Maine Complaint Regarding Group Insurance Contract: A Detailed Description Group insurance contracts are agreements between an insurance provider and a group, such as an employer, association, or organization, to provide insurance coverage to eligible individuals within the group. However, there may be instances where individuals or groups in Maine have complaints regarding their group insurance contracts. These complaints can revolve around various aspects of the contract, including coverage, premiums, claims, or the overall terms and conditions. Here are some common types of Maine complaints regarding group insurance contracts: 1. Coverage Denial Complaints: These complaints arise when an individual believes that their valid insurance claim has been wrongfully denied by the insurance provider. This could include medical procedures, treatments, or medications that were not covered under the policy, leading to financial burden for the insured. 2. Premium Increase Complaints: Individuals or groups may file complaints when they experience substantial increases in their insurance premiums without a clear explanation. Such complaints may challenge the fairness or the transparency of the premium adjustment process. 3. Lack of Transparency Complaints: Parties involved may complain about the lack of transparency in the insurance contract, such as ambiguous language, hidden terms, or unfair exclusions. This can create confusion and difficulties in understanding the policy's coverage and limitations. 4. Claim Processing Delay Complaints: Complaints may be made when insurance providers delay or improperly handle the processing of claims, causing significant inconvenience or financial hardship for the insured party. This could involve delayed reimbursements or the requirement of excessive documentation. 5. Inadequate Provider Network Complaints: Some complaints may arise due to limited healthcare provider networks available under the group insurance contract. If individuals find their preferred doctors or hospitals are not covered or accessible, they may seek resolution or alternative options. 6. Administrative Errors Complaints: Complaints can occur when policyholders identify mistakes made by the insurance provider in record-keeping, premium calculations, or other administrative matters. These errors may lead to incorrect billing, policy cancellations, or the denial of coverage. 7. Lack of Communication Complaints: Parties may file complaints when the insurance provider fails to provide sufficient and transparent information regarding changes to the group insurance contract. Insured individuals may not be aware of modifications, limitations, or new benefits and, as a result, miss out on opportunities to make informed decisions. Maine regulation authorities such as the Maine Bureau of Insurance oversee these complaints and provide a platform for individuals to raise their concerns. It is essential for both the insured individuals and insurance providers to communicate effectively, maintain transparency, and promptly address any issues that may arise to ensure a fair and satisfactory resolution for all parties involved.

Maine Complaint regarding Group Insurance Contract

Description

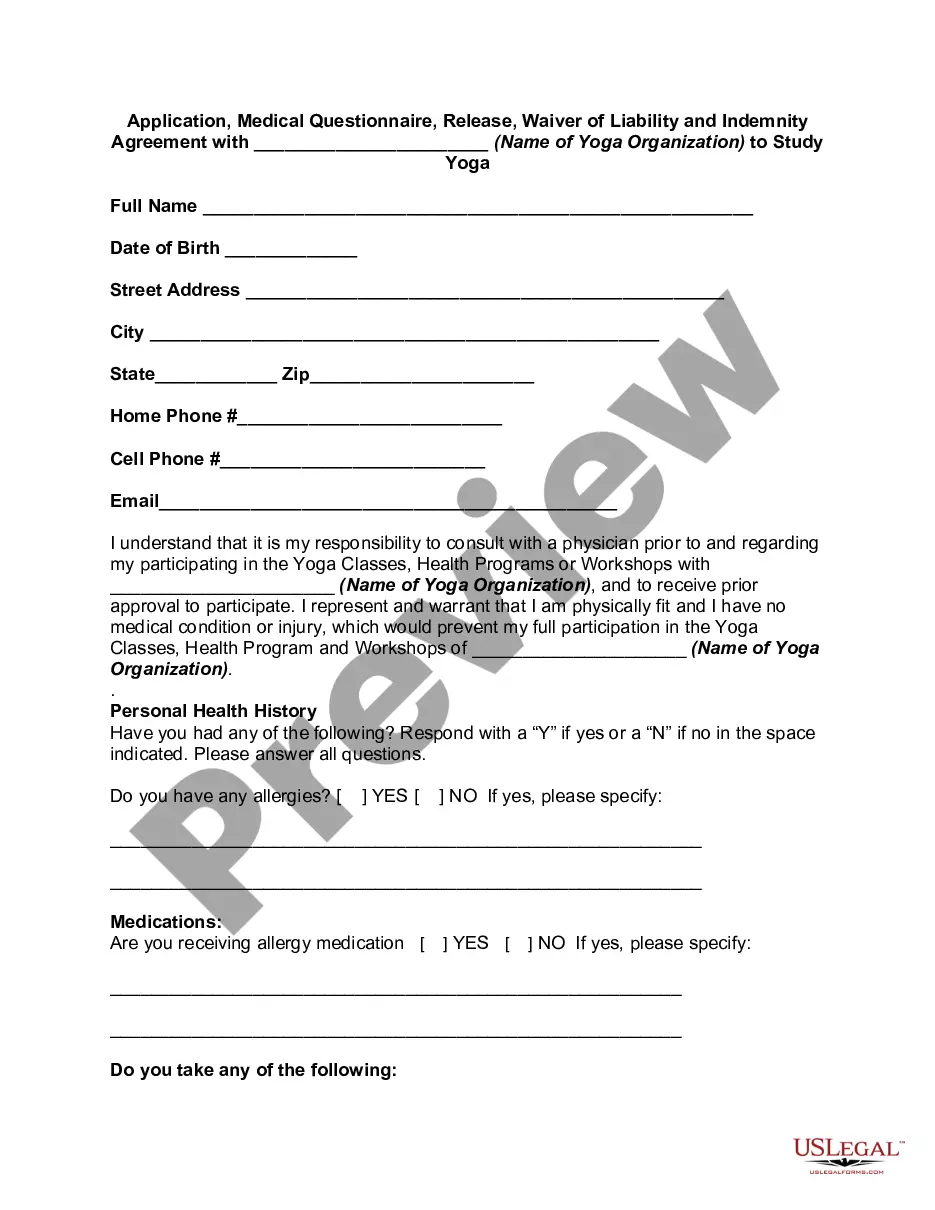

How to fill out Maine Complaint Regarding Group Insurance Contract?

US Legal Forms - one of the greatest libraries of legal types in the USA - offers an array of legal record templates you can download or print out. Using the web site, you can find a huge number of types for company and specific purposes, categorized by groups, claims, or search phrases.You will discover the latest types of types like the Maine Complaint regarding Group Insurance Contract in seconds.

If you already possess a membership, log in and download Maine Complaint regarding Group Insurance Contract in the US Legal Forms local library. The Acquire button will show up on every kind you see. You have accessibility to all in the past acquired types within the My Forms tab of your own account.

In order to use US Legal Forms for the first time, listed below are simple instructions to help you get started out:

- Make sure you have picked the best kind for your area/state. Select the Review button to examine the form`s articles. See the kind explanation to ensure that you have selected the proper kind.

- In case the kind does not suit your demands, use the Research industry at the top of the monitor to find the one which does.

- In case you are satisfied with the form, verify your option by clicking the Buy now button. Then, select the prices program you prefer and give your accreditations to register for an account.

- Approach the purchase. Make use of your Visa or Mastercard or PayPal account to accomplish the purchase.

- Choose the file format and download the form on the gadget.

- Make changes. Complete, edit and print out and sign the acquired Maine Complaint regarding Group Insurance Contract.

Each and every design you put into your money does not have an expiration day and is also the one you have for a long time. So, if you wish to download or print out an additional version, just visit the My Forms area and click on around the kind you want.

Obtain access to the Maine Complaint regarding Group Insurance Contract with US Legal Forms, by far the most comprehensive local library of legal record templates. Use a huge number of expert and condition-particular templates that meet your business or specific demands and demands.

Form popularity

FAQ

The current chairman is Phil Bartlett.

Ask a third party such as an ombudsman to help with your dispute. File a complaint with your state department of insurance, which regulates insurance activity and insurer compliance with state laws and regulations. Seek arbitration if that is an option in your policy. File a legal claim against the insurer in court.

To file a complaint or request mediation, please complete and submit a webform at along with a copy of the contract and any other supporting documents.

Information To Include in Your Letter Give the basics. Tell your story. Tell the company how you want to resolve the problem. Be reasonable. File your complaint. Your Address. Your City, State, Zip Code. [Your email address, if sending by email] Date.

You can enter your complaint online by visiting the consumer complaint form. For more immediate assistance regarding the termination of your utility service, call our Consumer Assistance Hotline at 1-800-452-4699, Monday through Friday, a.m. to p.m.