Maine Salesperson Contract - Percentage Contract - Asset Purchase Transaction

Description

How to fill out Salesperson Contract - Percentage Contract - Asset Purchase Transaction?

Are you currently in a role where you require documentation for either business or personal tasks almost daily.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers a vast selection of form templates, such as the Maine Salesperson Contract - Percentage Contract - Asset Purchase Transaction, designed to comply with federal and state regulations.

Once you find the right form, click Get now.

Select the pricing plan you prefer, fill out the required information to create your account, and complete the transaction using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After logging in, you can download the Maine Salesperson Contract - Percentage Contract - Asset Purchase Transaction template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct city/state.

- Use the Preview button to inspect the form.

- Review the description to confirm you have chosen the appropriate form.

- If the form is not what you're looking for, utilize the Search field to find the form that suits your needs.

Form popularity

FAQ

An earn-out in mergers and acquisitions (M&A) refers to a contractual agreement where the seller receives additional compensation based on the business's future earnings. This structure can help bridge gaps between buyers and sellers regarding business valuation. Implementing such a clause in your Maine Salesperson Contract - Percentage Contract can enhance deal attractiveness.

Earnout on asset sale refers to the structure whereby the seller can receive additional payments based on the asset's future performance. This is particularly useful in aligning the seller's interests with the buyer's success. Incorporating an earnout clause in your Maine Salesperson Contract - Percentage Contract helps to protect both parties.

The 8% tax in Maine refers to the state sales tax applied to many goods and services. This tax plays a considerable role in the overall costs involved in asset purchases. For businesses or individuals entering into contracts, it is crucial to factor this tax into your financial planning. Using a Maine Salesperson Contract - Percentage Contract can ensure that such factors are adequately addressed.

Maine is not the highest taxed state in the US, but it ranks among the higher states for income and property taxes. Residents should be aware of how these taxes can impact their financial decisions related to purchasing assets. When dealing with contracts in asset purchases, you should consider these tax implications. Having a clear Maine Salesperson Contract - Percentage Contract can help streamline these transactions.

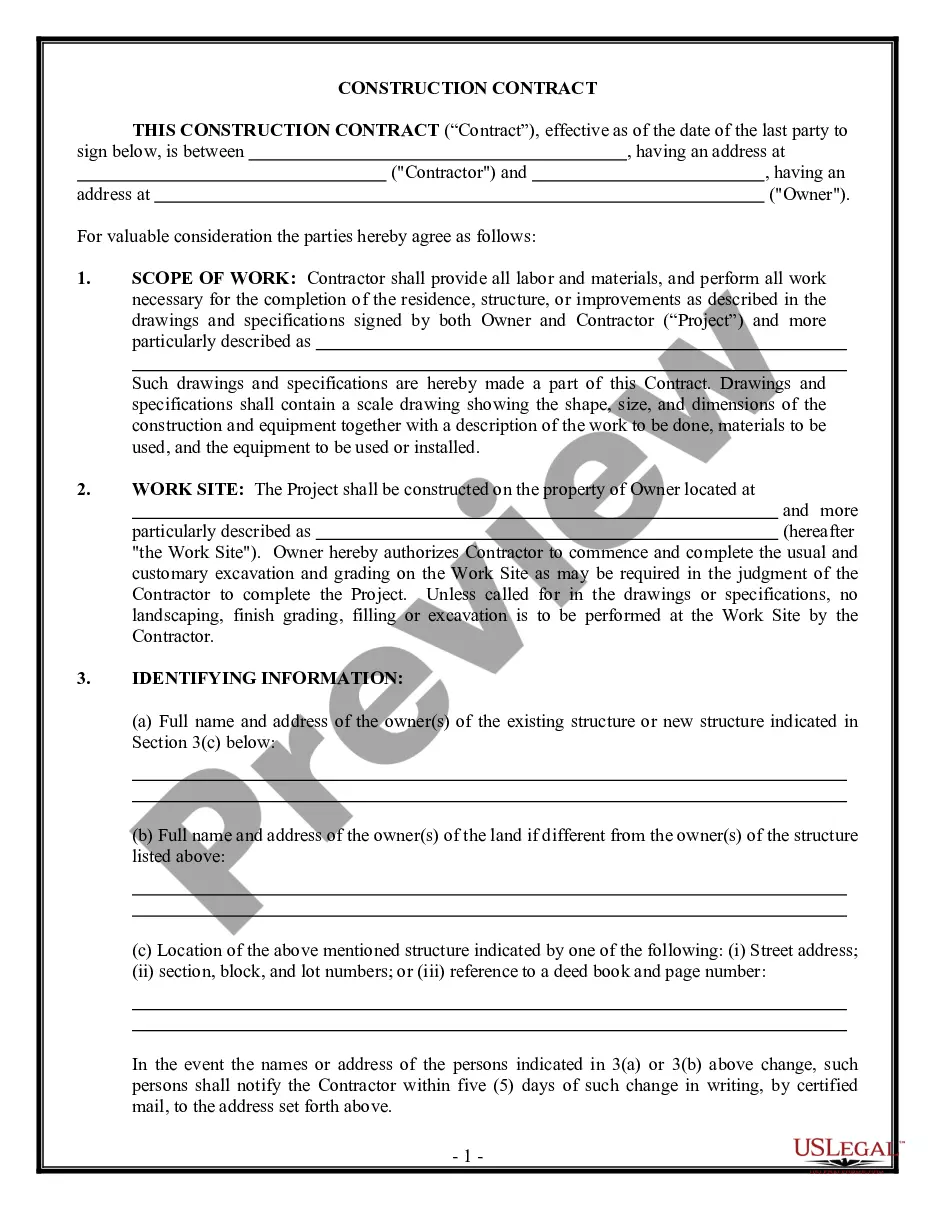

An asset purchase agreement is a legal contract to buy the assets of a business. It can also be used to purchase specific assets from a business, especially if they are significant in value.

An asset purchase involves just the assets of a company. In either format, determining what is being acquired is critical. This article focuses on some of the important categories of assets to consider in a business purchase: real estate, personal property, and intellectual property.

What is included in your contract will differ based on your circumstances, but a starting agreement should include:Party information.Definitions.Purchased assets.Purchase price.Additional covenants.Warranties or disclaimers.Indemnification.Breach of contract provisions.More items...

You would use an asset purchase agreement for a variety of situations. These contracts are advantageous when buyers and sellers want flexibility over the transaction. Additionally, the APA may be a component of a more significant transaction, such as a joint venture (JV) or the sale of a business entity.

In an asset purchase, the buyer will only buy certain assets of the seller's company. The seller will continue to own the assets that were not included in the purchase agreement with the buyer. The transfer of ownership of certain assets may need to be confirmed with filings, such as titles to transfer real estate.

A purchase agreement is a legal document that is signed by both the buyer and the seller. Once it is signed by both parties, it is a legally binding contract. The seller can only accept the offer by signing the document, not by just providing the goods.