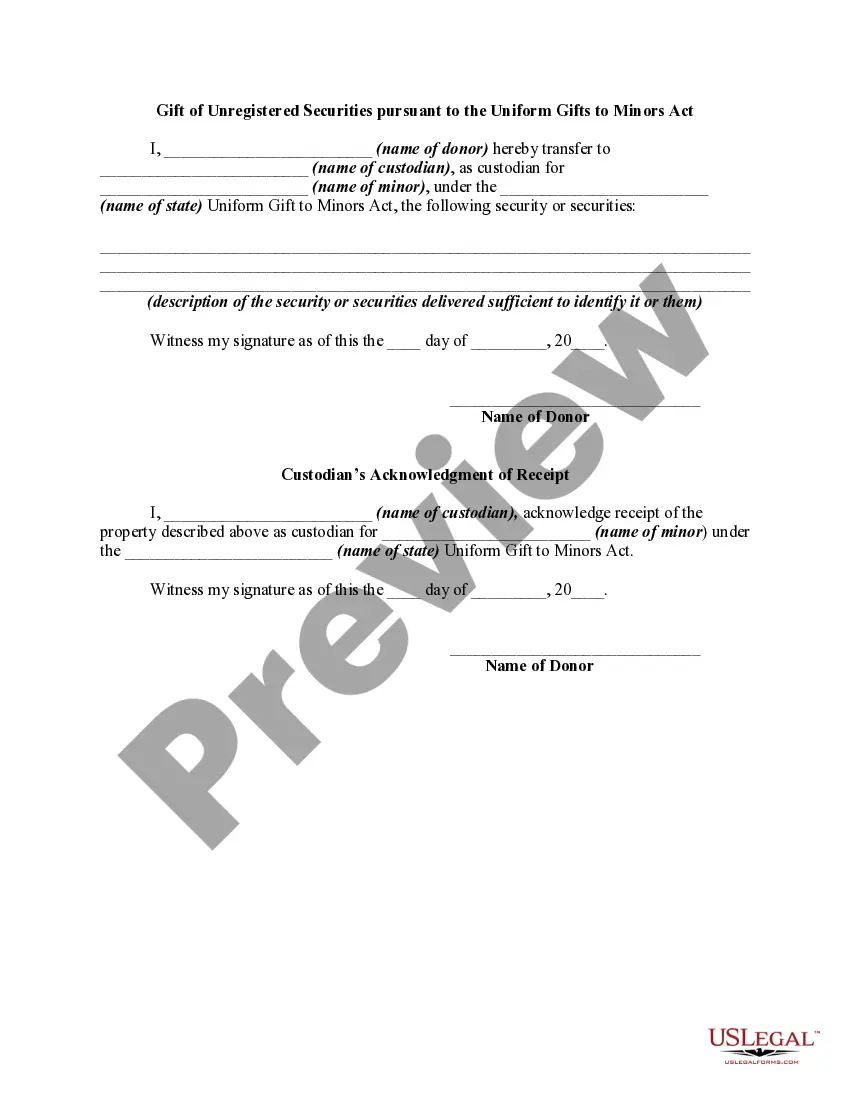

Maine Gift of Unregistered Securities pursuant to the Uniform Gifts to Minors Act

Description

How to fill out Gift Of Unregistered Securities Pursuant To The Uniform Gifts To Minors Act?

Discovering the right legitimate file design can be quite a have difficulties. Needless to say, there are a lot of layouts available on the net, but how do you discover the legitimate kind you want? Use the US Legal Forms internet site. The services offers 1000s of layouts, for example the Maine Gift of Unregistered Securities pursuant to the Uniform Gifts to Minors Act, which you can use for organization and private requirements. All of the kinds are checked out by specialists and satisfy state and federal needs.

Should you be already listed, log in in your profile and click on the Obtain key to have the Maine Gift of Unregistered Securities pursuant to the Uniform Gifts to Minors Act. Make use of profile to search through the legitimate kinds you possess acquired in the past. Go to the My Forms tab of your profile and obtain one more version of your file you want.

Should you be a brand new customer of US Legal Forms, here are straightforward guidelines so that you can comply with:

- First, ensure you have chosen the proper kind for your personal area/county. It is possible to look over the form making use of the Preview key and browse the form description to make sure this is the best for you.

- When the kind does not satisfy your needs, use the Seach area to get the correct kind.

- When you are positive that the form would work, click on the Buy now key to have the kind.

- Opt for the pricing strategy you would like and enter the needed info. Build your profile and buy your order using your PayPal profile or charge card.

- Choose the document file format and obtain the legitimate file design in your device.

- Total, change and print out and indication the acquired Maine Gift of Unregistered Securities pursuant to the Uniform Gifts to Minors Act.

US Legal Forms may be the greatest catalogue of legitimate kinds that you will find a variety of file layouts. Use the company to obtain appropriately-manufactured papers that comply with state needs.

Form popularity

FAQ

Eight states (Florida, Virginia, Washington, Alaska, Ohio, Oregon, Pennsylvania and Tennessee) have their UTMA age of majority from 21 to 25. Wyoming's range is the widest, spanning from 21 to 30.

If a minor has reached the age of twenty-one (21) and seeks to withdraw the funds from the UTMA account of which he/she is the beneficiary, the minor must contact the custodian, as the custodian is the only person authorized to make withdrawals or close the account.

Alaska, Arkansas, California, Washington DC, Kentucky, and Michigan Maine are some of the states that allow UTMA accounts to be chosen for payout between the ages of 18-21. California and Nevada are an exception, as they allow the range to be 18 to 25.

Depending on the state a UTMA account is handed over to a child when they reach either age 18 or age 21. In some jurisdictions, at age 18 a UTMA account can only be handed over with the custodian's permission, and at 21 is transferred automatically.

It's called the Uniform Transfers to Minors Act (UTMA), a type of custodial account that allows parents or other caretakers to pay expenses for anything child-related, including tuition.

How does an UTMA account work? An adult opens the UTMA account and contributes to it on behalf of a minor beneficiary. The custodian manages the account until the minor comes of age. All custodial assets transfer to the UTMA beneficiary.

The age of majority for an UTMA is different in each state. In most states, the age of majority is 21 ? which means that when a child turns 21, the custodianship of assets will end. But in other states, the age of majority is either 18 or 25. The custodian can also sometimes choose between a selection of ages.

When Can a Child Claim Ownership of an UTMA Account? Depending on the state a UTMA account is handed over to a child when they reach either age 18 or age 21. In some jurisdictions, at age 18 a UTMA account can only be handed over with the custodian's permission, and at 21 is transferred automatically.