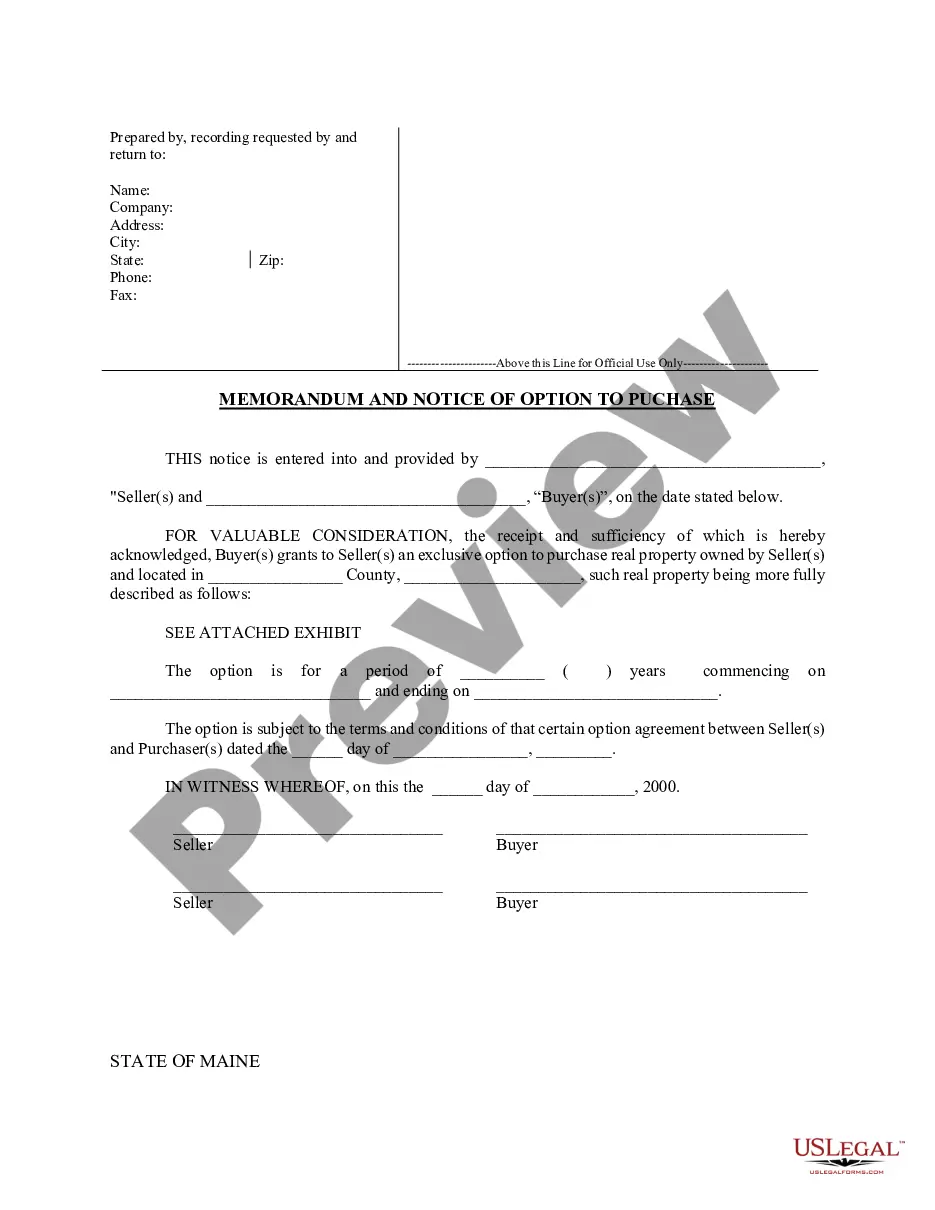

This Memorandum and Notice of Option Agreement is for recording in the official records in order to provide notice that an Option to Purchase exists on a certain parcel of real estate. It is used in lieu of recording the entire Option Agreement.

Maine Notice of Option for Recording

Description

How to fill out Maine Notice Of Option For Recording?

Have any template from 85,000 legal documents including Maine Notice of Option for Recording online with US Legal Forms. Every template is prepared and updated by state-accredited legal professionals.

If you already have a subscription, log in. When you are on the form’s page, click the Download button and go to My Forms to access it.

If you haven’t subscribed yet, follow the tips listed below:

- Check the state-specific requirements for the Maine Notice of Option for Recording you need to use.

- Read through description and preview the sample.

- As soon as you are sure the template is what you need, click on Buy Now.

- Select a subscription plan that really works for your budget.

- Create a personal account.

- Pay out in just one of two appropriate ways: by bank card or via PayPal.

- Choose a format to download the file in; two options are available (PDF or Word).

- Download the file to the My Forms tab.

- When your reusable template is downloaded, print it out or save it to your gadget.

With US Legal Forms, you’ll always have instant access to the right downloadable template. The platform gives you access to documents and divides them into categories to streamline your search. Use US Legal Forms to get your Maine Notice of Option for Recording easy and fast.

Form popularity

FAQ

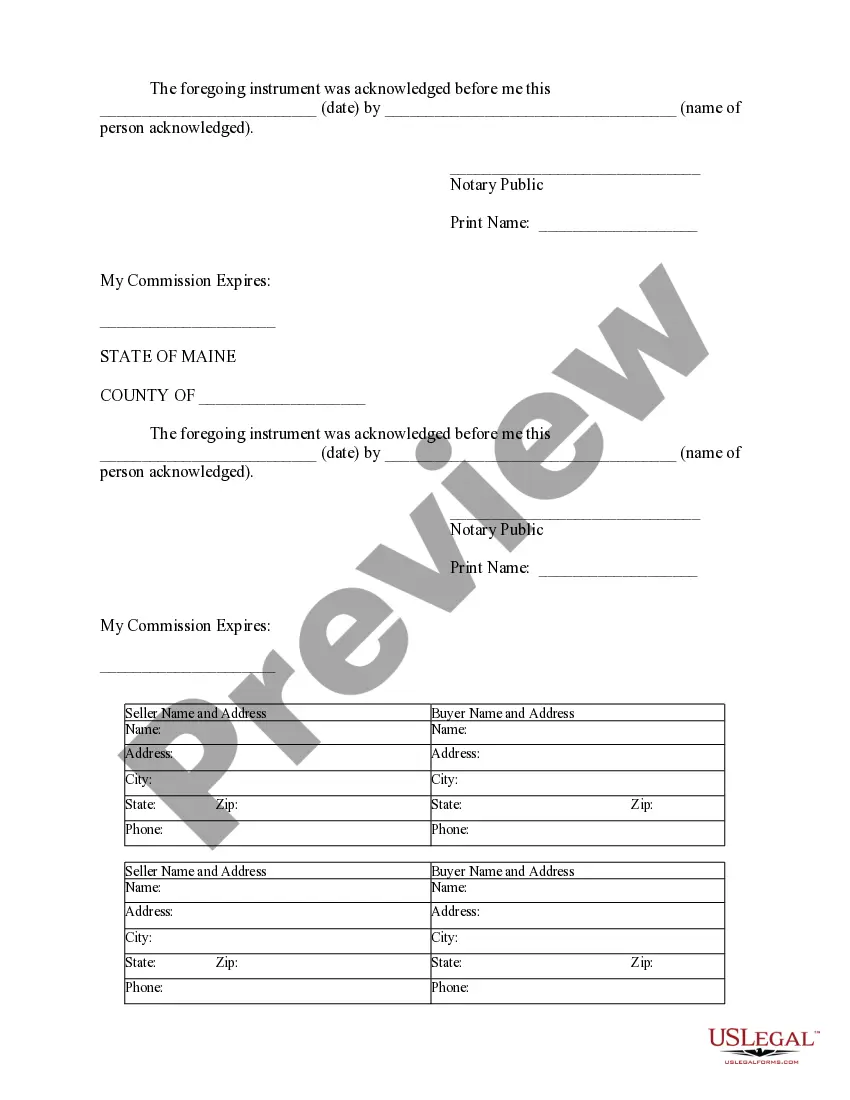

Must have a prepared document with original signatures and notary (Maine notary must include an acknowledgement statement). Names(s) of each signer (individuals, corporations, trusts etc.) Notary/attorney name (or bar number for attorney) must be printed beneath signature line.

The most common documents are related to mortgages, deeds, easements, foreclosures, estoppels, leases, licenses, and fees, among other kinds of documents. The most important real estate documents list ownership, encumbrances, and lien priority. These are used to maintain proper real estate transactions.

Although recording statutes vary between U.S. states, they virtually all require that an interest in real property be formally recorded in the appropriate county office in order to be valid.If your deed has not been recorded, you are not recognized as the legal owner of your property.

The information about your home purchase and the terms and conditions of your mortgage loan are recorded among the land records in the jurisdiction where the property is located. These documents are public. In most states, you do not even have to go down to the local recorder of deeds office.

Currently, Alaska, Arkansas, California, Colorado, District of Columbia, Georgia, Hawaii, Idaho, Indiana, Kentucky, Maine, Maryland, Michigan, Minnesota, Mississippi, Montana, Nebraska, Nevada, New Jersey, New York, North Dakota, Ohio (regarding mortgages, OH follows the Race statute), Oregon, Pennsylvania (regarding

Mortgages are interests in property, and so can and should be recorded as soon as possible after the closing. Most states have recording statutes that impose restrictions on when and how a document conveying property rights can be legally created.

1. C Explanation: Recording an instrument provides constructive notice to the public of the interest set forth in the recorded instrument. 2. A Explanation: A corporate seal may be added where a corporation is grantor, in order to indicate that the person who signed had authority to sign on behalf of the corporation.

In order to clear the title to the real property owned by the mortgagor, the Satisfaction of Mortgage document must be recorded with the County Recorder or Recorder of Deeds. If the mortgagee fails to record a satisfaction within the set time limits, the mortgagee may be responsible for damages set out by statute.

Failure to record a deed effectively makes it impossible for the public to know about the transfer of a property. That means the legal owner of the property appears to be someone other than the buyer, a situation that can generate serious ramifications.