A trust is the legal relationship between one person, the trustee, having an equitable ownership or management of certain property and another person, the beneficiary, owning the legal title to that property. The beneficiary is entitled to the performance of certain duties and the exercise of certain powers by the trustee, which performance may be enforced by a court of equity. Most trusts are founded by the persons (called trustors, settlors and/or donors) who execute a written declaration of trust which establishes the trust and spells out the terms and conditions upon which it will be conducted. The declaration also names the original trustee or trustees, successor trustees or means to choose future trustees.

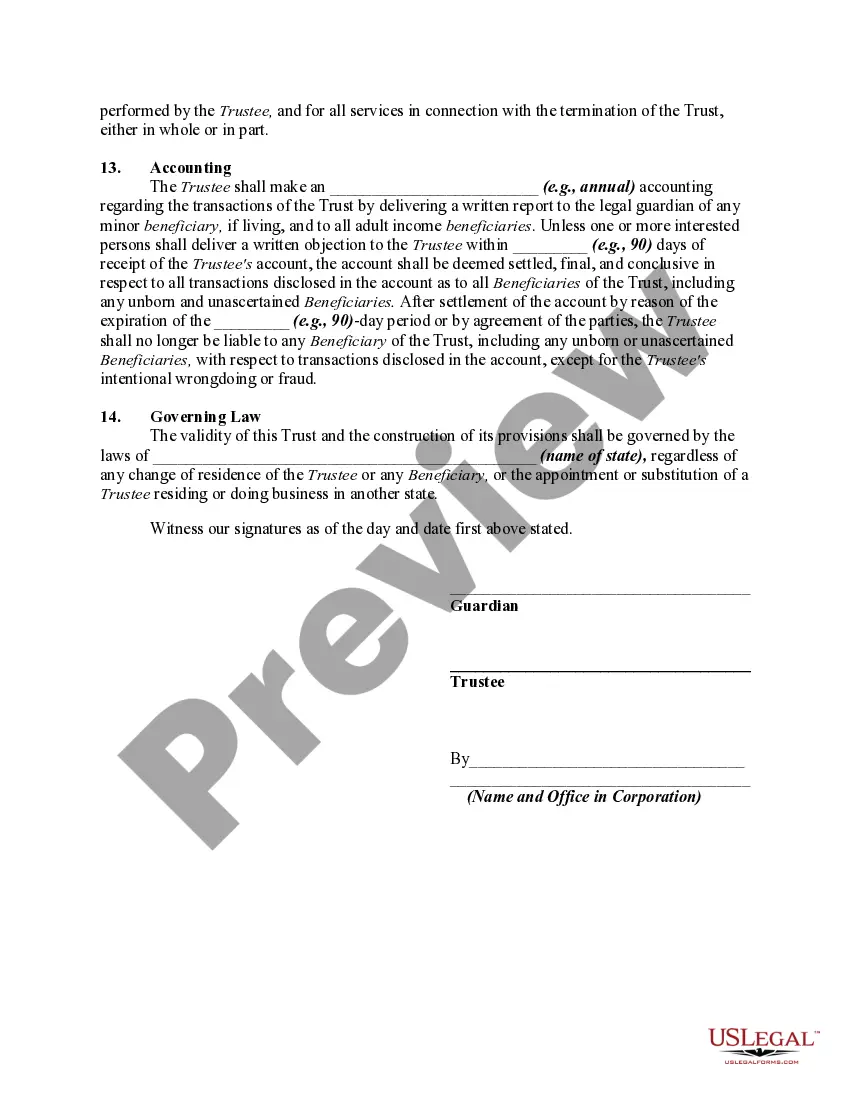

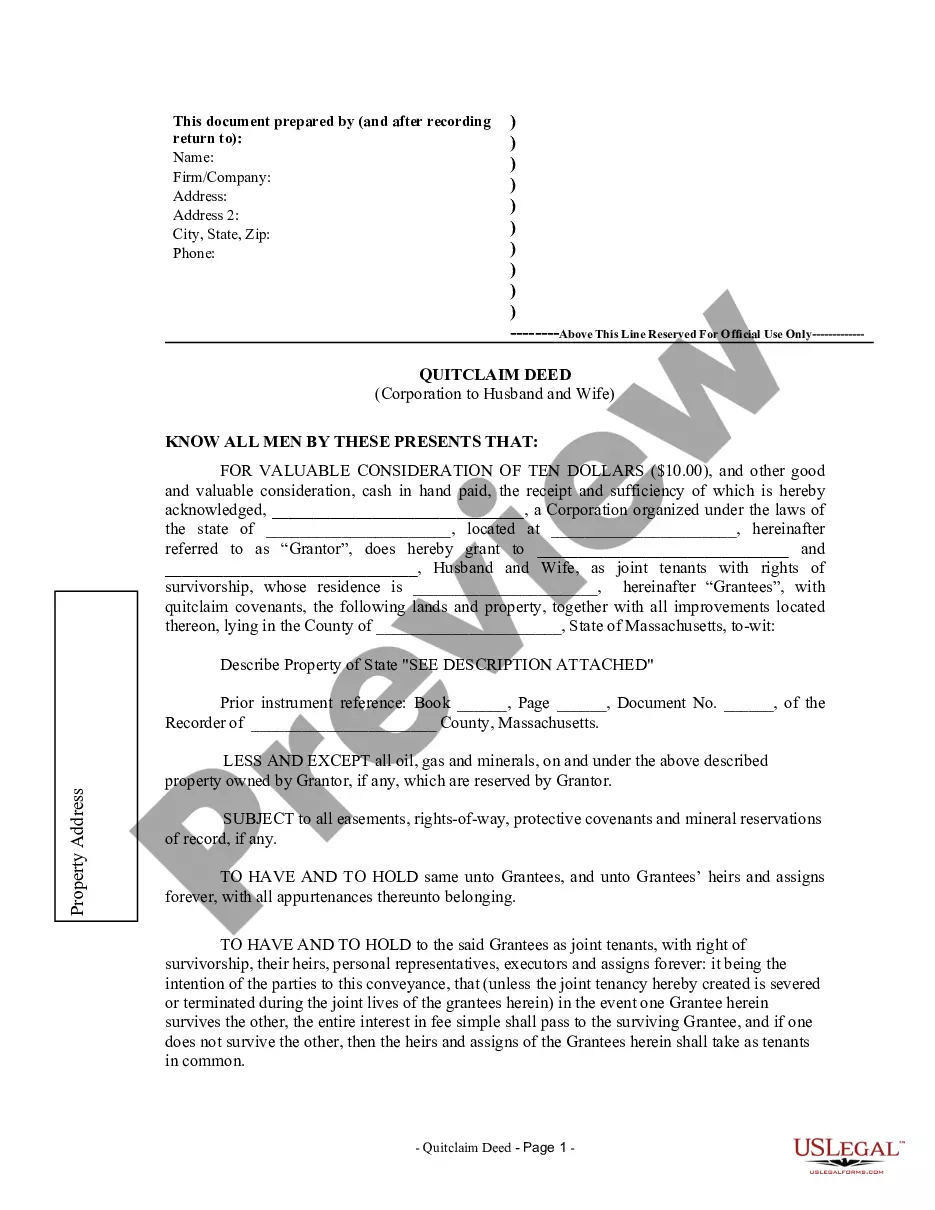

Maine Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor

Description

How to fill out Trust Agreement To Hold Funds For Minor Resulting From Settlement Of A Personal Injury Action Filed On Behalf Of Minor?

Are you presently in a location where you frequently require documents for either business or personal purposes.

There is a plethora of legal document templates accessible online, yet locating reliable ones is challenging.

US Legal Forms offers myriad templates, such as the Maine Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor, designed to comply with federal and state regulations.

Once you find the correct form, click Purchase now.

Select the pricing plan you want, complete the necessary information to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Maine Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/state.

- Use the Review button to examine the form.

- Read the description to confirm that you have selected the correct form.

- If the form is not what you are seeking, use the Search area to find the template that suits your needs.

Form popularity

FAQ

After an accident in Maine, you generally have six years to file a personal injury claim. This time frame is crucial because it determines whether you can pursue legal action for your injuries. Understanding the timeframe helps you prepare and consider important aspects, like a Maine Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor. Always remember to consult with an attorney to ensure you meet all necessary deadlines.

Generally, it is quite challenging to get around the statute of limitations in Maine. There are only a few limited exceptions, such as if the injured party was a minor at the time of the incident. In these cases, a Maine Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor ensures that the financial aspects of the claim can be handled appropriately, even if the time limits vary. Consulting legal help can clarify your options.

Yes, you can sue for emotional distress in Maine, but there are specific legal standards you must meet. These claims often require demonstration of severe emotional impact due to someone else's negligence. When filing such claims, consider how a Maine Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor may help manage compensation for emotional damages. Consulting with an attorney can guide you through the process effectively.

In Maine, the time bar for personal injury claims generally allows you to file a lawsuit within six years from the date of the injury. This timeframe emphasizes the importance of taking timely action. If a claim is not filed within this period, you could lose your right to seek compensation. To secure a Maine Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor, it is vital to understand these deadlines.

Yes, Texas law requires court approval for any settlement involving a minor. This is to ensure that the minor's best interests are protected, especially in cases arising from personal injury actions. Using a Maine Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor can be an effective way to manage and safeguard these funds. For streamlined processes and expert guidance, consider uslegalforms to assist you in navigating this important legal requirement.

Yes, you can place a settlement into a trust. Using a Maine Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor offers a safe way to manage and protect the funds. This approach ensures the funds are used appropriately for the minor's benefit. Working with legal experts, like those at uslegalforms, can help streamline this process.

In Maine, the statute of limitations for personal injury claims is six years. This means you have six years from the date of the injury to file a lawsuit. It's crucial to be aware of these time limits, especially when dealing with a settlement for a minor. A Maine Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor can help secure the settlement funds for future needs.