Maine Revocable Trust for Married Couple: A Detailed Description A Maine Revocable Trust for Married Couple is a legally binding document that allows a married couple to effectively manage and protect their assets during their lifetime and ensure a seamless transfer of wealth to their beneficiaries after their demise. This type of trust, also known as a Living Trust or a Family Trust, offers numerous benefits for couples seeking to safeguard their assets, provide for their loved ones, and maintain privacy. When setting up a Maine Revocable Trust for Married Couple, the couple acts as the trustees, retaining full control and ownership over the assets placed in the trust. The trust can be amended, modified, or even revoked entirely by the couple, providing them with the flexibility to adapt to changes in their circumstances. One notable advantage of a revocable trust is that it allows assets to bypass probate, simplifying the transfer of property in the event of death. By avoiding probate, costs and delays associated with the court process are minimized, ensuring a quicker, more efficient distribution of assets to beneficiaries. Moreover, a Maine Revocable Trust for Married Couple provides the couple with the ability to manage their assets during their lifetime, even in the event of incapacity or disability. The trust appoints successor trustees who can take over management responsibilities if the couple becomes unable to do so, ensuring the seamless continuation of asset management without the need for court intervention. Additionally, a revocable trust allows for greater privacy compared to a will. Unlike a will, which becomes a public document after probate, a trust remains confidential, enabling couples to keep their estate plans and financial affairs out of the public eye. There are several types of Maine Revocable Trusts for Married Couples, including: 1. General Revocable Living Trust: This is the most common type of revocable trust and provides the couple with maximum control and flexibility over their assets. 2. Marital Revocable Living Trust: This trust is specifically designed to take advantage of the marital deduction provided by the Internal Revenue Code, allowing the couple to minimize estate taxes upon transfer of assets to the surviving spouse. 3. Qualified Personnel Residence Trust (PRT): A PRT allows the couple to transfer their primary residence or vacation home into the trust, potentially reducing estate taxes while still maintaining the right to live in the property for a designated period of time. 4. Credit Shelter Trust: Also known as a bypass trust or family trust, a credit shelter trust is created to utilize both spouses' estate tax exemptions and maximize the ultimate transfer of assets to beneficiaries, while minimizing estate taxes. In conclusion, a Maine Revocable Trust for Married Couple offers an effective and flexible estate planning tool for married individuals, allowing them to maintain control over their assets, provide for their loved ones, and simplify the distribution of assets after their passing. With different types of trusts available to cater to specific needs and goals, couples can tailor their trust to meet their unique circumstances and achieve their desired outcomes.

Maine Revocable Trust for Married Couple

Description

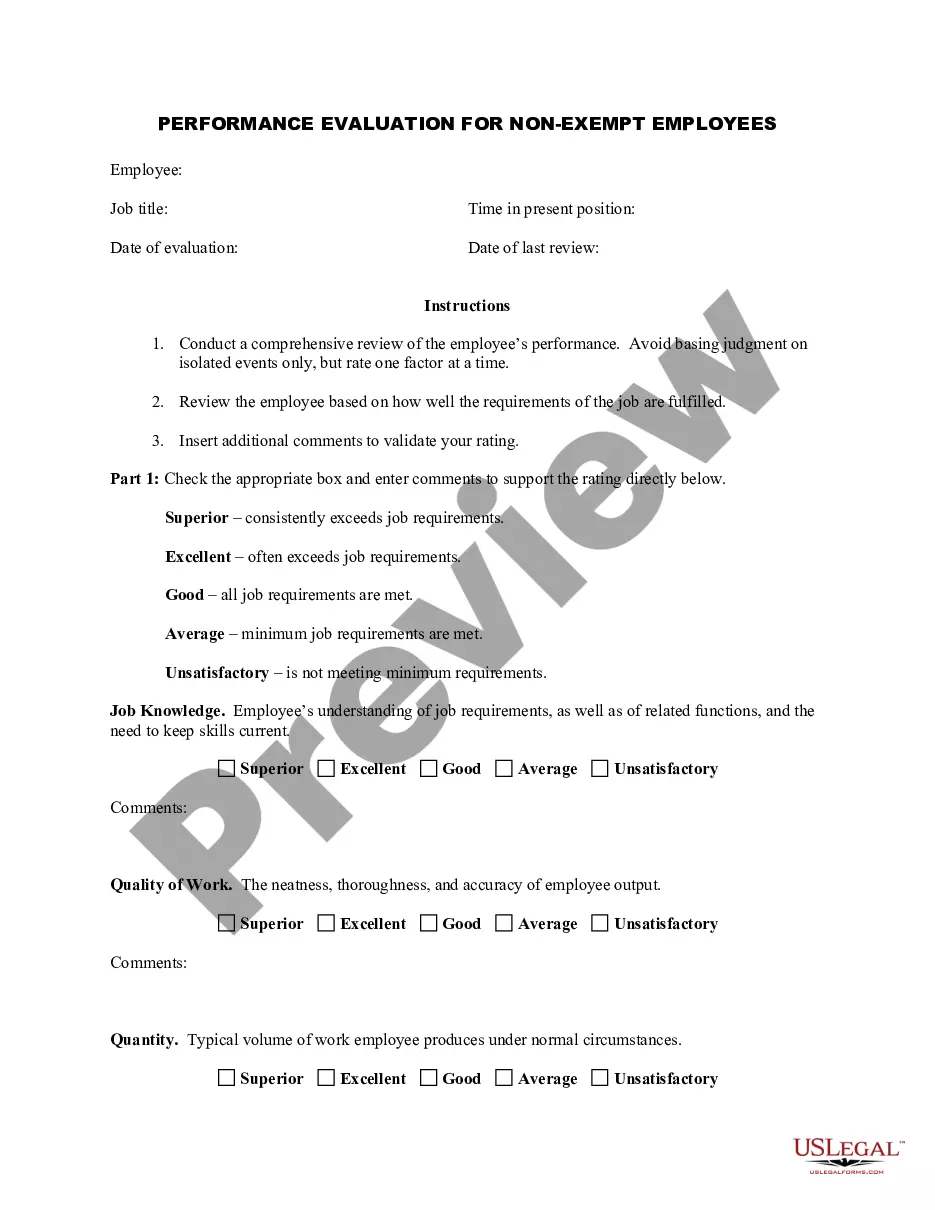

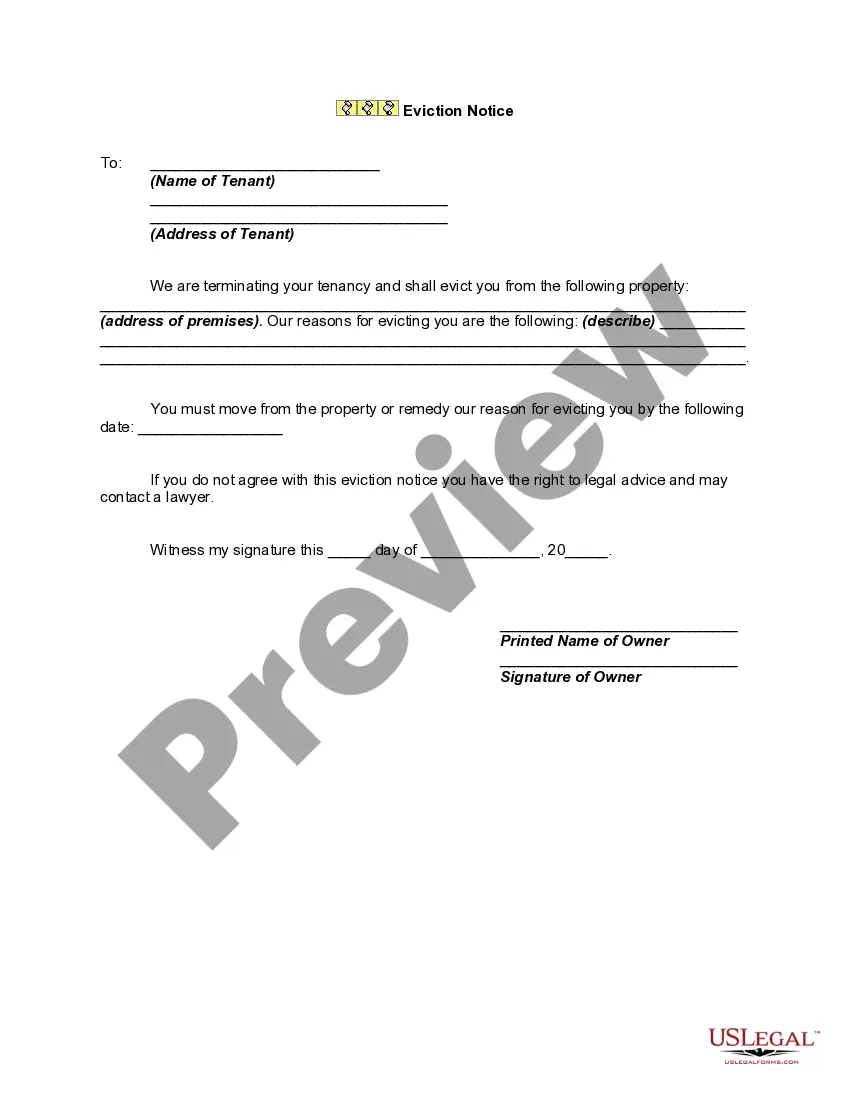

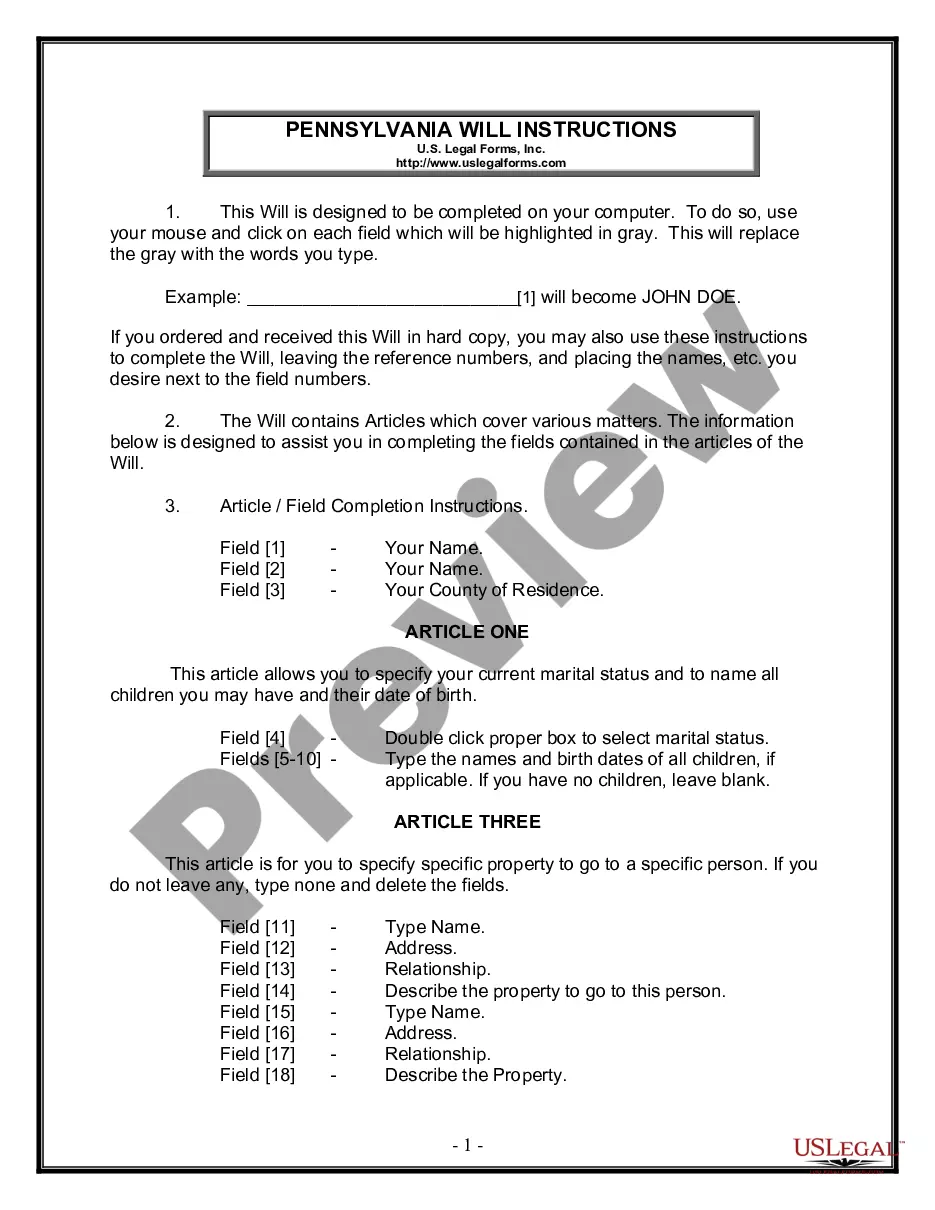

How to fill out Maine Revocable Trust For Married Couple?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a variety of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can obtain the latest documents like the Maine Revocable Trust for Married Couple within moments.

If you already have an account, Log In and download the Maine Revocable Trust for Married Couple from the US Legal Forms library. The Download button will appear on each form you review. You can access all previously downloaded forms in the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the purchase.

Choose the format and download the document to your device. Edit. Fill out, modify, print, and sign the acquired Maine Revocable Trust for Married Couple. Every template added to your account has no expiration date and is yours forever. So, if you want to download or print another copy, just visit the My documents section and click on the form you wish.

- Ensure you have selected the correct form for your city/state.

- Click on the Preview button to review the form's content.

- Check the form details to confirm you have chosen the right document.

- If the form does not meet your needs, utilize the Search field at the top of the page to find the one that does.

- Once you are happy with the form, confirm your choice by clicking the Get now button.

- Then, select the pricing plan you prefer and provide your credentials to register for an account.

Form popularity

FAQ

One disadvantage of a joint revocable trust for a married couple is that it may limit flexibility in managing assets. Both spouses must agree on any changes, which can be challenging if circumstances change or if one spouse becomes incapacitated. Additionally, if one spouse passes away, the entire trust may need to be re-evaluated, potentially leading to additional costs and administrative work. Consider exploring alternative options, like individual trusts, to ensure both partners maintain control and adaptability with their estate planning.

While a joint trust can simplify asset management for a Maine Revocable Trust for Married Couple, there are some disadvantages to consider. One primary concern is that both spouses must agree on any changes to the trust, which may complicate decision-making. Additionally, if one spouse experiences financial difficulties or legal issues, the assets in the joint trust could be affected. Evaluating these factors is essential before establishing a joint trust.

Remarried couples often benefit from a Maine Revocable Trust for Married Couple, which allows them to protect their individual assets while planning for their blended families. Setting up a trust helps ensure that both spouses' wishes are honored and that children from previous marriages are financially secured. It's vital to address individual concerns and to customize the trust to reflect the couple's unique family dynamics and financial objectives.

The best trust for a married couple often depends on their financial goals and family situation. Many couples opt for a Maine Revocable Trust for Married Couple because it provides flexibility and control over assets during their lifetimes while facilitating a smooth transition upon death. The trust can be easily amended or revoked, adapting to changing needs. Professional advice can help tailor the trust to your specific needs and goals.

The most popular form of marital trust is the A/B trust, also known as a bypass trust. In a Maine Revocable Trust for Married Couple, this approach allows one spouse’s assets to pass to the other without triggering estate taxes. This structure aims to maximize tax benefits while ensuring that both partners are financially secure. Understanding the nuances of each type can help you choose the best option for your circumstances.

To place your house in a Maine Revocable Trust for Married Couple, you will need to draft a trust document that outlines the terms of the trust. After creating the trust, you must execute a deed transferring your property ownership to the trust. It's crucial to file this deed with your local registry of deeds to ensure legal validity. Consulting with a legal professional can provide guidance specific to your situation.

The tax rate for trusts in Maine varies based on the income generated by the trust. Generally, a Maine Revocable Trust for Married Couple is taxed at the same rates as personal income tax, which can increase significantly at higher income levels. It is vital to understand these tax implications to make informed decisions about your estate planning. Engaging with a tax advisor can provide clarity on how to minimize the tax burden effectively.

While a joint revocable trust offers many benefits, it can have disadvantages as well. One major drawback of a Maine Revocable Trust for Married Couples is the potential for complexity in decision-making if spouses disagree. Additionally, if one spouse becomes incapacitated, the other may face challenges in managing the trust independently. Consulting a knowledgeable professional can help assess if this type of trust aligns with your goals.

When a spouse dies, the first step is to locate their will and any existing estate planning documents, such as a Maine Revocable Trust for Married Couple. Reviewing these documents will provide essential guidance on managing their estate. It is also crucial to notify the appropriate authorities, such as financial institutions and insurance companies, about the passing to initiate any claims. Don't hesitate to consult with an attorney specialized in trusts to navigate this difficult time effectively.

A joint trust typically becomes irrevocable when one spouse passes away. This is important for a Maine Revocable Trust for Married Couple, as it provides clarity on the management and distribution of assets after one partner's death. The surviving spouse usually retains control, but the trust's terms may limit their ability to change it. Understanding these nuances can help you better prepare for the future.

More info

Free email alerts when we put great stuff in your inbox. 2. Your name on the list. 3. Subscribing allows you to be the first to know about new content. 4.