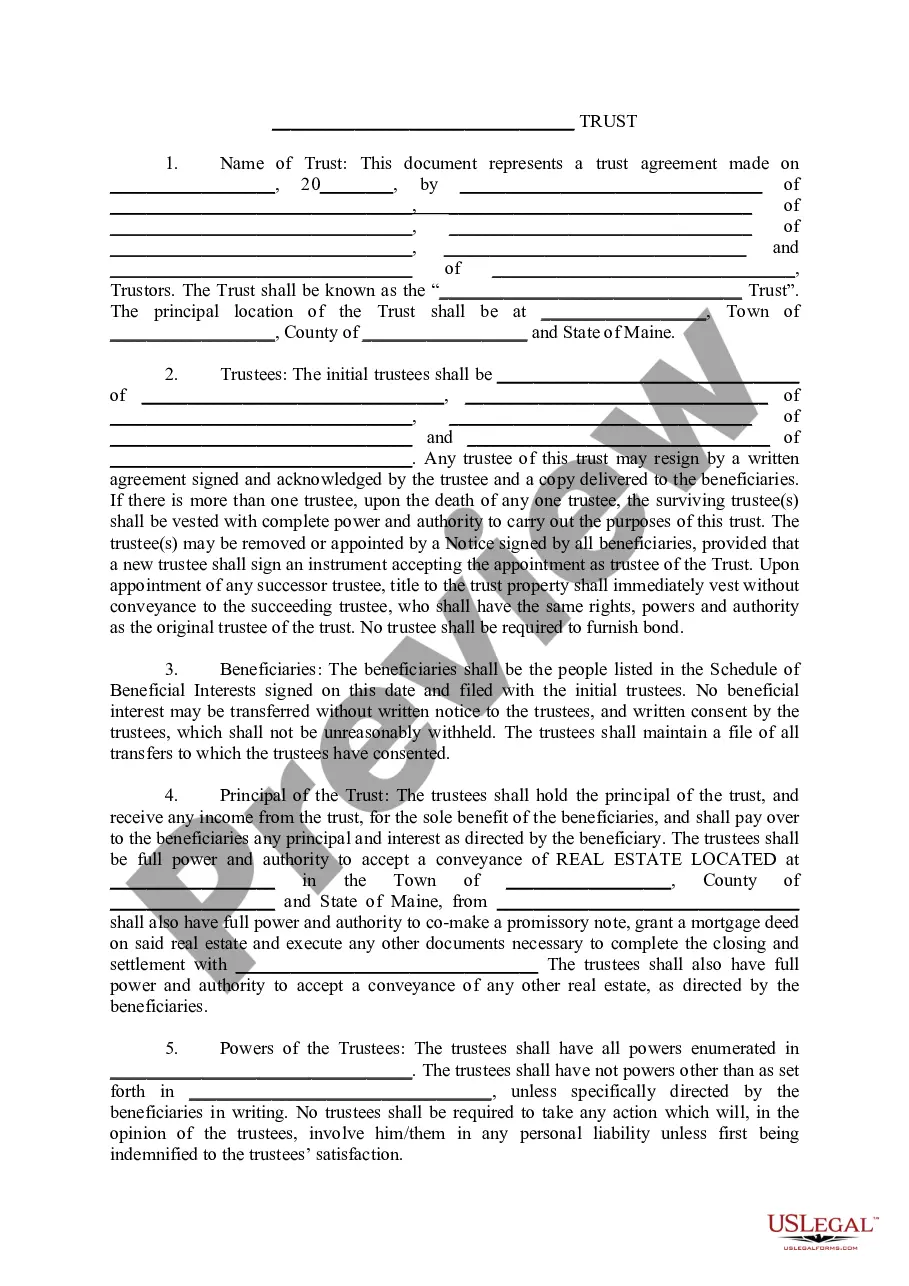

Maine Trust Agreement

Description

How to fill out Maine Trust Agreement?

Welcome to the most significant legal files library, US Legal Forms. Here you can find any example such as Maine Trust Agreement forms and download them (as many of them as you wish/need to have). Get ready official files within a several hours, rather than days or even weeks, without having to spend an arm and a leg with an lawyer. Get the state-specific example in clicks and feel confident understanding that it was drafted by our qualified legal professionals.

If you’re already a subscribed user, just log in to your account and click Download next to the Maine Trust Agreement you need. Due to the fact US Legal Forms is online solution, you’ll generally have access to your saved forms, regardless of the device you’re using. See them in the My Forms tab.

If you don't come with an account yet, what are you waiting for? Check out our guidelines listed below to get started:

- If this is a state-specific document, check its applicability in your state.

- View the description (if offered) to understand if it’s the correct example.

- See far more content with the Preview feature.

- If the document meets your needs, click Buy Now.

- To make your account, pick a pricing plan.

- Use a credit card or PayPal account to join.

- Save the file in the format you require (Word or PDF).

- Print the document and complete it with your/your business’s details.

As soon as you’ve filled out the Maine Trust Agreement, give it to your legal professional for confirmation. It’s an extra step but a necessary one for making certain you’re totally covered. Join US Legal Forms now and get a mass amount of reusable examples.

Form popularity

FAQ

Personal trusts are further divided into either 1) Under Declaration of Trust (U/D/T) meaning the grantor and the trustee are the same person and the grantor controls the trust assets, and 2) Trust Under Agreement (U/A) meaning the grantor and the trustee are different persons and the trustee controls the trust assets.

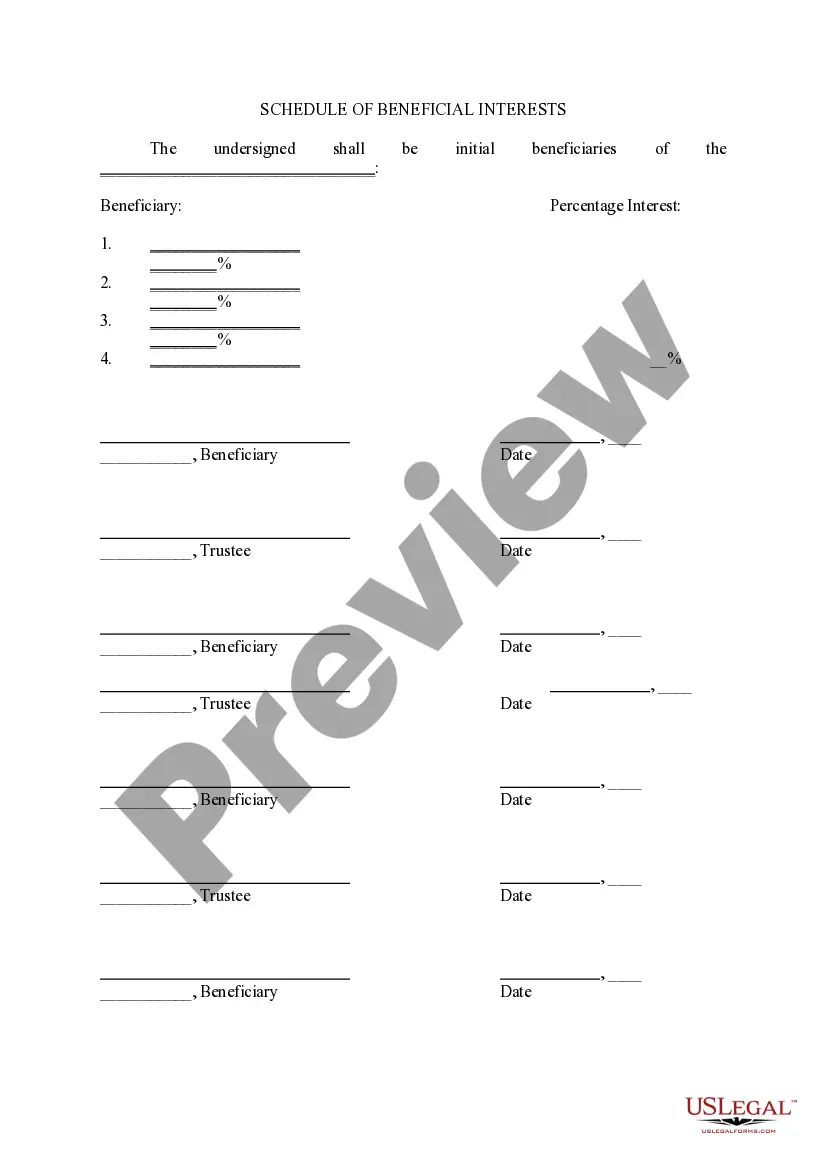

A trust agreement is a document that allows you (the trustor) to legally transfer the ownership of specific assets to another person (trustee) to be held for the trustor's beneficiaries.Assets controlled in the trust. Powers and limitations for the trustee. Compensation for the trustee.

The trustee is the legal owner of the property in trust, as fiduciary for the beneficiary or beneficiaries who is/are the equitable owner(s) of the trust property. Trustees thus have a fiduciary duty to manage the trust to the benefit of the equitable owners.

Under California law (Probate Code section 16061.7) every Trust beneficiary, and every heir-at-law of the decedent, is entitled to receive a copy of the Trust document. So all you have to do once your parents are gone is request a copy of the Trust from whomever has it.

Paperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork. Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required. Transfer Taxes. Difficulty Refinancing Trust Property. No Cutoff of Creditors' Claims.

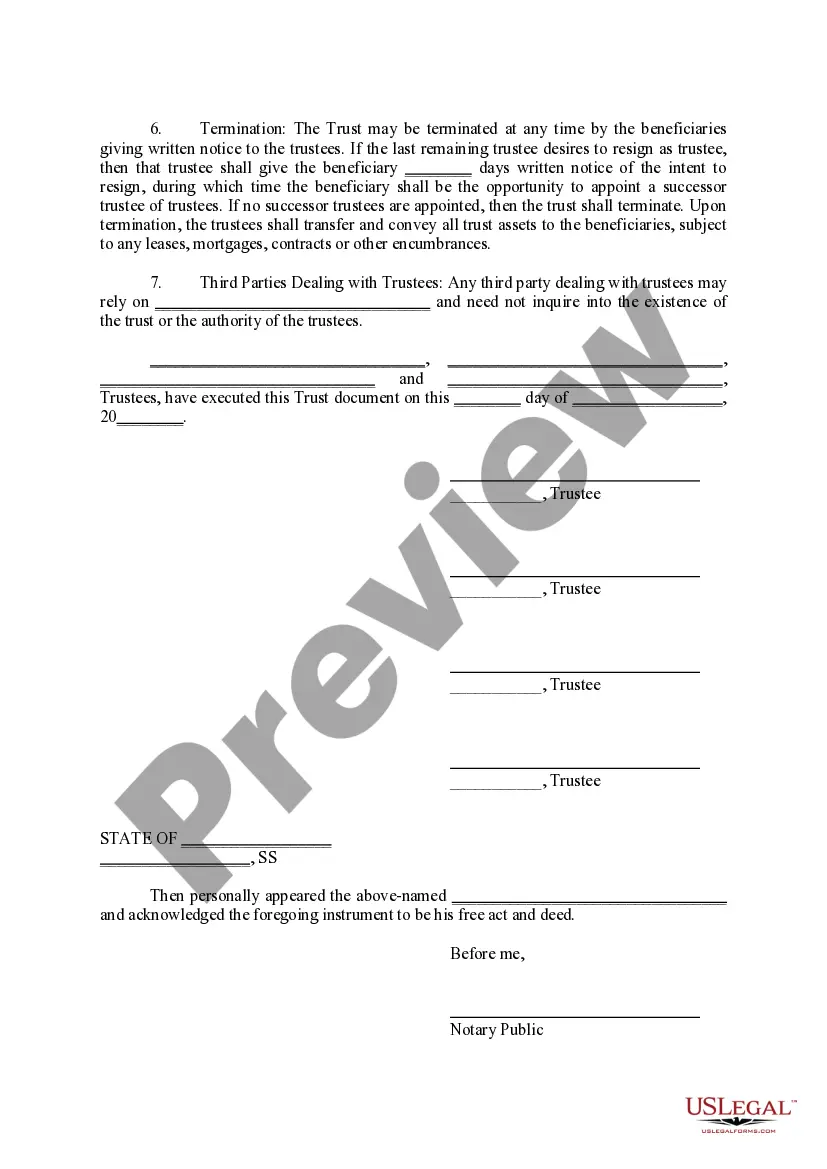

How to sign as a Trustee. When signing anything on behalf of the trust, always sign as John Smith, Trustee. By signing as Trustee, you will not be personally liable for that action as long as that action is within the scope of your authority under the trust.

As discussed above all trustees need to sign the trust deed for it to be valid. You should if you are trustee to sign as trustee following your name on all signature areas of the deed where required.The witness can not be a party to the trust either, meaning they can not be a beneficiary, settlor, or trustee.

To manage and control spending and investments to protect beneficiaries from poor judgment and waste; To avoid court-supervised probate of trust assets and be private; To protect trust assets from the beneficiaries' creditors;To reduce income taxes or shelter assets from estate and transfer taxes.

When they pass away, the assets are distributed to beneficiaries, or the individuals they have chosen to receive their assets. A settlor can change or terminate a revocable trust during their lifetime. Generally, once they die, it becomes irrevocable and is no longer modifiable.