Barter is the trading of goods or services directly for other goods or services, without using money or any other similar unit of account or medium of exchange. Bartering is sometimes used among business as the method for the exchange of goods and services. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Maine Bartering Contract or Exchange Agreement

Description

How to fill out Bartering Contract Or Exchange Agreement?

Are you presently in a scenario where you require documentation for either business or specific activities nearly every day? There are numerous legal document templates accessible online, but locating ones you can rely on is not simple.

US Legal Forms provides thousands of template forms, such as the Maine Bartering Contract or Exchange Agreement, designed to comply with state and federal regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the Maine Bartering Contract or Exchange Agreement template.

- Locate the form you need and ensure it is for the right city/state.

- Utilize the Review option to examine the document.

- Check the outline to confirm you have selected the correct form.

- If the form is not what you seek, use the Search field to find a form that fits your requirements.

- Once you find the correct form, click Purchase now.

- Select the pricing plan you need, fill in the required details to create your account, and complete the payment using your PayPal or credit card.

- Choose a convenient document format and download your copy.

Form popularity

FAQ

To report proceeds from broker and barter exchange transactions, review the information provided on the 1099-B form you received. This form will outline the income you need to report, which typically falls under additional income. Using a Maine Bartering Contract or Exchange Agreement can help keep track of transactions, easing the process of reporting to the IRS.

When filing proceeds from broker and barter exchange transactions, you must report the income on your tax return as well. Make sure to gather all necessary documentation, including any forms received from the broker or exchange. A Maine Bartering Contract or Exchange Agreement can serve as essential documentation, ensuring that you fully comply with IRS requirements.

To report barter income, you need to include the fair market value of the goods or services received in exchange. This income should be reported on your tax return, specifically on Schedule C if you are self-employed. Utilizing a Maine Bartering Contract or Exchange Agreement can help you clearly outline the terms and value of the exchange, making your tax reporting smoother.

Bartering is subject to several rules, including tax implications and contract requirements. When creating a Maine Bartering Contract or Exchange Agreement, both parties should provide a clear description of the exchanged items and their fair market values. Additionally, it is essential to keep accurate records for tax reporting and to ensure compliance with local regulations.

No, bartering is not illegal in the US. It is a recognized practice, and many individuals and businesses utilize Maine Bartering Contracts or Exchange Agreements to trade goods and services. However, both parties must follow regulations, report income, and comply with any local laws related to bartering.

Trading does indeed count as income, similar to bartering. When you enter into a Maine Bartering Contract or Exchange Agreement, you must consider the fair market value of what you receive in exchange. This value is subject to income tax, so it's essential to keep accurate records of your transactions.

Yes, bartering does count as income. When you engage in a Maine Bartering Contract or Exchange Agreement, the value of goods or services exchanged must be reported as income for tax purposes. The IRS expects individuals to estimate the fair market value of the items exchanged and include them in their income.

Recording a barter transaction involves documenting the date, parties involved, specific items exchanged, and their fair market values. This recordkeeping is essential for tax purposes and ensuring accuracy in exchanges. Utilizing a Maine Bartering Contract or Exchange Agreement can facilitate this documentation by providing a structured format for your transactions.

To claim bartering on your taxes, you must report the overall value of the goods or services you received during the tax year. Keep well-documented records to substantiate your claims, including details from your Maine Bartering Contract or Exchange Agreement. This organized approach will simplify your tax reporting process and help ensure compliance with IRS regulations.

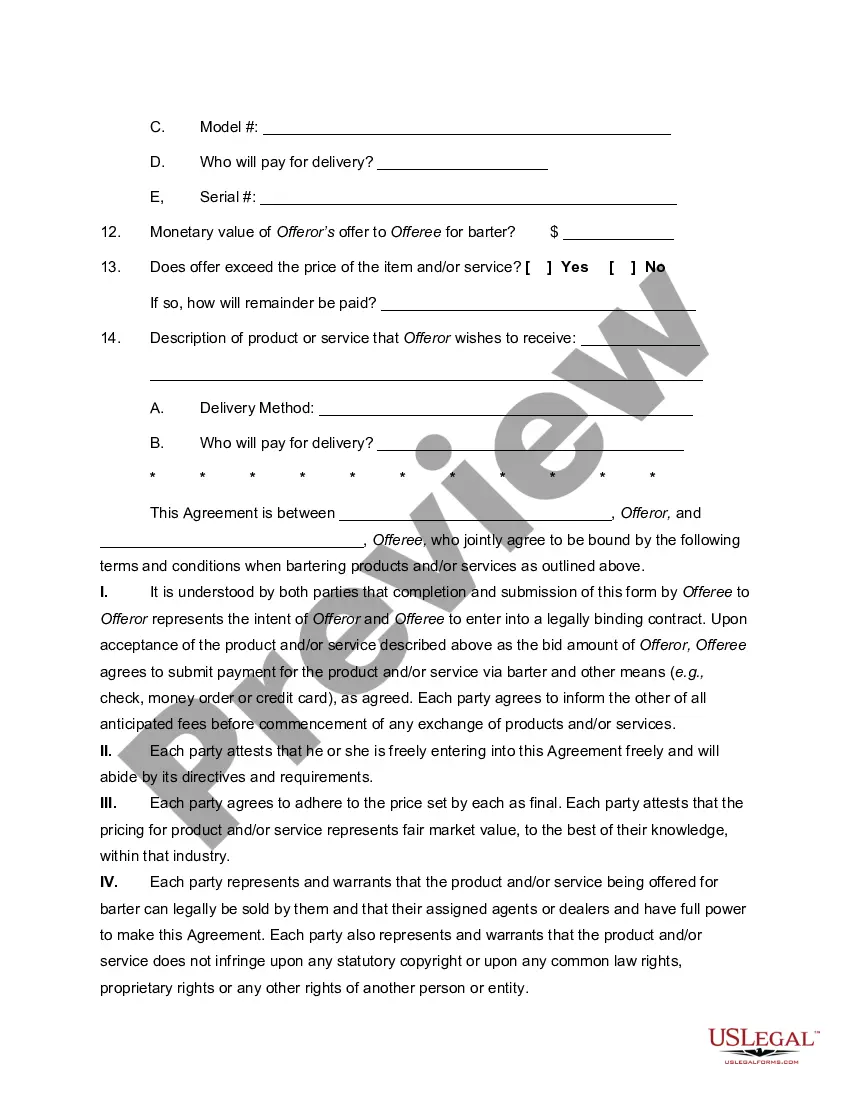

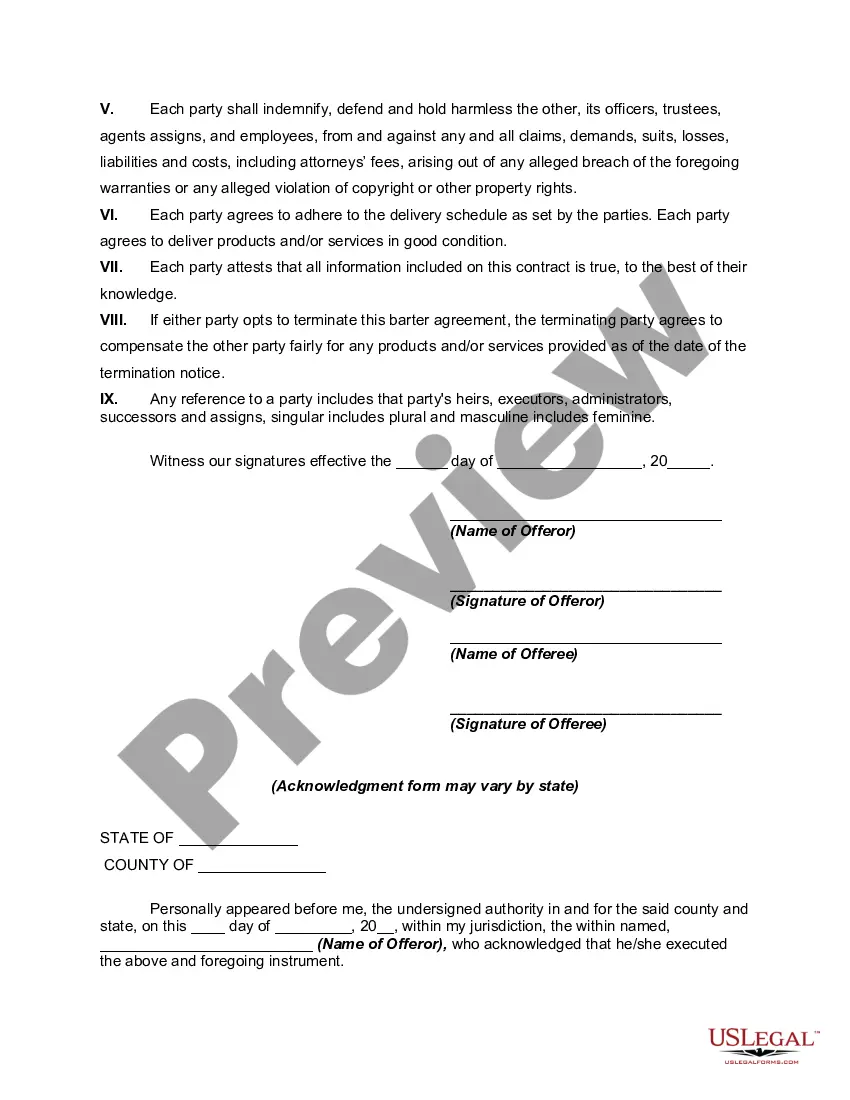

A contract of barter or exchange is a legally binding document that outlines the terms and conditions of the traded items or services. This agreement clarifies what each party is exchanging and helps prevent misunderstandings. Utilizing a Maine Bartering Contract or Exchange Agreement can facilitate a smoother transaction and provide clear legal protection.