A deed in lieu of foreclosure is a method sometimes used by a lienholder on property to avoid a lengthy and expensive foreclosure process, with a deed in lieu of foreclosure a foreclosing lienholder agrees to have the ownership interest transferred to the bank/lienholder as payment in full. The debtor basically deeds the property to the bank instead of them paying for foreclosure proceedings. Therefore, if a debtor fails to make mortgage payments and the bank is about to foreclose on the property, the deed in lieu of foreclosure is an option that chooses to give the bank ownership of the property rather than having the bank use the legal process of foreclosure.

Maine Offer by Borrower of Deed in Lieu of Foreclosure

Description

How to fill out Offer By Borrower Of Deed In Lieu Of Foreclosure?

Are you presently within a position the place you need paperwork for possibly organization or individual uses just about every working day? There are a variety of authorized document web templates accessible on the Internet, but locating types you can trust is not easy. US Legal Forms provides a large number of type web templates, such as the Maine Offer by Borrower of Deed in Lieu of Foreclosure, which can be published to meet federal and state needs.

If you are previously acquainted with US Legal Forms website and possess a free account, simply log in. Next, it is possible to download the Maine Offer by Borrower of Deed in Lieu of Foreclosure web template.

If you do not provide an account and need to begin to use US Legal Forms, follow these steps:

- Discover the type you will need and make sure it is for the right city/area.

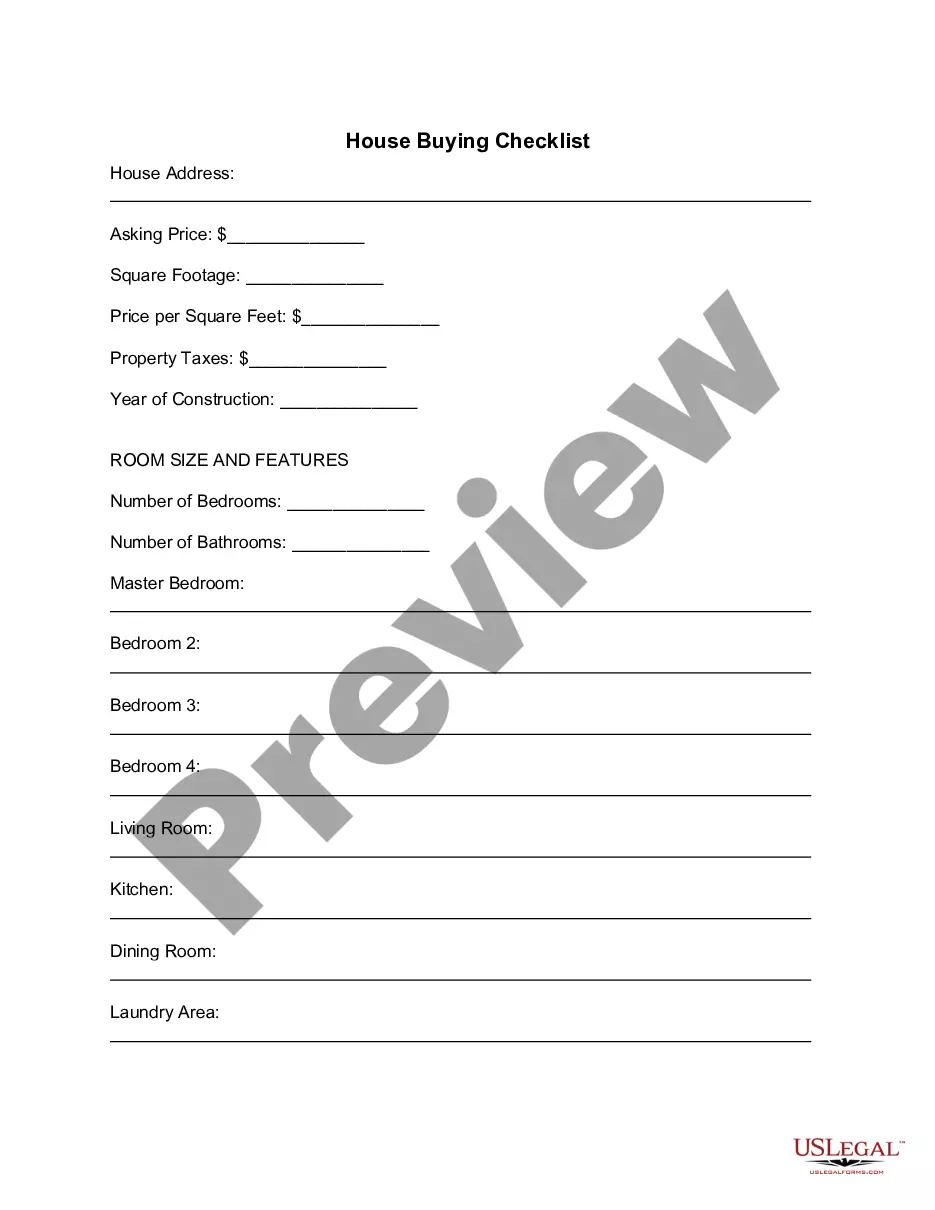

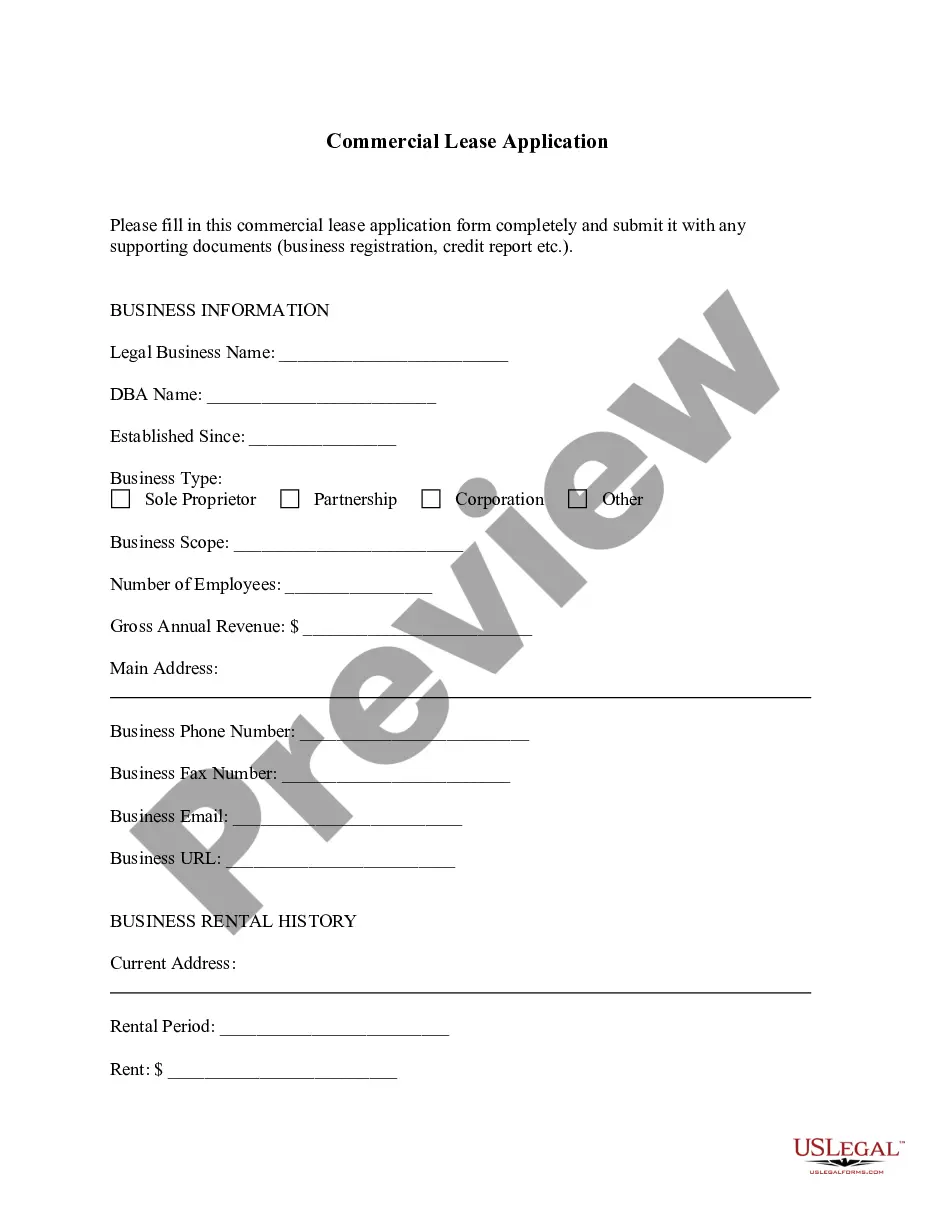

- Utilize the Preview option to review the form.

- See the outline to actually have chosen the appropriate type.

- When the type is not what you`re seeking, utilize the Lookup industry to discover the type that suits you and needs.

- Whenever you obtain the right type, click on Get now.

- Opt for the rates program you would like, complete the desired information to create your account, and buy the order using your PayPal or bank card.

- Decide on a convenient data file file format and download your copy.

Find each of the document web templates you may have purchased in the My Forms menu. You can obtain a extra copy of Maine Offer by Borrower of Deed in Lieu of Foreclosure any time, if needed. Just select the required type to download or produce the document web template.

Use US Legal Forms, one of the most considerable variety of authorized types, to conserve time as well as stay away from faults. The services provides skillfully manufactured authorized document web templates that you can use for an array of uses. Make a free account on US Legal Forms and start creating your life easier.

Form popularity

FAQ

Foreclosures show up on your credit report, which can make it virtually impossible for you to buy another home for years. A deed in lieu of foreclosure can release you from your mortgage responsibilities and allow you to avoid a foreclosure on your credit report.

Redemption Period in Maine Some states have a law that gives a foreclosed homeowner time after the foreclosure sale to redeem the property. But in Maine, the redemption period takes place before the sale. After the court issues a foreclosure judgment, the redemption period is 90 days from the judgment date.

This practice note discusses residential mortgage foreclosures in Maine. Maine is a judicial foreclosure state for residential mortgages, meaning that foreclosures must proceed by civil action under Me.

With a total of 737,782 housing units, Maine saw 152 foreclosures for a foreclosure rate of one in every 4,854 homes.

From the filing of a foreclosure complaint to the auction sale of the property, the foreclosure process in Maine generally takes 10 to 16 months. As a homeowner, you can participate fully in the process, and you have the right to request free mediation at the courthouse.

Items that a lender should consider when determining which course of action to take include, among other things, the property location, the type of foreclosure process, the type of loan (recourse or nonrecourse), existing liens on the property, operational costs, status of construction, availability of title insurance, ...

In Maine, homeowners get the chance to participate in the state's foreclosure diversion program?an informal process that can help the owner avoid foreclosure. Under federal law, the foreclosure can't typically start until you're more than 120 days delinquent on your house payment.