Maine Loan Agreement - Short Form

Description

How to fill out Loan Agreement - Short Form?

You can spend time online attempting to locate the legal document template that meets the state and federal requirements you require.

US Legal Forms provides thousands of legal forms that are reviewed by professionals.

You can easily download or print the Maine Loan Agreement - Short Form from their services.

If available, utilize the Preview button to review the document template as well. To find another version of the form, use the Search area to locate the template that fits your needs and requirements. Once you have identified the template you want, click Purchase now to proceed. Select the pricing plan you desire, enter your details, and register for an account on US Legal Forms. Complete the payment. You can use your credit card or PayPal account to pay for the legal form. Choose the format of the document and download it to your device. Make changes to the document if necessary. You can complete, modify, sign, and print the Maine Loan Agreement - Short Form. Download and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you possess a US Legal Forms account, you may Log In and then click the Download button.

- After that, you can complete, modify, print, or sign the Maine Loan Agreement - Short Form.

- Each legal document template you purchase belongs to you permanently.

- To obtain another copy of any purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow these simple instructions below.

- First, make sure you have selected the correct document template for the county/area you choose.

- Read the form description to ensure you have selected the correct form.

Form popularity

FAQ

A loan agreement should be structured to include information about the borrower and the lender, the loan amount, and repayment terms, including interest charges and a timeline for repaying the loan. It should also spell out penalties for late payments or default and should be clear about expectations between parties.

Read our editorial guidelines here . A personal loan agreement is a written contract between two parties, generally a borrower and a lender. It outlines how much money is being borrowed, the repayment schedule and what should be done if there's a dispute over paying it back.

A loan agreement may be called a number of different things, including a loan contract, a credit agreement, a financing agreement, and in some cases, a promissory note.

A type of loan used to support a temporary personal or business capital need.

Categorizing loan agreements by type of facility usually results in two primary categories: term loans, which are repaid in set installments over the term, or. revolving loans (or overdrafts) where up to a maximum amount can be withdrawn at any time, and interest is paid from month to month on the drawn amount.

Short term loans are called such because of how quickly the loan needs to be paid off. In most cases, it must be paid off within six months to a year ? at most, 18 months. Any longer loan term than that is considered a medium term or long term loan. Long term loans can last from just over a year to 25 years.

The biggest advantage of a short term loan is that, upon approval, you will often receive funds within a week. If for example, you need to make a quick payment to outstanding bills, or you need to purchase new stock quickly ? a short term loan will help you meet your cash requirements immediately.

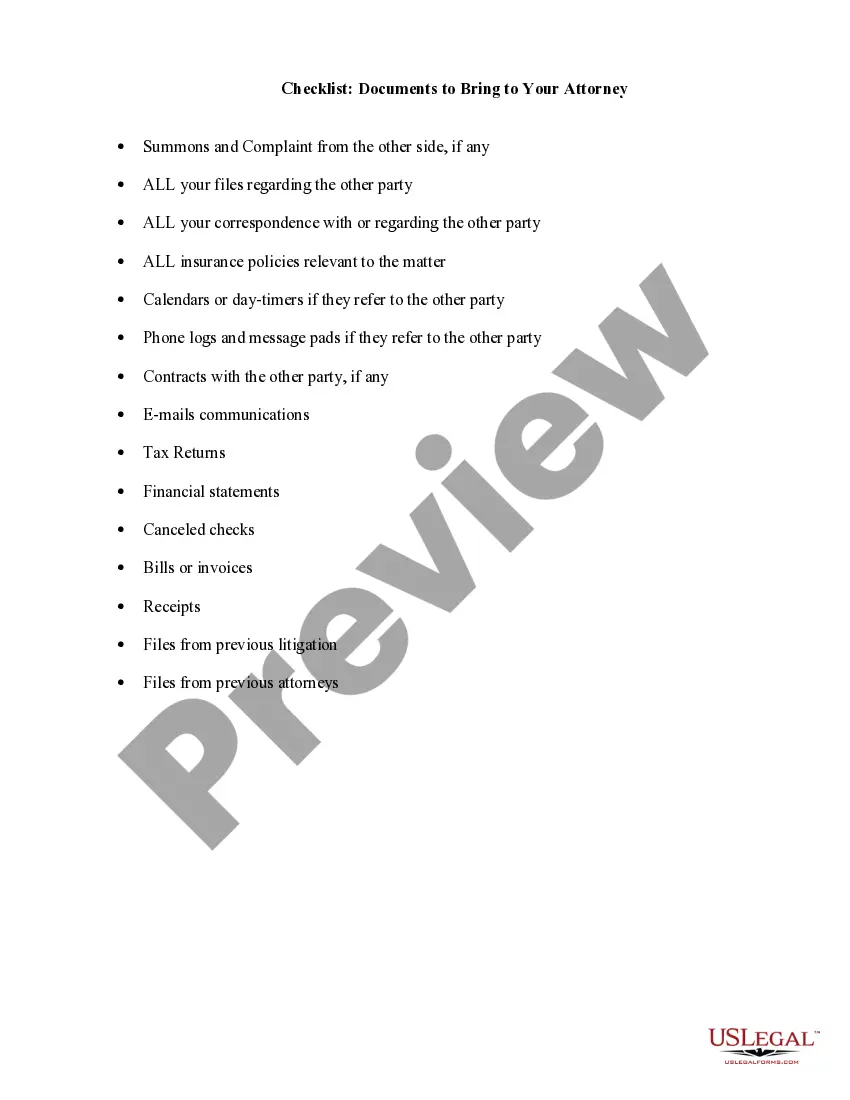

What to include in your loan agreement? The amount of the loan, also known as the principal amount. The date of the creation of the loan agreement. The name, address, and contact information of the borrower. The name, address, and contact information of the lender.