Maine Partial Assignment of Life Insurance Policy as Collateral is a legal arrangement wherein a policyholder transfers a portion of their life insurance policy's benefits to a creditor as collateral for a loan or debt. This type of assignment allows individuals in Maine to leverage the cash value of their life insurance policies to secure financing. The Maine Partial Assignment of Life Insurance Policy as Collateral serves as a security measure for lenders, ensuring that in the case of default, they can collect a portion of the death benefit proceeds to cover the outstanding debt. This agreement offers peace of mind to creditors, as they have a tangible asset to secure their loan against. Maine recognizes different variations of Partial Assignment of Life Insurance Policy as Collateral, including: 1. Absolute Assignment: This type of partial assignment fully transfers ownership rights of a portion of the life insurance policy to the creditor. The creditor becomes the temporary policyholder and has the authority to make changes, including borrowing against the cash value, surrendering the policy, or canceling it altogether. 2. Collateral Assignment: In this form of partial assignment, the policyholder designates a specific portion of their life insurance policy's proceeds as collateral for the loan. The policy remains in the hands of the policyholder, who retains the right to control the policy's cash value and make beneficiary designations. However, in the event of default, the lender can collect the agreed-upon portion of the death benefit. 3. Irrevocable Assignment: An irrevocable Partial Assignment of Life Insurance Policy as Collateral offers the holder limited control or ability to change the terms. Once established, this assignment cannot be revoked by the policyholder without the consent of the lender. The lender gains more control over any benefits or cash value tied to the assigned portion of the policy. It is essential to note that specific terms, conditions, and regulations may vary depending on insurers, lenders, and federal or state laws governing life insurance policies and loan agreements. Seeking legal advice or consulting with an insurance professional before entering into a Maine Partial Assignment of Life Insurance Policy as Collateral agreement is strongly advised to ensure compliance and safeguard one's financial interests.

Maine Partial Assignment of Life Insurance Policy as Collateral

Description

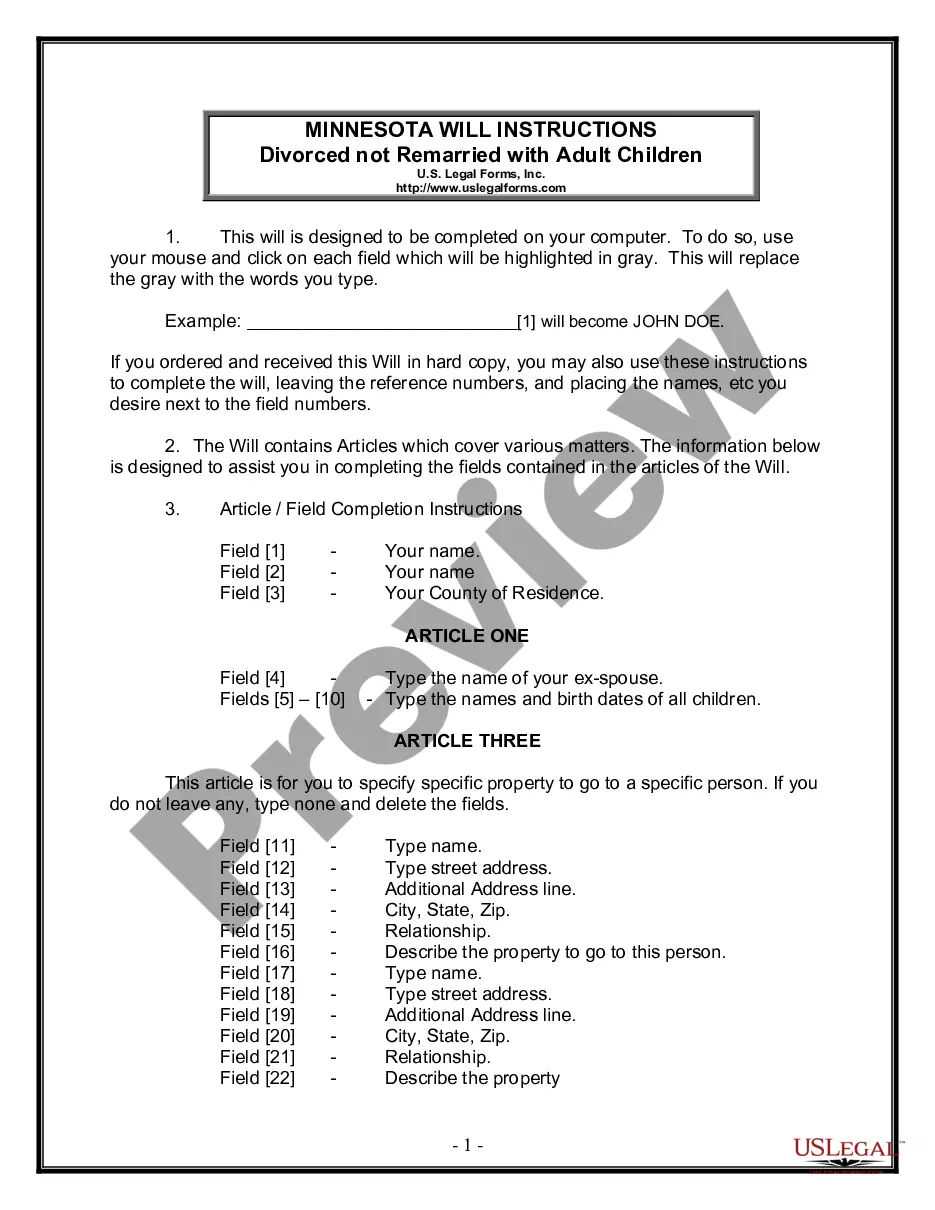

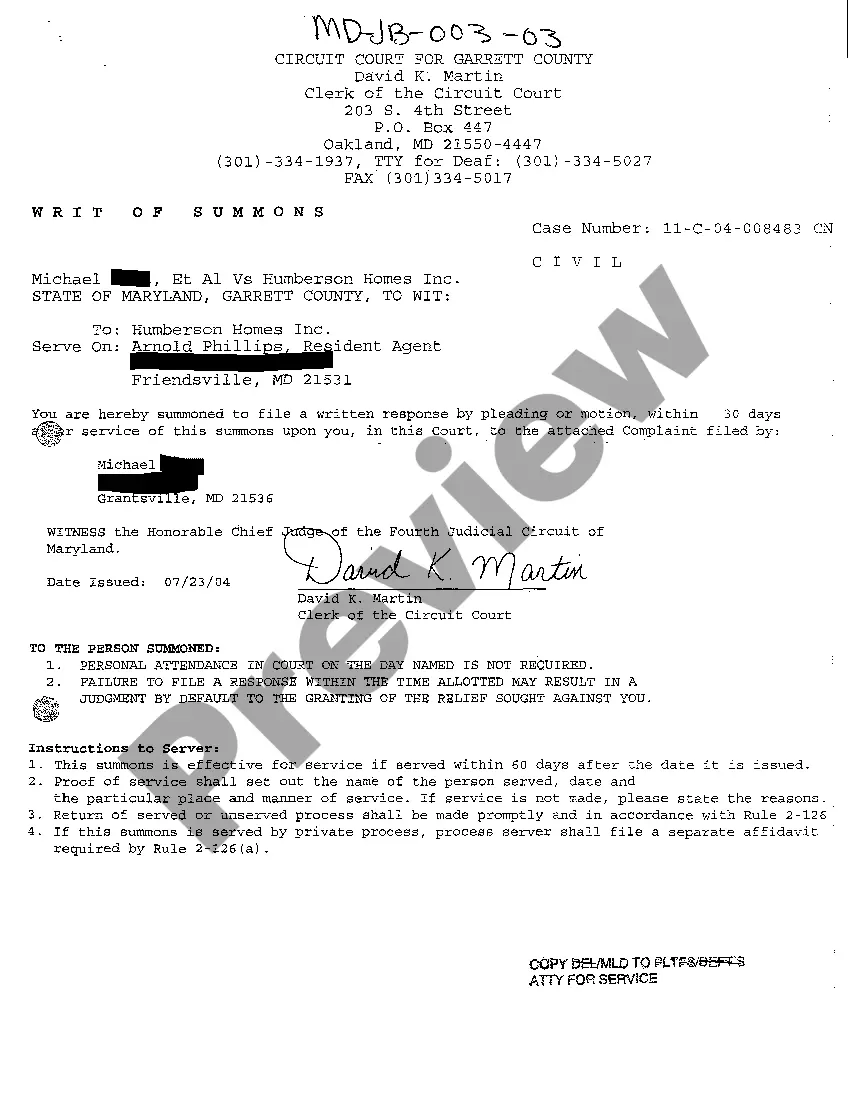

How to fill out Maine Partial Assignment Of Life Insurance Policy As Collateral?

US Legal Forms - among the most significant libraries of authorized types in the States - gives a wide array of authorized document templates it is possible to obtain or print. Utilizing the site, you will get a huge number of types for enterprise and individual reasons, sorted by types, suggests, or search phrases.You will find the most up-to-date models of types just like the Maine Partial Assignment of Life Insurance Policy as Collateral within minutes.

If you already possess a membership, log in and obtain Maine Partial Assignment of Life Insurance Policy as Collateral through the US Legal Forms local library. The Obtain button will appear on every single form you see. You get access to all previously saved types inside the My Forms tab of the bank account.

If you want to use US Legal Forms for the first time, listed here are basic directions to obtain began:

- Make sure you have picked the proper form for the city/area. Click the Review button to analyze the form`s content. Look at the form description to actually have chosen the right form.

- When the form doesn`t satisfy your specifications, utilize the Lookup field towards the top of the monitor to obtain the one which does.

- If you are satisfied with the form, confirm your choice by simply clicking the Get now button. Then, opt for the rates program you prefer and offer your qualifications to register for the bank account.

- Procedure the deal. Make use of charge card or PayPal bank account to perform the deal.

- Find the structure and obtain the form on your own system.

- Make adjustments. Complete, modify and print and indication the saved Maine Partial Assignment of Life Insurance Policy as Collateral.

Every single template you included with your bank account lacks an expiration date and it is your own forever. So, if you would like obtain or print one more copy, just visit the My Forms section and click on in the form you want.

Gain access to the Maine Partial Assignment of Life Insurance Policy as Collateral with US Legal Forms, one of the most comprehensive local library of authorized document templates. Use a huge number of specialist and express-certain templates that meet your company or individual needs and specifications.

Form popularity

FAQ

If you have a $500,000 life insurance policy and die while still owing $50,000 on a business loan, the lender could claim $50,000 of your death benefit ? assuming, of course, that you listed that lender as a collateral assignee.

If you don't repay the loan promptly, there is a chance that the loan balance plus loan interest will exceed the cash value of your life insurance policy. If that happens, the insurance company can surrender the policy, leaving you without any life insurance coverage.

Which of these actions is taken when a policyowner uses a Life Insurance policy as collateral for a bank loan? Collateral assignment" A policyowner using the Life Insurance policy as collateral for a bank loan normally would make a collateral assignment.

A collateral assignment is typically used when an insurance policy is used as collateral for a loan. This is a temporary assignment until the debt is paid in full.

Reinstatement - The process by which a life insurance company puts a policy back in force after it lapsed because of nonpayment of renewal premiums. Renewal - Continuation of a policy after its expiration date.

Under partial assignment, only the designated amount is paid to the assignee. Rest of the proceeds are paid to the nominee. If your expected insurance proceeds are more than the loan amount, you should opt for partial assignment.

Collateral assignment, on the other hand, is a temporary and often revocable arrangement. The policyholder retains ownership and control over the policy but agrees that the lender has a claim to a part of the death benefit if the loan is not repaid.

Collateral assignment of life insurance is a method of providing a lender with collateral when you apply for a loan. In this case, the collateral is your life insurance policy's face value, which could be used to pay back the amount you owe in case you die while in debt.