Maine Revocable Trust for Asset Protection

Description

How to fill out Revocable Trust For Asset Protection?

Selecting the top legal document template can be rather a challenge.

Of course, there are numerous templates accessible online, but how do you find the legal document you require.

Make use of the US Legal Forms website. The service offers a multitude of templates, including the Maine Revocable Trust for Asset Protection, which can serve both business and personal purposes.

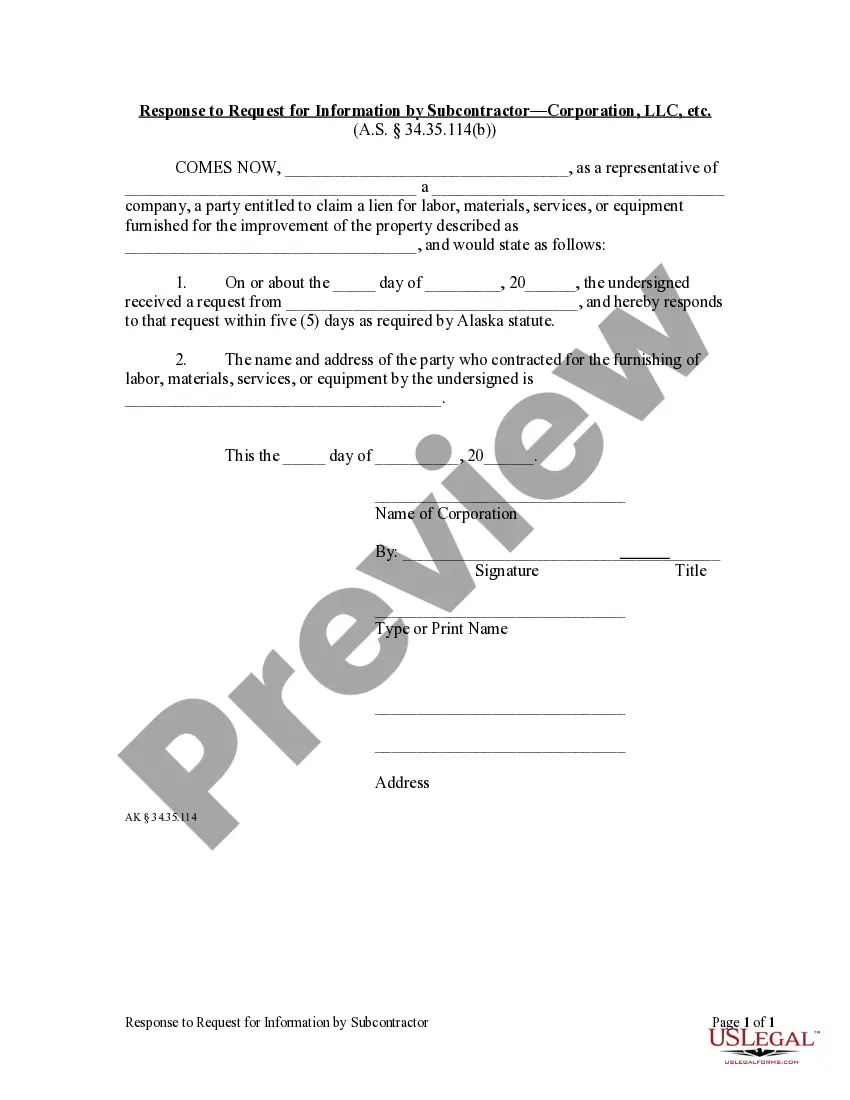

You can review the form using the Preview option and check the form details to ensure it is the right one for you.

- All of the forms are vetted by professionals and meet state and federal regulations.

- If you are already registered, Log In to your account and click the Download option to locate the Maine Revocable Trust for Asset Protection.

- Use your account to browse through the legal forms you have previously purchased.

- Go to the My documents section of your account and retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, make sure you have selected the correct form for your city/state.

Form popularity

FAQ

When creating a Maine Revocable Trust for Asset Protection, certain assets may not be suitable for inclusion. For instance, assets like retirement accounts or certain types of life insurance may have specific tax implications or beneficiary designations that could complicate matters. Additionally, personal items like your primary residence should be evaluated carefully, especially regarding exemptions from estate taxes. Before consolidating your assets into a trust, seek advice to ensure you make the best choices.

Yes, a Maine Revocable Trust for Asset Protection can play a vital role in asset management. However, it is important to understand that while a revocable trust allows you to maintain control over your assets, it does not provide protection from creditors. This type of trust allows for flexibility, as you can modify or revoke it anytime, making it an attractive option for many individuals. For enhanced asset protection, consider using it alongside other strategies.

The main downside of a revocable trust, like a Maine Revocable Trust for Asset Protection, is its lack of asset protection against creditors. You have the flexibility to change or revoke the trust, which means you still hold control over the assets. This control may expose your wealth to potential risks. It's important to weigh these factors when considering a revocable trust for your estate planning.

An asset protection trust is typically an irrevocable trust designed to shield your assets from creditors. Unlike a Maine Revocable Trust for Asset Protection, which allows for changes during your lifetime, an asset protection trust removes assets from your control. This type can effectively protect your wealth from lawsuits and other claims. Proper planning and legal advice are essential for this approach.

A revocable trust, like a Maine Revocable Trust for Asset Protection, does not offer robust asset protection against creditors. You maintain control over the assets, which means they may still be counted against you if financial trouble arises. However, it provides other benefits, such as easy management and distribution of your estate. Understanding the limitations can help you make informed decisions.

For asset protection, irrevocable trusts generally offer stronger safeguards than revocable ones. However, a Maine Revocable Trust for Asset Protection can still offer significant benefits, such as easy adjustments during your life. Each type of trust serves distinct purposes, so it’s vital to assess your specific situation and goals. Working with a specialist can help you choose the best option for your needs.

The best structure for asset protection often includes various legal tools. A Maine Revocable Trust for Asset Protection is one effective option that allows you to manage your assets while keeping them secure from potential claims. Diversifying your protective measures, including other trusts or insurance products, can enhance your overall strategy. Consult a professional to tailor a plan that fits your needs.

To protect your assets from nursing home costs in Maine, consider establishing a Maine Revocable Trust for Asset Protection. This trust can help you manage your resources while allowing you to retain control during your lifetime. It’s advisable to plan early and consult with a legal expert to explore all your options effectively. This proactive approach can shield your assets when the time comes.

The best trust to hold assets often depends on your goals. A Maine Revocable Trust for Asset Protection can provide you with a safe way to manage and distribute your property while maintaining flexibility. If you seek additional protection against creditors, an irrevocable trust might suit your needs better. Evaluate your situation to identify the right trust structure for you.

Choosing between a revocable and irrevocable trust depends on your specific needs. A Maine Revocable Trust for Asset Protection allows you flexibility, as you can modify it during your lifetime. On the other hand, an irrevocable trust offers stronger protection, but you relinquish control over the assets. Consider your priorities when deciding which option works best for you.