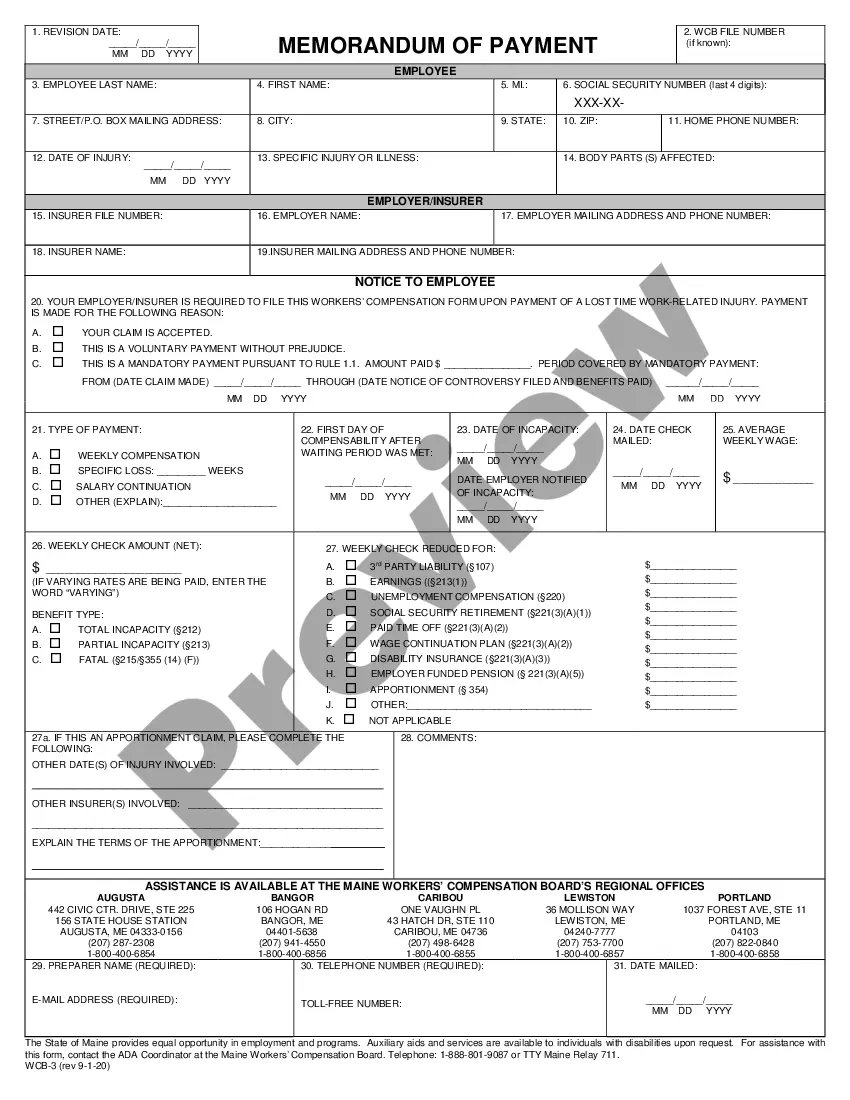

Maine Wage Statement is a document issued by employers to their employees upon the payment of wages. The statement provides a breakdown of the wages earned and deductions taken during the pay period. It includes the employee’s name, address, and Social Security number, as well as the employer’s name, addressunveilingIN (Federally Employer Identification Number). The statement also lists the gross earnings, deductions, and net earnings for the period. These deductions may include federal and state taxes, Social Security taxes, Medicare taxes, and any other deductions taken from the employee’s wages. Additionally, the statement may include the hours worked, overtime pay, holiday pay, and vacation pay. There are two types of Maine Wage Statements: a paper statement issued to the employee, and an electronic statement available on the Maine Department of Labor website.

Maine Wage Statement

Description

How to fill out Maine Wage Statement?

If you’re looking for a method to accurately fill out the Maine Wage Statement without enlisting the help of a legal professional, then you’ve come to the perfect destination.

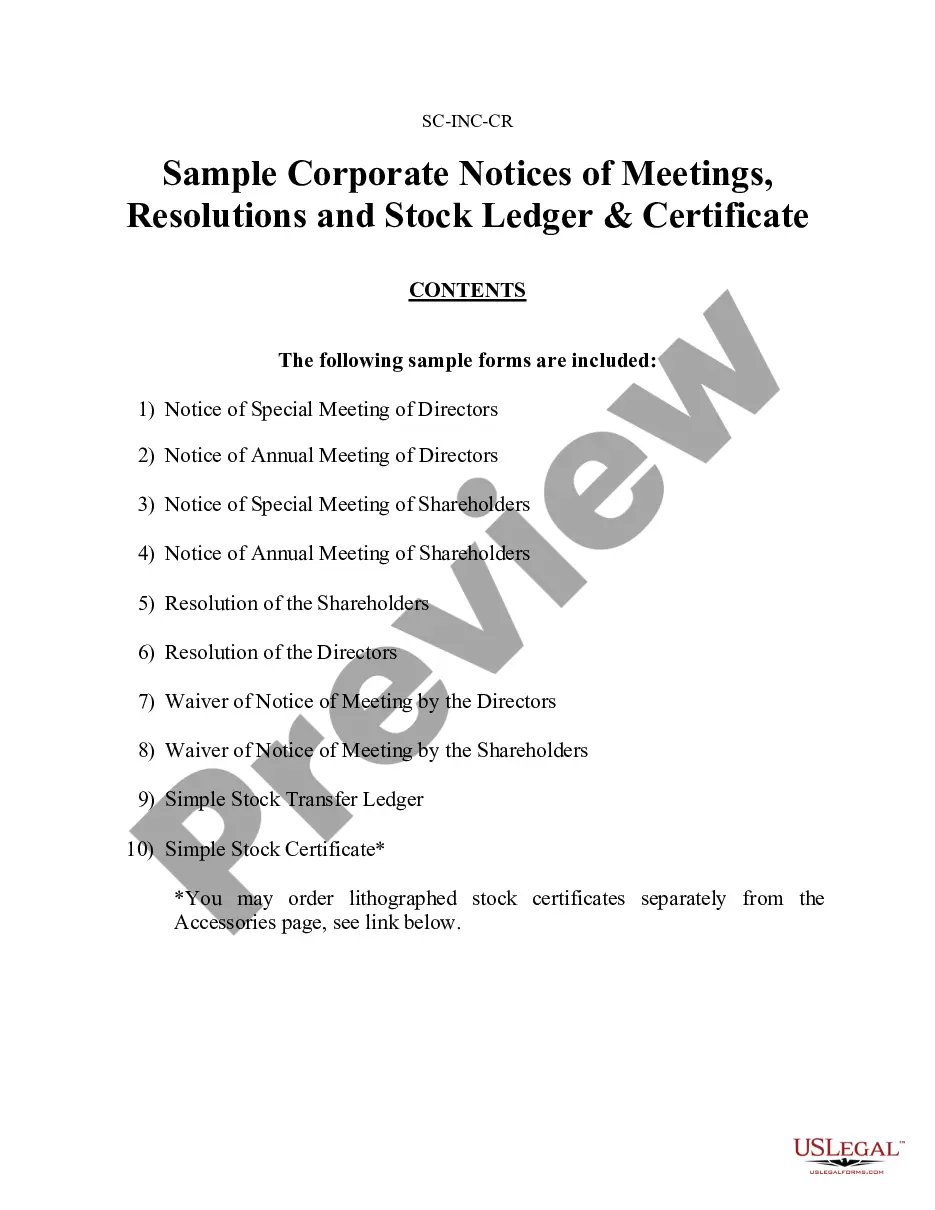

US Legal Forms has established itself as the most comprehensive and trustworthy repository of official templates for every personal and business situation.

Another significant benefit of US Legal Forms is that you will never misplace the documentation you obtained - you can access any of your downloaded forms in the My documents section of your profile whenever you need it.

- Ensure that the document displayed on the screen aligns with your legal circumstances and state regulations by reviewing its text description or exploring the Preview mode.

- Enter the form title into the Search tab at the top of the page and select your state from the list to find another template in case of any discrepancies.

- Go through the content verification again and click Buy now once you are certain that the documentation meets all the stipulations.

- Log in to your account and select Download. Create an account with the service and choose a subscription plan if you haven’t already.

- Utilize your credit card or the PayPal option to secure your US Legal Forms subscription. The document will be ready for download immediately after.

- Decide on the format in which you wish to receive your Maine Wage Statement and download it by clicking the respective button.

- Upload your template to an online editor to fill out and sign it quickly or print it to prepare your physical copy manually.

Form popularity

FAQ

These benefits include: Weekly compensation for lost time from work because of an injury. Payment of medical bills, prescriptions, and related costs. Payment for the loss of a specific body part.

Once you give notice of your injuries, your employer must fill out a form called a "First Report of Injury" within seven days. Your employer must file the report with the Maine Workers' Compensation Board and provide a copy to you and its insurance company.

There is a seven day waiting period after an injury before benefits begin. Compensation is retroactive and the first seven days are paid for if the period of injury is more than 14 days.

You must tell your employer (which can mean a supervisor or someone from management) that you were injured within 60 days of the injury. If your employer has selected a health care provider, you must go to your employer's health care provider for the first ten days of treatment.

For further assistance, contact the Maine Workers' Compensation Board, ADA Coordinator, telephone: (888) 801-9087 or TTY (877) 832-5525.

Workers' comp in Maine helps protect both employers and employees. As an employer, you get protection against lawsuits resulting from workplace injuries or illnesses. And your employees will receive benefits that can help them recover from a work-related injury or illness.

Your health insurer must pay the bills if the workers' compensation insurer is denying your claim. Your health insurer can be paid back if your claim is later deemed to be work-related. injury? If you miss more than 7 days of work because of an injury, you are entitled to receive weekly compensation benefits.