The courts have inherent power to restrain the sale of mortgaged premises in foreclosure proceedings, but are reluctant to exercise such power except where it is shown that particular circumstances, extrinsic to the instrument, would render its enforcement in this manner inequitable and work irreparable injury, and that complainant has no adequate remedy at law. Furthermore, a party must show a probable right of recovery in order to obtain a temporary injunction of a foreclosure action.

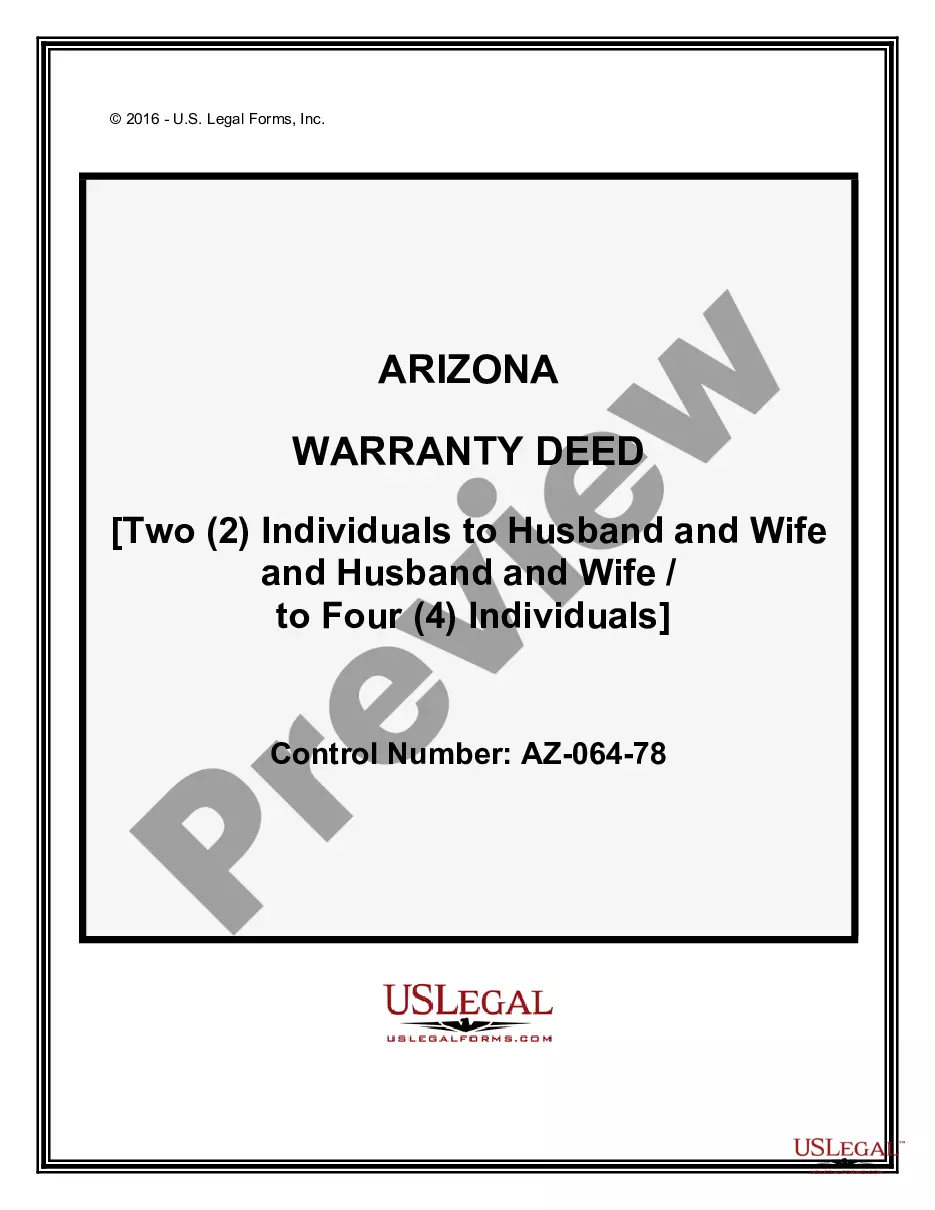

Maine Complaint or Petition to Enjoin Foreclosure Sale due to Misunderstanding as to Promissory Note's Terms of Payment upon Assumption of Note

Description

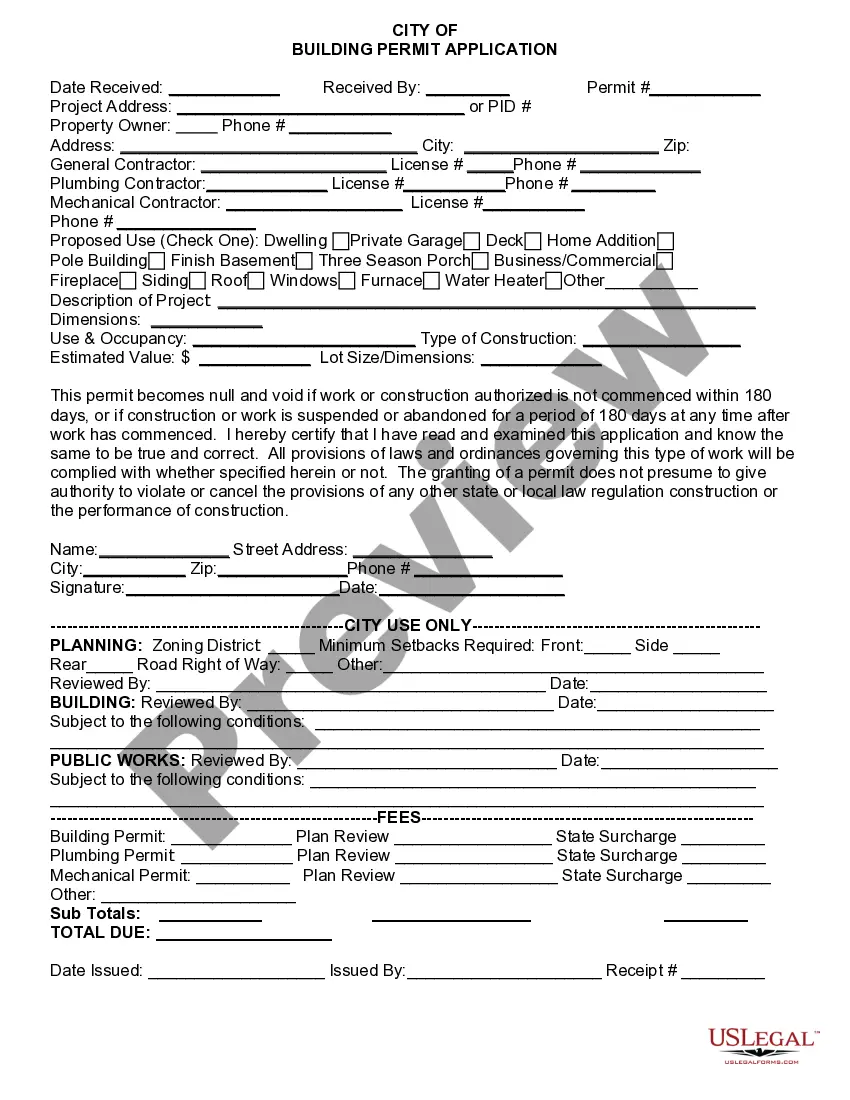

How to fill out Complaint Or Petition To Enjoin Foreclosure Sale Due To Misunderstanding As To Promissory Note's Terms Of Payment Upon Assumption Of Note?

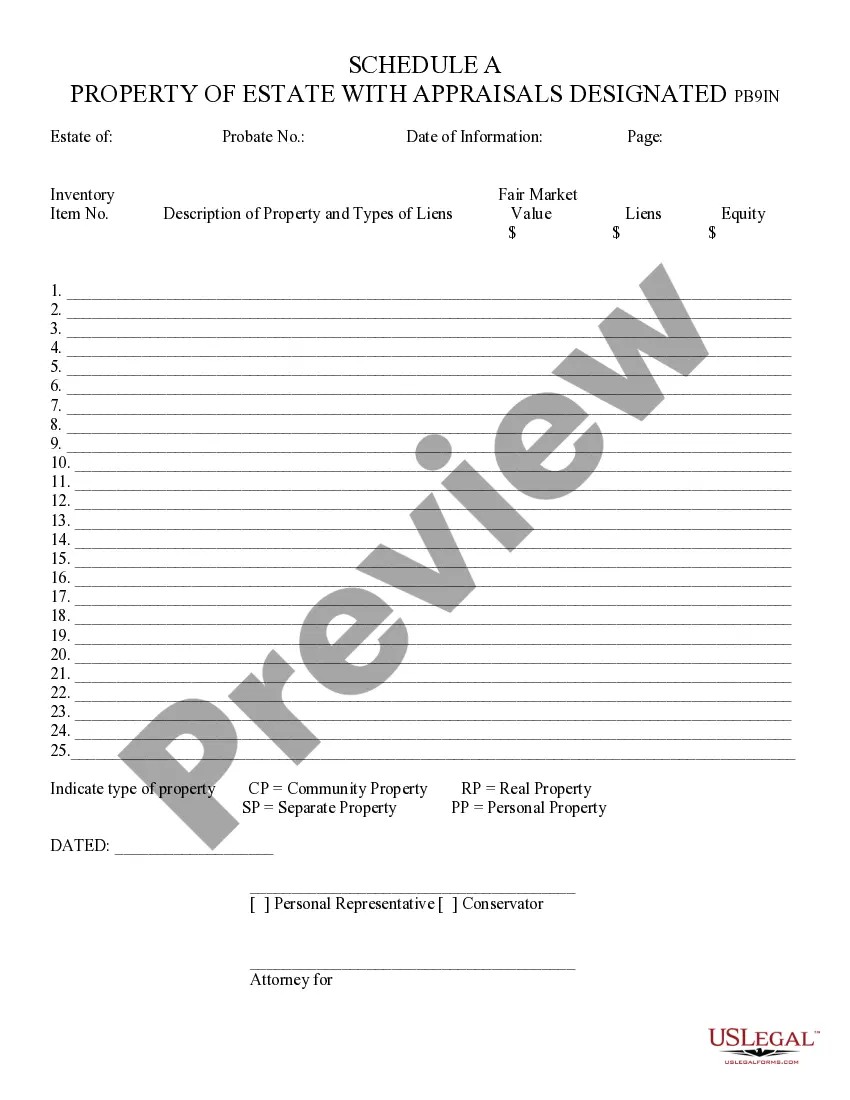

US Legal Forms - one of the biggest libraries of authorized forms in the States - gives a wide array of authorized record layouts you are able to acquire or produce. While using website, you may get a huge number of forms for organization and person reasons, categorized by types, says, or keywords.You will find the most recent models of forms like the Maine Complaint or Petition to Enjoin Foreclosure Sale due to Misunderstanding as to Promissory Note's Terms of Payment upon Assumption of Note within minutes.

If you currently have a membership, log in and acquire Maine Complaint or Petition to Enjoin Foreclosure Sale due to Misunderstanding as to Promissory Note's Terms of Payment upon Assumption of Note from the US Legal Forms catalogue. The Acquire button will appear on every single kind you see. You have access to all previously saved forms within the My Forms tab of your own bank account.

If you wish to use US Legal Forms the very first time, here are straightforward recommendations to obtain started off:

- Be sure you have chosen the right kind to your town/state. Click on the Review button to check the form`s articles. Read the kind outline to actually have selected the correct kind.

- If the kind doesn`t match your needs, use the Lookup discipline on top of the monitor to obtain the the one that does.

- When you are satisfied with the form, validate your option by visiting the Acquire now button. Then, pick the rates plan you want and give your references to sign up on an bank account.

- Procedure the purchase. Utilize your credit card or PayPal bank account to finish the purchase.

- Select the formatting and acquire the form in your gadget.

- Make changes. Load, change and produce and indication the saved Maine Complaint or Petition to Enjoin Foreclosure Sale due to Misunderstanding as to Promissory Note's Terms of Payment upon Assumption of Note.

Each design you included in your account lacks an expiration date and is yours for a long time. So, if you wish to acquire or produce another duplicate, just visit the My Forms portion and click in the kind you will need.

Obtain access to the Maine Complaint or Petition to Enjoin Foreclosure Sale due to Misunderstanding as to Promissory Note's Terms of Payment upon Assumption of Note with US Legal Forms, the most considerable catalogue of authorized record layouts. Use a huge number of specialist and express-specific layouts that fulfill your small business or person requirements and needs.

Form popularity

FAQ

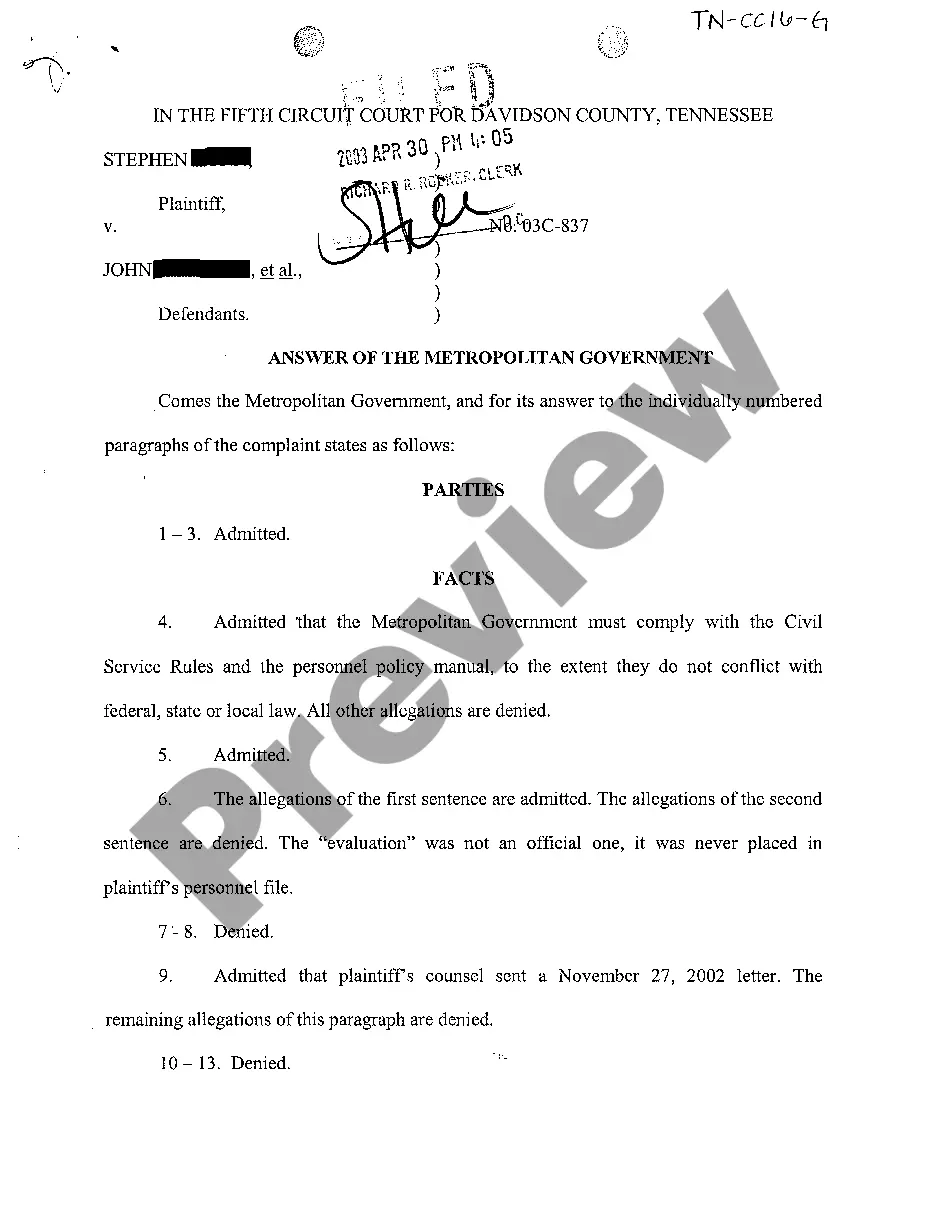

How to Respond to a Foreclosure Summons Step 1: Read the Summons. ... Step 2: Speak to Foreclosure Lawyer. ... Step 3: Decide If You Want to Contest. ... Step 4: Prepare a Mortgage Foreclosure Appearance and Answer to the Complaint. ... Step 5: File the Form with the Court Clerk. ... Step 6: Send a Copy of Your Answer to the Other Parties.

Soon after a foreclosure is filed you will be "served": either someone from the sheriff's department or a private process server (someone hired by the lender) will hand-deliver to you (or someone else in your household) a summons and a complaint.

The homeowner or other defendant may file a written answer to the complaint, explaining why the lender does not have the legal right to foreclose. This must occur within 35 days from receipt of the summons and foreclosure complaint.

How do I prepare an Answer to the foreclosure? Copy the information from the top of the foreclosure Complaint. ... Title your paper ?Answer to Complaint in Foreclosure.? Next, your Answer should respond to each claim made against you in the Complaint. ... Sign the Answer.

You must file your ?Answer? to the complaint with the court in your county. Legal help can be found through the Ohio Legal Services Association, the Legal Aid Society of Columbus, or the Ohio State Bar Association. Submitting your ?Answer? to the court slows down the foreclosure process.

Foreclosure is when the bank or mortgage lender takes possession of property that is in default, often against the homeowner's will. Your mortgage agreement states that if you stop making payments on your loan, the bank can reclaim the property through foreclosure.