The "look through" trust can affords long term IRA deferrals and special protection or tax benefits for the family. But, as with all specialized tools, you must use it only in the right situation. If the IRA participant names a trust as beneficiary, and the trust meets certain requirements, for purposes of calculating minimum distributions after death, one can "look through" the trust and treat the trust beneficiary as the designated beneficiary of the IRA. You can then use the beneficiary's life expectancy to calculate minimum distributions. Were it not for this "look through" rule, the IRA or plan assets would have to be paid out over a much shorter period after the owner's death, thereby losing long term deferral.

Maine Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account

Description

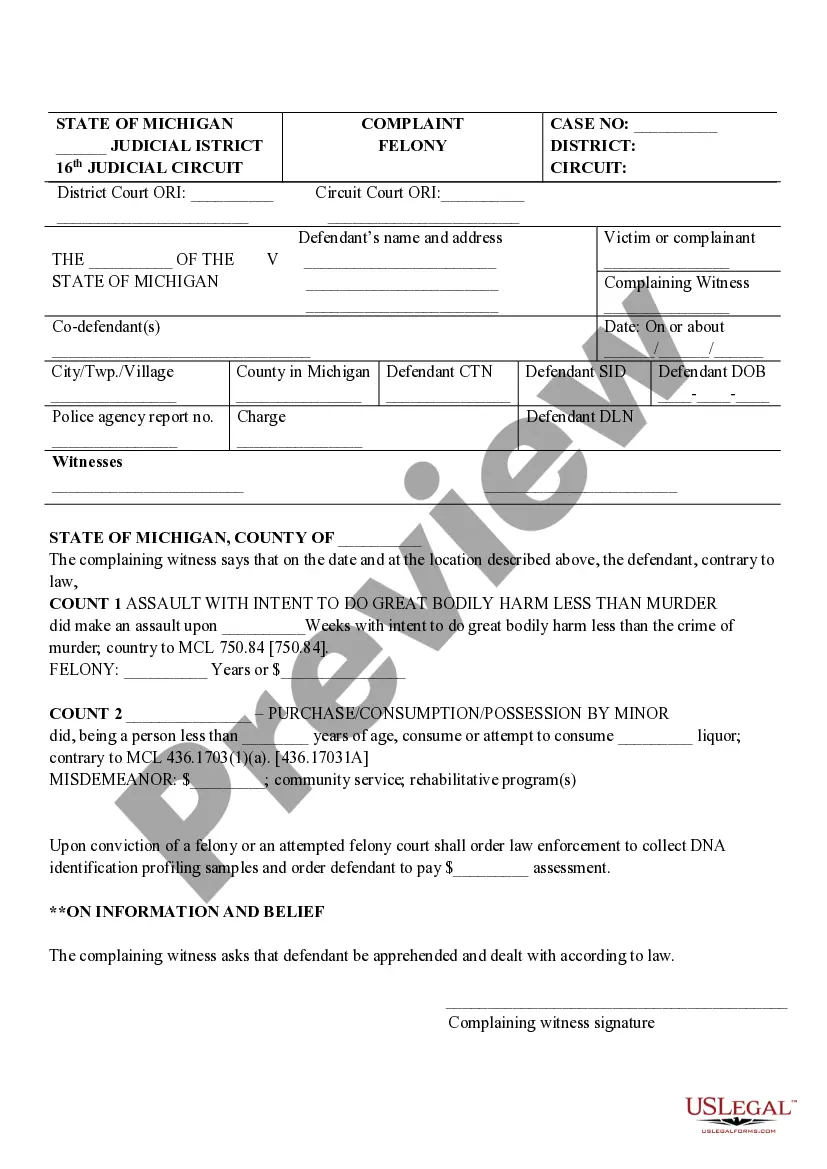

How to fill out Irrevocable Trust As Designated Beneficiary Of An Individual Retirement Account?

Identifying the appropriate legal document template can be a challenge. Obviously, there are many templates available online, but how do you locate the legal form you require.

Utilize the US Legal Forms website. This service offers a vast array of templates, including the Maine Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account, which can be applied for both business and personal needs. All forms are vetted by experts and comply with state and federal regulations.

If you are already a member, Log In to your account and click on the Download option to obtain the Maine Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account. Use your account to review the legal forms you may have purchased previously. Navigate to the My documents section of your account and download another copy of the document you need.

Choose the document format and download the legal document template to your device. Complete, modify, print, and sign the received Maine Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account. US Legal Forms offers the largest collection of legal templates, providing you with professionally crafted documents that adhere to state regulations.

- If you are a new user of US Legal Forms, here are simple steps for you to take.

- First, ensure you have selected the correct form for your city/state. You can review the form using the Preview option and read the form description to confirm it's the right one for you.

- If the form does not meet your needs, use the Search bar to find the correct form.

- Once you are certain the form is appropriate, click on the Buy Now button to obtain it.

- Select the pricing plan you wish to use and enter the required information.

- Create your account and pay for your order using your PayPal account or credit card.

Form popularity

FAQ

One valid reason for naming a trust as the beneficiary is to control how assets are distributed over time. A Maine Irrevocable Trust as a designated beneficiary of an Individual Retirement Account can provide financial protection for minors or individuals who may need assistance managing their inheritance. Additionally, it can help in reducing estate taxes and protecting assets from creditors. By making this thoughtful decision, you can secure your financial legacy.

You can indeed put a trust as a beneficiary of various accounts, including retirement accounts. By designating a Maine Irrevocable Trust as the beneficiary of your Individual Retirement Account, you provide a clear path for asset distribution. This method not only helps in avoiding probate but also ensures that the trust's terms govern how assets are managed. This can bring peace of mind knowing your wishes are officially documented.

Yes, a trust can be named as a beneficiary in a will. When you designate a Maine Irrevocable Trust as the beneficiary, it allows for structured management of the assets left behind. This approach ensures that your wishes are followed even after your passing. Using a trust can simplify the distribution process and protect assets for your loved ones.

A trust can serve as an eligible designated beneficiary under certain conditions, particularly when it is a Maine Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account. To qualify, the trust must be properly structured with identifiable beneficiaries who are eligible individuals. By utilizing this strategy, you can protect your retirement assets and provide for your loved ones while adhering to regulations. Using a trusted resource like uslegalforms can guide you in setting up your trust correctly and efficiently.

Indeed, a trust can be named as the beneficiary of a retirement account, including a Maine Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account. This arrangement allows for careful management of the funds after your death, ensuring they are distributed according to your wishes. It’s essential to set up the trust correctly to avoid adverse tax consequences and ensure the intended benefits for your heirs. Consulting with legal professionals can provide clarity and help you navigate the requirements.

Yes, you can place retirement accounts in a Maine Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account. However, it is crucial to follow specific legal guidelines to ensure compliance and maximize benefits. By structuring the trust properly, you can control how the assets are distributed after your passing. This method may also help in mitigating estate taxes and protecting your assets from creditors.

Filling out a beneficiary designation form is straightforward, but accuracy is crucial. Begin by listing the name and details of the beneficiary, which can be an individual or a trust, such as a Maine Irrevocable Trust as designated beneficiary of an Individual Retirement Account. If you're unsure about the details or implications, platforms like US Legal Forms can provide guidance and templates to assist you in the process.

An irrevocable trust can indeed inherit an IRA, allowing for distinct management of assets after the owner's passing. This arrangement can be beneficial in protecting the assets from creditors and ensuring that funds are used according to your wishes. Utilizing a Maine Irrevocable Trust as designated beneficiary of an Individual Retirement Account ensures you maintain control over how and when the assets are distributed.

Whether to name a trust as the beneficiary of your retirement accounts depends on your unique situation. While a Maine Irrevocable Trust as designated beneficiary of an Individual Retirement Account provides significant benefits, including asset protection and controlled distribution, it also requires careful planning. Discussing your options with a financial advisor can help you make the best choice for your estate.

Naming a trust as a beneficiary of an IRA can lead to complications, particularly regarding tax treatment. Trusts may not receive the same tax benefits as individual beneficiaries, which can result in higher taxes owed on withdrawals. It is beneficial to consult with an expert to explore how a Maine Irrevocable Trust as designated beneficiary of an Individual Retirement Account can mitigate these issues effectively.