document that lenders use when they sell loans secured by trust deeds. While they can freely sell the promissory notes between themselves, the trust deeds that give them the right to foreclose have to be assigned with a legal document.

No. MERS, MERSCORP Holdings or the MERS® System are not document custodians and do not hold promissory notes or mortgage documents on behalf of lenders, servicers or investors. We are not responsible for keeping mortgage recordsthe servicer maintains the loan files.

An assignment of a deed of trust is simply the movement of the deed of trust from one party to another, a party that was not originally involved in the deed creation when the property was bought. A corporate assignment is simply an assignment of the deed of trust between different businesses.

Some owners are put off using solicitors duke to the deed of trust cost. Individuals can write out their own, and use someone else as a witness. However, this may have errors or not be a legally binding document. The investment of getting a deed of trust when buying a property is often worth it in the long term.

When your mortgage lender decides he wants to sell your mortgage loan to another lender, your mortgage lender will sign an assignment of deed of trust in favor of the new lender. This assignment gives the new lender the same lien on your property that your original lender had under the mortgage loan.

A Deed of Assignment refers to a legal document which an assignor states his willingness to assign the ownership of his property to the assignee. The Deed of Assignment is required to effect a transfer of property and to show the legal right to possess it.

If there's a deed of trust on a property, the lender can sell the property and pay off the loan. Whether your loan falls under the mortgage or deed of trust definition, you'll need to get approval from the lender before you sell your home for less than you owe.

In financed real estate transactions, trust deeds transfer the legal title of a property to a third partysuch as a bank, escrow company, or title companyto hold until the borrower repays their debt to the lender. Trust deeds are used in place of mortgages in several states.

The MERS® System is a national electronic database that tracks changes in mortgage servicing rights and beneficial ownership interests in loans secured by residential real estate. More than two-thirds of all newly originated residential loans in the United States are registered on the MERSA® System.