Maine Agreement for Purchase of Business Assets from a Corporation is a legal document that outlines the terms and conditions of a transaction involving the acquisition of business assets from a corporation. This agreement is applicable in the state of Maine. It is crucial to understand the various types of Maine Agreement for Purchase of Business Assets from a Corporation to choose the most suitable one for your specific situation. Here are some relevant keywords and types of agreements to consider: 1. Asset Purchase Agreement: This type of agreement is used when the buyer intends to acquire specific business assets from the corporation, such as inventory, equipment, intellectual property rights, customer lists, contracts, and goodwill. 2. Stock Purchase Agreement: In this type of agreement, the buyer purchases the corporation's outstanding shares, acquiring both the assets and liabilities of the entire business entity. 3. Merger Agreement: A merger agreement is used when two or more corporations decide to merge into a single entity. This agreement governs the consolidation of their assets, liabilities, and operations. 4. Acquisition Agreement: An acquisition agreement covers a broader scope and can be used interchangeably with a purchase agreement. It involves the acquisition of various business assets, which may include real estate, tangible property, intangible assets, contracts, and rights. 5. Letter of Intent (LOI): Although not a separate agreement, a Letter of Intent may be used as a preliminary document to express the buyer's intent to purchase the corporation's assets. It outlines the main terms and conditions that may be further negotiated and detailed in the final agreement. 6. Due Diligence Agreement: This agreement defines the specific timeframe and access granted to the buyer for conducting a thorough investigation of the corporation's financial, legal, and operational records. It ensures transparency and allows the buyer to assess the value and risks associated with the purchase. 7. Confidentiality Agreement (NDA): Before entering into any negotiations or sharing sensitive information, a Non-Disclosure Agreement is often signed. This agreement protects the confidential information exchanged during the due diligence process and restricts its use or disclosure to third parties. The Maine Agreement for Purchase of Business Assets from a Corporation is a critical legal document that governs the buying, selling, and transfer of business assets. It covers aspects such as purchase price, payment terms, representations and warranties, indemnification, governing law, dispute resolution, and various other provisions to safeguard both parties' interests. As the specifics of each transaction can vary, it is advisable to consult with legal professionals experienced in Maine corporate law to ensure compliance and protect your interests throughout the process.

Maine Agreement for Purchase of Business Assets from a Corporation

Description

How to fill out Maine Agreement For Purchase Of Business Assets From A Corporation?

US Legal Forms - one of the most significant libraries of lawful kinds in the United States - delivers a wide range of lawful papers web templates you can down load or print out. Utilizing the site, you may get a huge number of kinds for company and person functions, categorized by groups, says, or keywords.You can find the latest types of kinds like the Maine Agreement for Purchase of Business Assets from a Corporation in seconds.

If you already have a membership, log in and down load Maine Agreement for Purchase of Business Assets from a Corporation through the US Legal Forms library. The Obtain option will show up on every type you perspective. You get access to all earlier delivered electronically kinds in the My Forms tab of your bank account.

In order to use US Legal Forms initially, here are straightforward instructions to obtain started off:

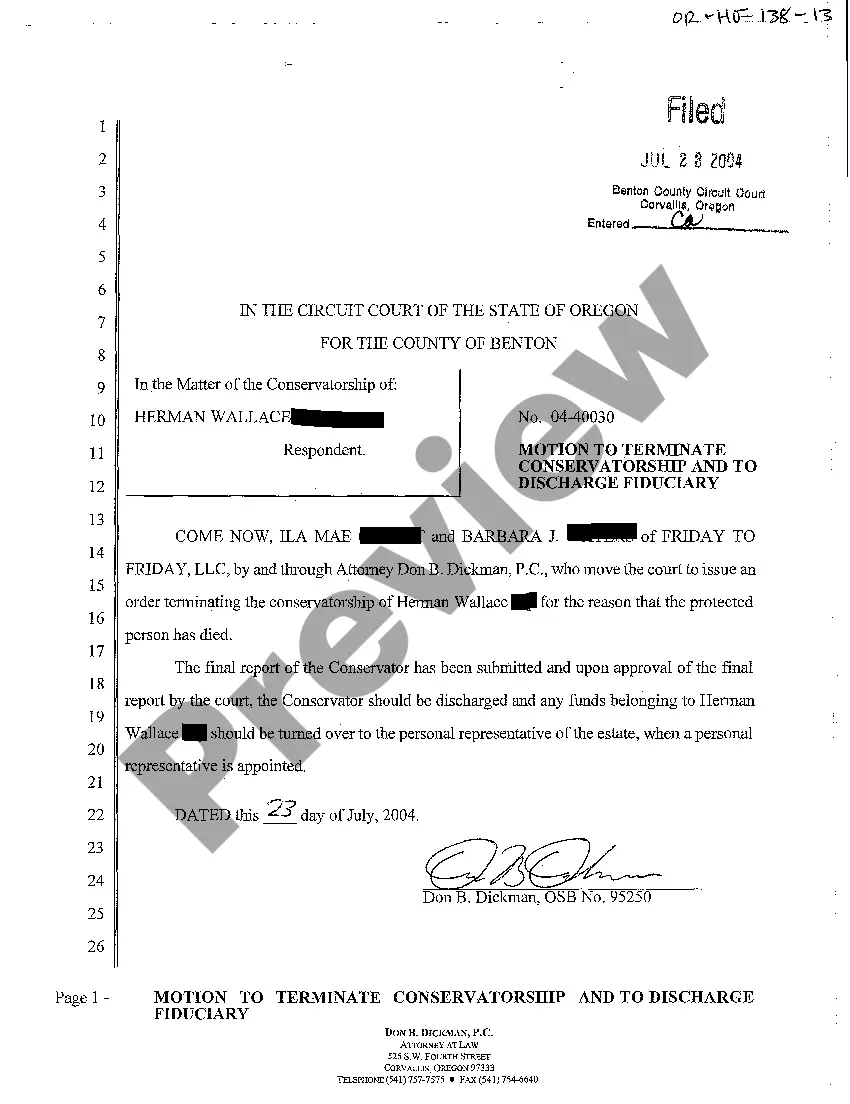

- Make sure you have chosen the right type for your personal town/county. Click the Review option to check the form`s information. See the type description to actually have chosen the right type.

- In case the type does not suit your demands, take advantage of the Research industry at the top of the screen to get the one who does.

- When you are satisfied with the form, affirm your choice by clicking the Acquire now option. Then, select the pricing prepare you prefer and offer your references to sign up for an bank account.

- Method the purchase. Make use of Visa or Mastercard or PayPal bank account to perform the purchase.

- Pick the file format and down load the form on the gadget.

- Make alterations. Load, revise and print out and sign the delivered electronically Maine Agreement for Purchase of Business Assets from a Corporation.

Every single design you included with your money does not have an expiry date which is your own permanently. So, in order to down load or print out one more version, just go to the My Forms area and then click in the type you will need.

Gain access to the Maine Agreement for Purchase of Business Assets from a Corporation with US Legal Forms, by far the most extensive library of lawful papers web templates. Use a huge number of specialist and express-particular web templates that meet your business or person requires and demands.

Form popularity

FAQ

Key Takeaways. In an asset sale, a firm sells some or all of its actual assets, either tangible or intangible. The seller retains legal ownership of the company that has sold the assets but has no further recourse to the sold assets. The buyer assumes no liabilities in an asset sale.

The liquidation of a company is when the company's assets are sold and the company ceases operations and is deregistered. The assets are sold to pay back various claimants, such as creditors and shareholders. The liquidation process happens when a company is insolvent; it can no longer meet its financial obligations.

In an asset purchase, the buyer agrees to purchase specific assets and liabilities. This means that they only take on the risks of those specific assets. This could include equipment, fixtures, furniture, licenses, trade secrets, trade names, accounts payable and receivable, and more.

Asset Sale Planning Generally speaking, sales of assets such as equipment, buildings, vehicles and furniture will be taxed at ordinary income tax rates, while intangible assets such as goodwill or intellectual property will be taxed at capital gains rates.

Also known as divestiture, divestment is effectively the opposite of an investment and is usually done when that subsidiary asset or division is not performing up to expectations. In some cases, however, a company may be forced to sell assets as the result of legal or regulatory action.

If purchasing a business entity, you are purchasing all the corporation's shares or if a limited liability company, its membership interest. In contrast, if purchasing the business' assets, you are buying all the assets, contracts, debts, and anything else registered under the business' name.

In an asset sale, assets to be sold need to be specified and duly transferred. Merger consideration is typically paid directly to stockholders, whereas in an asset sale you have to take the additional step of distributing the sale proceeds to the stockholders.

Recitals that describe the relevant background of the transaction. A list of definitions of the words that shall rule the interpretation of the asset purchase agreement. The terms and conditions for the sale and purchase of the assets, including the purchase price and the terms and conditions for its payment.