The Maine Direct Deposit Form for Stimulus Check is a document that allows individuals in Maine to provide their banking information to the Internal Revenue Service (IRS) or other relevant government agencies for the purpose of receiving the stimulus check payments directly into their bank accounts. This form eliminates the need for a physical check to be mailed, providing a faster and more convenient method of receiving the stimulus money. The Maine Direct Deposit Form for Stimulus Check is specifically designed for residents of Maine who are eligible for the stimulus check payments. It requires individuals to fill out their personal information, including their full name, social security number, address, and contact details. Additionally, individuals are required to provide their bank account information, such as the bank's routing number and the account number, to ensure accurate and secure processing of the deposit. By completing the Maine Direct Deposit Form for Stimulus Check, eligible individuals can ensure that their stimulus payments are electronically deposited into their bank accounts, reducing the risk of delays or lost checks. This form can be obtained from the official websites of the IRS or the Maine Department of Revenue Services. It is essential to use the correct and updated version of the form to ensure accurate processing of the stimulus payment. It is important to note that there may not be different types of Maine Direct Deposit Forms for Stimulus Check. However, it is advised to check for any updated versions or specific instructions that may be provided by the IRS or state authorities. These updates or instructions may contain important information regarding any changes or specific requirements for the direct deposit form. Overall, the Maine Direct Deposit Form for Stimulus Check enables individuals in Maine to receive their stimulus payments in a quick and secure manner, eliminating the need for physical checks and potential delays in receiving the much-needed financial assistance.

Maine Direct Deposit Form for Stimulus Check

Description

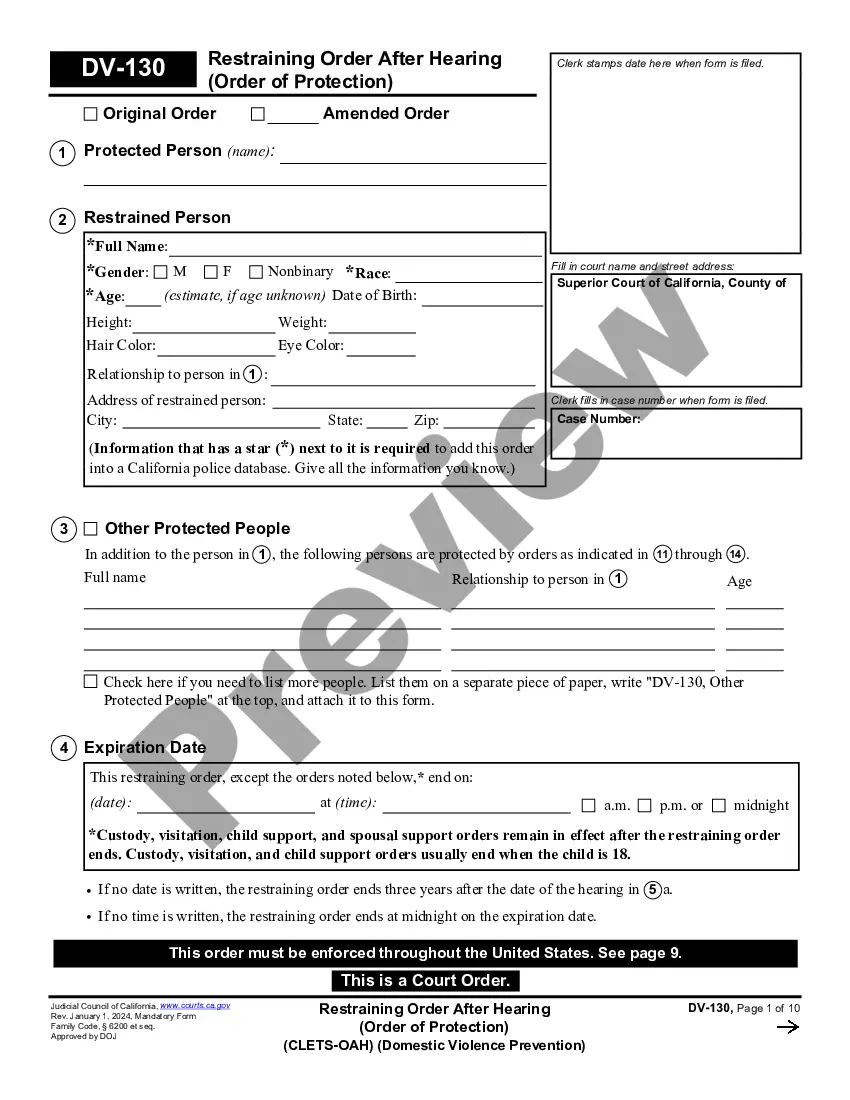

How to fill out Maine Direct Deposit Form For Stimulus Check?

Selecting the optimal legal document template might be a challenge.

Of course, there are numerous designs accessible online, but how can you locate the legal template you require.

Use the US Legal Forms website. The service provides thousands of templates, such as the Maine Direct Deposit Form for Stimulus Check, which you can utilize for business and personal purposes.

You can review the form using the Preview button and check the form details to confirm this is the right one for you.

- All of the forms are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to access the Maine Direct Deposit Form for Stimulus Check.

- Use your account to explore the legal forms you may have acquired previously.

- Go to the My documents tab in your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps you should follow.

- First, ensure you have selected the correct form for your city/state.

Form popularity

FAQ

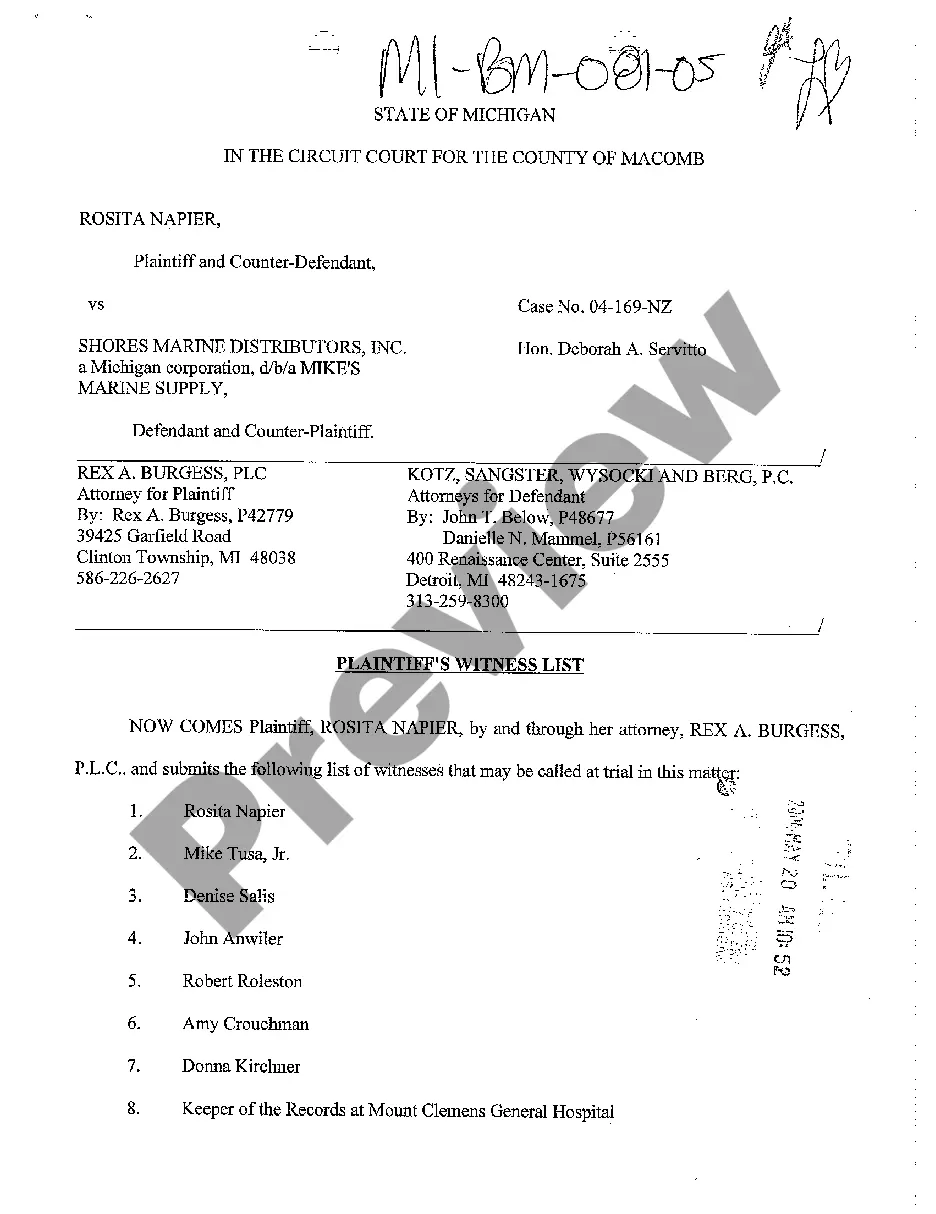

Disaster Relief Payments (or so-called hazard payments) were meant to help Maine citizens offset hardship incurred as a result of the COVID-19 pandemic. These Disaster Relief Payments were the result of bipartisan negotiations on the State budget, which Governor Mills signed into law.

The second stimulus checks for the COVID-19 relief package are set to total $600 per person, with phase outs based on adjusted gross income limits that are similar to the first relief package. Families also get additional $600 payments for each qualifying dependent under age 17.

Stimulus Check's Impact Stimulus checks are really just advanced payments of a new Recovery Rebate tax credit for the 2020 tax year. As such, they aren't included in taxable income.

The payment may be subject to federal income tax. To the extent the Disaster Relief Payment is taxable by the Internal Revenue Service and included in your 2021 or 2022 federal adjusted gross income, you will be able to subtract the amount on your 2021 or 2022 Maine individual income tax return.

Those eligible must not be claimed as a dependent, must file as a full-time Maine resident, and must have a Federal adjusted gross income (FAGI) of less than: $100,000 if filing single or if married and filing separately; $150,000 if filing as head of household; $200,000 for couples filing jointly.

"No, the Third Economic Impact Payment is not includible in your gross income," the IRS writes. "Therefore, you will not include the third payment in your taxable income on your 2021 Federal income tax return or pay income tax on the third payment."

To check the status of your Maine state tax refund online, go to . Then, click Submit for refund status. Refund information is updated Tuesday and Friday nights. Any change to your refund information will appear the next day.

Mainers can check their eligibility with Maine Revenue Services at a website for the relief checks the state has set up....Must have a Federal adjusted gross income (FAGI) of less than:$100,000 if filing single or if married and filing separately.$150,000 if filing as head of household.$200,000 for couples filing jointly.3 days ago