Maine UCC Financing Statement Additional Party (Maine UCC F-AP) is a type of financial document that provides information regarding secured transactions between a debtor and a creditor. This document is used to supplement an existing Maine UCC Financing Statement and serves to identify additional parties involved in the transaction. It includes information such as the name of the debtor, the name of the creditor, the type of collateral, and any additional parties involved in the transaction. There are three types of Maine UCC Financing Statement Additional Party: Financing Statement Amendment, Financing Statement Continuation, and Financing Statement Termination. Each type serves a different purpose, and all must be filed with the Maine Secretary of State in order to be valid.

Maine UCC Financing Statement Additional Party

Description

How to fill out Maine UCC Financing Statement Additional Party?

Working with legal paperwork requires attention, accuracy, and using properly-drafted templates. US Legal Forms has been helping people nationwide do just that for 25 years, so when you pick your Maine UCC Financing Statement Additional Party template from our service, you can be certain it meets federal and state regulations.

Dealing with our service is straightforward and quick. To get the required document, all you’ll need is an account with a valid subscription. Here’s a brief guideline for you to find your Maine UCC Financing Statement Additional Party within minutes:

- Make sure to carefully check the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Search for another official blank if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Maine UCC Financing Statement Additional Party in the format you prefer. If it’s your first time with our service, click Buy now to proceed.

- Register for an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to obtain your form and click Download. Print the blank or upload it to a professional PDF editor to prepare it paper-free.

All documents are created for multi-usage, like the Maine UCC Financing Statement Additional Party you see on this page. If you need them in the future, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and prepare your business and personal paperwork quickly and in full legal compliance!

Form popularity

FAQ

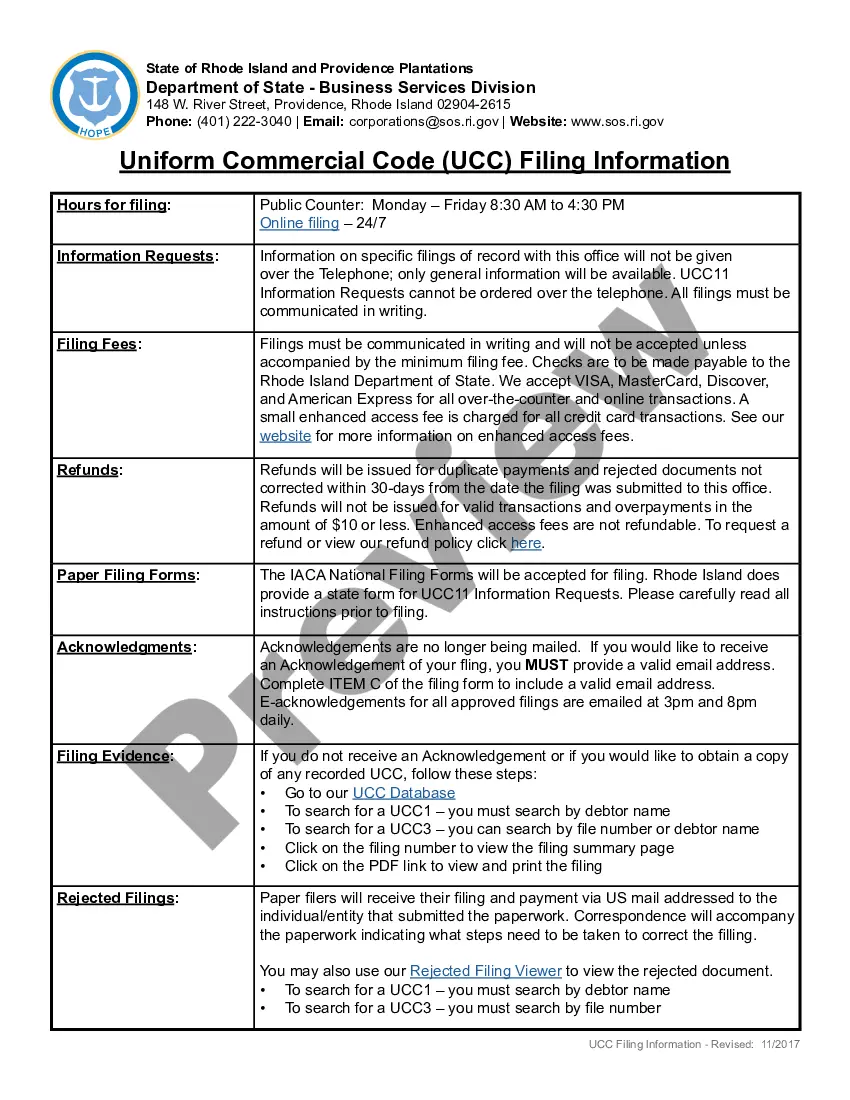

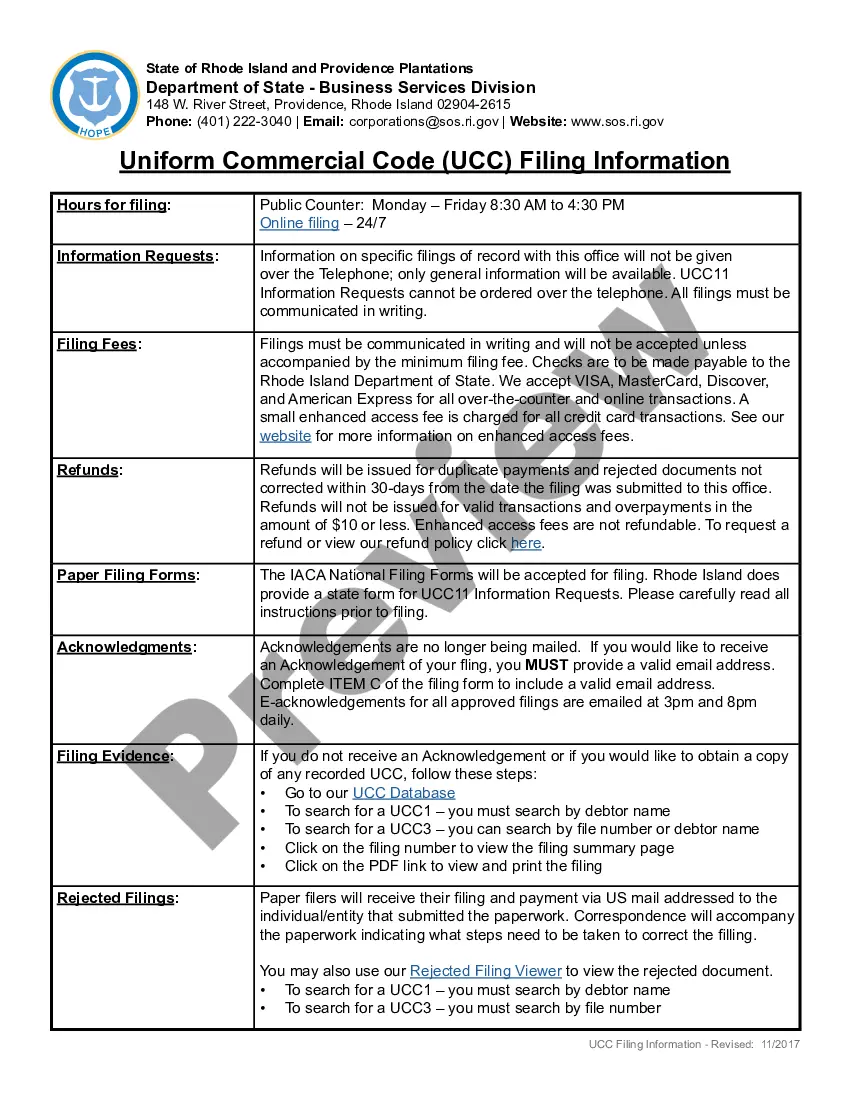

How to complete a UCC1 (Step by Step) Filer Information. Name and phone number of contact at filer. Email contact at filer.Debtor Information. Organization or individual's name. Mailing address. Secured Party Information. Organization or individual's name. Mailing address. Collateral Information. Description of collateral.

How do I get rid of a UCC filing? You can remove a UCC filing when you've repaid your business loan in full. Once you repay the debt, the lender should remove the lien from your business assets. If not, you may request that the lender files a UCC-3 to terminate the lien.

To put it in simple terms, the secured party is the creditor on the UCC loan. The creditor is the secured party because they have a financial interest in the collateral which the lien is on.

The first UCC-1 filer holds a first-position lien, the second filer has a second-position lien and so forth. Usually, the first-position lien must be completely satisfied before the second-position lien holder can receive any remaining collateral.

If the individual resides in a state other than where the business is registered, multiple filings may be required in order to perfect. For more information on UCC filings, visit the First Corporate Solutions reference library or register for one of our free webinar events!

Ask the lender to terminate the lien upon payoff. A good rule of thumb is to request that your lender file a UCC-3 form with your secretary of state as soon as possible after you pay off your loan. The UCC-3 will terminate the lien on your company's assets (or assets) and remove the UCC-1 filing.

A UCC filing, also known as a UCC lien or a UCC-1, is a financing statement which lenders can file against your business with your secretary of state. When you take out a secured loan, the lender may file a lien to protect the asset(s) you committed to secure financing.

Assignment When a secured party needs to assign or transfer all or a portion of its rights to the collateral listed in a UCC-1 financing statement. It is considered an alteration of the previous filing.