Maine Demand for Collateral by Creditor

Description

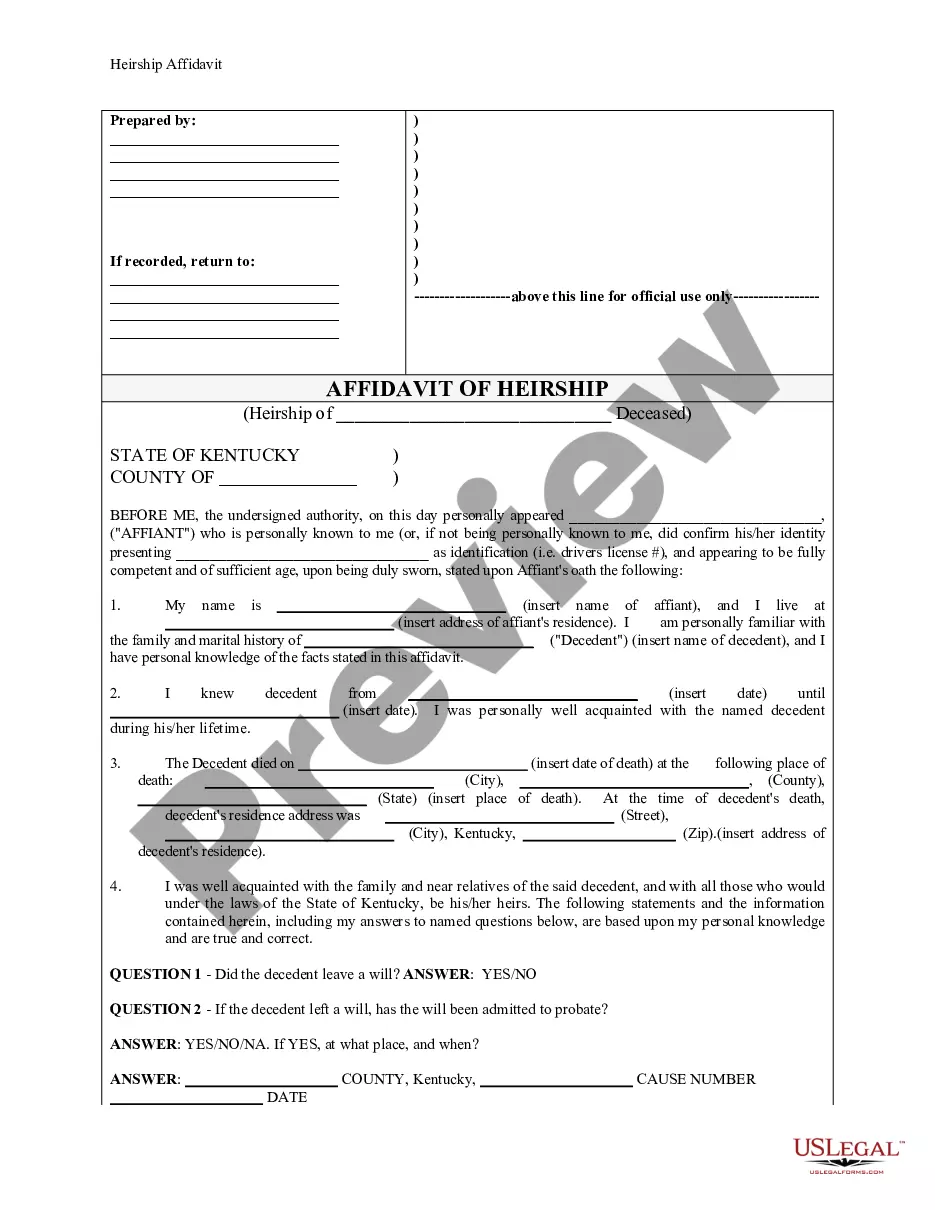

How to fill out Demand For Collateral By Creditor?

Selecting the finest legal document template can be a challenge.

Certainly, there are numerous templates accessible online, but how do you find the legal form you need.

Take advantage of the US Legal Forms website.

If you are a new user of US Legal Forms, here are some simple steps for you to follow: First, make sure you have selected the correct form for your city/county. You can review the form using the Preview button and examine the form outline to confirm it is the right one for you.

- The service offers thousands of templates, including the Maine Demand for Collateral by Creditor, that can be utilized for business and personal purposes.

- All of the forms are vetted by professionals and comply with federal and state requirements.

- If you are already registered, Log In to your account and click on the Obtain button to access the Maine Demand for Collateral by Creditor.

- Use your account to browse the legal forms you have previously purchased.

- Visit the My documents section of your account to obtain another copy of the document you need.

Form popularity

FAQ

In Maine, the statute of limitations for credit card debt is six years. This means creditors must initiate legal action within this timeframe to recover debts. If a claim exceeds this limit, it may be barred by law, making timely enforcement necessary. Utilizing resources such as USLegalForms can provide valuable insights into managing these situations effectively.

A federal court judgment typically remains in effect for 20 years. This timeframe allows creditors to pursue collections effectively, including through a Maine Demand for Collateral by Creditor if applicable. To enforce a judgment after this period, a renewal process must be undertaken. This legal provision enables creditors to maintain their rights over an extended duration.

In Maine, a property lien generally remains in effect for 10 years. Creditors can assert a lien as part of the Maine Demand for Collateral by Creditor process to secure debts owed to them. It's crucial for creditors to monitor these timeframes and ensure they take necessary legal actions to maintain the lien's validity. Keep in mind that liens can be renewed, extending their enforceability.

The statute of limitations in Maine varies depending on the type of claim. For most contracts, including written agreements, it's six years. However, for a Maine Demand for Collateral by Creditor related to unsecured debts, the limitation reduces to six years as well. Understanding these timelines helps ensure that you act promptly within the legal framework.

In Maine, a judgment is typically valid for 20 years from the date it is issued. This means your rights as a creditor to collect on a judgment through a Maine Demand for Collateral by Creditor can last for two decades. However, it is essential to renew the judgment before it expires to maintain your collection rights. Be aware that state laws can change, so staying updated is beneficial.

If you fail to make payments, creditors have several actions they can take. They may issue a Maine Demand for Collateral by Creditor to reclaim collateral tied to the debt. Furthermore, they can pursue legal action, seeking a court judgment that allows them to garnish wages or place liens on property.

Debt collectors must adhere to strict regulations when collecting debts. They cannot use threats or harassment to pressure debtors, nor can they call at unreasonable hours. Understanding your rights is essential, and platforms like uslegalforms can help you navigate issues related to a Maine Demand for Collateral by Creditor.

When a debtor defaults on their payments, creditors may take action to recover the owed amount. This can include filing a Maine Demand for Collateral by Creditor to seize any collateral securing the debt. Additionally, they may pursue legal avenues to obtain a judgment, which can lead to wage garnishment or asset seizure.

A time barred debt in Maine refers to a debt that cannot be legally enforced due to the expiration of the statute of limitations. Typically, this period lasts six years for most debts. If sufficient time has passed since the last payment or acknowledgment, creditors may not pursue a Maine Demand for Collateral by Creditor.

In Maine, creditors generally have three years to collect debts from an estate after a person's passing. This time frame is crucial for creditors when considering a Maine Demand for Collateral by Creditor. If creditors do not act within this period, they may forfeit their right to collect the debt.