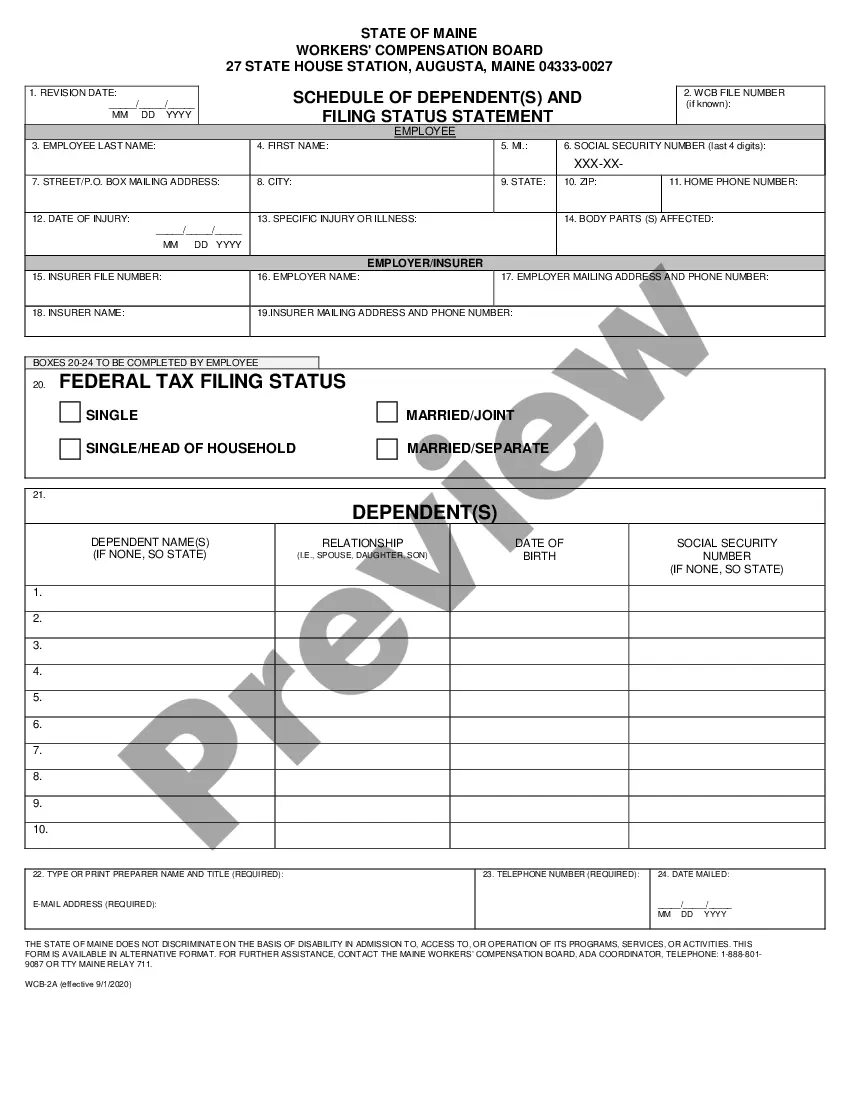

The Maine Schedule of Dependents and Filing Status Statement (Form 1040ME) is a tax form used by Maine residents to report information about dependents and filing status for the state income tax. The form is used to determine the amount of tax due, the filing status, and any applicable credits and deductions. The form also includes a worksheet to calculate the Adjusted Gross Income (AGI) of the taxpayer. There are two types of Maine Schedule of Dependents and Filing Status Statement: Form 1040ME-A for single taxpayers and Form 1040ME-B for married taxpayers filing jointly. Form 1040ME-A is used to report information about dependents, if applicable, and filing status for single taxpayers. It also includes a worksheet to calculate the AGI of the taxpayer. Form 1040ME-B is used to report information about dependents, if applicable, and filing status for married taxpayers filing jointly. It also includes a worksheet to calculate the AGI of both taxpayers combined. The form must be completed and submitted to the state of Maine by the due date specified in the instructions. Failure to do so may result in penalties and interest being applied.

Maine Schedule of Dependents And Filing Status Statement

Description

How to fill out Maine Schedule Of Dependents And Filing Status Statement?

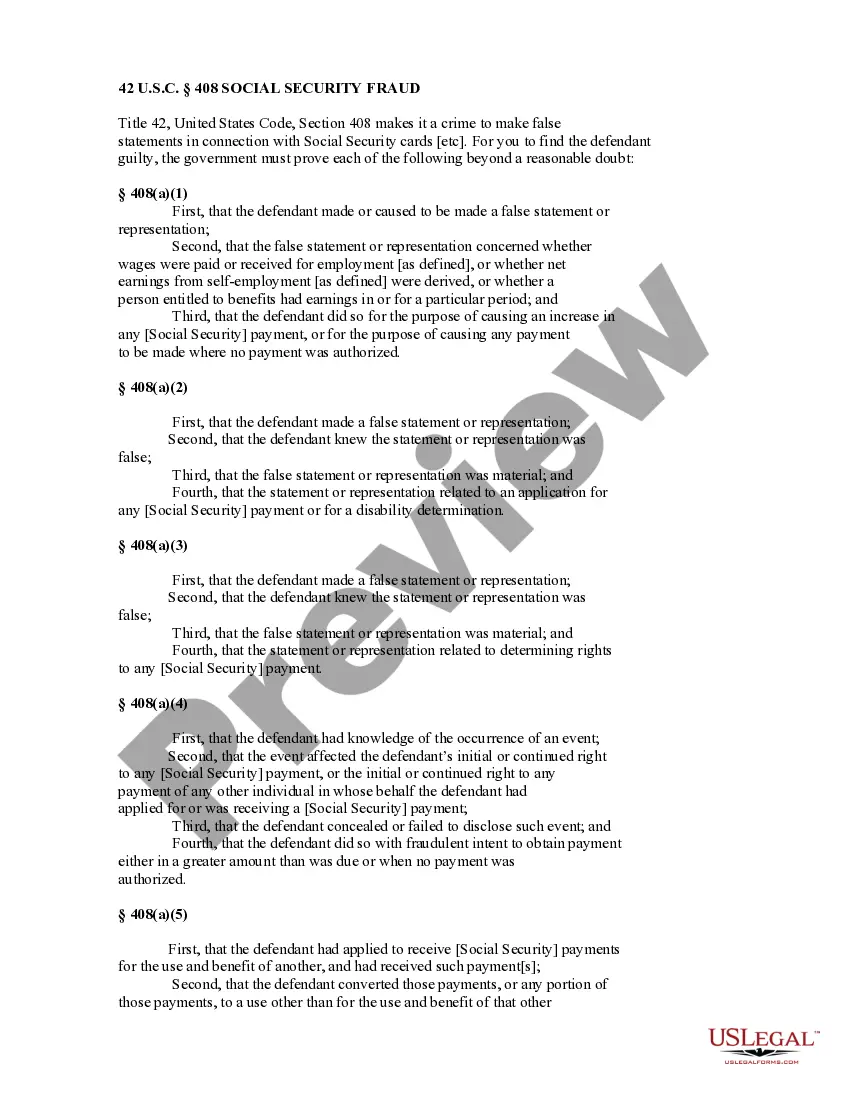

If you're looking for a method to properly compile the Maine Schedule of Dependents and Filing Status Statement without employing an attorney, then you are in the ideal place.

US Legal Forms has established itself as the most comprehensive and trustworthy repository of formal templates for every personal and business circumstance.

Another fantastic aspect of US Legal Forms is that you never lose the paperwork you've purchased - you can access any of your downloaded templates in the My documents section of your profile whenever required.

- Ensure the document you view on the page aligns with your legal context and state regulations by reviewing its text description or checking the Preview mode.

- Enter the document title in the Search tab at the top of the page and choose your state from the dropdown to locate another template if any discrepancies arise.

- Repeat the content verification and click Buy now when you are confident that the paperwork meets all the criteria.

- Log in to your account and click Download. Create an account with the service and choose a subscription plan if you don’t already have one.

- Use your credit card or the PayPal option to cover the cost of your US Legal Forms subscription. The document will be ready for download immediately afterward.

- Decide on the format you wish to receive your Maine Schedule of Dependents and Filing Status Statement in and download it by selecting the appropriate button.

- Incorporate your template into an online editor to complete and sign it swiftly or print it out to prepare a physical copy by hand.

Form popularity

FAQ

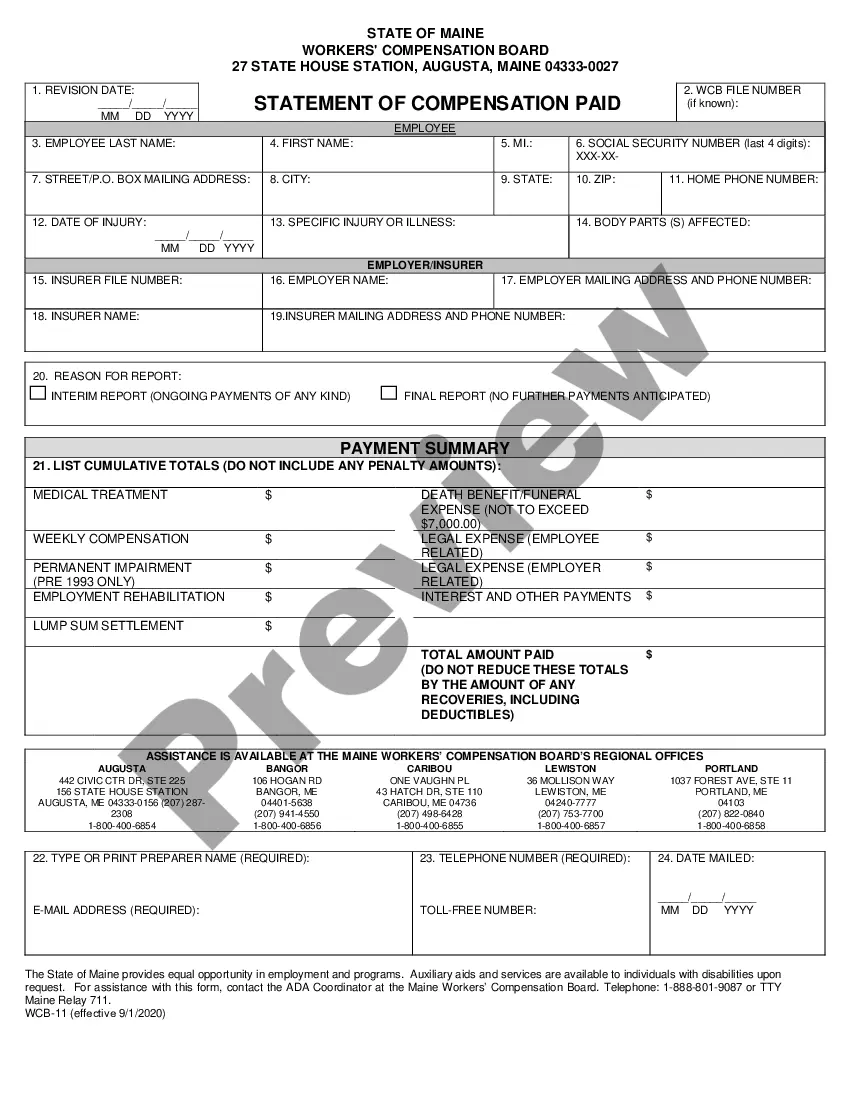

Workers' comp in Maine helps protect both employers and employees. As an employer, you get protection against lawsuits resulting from workplace injuries or illnesses. And your employees will receive benefits that can help them recover from a work-related injury or illness.

Your health insurer must pay the bills if the workers' compensation insurer is denying your claim. Your health insurer can be paid back if your claim is later deemed to be work-related. injury? If you miss more than 7 days of work because of an injury, you are entitled to receive weekly compensation benefits.

Once you give notice of your injuries, your employer must fill out a form called a "First Report of Injury" within seven days. Your employer must file the report with the Maine Workers' Compensation Board and provide a copy to you and its insurance company.

There is a seven day waiting period after an injury before benefits begin. Compensation is retroactive and the first seven days are paid for if the period of injury is more than 14 days.

For further assistance, contact the Maine Workers' Compensation Board, ADA Coordinator, telephone: (888) 801-9087 or TTY (877) 832-5525.