An invoice is a document or electronic statement stating the items sold and the amount payable. It is also called a bill. Invoicing is when invoices are produced and sent to customers. It is used to communicate to a buyer the specific items, price, and quantities they have delivered and now must be paid for by the buyer. Payment terms will usually accompany the billing information. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

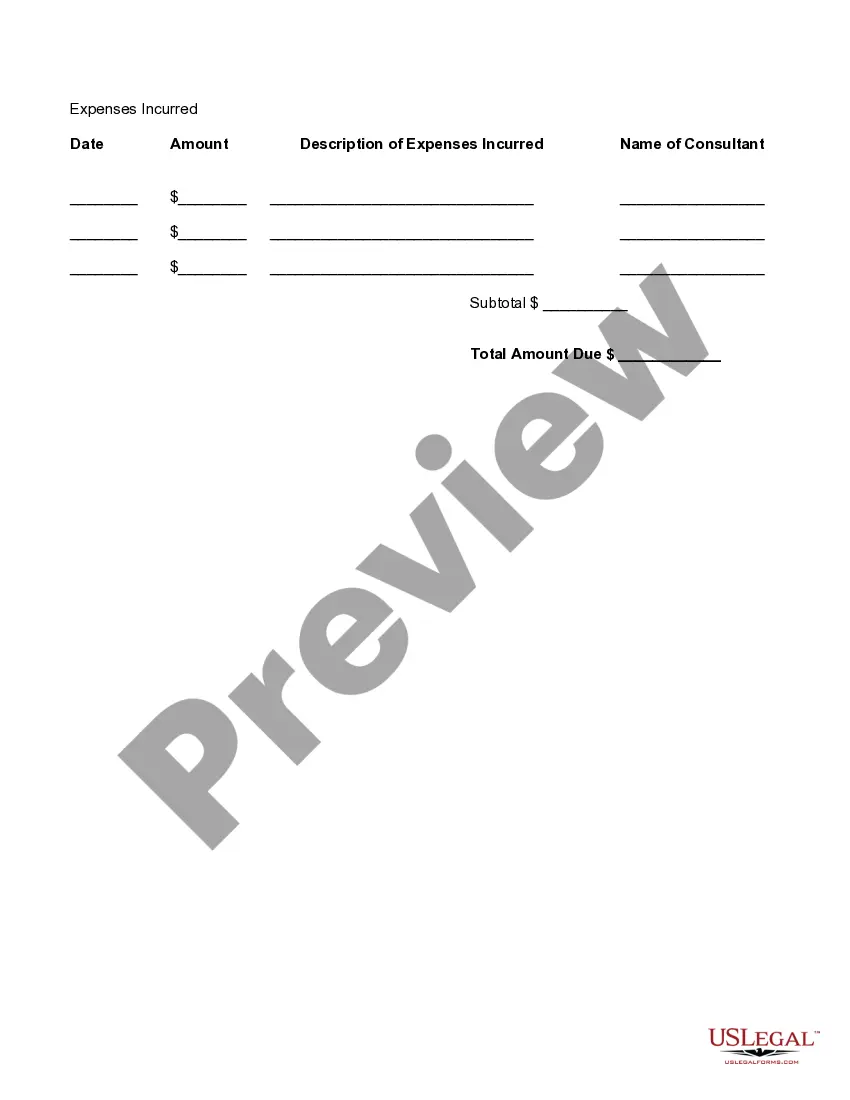

Maine Detailed Consultant Invoice is a comprehensive invoice document that provides a detailed breakdown of consulting services rendered by a consultant or consulting firm in the state of Maine. This invoice serves as an essential tool for accurately documenting and billing consultancy work, ensuring transparency and professionalism in business transactions. Keywords: Maine, Detailed, Consultant Invoice, breakdown, consulting services, consultant, consulting firm, document, billing, transparency, professionalism, business transactions. There are various types of Maine Detailed Consultant Invoice that can be customized based on the specific requirements of the consultancy services provided. Some examples of these invoice types include: 1. Hourly Rate Invoice: This type of invoice is commonly used when the consultant charges an hourly rate for their services. It includes detailed information about the number of hours worked, the hourly rate, and the total amount due. 2. Fixed Fee Invoice: This invoice type is applicable when the consultant charges a fixed fee for the entire project. It lists the agreed-upon fee and any additional charges or expenses, ensuring clear communication regarding the total amount owed. 3. Retainer Invoice: A retainer invoice is used when the consultant receives a retainer fee in advance for future consulting services. It specifies the retainer amount, the services covered by the retainer, and any applicable additional charges. 4. Expense Invoice: In cases where consultants incur expenses on behalf of the client, an expense invoice is used to document and reimburse these costs. It includes a detailed breakdown of the expenses, such as travel, accommodation, and other related expenses. 5. Progress Invoice: For long-term projects or ongoing consulting services, a progress invoice is utilized to bill the client at specific milestones or intervals. It provides a detailed summary of the work completed, associated costs, and the remaining balance. Regardless of the invoice type used, a Maine Detailed Consultant Invoice typically includes essential information such as the consultant's name and contact details, client's information, invoice number, date, description of services provided, quantity, rates, subtotal, taxes, and the final amount due. In conclusion, Maine Detailed Consultant Invoice plays a crucial role in ensuring proper billing, payment, and documentation of consulting services rendered in the state of Maine. By utilizing specific invoice types tailored to the nature of the consultancy work, consultants and clients can maintain transparency and professionalism in their business transactions.Maine Detailed Consultant Invoice is a comprehensive invoice document that provides a detailed breakdown of consulting services rendered by a consultant or consulting firm in the state of Maine. This invoice serves as an essential tool for accurately documenting and billing consultancy work, ensuring transparency and professionalism in business transactions. Keywords: Maine, Detailed, Consultant Invoice, breakdown, consulting services, consultant, consulting firm, document, billing, transparency, professionalism, business transactions. There are various types of Maine Detailed Consultant Invoice that can be customized based on the specific requirements of the consultancy services provided. Some examples of these invoice types include: 1. Hourly Rate Invoice: This type of invoice is commonly used when the consultant charges an hourly rate for their services. It includes detailed information about the number of hours worked, the hourly rate, and the total amount due. 2. Fixed Fee Invoice: This invoice type is applicable when the consultant charges a fixed fee for the entire project. It lists the agreed-upon fee and any additional charges or expenses, ensuring clear communication regarding the total amount owed. 3. Retainer Invoice: A retainer invoice is used when the consultant receives a retainer fee in advance for future consulting services. It specifies the retainer amount, the services covered by the retainer, and any applicable additional charges. 4. Expense Invoice: In cases where consultants incur expenses on behalf of the client, an expense invoice is used to document and reimburse these costs. It includes a detailed breakdown of the expenses, such as travel, accommodation, and other related expenses. 5. Progress Invoice: For long-term projects or ongoing consulting services, a progress invoice is utilized to bill the client at specific milestones or intervals. It provides a detailed summary of the work completed, associated costs, and the remaining balance. Regardless of the invoice type used, a Maine Detailed Consultant Invoice typically includes essential information such as the consultant's name and contact details, client's information, invoice number, date, description of services provided, quantity, rates, subtotal, taxes, and the final amount due. In conclusion, Maine Detailed Consultant Invoice plays a crucial role in ensuring proper billing, payment, and documentation of consulting services rendered in the state of Maine. By utilizing specific invoice types tailored to the nature of the consultancy work, consultants and clients can maintain transparency and professionalism in their business transactions.