Maine Certificate of Trust for Mortgage

Description

How to fill out Certificate Of Trust For Mortgage?

If you wish to comprehensive, acquire, or printing authorized papers themes, use US Legal Forms, the biggest collection of authorized types, that can be found on the Internet. Use the site`s simple and convenient search to discover the files you will need. A variety of themes for enterprise and person purposes are sorted by categories and suggests, or key phrases. Use US Legal Forms to discover the Maine Certificate of Trust for Mortgage with a number of click throughs.

If you are previously a US Legal Forms client, log in in your profile and click on the Download button to get the Maine Certificate of Trust for Mortgage. You can even gain access to types you previously acquired from the My Forms tab of the profile.

If you use US Legal Forms for the first time, refer to the instructions beneath:

- Step 1. Ensure you have chosen the shape for your appropriate city/country.

- Step 2. Utilize the Preview choice to examine the form`s information. Do not overlook to read through the description.

- Step 3. If you are unhappy with the form, make use of the Search area at the top of the display screen to get other types in the authorized form design.

- Step 4. When you have found the shape you will need, select the Acquire now button. Opt for the costs strategy you like and put your qualifications to sign up to have an profile.

- Step 5. Process the deal. You can utilize your charge card or PayPal profile to finish the deal.

- Step 6. Select the file format in the authorized form and acquire it in your system.

- Step 7. Full, revise and printing or signal the Maine Certificate of Trust for Mortgage.

Each authorized papers design you buy is your own property forever. You might have acces to each and every form you acquired with your acccount. Go through the My Forms portion and choose a form to printing or acquire once more.

Remain competitive and acquire, and printing the Maine Certificate of Trust for Mortgage with US Legal Forms. There are millions of expert and state-certain types you can use for your enterprise or person requirements.

Form popularity

FAQ

(1) Any Massachusetts trust desiring to do business in this state shall file with the secretary of state a verified copy of the trust instrument creating such a trust and any amendment thereto, the assumed business name, if any, and the names and addresses of its trustees.

A certification of trust provides information regarding the settlor of the trust, the acting trustee, and the power and authority of the trustee to manage and invest trust property or to act with respect to a specific transaction.

Laws, cases, and web sources on the law of trusts in Massachusetts. Trusts can be used for estate planning, asset protection, limiting taxes, and other special purposes. It may be helpful to use an attorney when choosing and devising a trust document.

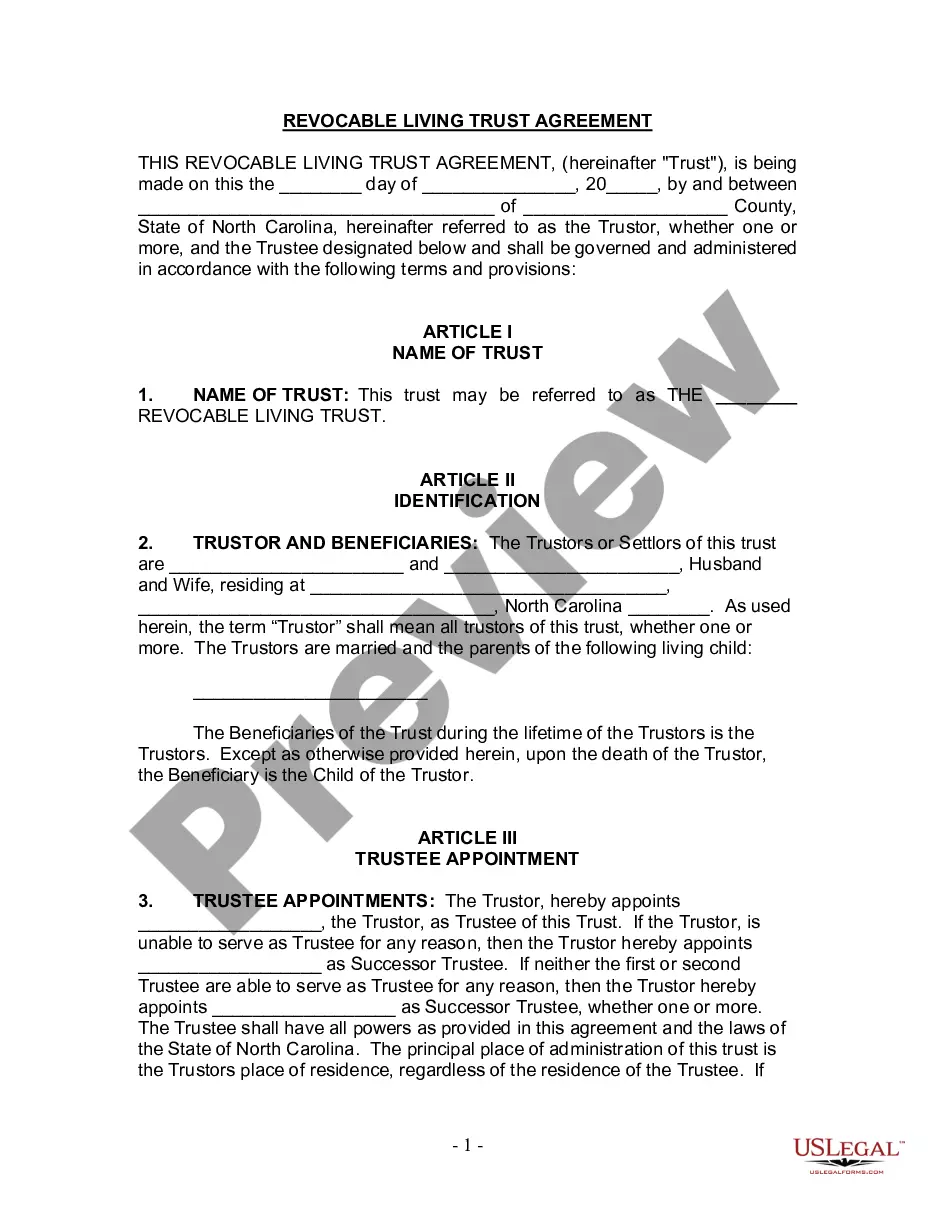

The trust agreement is the parent document that details anything and everything regarding the trust, including its agreements. Meanwhile, the certificate of trust is used in tandem to keep nonessential information confidential.

A Certification of Trust is a legal document that can be used to certify both the existence of a Trust, as well as to prove a Trustee's legal authority to act. It's shorter than the actual Trust document, and it can offer pertinent information without making every aspect of the Trust public.