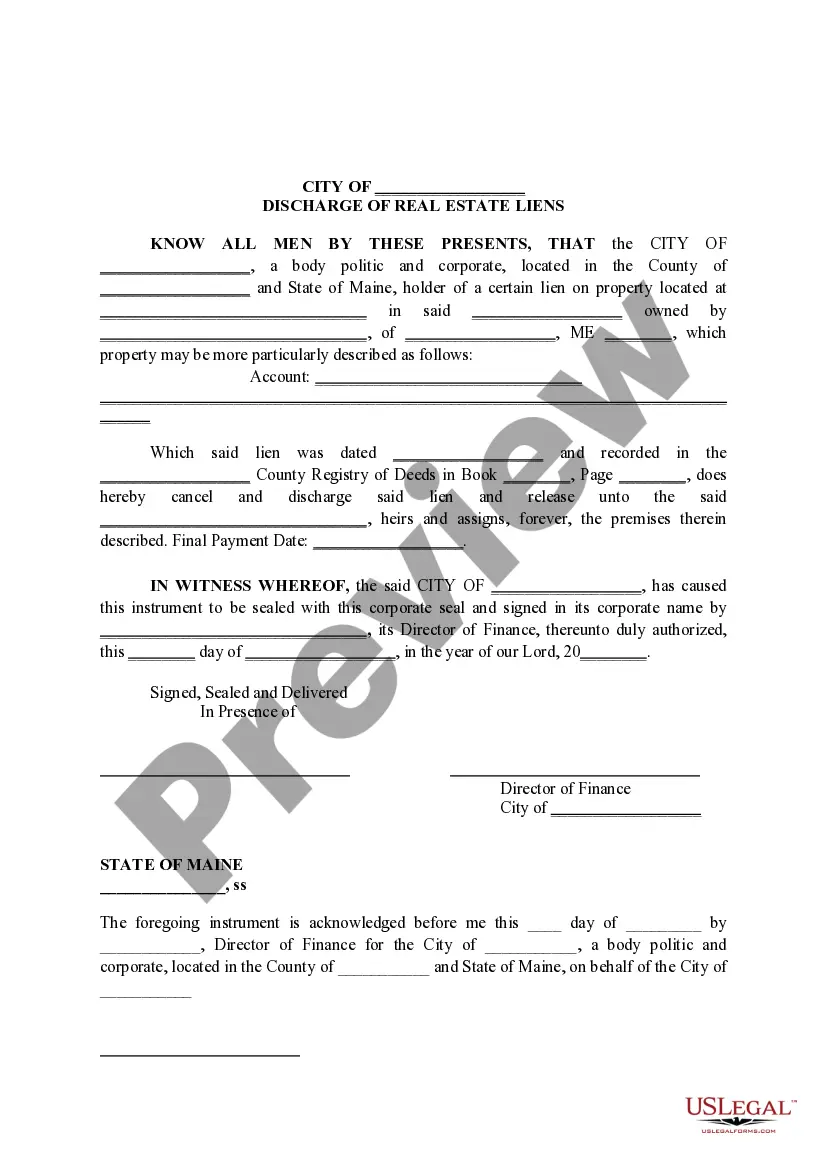

Maine Discharge of Real Estate Liens

Description

How to fill out Maine Discharge Of Real Estate Liens?

Welcome to the most significant legal files library, US Legal Forms. Here you can find any example including Maine Discharge of Real Estate Liens forms and save them (as many of them as you want/need). Get ready official papers within a few hours, instead of days or even weeks, without having to spend an arm and a leg on an legal professional. Get your state-specific example in a few clicks and be assured understanding that it was drafted by our qualified lawyers.

If you’re already a subscribed user, just log in to your account and then click Download next to the Maine Discharge of Real Estate Liens you need. Because US Legal Forms is online solution, you’ll always have access to your saved templates, no matter the device you’re using. Find them inside the My Forms tab.

If you don't come with an account yet, what are you awaiting? Check our guidelines below to get started:

- If this is a state-specific sample, check its applicability in your state.

- View the description (if offered) to learn if it’s the right template.

- See more content with the Preview function.

- If the document meets all of your requirements, click Buy Now.

- To create your account, choose a pricing plan.

- Use a card or PayPal account to subscribe.

- Download the document in the format you need (Word or PDF).

- Print the file and fill it out with your/your business’s info.

Once you’ve filled out the Maine Discharge of Real Estate Liens, give it to your lawyer for confirmation. It’s an additional step but an essential one for being sure you’re totally covered. Join US Legal Forms now and get a large number of reusable examples.

Form popularity

FAQ

It basically states that you've paid the subcontractor what is owed, they accept the payment in full, and they waive the right to put a lien on your property. Simply present this form to the subcontractor with your payment and ask them to sign it. Make sure you get their signature!

1 : a charge upon real or personal property for the satisfaction of some debt or duty ordinarily arising by operation of law The bank had a lien on our house. 2 : the security interest created by a mortgage the lien of a mortgage.

The removal of a lien on a motor vehicle or real property after the claim has been satisfied is referred to as a discharge of lien.

Liens have a higher priority than discharges because of specific legislation. Sometimes liens can be removed "in trust". A discharge in trust is a method used to remove a lien via a third party, usually a lawyer.In some cases, parties may take steps to have a lien removed by a Consent Order or a Court Order.

When a taxpayer fails to pay the entire real estate tax obligation within twelve months after commitment, by law, the tax collector will record a lien at the Hancock County registry of Deeds.

For instance, in California, most mechanic's liens will expire after 90 days from the date it was recorded, but in Florida, the lien will be in effect for a year.

A lien is a legal right or interest of a creditor in the property of another, usually lasting until a debt or duty is satisfied. An encumbrance is a claim or liability attached to property. It includes any property right that is not an ownership interest.

A lien does not convey ownership, with one exception A lienor generally has an equitable interest in the property, but not legal ownership.

In most states, you can typically search by address with the county recorder, clerk, or assessor's office online. The search for liens is free, though you may have to pay a small fee for a copy of the report, which will vary by county.