Maine Revocable Living Trust for Grandchildren

Description

How to fill out Revocable Living Trust For Grandchildren?

If you want to complete, download, or create valid document templates, utilize US Legal Forms, the largest collection of legal forms, accessible online.

Employ the site’s straightforward and convenient search to locate the documents you need.

Various templates for business and personal purposes are categorized by types and states, or keywords.

Step 5. Complete the transaction process. You can use your credit card or PayPal account to finalize the purchase.

Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, edit, and print or sign the Maine Revocable Living Trust for Grandchildren.

- Use US Legal Forms to find the Maine Revocable Living Trust for Grandchildren in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to acquire the Maine Revocable Living Trust for Grandchildren.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for the correct city/state.

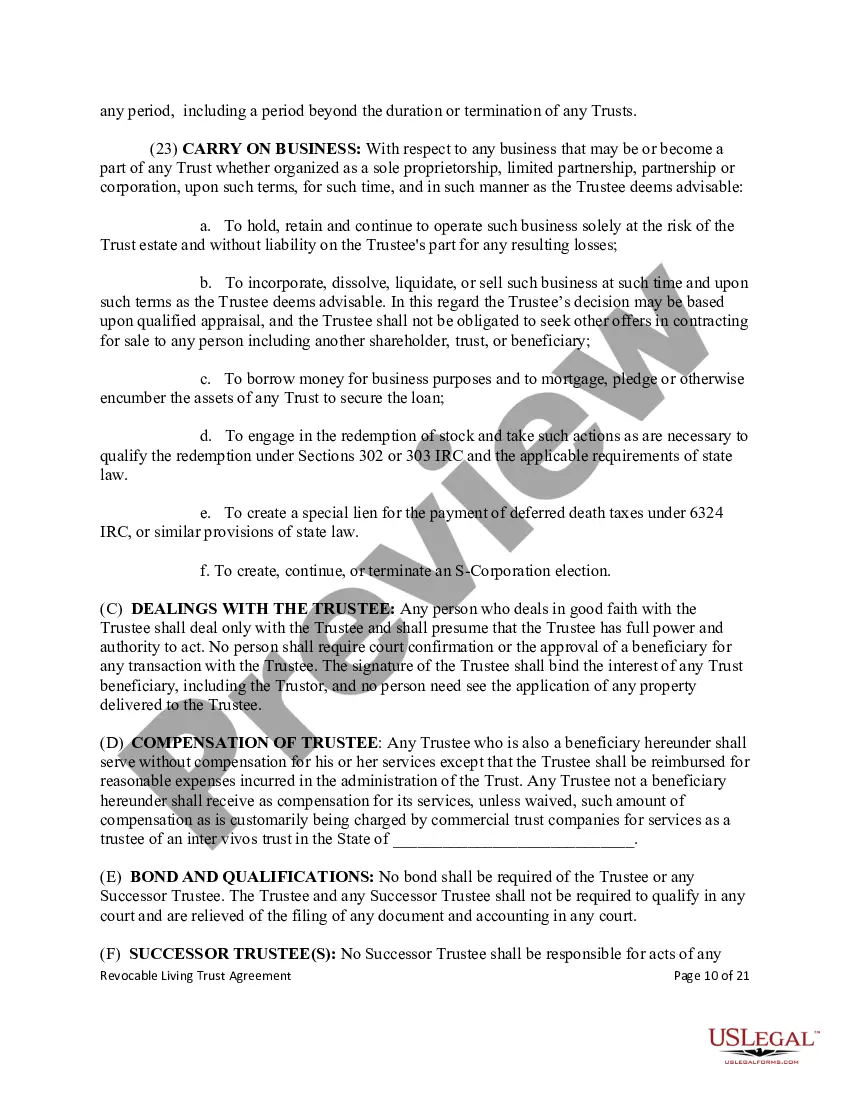

- Step 2. Use the Review option to examine the details of the form. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search section at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your information to register for an account.

Form popularity

FAQ

The Maine Revocable Living Trust for Grandchildren stands out as the best option for protecting your grandchild's inheritance. This trust allows you to retain control over the assets while still providing for their future. You can tailor the distribution of assets based on your grandchild's needs and life stages. Choosing this trust gives you the freedom and security to ensure your legacy supports your family's future.

The main disadvantage of an irrevocable trust for grandchildren is the loss of control over the assets. Once you place your assets in this trust, you cannot modify the terms or reclaim the assets. This can be particularly concerning if circumstances change and you need access to those funds. On the other hand, a Maine Revocable Living Trust for Grandchildren allows for flexibility, giving you peace of mind while still prioritizing your grandkids’ interests.

Establishing a Maine Revocable Living Trust for Grandchildren is one of the best ways to leave an inheritance. This trust not only allows for smooth asset transfer but also provides flexibility in how and when your grandchildren receive their inheritance. You can set specific conditions, such as age or milestones, ensuring that your grandchildren benefit from your wealth in a responsible manner. This proactive approach ensures that your legacy is protected and managed effectively.

To effectively avoid inheritance tax, the Maine Revocable Living Trust for Grandchildren is often the best option. This type of trust allows you to retain control of your assets during your lifetime, while also ensuring that the assets passed to your grandchildren are excluded from the taxable estate. By setting up this trust, you can secure your grandchildren's inheritance without the burden of significant tax implications. Therefore, consulting with an estate planning expert can help you maximize these benefits.

The major disadvantage of the Maine Revocable Living Trust for Grandchildren lies in the initial setup costs and maintenance. Establishing a trust often involves legal fees and time to create a detailed plan. Additionally, if the grantors wish to maintain control, they may feel burdened by the ongoing management responsibilities. Understanding these factors can help families weigh their options effectively.

Considering a Maine Revocable Living Trust for Grandchildren can be a wise decision for many families. A trust can simplify the transfer of assets, avoid probate, and protect the children’s inheritance. However, parents should evaluate their unique financial situation and goals to determine if a trust aligns with their estate planning objectives. Consulting with a legal expert can provide valuable insights tailored to their needs.

Maine Revocable Living Trust for Grandchildren can provide great benefits, but trust funds also come with certain risks. Mismanagement of trust assets can lead to financial losses. Additionally, potential conflicts among beneficiaries can arise, complicating access to their benefits. It’s important to establish clear guidelines and select a trustworthy trustee to minimize these dangers.

One downside of a Maine Revocable Living Trust for Grandchildren is that it does not offer protection from creditors or legal judgments during your lifetime. While you have the flexibility to amend or revoke the trust as needed, this feature can leave assets exposed. Additionally, you may face higher administrative costs compared to simpler estate planning options. Nonetheless, the benefits often outweigh these considerations, making it a popular choice for many.

A Maine Revocable Living Trust for Grandchildren is often considered an ideal option. This type of trust allows you to manage assets today while ensuring protection for your grandchildren's inheritance in the future. By using this trust, you can exert control over when and how your grandchildren receive their benefits. Each family's situation is unique, so it's wise to consult a legal professional to tailor the trust to meet your specific needs.

To list a trust as a beneficiary, you'll need to provide the trust's name along with the trustee's information. This inclusion ensures that assets can transfer to your Maine Revocable Living Trust for Grandchildren after your passing. It's important to review your existing accounts and policies to formally change the beneficiary designation. Consulting with an experienced estate planning attorney can help you navigate this process smoothly.