Maine Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause

Description

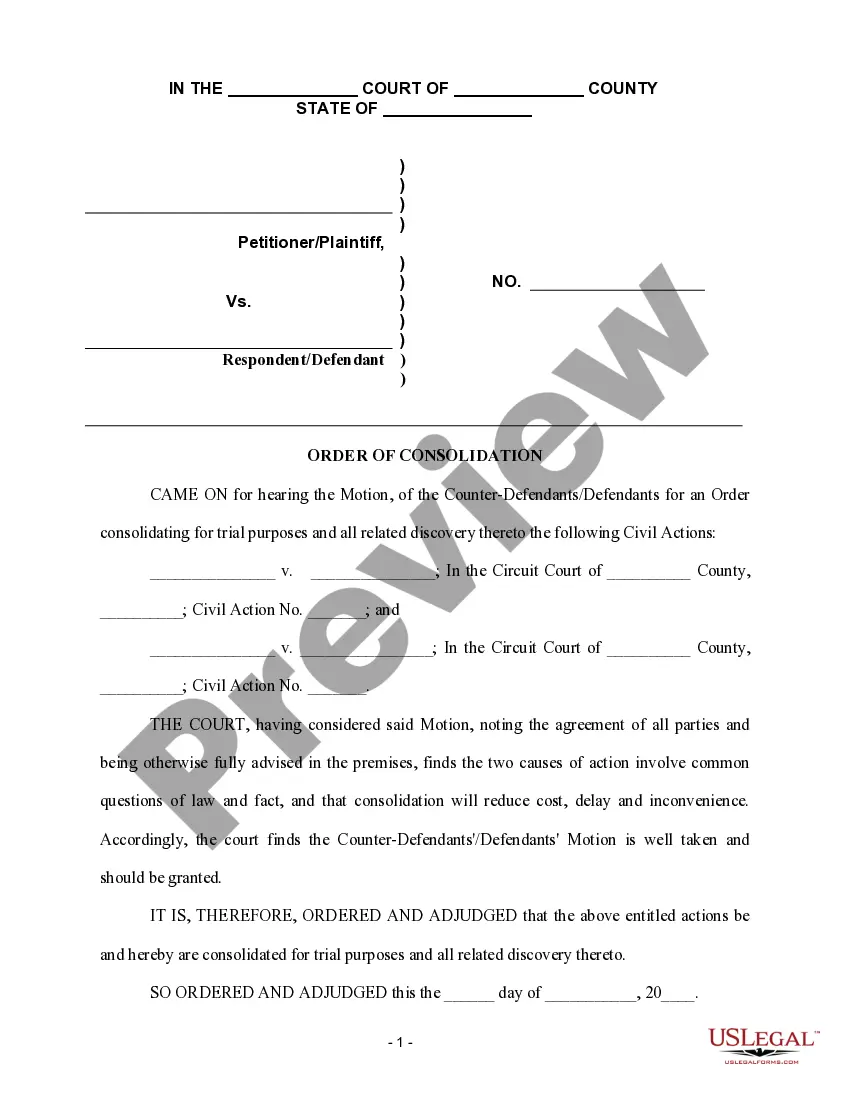

How to fill out Contract With Consultant As Self-Employed Independent Contractor With Limitation Of Liability Clause?

Selecting the ideal legal document template can be quite a challenge. Clearly, there are numerous templates accessible online, but how do you find the legal form you need? Utilize the US Legal Forms website. The service offers thousands of templates, such as the Maine Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, which can be utilized for business and personal needs. All of the forms are reviewed by experts and comply with federal and state regulations.

If you have already created an account, Log In to your profile and click the Obtain button to access the Maine Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause. Use your account to browse the legal forms you have previously purchased. Visit the My documents section of your profile to obtain another copy of the document you need.

If you are a new user of US Legal Forms, here are some simple steps for you to follow: First, make sure you have selected the correct form for your city/state. You can review the form using the Preview button and check the form description to ensure this is the right one for you. If the form does not meet your needs, use the Search field to find the appropriate form. When you are confident that the form is correct, click the Get now button to acquire the form. Choose the pricing plan you prefer and enter the required information. Create your account and pay for the order using your PayPal account or credit card.

Don't alter or remove any HTML tags. Only alter plain text outside of the HTML tags.

- Choose the file format.

- Download the legal document template to your device.

- Complete, edit, and print the acquired Maine Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause.

- US Legal Forms boasts the largest library of legal forms.

- For a plethora of document templates, utilize the service to download professionally crafted paperwork that meets state requirements.

Form popularity

FAQ

A limitation of liability for professional services restricts the financial exposure of service providers, ensuring they are not liable for amounts exceeding what they earned from the client. In the context of the Maine Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, this protects consultants from excessive claims. By clearly defining liability, both consultants and clients can engage in a more secure and confident partnership.

A limitation of liability clause for a consultant restricts the amount they may owe in case of a breach or failure to perform. This clause is critical in the Maine Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, as it helps both parties understand the maximum exposure to risk. This not only creates clarity but also fosters a more trusting business relationship.

A standard indemnification clause for consultants requires one party to compensate the other for certain damages or losses. In the context of the Maine Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, this means if a consultant's actions cause harm, they may be responsible for covering related costs. The clause protects clients by ensuring that they are not financially burdened by the consultant's negligence.

The liability clause in a consulting agreement outlines the extent to which a consultant can be held accountable for damages or losses. This clause is vital in the Maine Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, as it defines the boundaries of liability and protects both parties involved. Essentially, it ensures that neither side suffers significant losses beyond what was explicitly agreed upon.

Writing a simple contract agreement starts with stating the essential details, such as names, responsibilities, and payment. Clarity is vital, so avoid using legal jargon. It’s important to include a Limitation of Liability Clause to protect yourself legally. Using uslegalforms can provide handy templates that guide you through creating a Maine Contract with Consultant as Self-Employed Independent Contractor.

The best contract for contractors is one that clearly defines the scope of work, payment terms, and expectations for both parties. It should also include a Limitation of Liability Clause, which can protect against unforeseen events. Personalized contracts tailored to specific projects often lead to smoother working relationships. Consider a Maine Contract with Consultant as Self-Employed Independent Contractor as a strong option.

To write a consultancy agreement, outline the scope of work and deliverables expected from the consultant. Specify the fees, payment schedule, and relevant deadlines. Including a Limitation of Liability Clause is essential for risk management. Utilizing uslegalforms can provide you with effective templates for your Maine Contract with Consultant as Self-Employed Independent Contractor.

Writing a contract for a contractor requires outlining the project details and expectations. Include elements such as deadlines, payment arrangements, and any required materials. Don't forget to incorporate a Limitation of Liability Clause for protection. Using the uslegalforms platform can help you craft a tailored Maine Contract with Consultant as Self-Employed Independent Contractor.

Becoming an independent contractor in Maine starts with registering your business with the state. Next, you should obtain the necessary permits and licenses to operate legally. It's also wise to understand tax obligations as this status affects your returns. Finally, consider using a Maine Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause to formalize your agreements.

Filling out a contract agreement involves entering names, dates, and specific project details. Include the Limitation of Liability Clause to safeguard against unexpected issues. Carefully review all terms and ensure clarity in your descriptions. Using our platform at uslegalforms can simplify this process and provide templates designed for your needs.