A guaranty is an undertaking on the part of one person (the guarantor) that is collateral to an obligation of another person (the debtor or obligor), and which binds the guarantor to performance of the obligation in the event of default by the debtor or obligor. A guaranty agreement is a type of contract. Thus, questions relating to such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law.

Maine Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability

Description

How to fill out Continuing Guaranty Of Business Indebtedness With Guarantor Having Limited Liability?

If you require extensive, obtain, or create legal document templates, utilize US Legal Forms, the largest repository of legal forms available online.

Take advantage of the site's straightforward and user-friendly search to locate the documents you require.

Various templates for business and personal purposes are categorized by types and states, or keywords.

Every legal document template you purchase is yours permanently. You have access to every form you bought in your account. Select the My documents section and choose a form to print or download again.

Complete and obtain, then print the Maine Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability using US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- Use US Legal Forms to find the Maine Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to obtain the Maine Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability.

- You can also access forms you have previously purchased in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

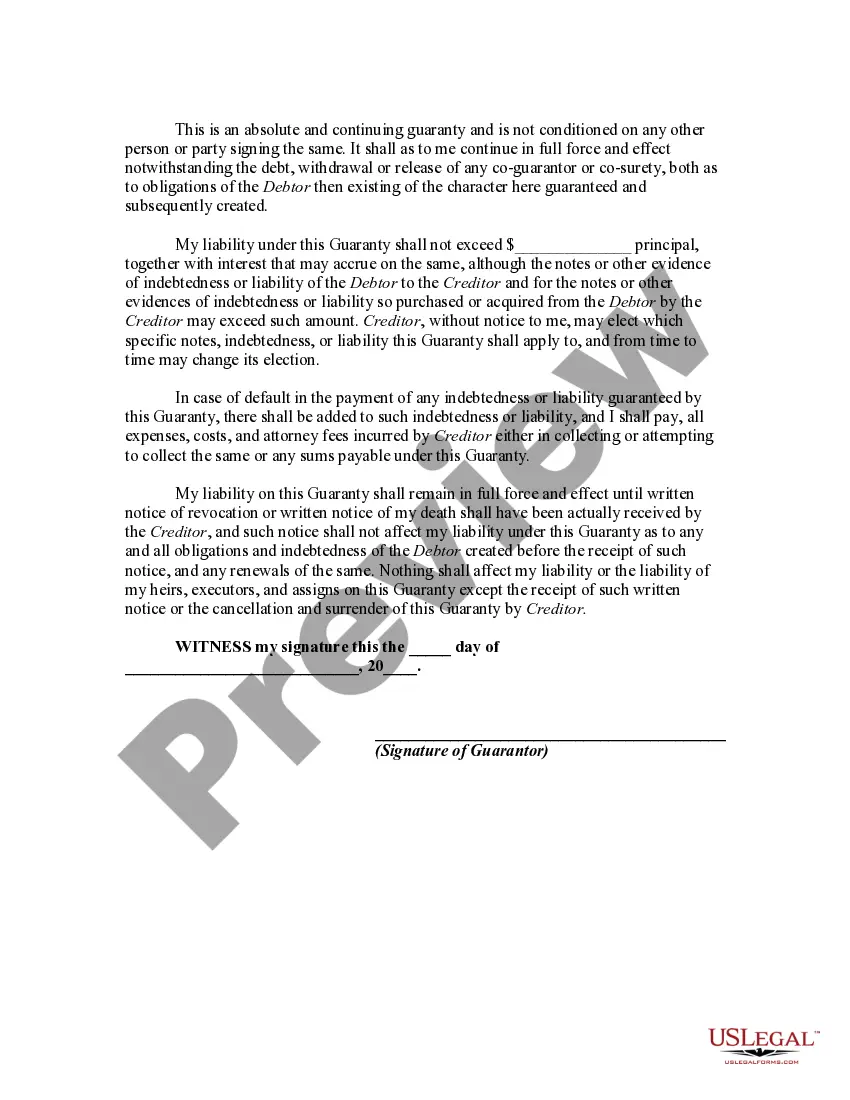

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Preview option to review the form's content. Don't forget to read the description.

- Step 3. If you are not satisfied with the type, utilize the Search field at the top of the screen to find alternate versions of the legal form template.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose the pricing plan you prefer and provide your details to create an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Choose the format of your legal form and download it to your device.

- Step 7. Complete, customize, and print or sign the Maine Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability.

Form popularity

FAQ

The three types of guarantees include unlimited guarantees, limited guarantees, and personal guarantees. Each offers different levels of risk and commitment to the guarantor. When navigating these options, consider how the Maine Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability aligns with your business goals and risk tolerance.

A guarantor for a business is an individual or entity that agrees to fulfill the business's debt obligations should it default. This role provides additional security for lenders, as the guarantor adds assurance against potential losses. For businesses operating in Maine, opting for a Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability can be a wise decision.

A guarantor typically assumes complete responsibility for a debtor’s obligations, while a limited guarantor agrees to cover specific amounts or conditions. The distinction is vital because a limited guarantor may enjoy reduced risk and liability. When dealing with financial matters, understanding these terms can help you choose the Maine Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability wisely.

An unlimited guaranty is a type of contract where the guarantor assumes full responsibility for a debt without any restrictions on the amount. This form of guarantee often places considerable risk on the guarantor, as they could be liable for the total amount owed. If you need clarity on this, refer to the Maine Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability for a safer option.

An unlimited continuing guaranty obligates the guarantor to cover all debts incurred by the borrower without any cap. This type of guarantee continues until explicitly canceled, providing extensive backing for a business's obligations. It is crucial to consider the implications of entering an unlimited continuing guaranty when assessing the Maine Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability.

A continuing guarantee allows a guarantor to support a borrower over a period, rather than for a single transaction. This means the guarantor remains liable for future debts that arise within the terms of the agreement. Understanding this concept is essential when exploring the Maine Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability.

The key difference lies in the scope of liability. An unlimited guarantee holds the guarantor fully responsible for the entire debt, whereas a limited guarantee only covers specified amounts or conditions outlined in the agreement. If you're considering the Maine Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, a limited guarantee may protect your financial interests better.