Maine Personal Guaranty — General: Understanding its Definition and Types The Maine Personal Guaranty — General is a legally binding document whereby an individual, known as the guarantor, assumes liability and becomes responsible for fulfilling the obligations or debts of another person or entity. This guarantee serves as a form of security for lenders or creditors in situations where they require additional assurance that the borrower will honor their financial commitments. In the state of Maine, there are various types of Personal Guaranty — General, each serving different purposes and involving distinct parties. Some commonly encountered types include: 1. Unconditional Personal Guaranty: This type of guarantee is the most straightforward and common. The guarantor, without any conditions or limitations, agrees to be held personally accountable for the entire debt or obligation of the borrower. In case of default or non-payment by the borrower, the guarantor can be pursued for full repayment. 2. Limited Personal Guaranty: Unlike the unconditional guarantee, a limited personal guaranty restricts the guarantor's liability to a specific amount or a defined portion of the debt. This type of guarantee allows the guarantor to limit their exposure and liability, protecting their personal assets while still offering a level of assurance to the lender or creditor. 3. Continuing Personal Guaranty: A continuing personal guaranty is one that extends beyond a single transaction or obligation. It applies to multiple and future financial obligations of the borrower, including future loans or credit arrangements. This guarantees ongoing protection for the lender or creditor against potential defaults or non-payment. 4. Joint and Several Personal guaranties: In cases where multiple guarantors are involved, a joint and several personal guaranty binds each guarantor together as a group and individually. This implies that either all guarantors are responsible collectively, or any single guarantor may be held fully liable for the entire debt if others fail to fulfill their obligations. When entering into a Maine Personal Guaranty — General, it is crucial to carefully review and understand the terms and conditions outlined in the agreement. Seek legal advice if necessary to ensure clarity and protect your interests. Guarantors must be aware of the potential consequences, such as the seizure of personal assets or damage to credit ratings, in the event of borrower defaults. By providing lenders or creditors with a personal guaranty, individuals can help secure favorable financing terms, increase their chances of approval, and build trust in business transactions. However, it is essential to assess the financial risks associated with personal guaranty obligations before committing to them.

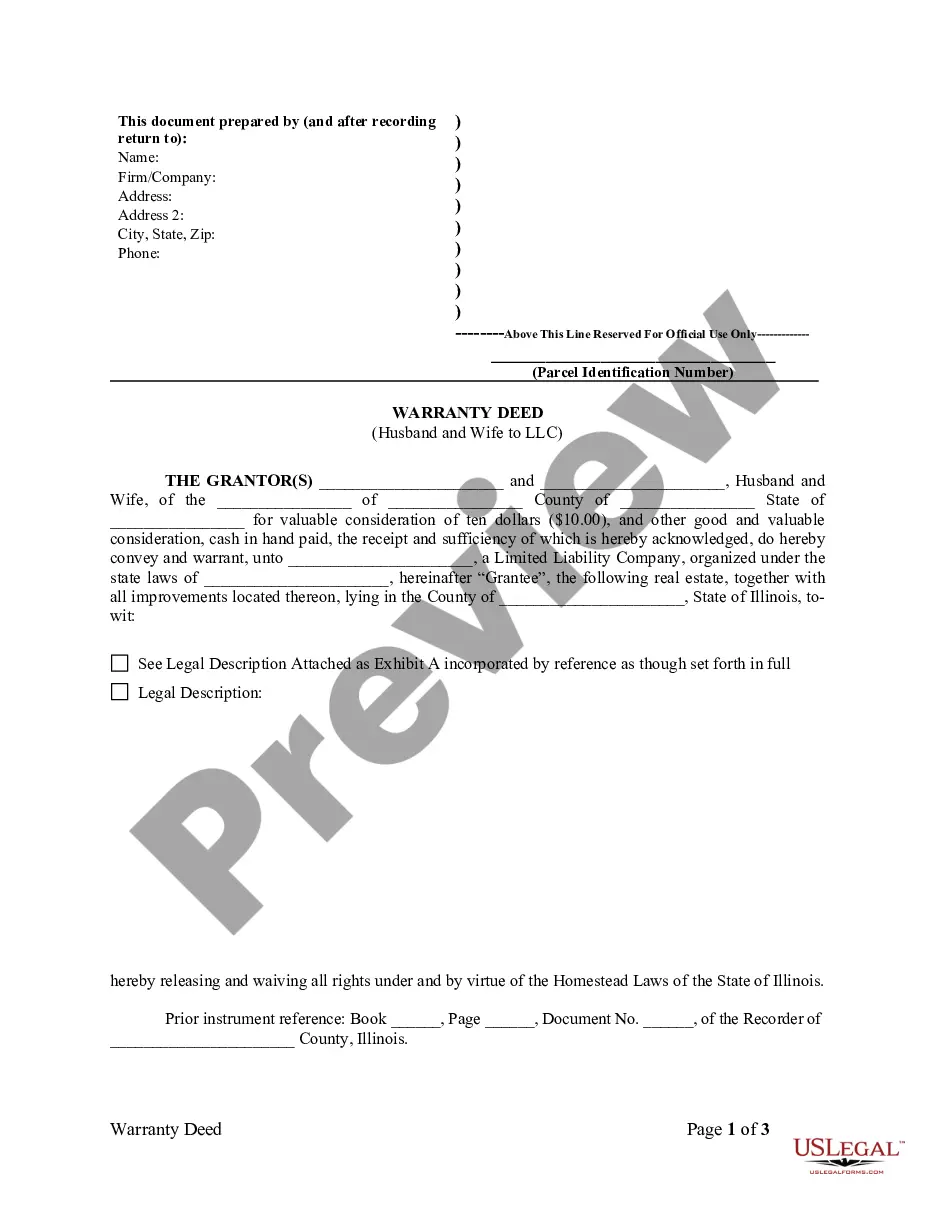

Maine Personal Guaranty - General

Description

How to fill out Maine Personal Guaranty - General?

It is possible to commit hrs on the Internet looking for the legal document design that meets the federal and state demands you need. US Legal Forms supplies 1000s of legal varieties which are evaluated by specialists. You can easily down load or print out the Maine Personal Guaranty - General from my services.

If you already have a US Legal Forms profile, it is possible to log in and then click the Obtain key. Afterward, it is possible to complete, edit, print out, or indicator the Maine Personal Guaranty - General. Every single legal document design you get is the one you have permanently. To acquire an additional backup of any obtained develop, proceed to the My Forms tab and then click the related key.

Should you use the US Legal Forms website the very first time, keep to the straightforward recommendations listed below:

- Initially, be sure that you have selected the best document design for that state/town that you pick. Read the develop information to make sure you have selected the right develop. If readily available, make use of the Review key to check throughout the document design also.

- If you would like locate an additional edition in the develop, make use of the Research field to get the design that meets your requirements and demands.

- Upon having identified the design you need, click on Acquire now to move forward.

- Find the rates prepare you need, enter your credentials, and register for a merchant account on US Legal Forms.

- Total the purchase. You can utilize your charge card or PayPal profile to pay for the legal develop.

- Find the structure in the document and down load it in your system.

- Make adjustments in your document if possible. It is possible to complete, edit and indicator and print out Maine Personal Guaranty - General.

Obtain and print out 1000s of document web templates using the US Legal Forms website, which offers the biggest assortment of legal varieties. Use skilled and state-distinct web templates to deal with your small business or personal requirements.