If you need to full, obtain, or print legal file templates, use US Legal Forms, the biggest collection of legal forms, which can be found online. Take advantage of the site`s simple and handy look for to get the files you need. A variety of templates for company and person purposes are sorted by types and suggests, or keywords and phrases. Use US Legal Forms to get the Maine Partial Release or Satisfaction of Mortgage by a Corporation with a number of mouse clicks.

When you are currently a US Legal Forms buyer, log in to the profile and then click the Download key to obtain the Maine Partial Release or Satisfaction of Mortgage by a Corporation. You may also gain access to forms you previously saved from the My Forms tab of your profile.

If you are using US Legal Forms the first time, follow the instructions beneath:

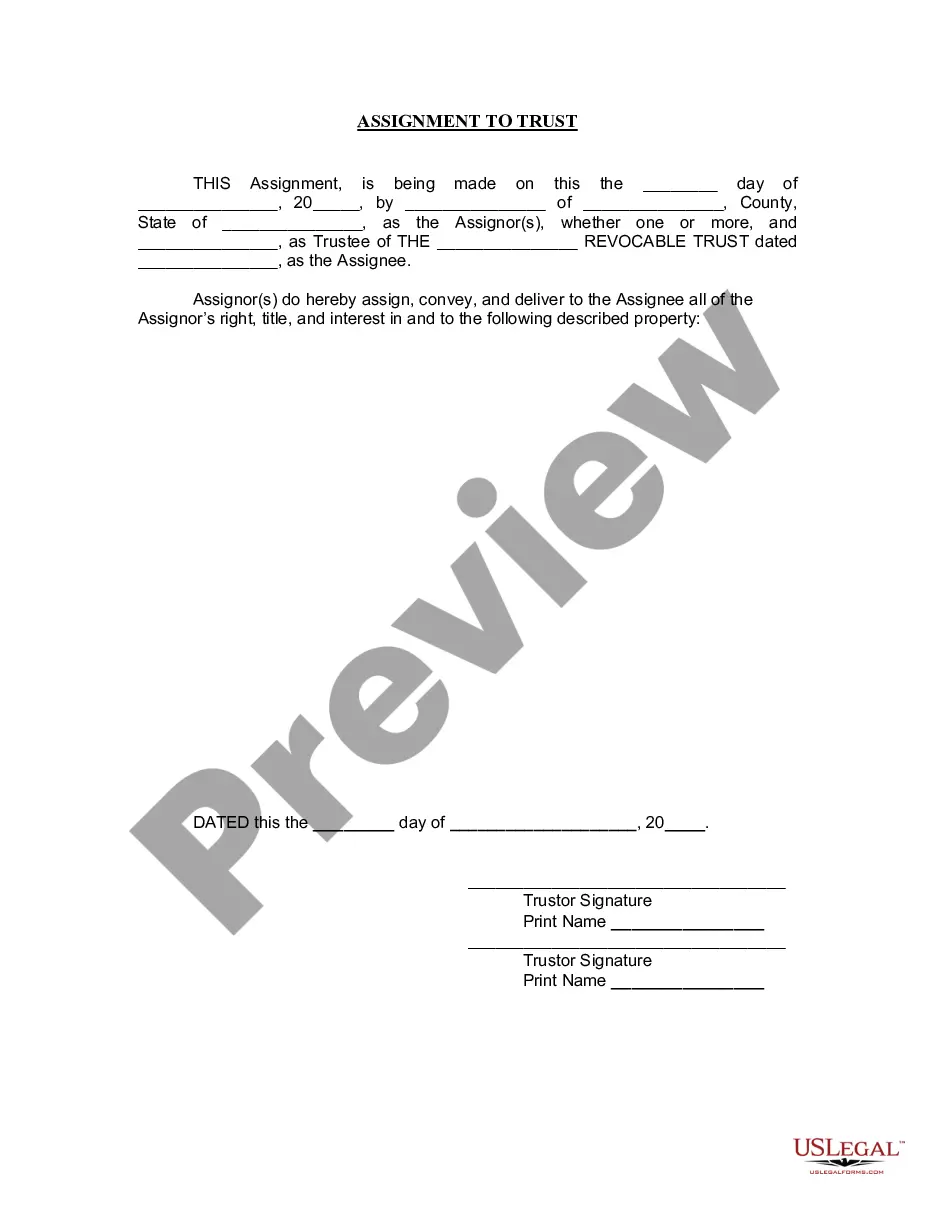

- Step 1. Ensure you have selected the shape to the correct metropolis/country.

- Step 2. Utilize the Preview choice to look through the form`s content. Never forget about to see the information.

- Step 3. When you are unhappy with the form, take advantage of the Research area towards the top of the monitor to locate other variations of your legal form web template.

- Step 4. Upon having identified the shape you need, click the Purchase now key. Choose the rates program you favor and put your qualifications to register on an profile.

- Step 5. Approach the deal. You can utilize your bank card or PayPal profile to finish the deal.

- Step 6. Choose the file format of your legal form and obtain it in your product.

- Step 7. Total, change and print or indicator the Maine Partial Release or Satisfaction of Mortgage by a Corporation.

Each and every legal file web template you acquire is your own property forever. You possess acces to every single form you saved in your acccount. Select the My Forms segment and select a form to print or obtain again.

Be competitive and obtain, and print the Maine Partial Release or Satisfaction of Mortgage by a Corporation with US Legal Forms. There are thousands of expert and state-certain forms you may use for the company or person requirements.