Maine Dividend Policy - Resolution Form - Corporate Resolutions

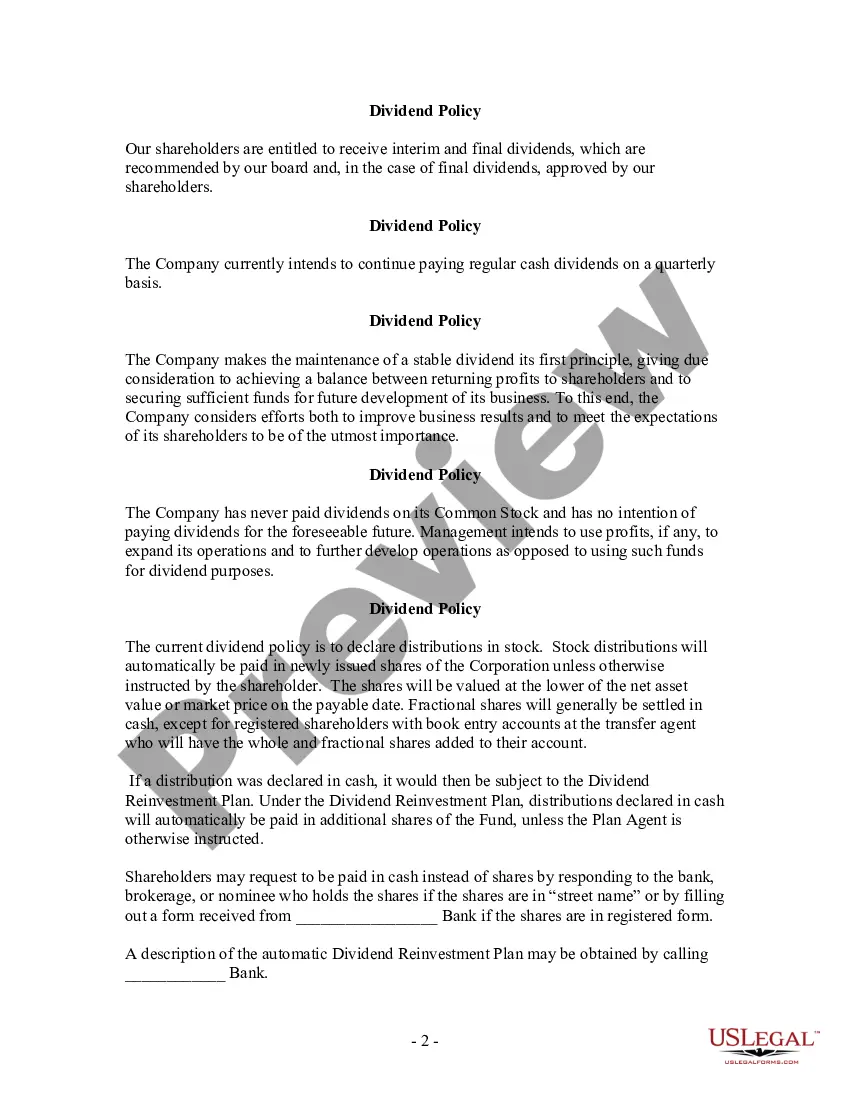

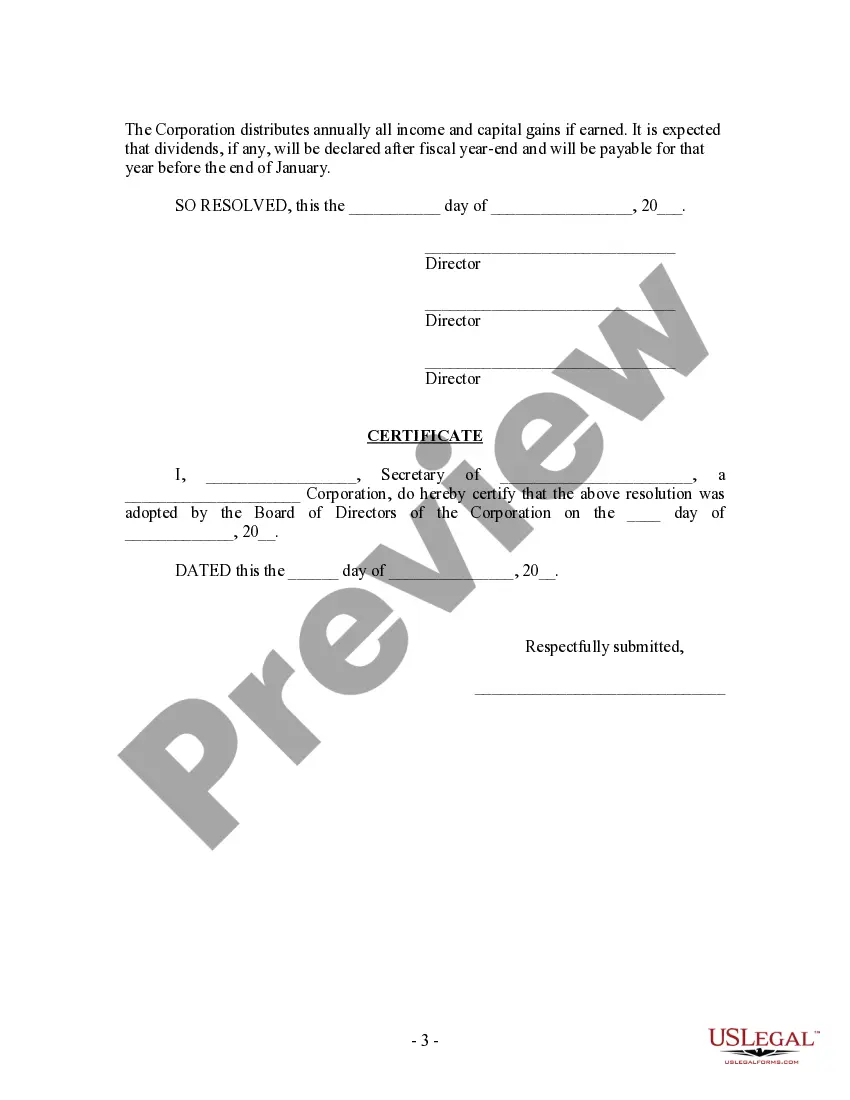

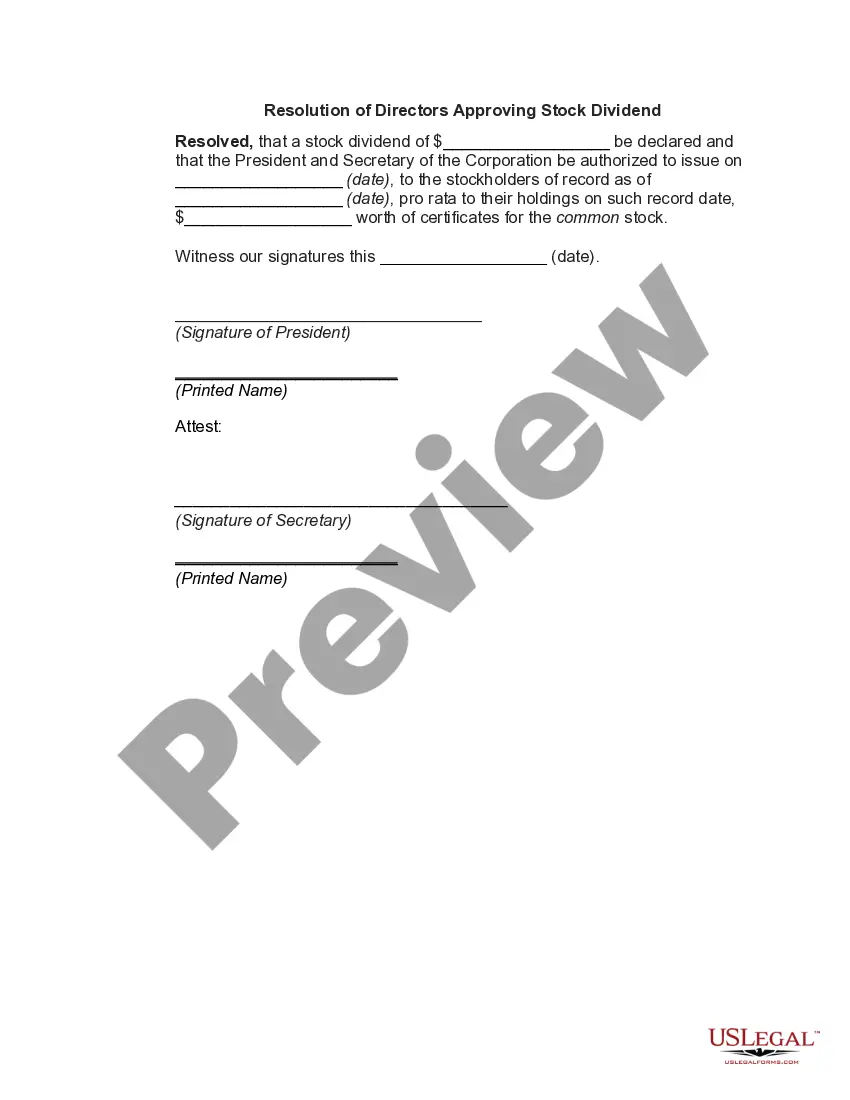

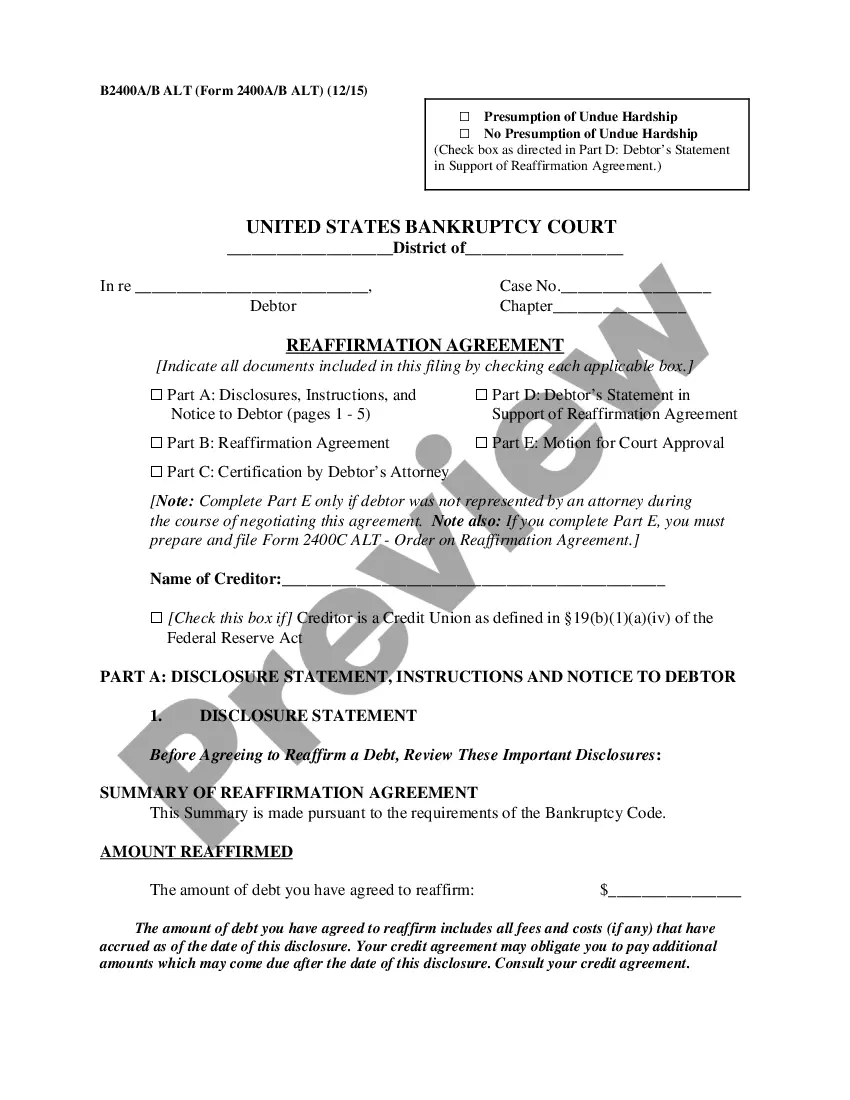

Description

How to fill out Dividend Policy - Resolution Form - Corporate Resolutions?

US Legal Forms - one of the largest collections of legal templates in the country - offers a diverse array of legal document formats that you can download or print.

Through the website, you can access thousands of templates for business and personal use, organized by categories, states, or keywords.

You can find the latest versions of documents such as the Maine Dividend Policy - Resolution Form - Corporate Resolutions in just a few minutes.

Review the form summary to confirm that you have chosen the right template.

If the form does not meet your requirements, use the Search box at the top of the screen to find the one that does.

- If you already possess a membership, Log In and download the Maine Dividend Policy - Resolution Form - Corporate Resolutions from the US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously downloaded documents from the My documents section of your account.

- If you are using US Legal Forms for the first time, here are a few simple steps to help you get started.

- Ensure you have selected the correct form for your area/region.

- Click the Preview button to review the content of the form.

Form popularity

FAQ

To fill out a resolution form, start by entering the date and the resolution title. Follow with the full text of the resolution and include spaces for signatures and dates. For effective completion, refer to the Maine Dividend Policy - Resolution Forms - Corporate Resolutions for guidance and structure.

A general shareholder resolution typically pertains to decisions affecting the management or policy of the corporation. This may include voting on the Maine Dividend Policy, changes to corporate governance, or major financial decisions. These resolutions empower shareholders to influence key corporate actions.

In a resolution, clearly state the intended action, provide a rationale, and include any necessary details. Ensure all relevant parties are named and there is adequate space for signatures. Using a well-organized Maine Dividend Policy - Resolution Form - Corporate Resolutions can help ensure all aspects are covered.

Typically, any shareholder that meets certain ownership thresholds can file a resolution. This allows them to propose changes or actions to be considered at shareholder meetings. Engaging with the Maine Dividend Policy - Resolution Form - Corporate Resolutions can streamline this process.

An example of a resolution can be a directive to amend the company's dividend policy, reflecting shareholder interests. This illustrates how shareholders can influence corporate governance. Properly formatted Maine Dividend Policy - Resolution Forms - Corporate Resolutions are essential for all stakeholders involved.

Requirements for a shareholder resolution generally include having a clear and specific proposal, supporting reasoning, and gaining sufficient shareholder support. Additionally, ensure compliance with relevant state laws and company bylaws. The Maine Dividend Policy - Resolution Form - Corporate Resolutions must adhere to these requirements for validity.

To conduct a shareholder resolution, first understand the issues that need attention. Draft the resolution, circulate it among shareholders, and garner their support through voting. Remember, when dealing with Maine Dividend Policy - Resolution Form - Corporate Resolutions, clarity and transparency are paramount.

To write a resolution form, start with the title, followed by the introduction of the resolution. Clearly articulate the actions or decisions being proposed, and include spaces for votes or signatures. A well-crafted Maine Dividend Policy - Resolution Form - Corporate Resolutions will ensure that the form meets all necessary legal requirements.

Writing a corporate resolution involves outlining the company details, stating the resolution specifically, and providing reasoning behind it. Ensure you include signatures from the appropriate parties. Utilizing effective Maine Dividend Policy - Resolution Forms - Corporate Resolutions can simplify this process, providing a structured format.

To write a written resolution, clearly state the proposed action at the beginning. Provide supporting arguments, specify the voting process, and include space for signatures. This method is a significant part of drafting Maine Dividend Policy - Resolution Forms - Corporate Resolutions, ensuring clear communication among shareholders.