Maine Revocable Living Trust for Married Couple

Description

How to fill out Revocable Living Trust For Married Couple?

Are you in a situation where you frequently require documents for both business or personal purposes.

There are numerous authentic document templates available online, but finding trustworthy ones can be challenging.

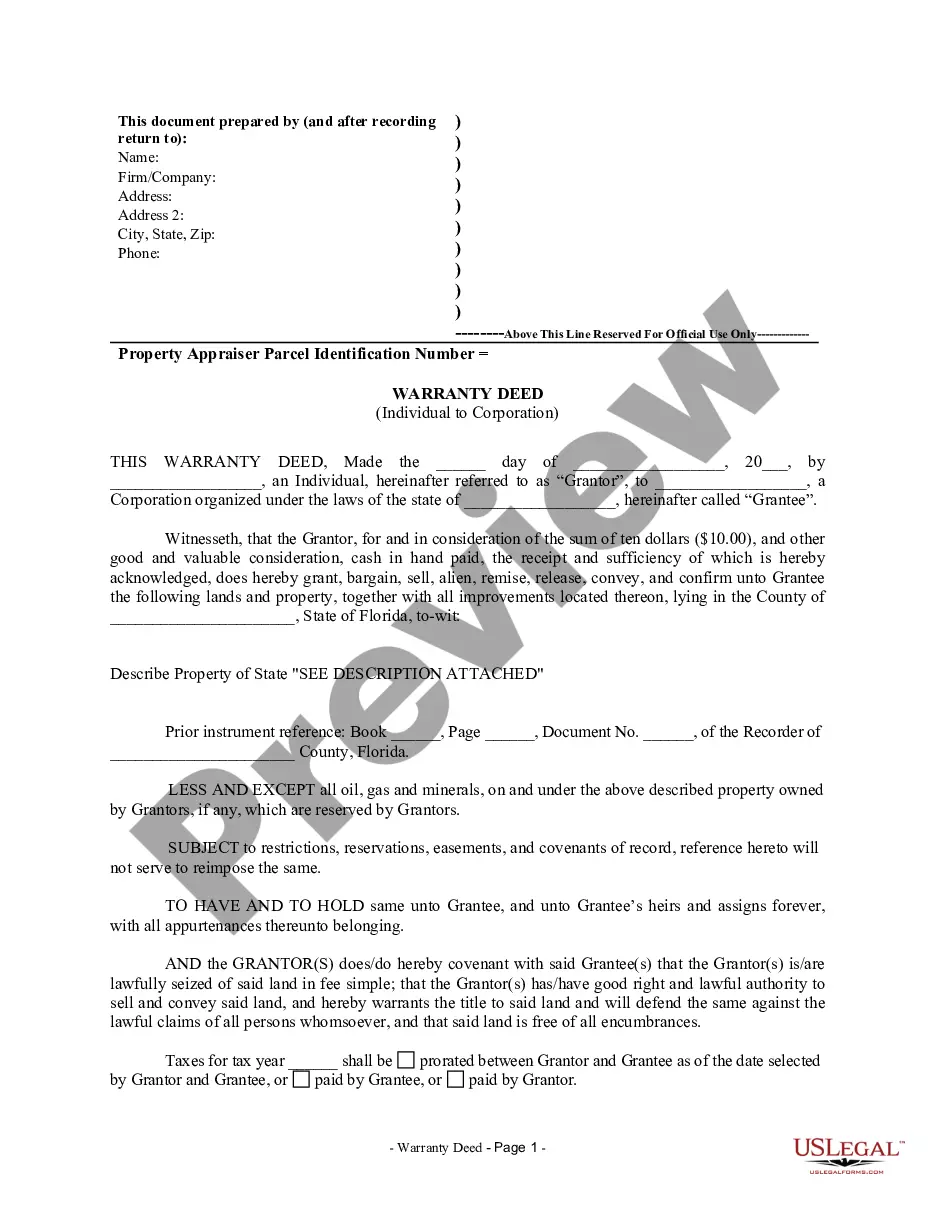

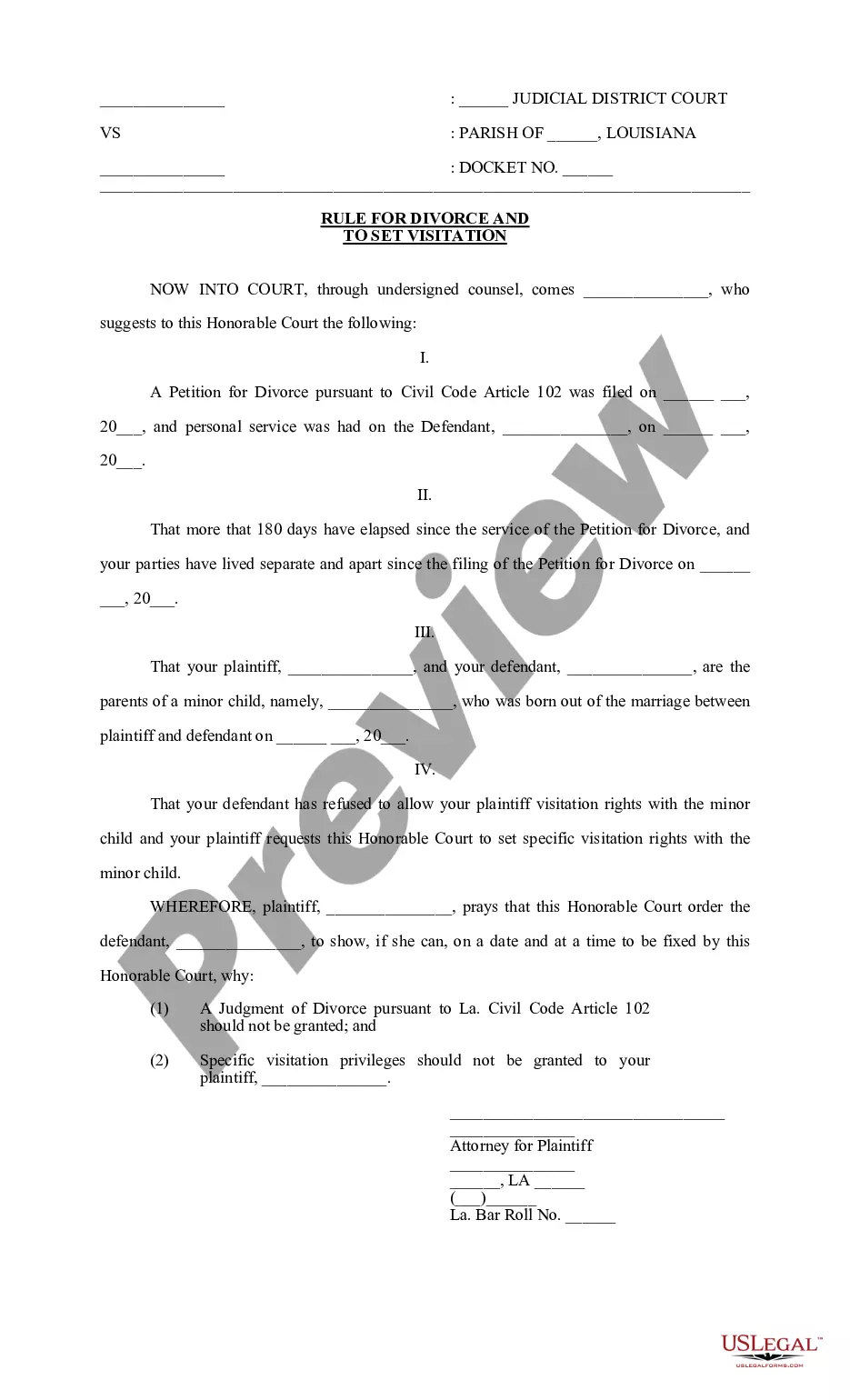

US Legal Forms offers thousands of form templates, including the Maine Revocable Living Trust for Married Couples, which can be customized to comply with state and federal regulations.

Once you acquire the correct form, click Purchase now.

Choose the pricing plan you prefer, enter the required information to create your account, and complete the transaction using PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Afterward, you can download the Maine Revocable Living Trust for Married Couples template.

- If you don’t have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is tailored to the correct city/region.

- Utilize the Review button to check the form.

- Read the description to confirm that you have selected the correct form.

- If the form is not what you're looking for, use the Lookup field to find the form that satisfies your needs.

Form popularity

FAQ

While joint revocable trusts can simplify estate management, they may lead to complications when it comes to individual assets or personal preferences. For example, a Maine Revocable Living Trust for Married Couple may not address how to handle disputes or changes in circumstances effectively. Additionally, if one partner passes away, the trust may need extensive revisions, which could complicate the process. An estate planning professional can help couples navigate these challenges while establishing clear guidelines.

Whether married couples should have separate revocable trusts can depend on various factors, such as individual assets and estate planning goals. A Maine Revocable Living Trust for Married Couple can simplify management and distribution of shared assets, but separate trusts may provide more personal control and protection for individual assets. Ultimately, consulting with an estate planning professional can help couples make an informed decision that aligns with their needs. Both options have their advantages, and the right choice varies for each couple.

The best type of trust for a married couple often depends on their specific financial situation and goals. A Maine Revocable Living Trust for Married Couple typically provides flexibility and control over assets during their lifetime while outlining how those assets will be managed after their death. This type of trust allows couples to change terms as needed, ensuring that their wishes are respected over time. For many, a revocable living trust serves as a solid foundation for estate planning.

A Maine Revocable Living Trust for Married Couple serves to combine the assets of both partners into one trust, simplifying management and distribution. Each spouse can contribute assets and establish guidelines for how those assets are managed during their lifetimes and after death. This arrangement not only ensures that the couple's wishes are honored but also provides protection from creditors. Furthermore, using platforms like uslegalforms can streamline the process of setting up and maintaining your trust.

A Maine Revocable Living Trust for Married Couple allows both spouses to manage their assets together while ensuring a smooth transition of wealth upon death. When establishing the trust, each spouse can appoint themselves or each other as trustees, maintaining control over the trust's assets. In addition, this type of trust helps avoid probate, providing privacy and quicker distribution of assets. Ultimately, it offers a flexible solution tailored to the couple's unique financial situation.

Yes, a revocable trust, such as a Maine Revocable Living Trust for Married Couple, can still be changed after one spouse dies. The surviving spouse typically retains the right to modify the trust's terms or even revoke it entirely if they choose. This adaptability is a key benefit, ensuring the trust continues to reflect the surviving spouse's wishes.

One downside of a revocable trust, including the Maine Revocable Living Trust for Married Couple, is that it does not provide protection from creditors. Additionally, since the trust remains revocable, it may not offer the same tax benefits as an irrevocable trust. Couples should weigh these factors carefully when deciding whether this type of trust suits their needs.

The best living trust for a married couple is often the Maine Revocable Living Trust for Married Couple. This trust allows joint management of assets while providing flexibility for both partners. It also simplifies the transfer of assets upon death, helping couples establish clear plans that reflect their wishes and ensure peace of mind.

When one spouse dies, a joint revocable trust generally allows the surviving spouse to maintain control over the assets. The trust often becomes a single trust, allowing the surviving spouse to manage the assets without major disruptions. This feature ensures that the surviving spouse doesn't face unnecessary hurdles during an already challenging time.

Typically, a joint revocable trust, like the Maine Revocable Living Trust for Married Couple, does not become irrevocable when one spouse dies. Instead, the surviving spouse usually retains control and can modify the trust as needed. This flexibility helps ensure that the trust continues to meet the couple's needs over time.