Maine Owner Financing Contract for Home: A Comprehensive Guide If you are considering purchasing a home in Maine but don't have the necessary funds or qualifying credit, entering into an owner financing contract can offer a viable solution. Owner financing, also known as seller financing or owner carry-back, is an arrangement where the seller acts as the lender, providing financing to the buyer, eliminating the need for traditional mortgage lenders. This detailed description will outline the key aspects of a Maine Owner Financing Contract for Home, explaining its benefits, terms, and variations. Benefits of a Maine Owner Financing Contract for Home: 1. Expanded Homeownership Opportunities: Owner financing contracts enable potential buyers with limited funds or credit issues to achieve homeownership, which may not have been possible through conventional loan programs. 2. Avoidance of Extensive Credit Checks: Unlike traditional mortgage lenders, sellers offering owner financing are more focused on the buyer's ability to repay rather than relying solely on credit scores. 3. Flexible Down Payments: The down payment requirements in owner financing contracts tend to be more flexible, allowing buyers to negotiate terms that suit their financial situation. 4. Faster Processing Times: Owner financing contracts typically require less paperwork and minimal red tape, resulting in faster approval and closing times compared to traditional mortgage loans. 5. Potential Negotiation Power: Buyers may have the opportunity to negotiate more favorable terms and interest rates, as they are entering into a direct agreement with the seller. Key Terms and Conditions of a Maine Owner Financing Contract for Home: 1. Purchase Price: The agreed-upon price at which the property will be sold. 2. Down Payment: The initial payment made by the buyer towards the purchase price to secure the property. 3. Interest Rate: The rate at which interest is charged on the outstanding balance of the loan. 4. Payment Schedule: The frequency and amount of payments to be made by the buyer to the seller, including the date when the final payment is due. 5. Loan Term: The duration of the loan, specifying when the buyer is expected to repay the entire loan amount. 6. Default Provisions: Clauses specifying the consequences of default, including the seller's rights to take legal action and potentially repossess the property. 7. Title and Ownership: The transfer of ownership rights, typically held by the seller until the loan is fully repaid. Types of Maine Owner Financing Contracts for Home: 1. Full Purchase Contracts: This type of contract involves the seller financing the entire purchase price of the home. 2. Partial Purchase Contracts: In this scenario, the seller agrees to finance a portion of the purchase price, while the buyer provides a cash down payment or seeks additional financing to cover the remaining balance. 3. Lease Option Contracts: Instead of a traditional sale, the buyer enters into a lease agreement with the option to purchase the property at a later date. This option may include added flexibility during the lease period, allowing the tenant-buyer time to arrange financing or improve credit scores before exercising the purchase option. In conclusion, a Maine Owner Financing Contract for Home offers a flexible, alternative financing option for buyers who may face challenges securing traditional mortgage loans. Understanding the benefits, key terms, and available variations of owner financing contracts can help prospective buyers navigate the process more effectively and achieve their homeownership goals.

Maine Owner Financing Contract for Home

Description

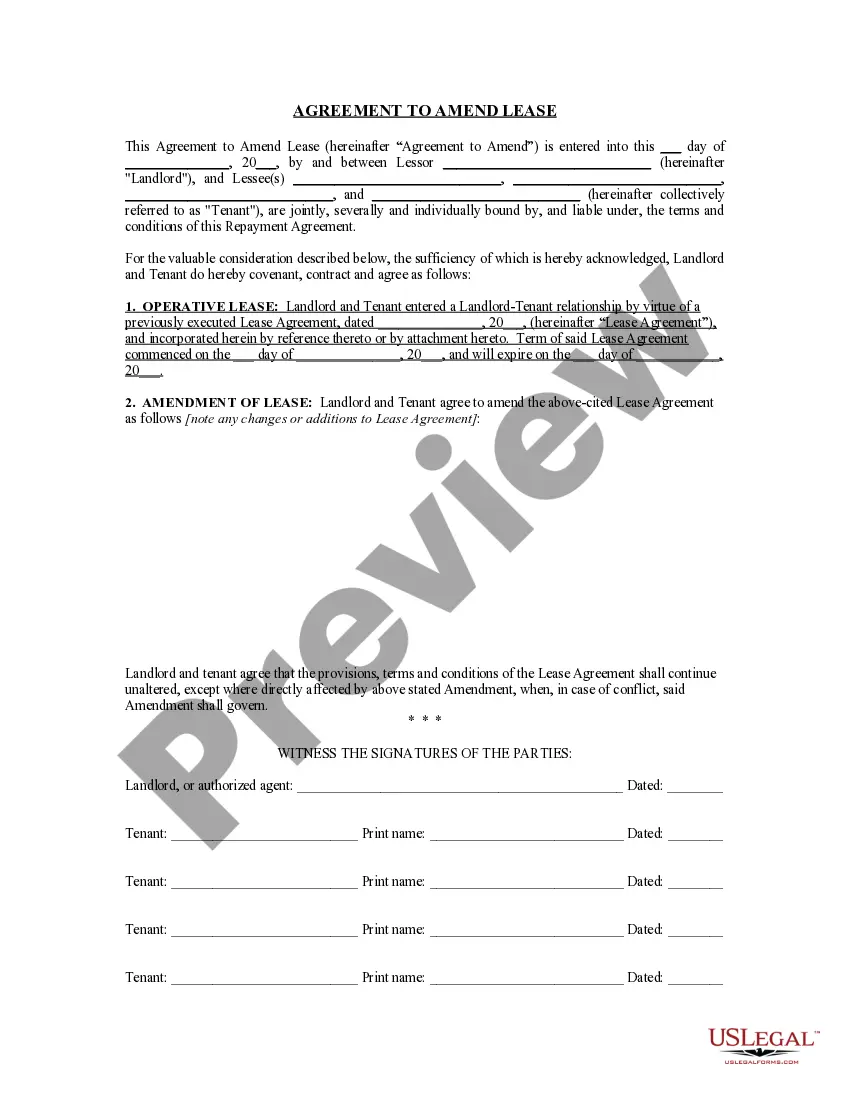

How to fill out Maine Owner Financing Contract For Home?

Discovering the right lawful document template could be a battle. Naturally, there are plenty of web templates accessible on the Internet, but how would you get the lawful develop you require? Use the US Legal Forms site. The services offers a huge number of web templates, such as the Maine Owner Financing Contract for Home, which can be used for enterprise and personal requires. All of the types are checked by pros and meet federal and state needs.

When you are presently listed, log in to the accounts and click the Acquire switch to get the Maine Owner Financing Contract for Home. Make use of your accounts to check from the lawful types you possess purchased in the past. Check out the My Forms tab of your own accounts and obtain another backup in the document you require.

When you are a whole new consumer of US Legal Forms, listed here are simple recommendations that you can adhere to:

- Very first, ensure you have selected the appropriate develop to your metropolis/area. You can look through the form using the Preview switch and browse the form description to ensure this is basically the best for you.

- In the event the develop fails to meet your requirements, use the Seach area to get the proper develop.

- Once you are sure that the form is acceptable, click on the Buy now switch to get the develop.

- Choose the prices strategy you desire and enter the required details. Build your accounts and buy an order with your PayPal accounts or credit card.

- Choose the data file structure and acquire the lawful document template to the device.

- Complete, change and print out and indication the received Maine Owner Financing Contract for Home.

US Legal Forms may be the most significant collection of lawful types where you can find different document web templates. Use the company to acquire expertly-created files that adhere to express needs.