Maine Retirement Cash Flow

Description

How to fill out Retirement Cash Flow?

Are you in a situation where you require documents for either business or personal reasons on a daily basis.

There are numerous legitimate document formats available online, but finding ones you can rely on isn't simple.

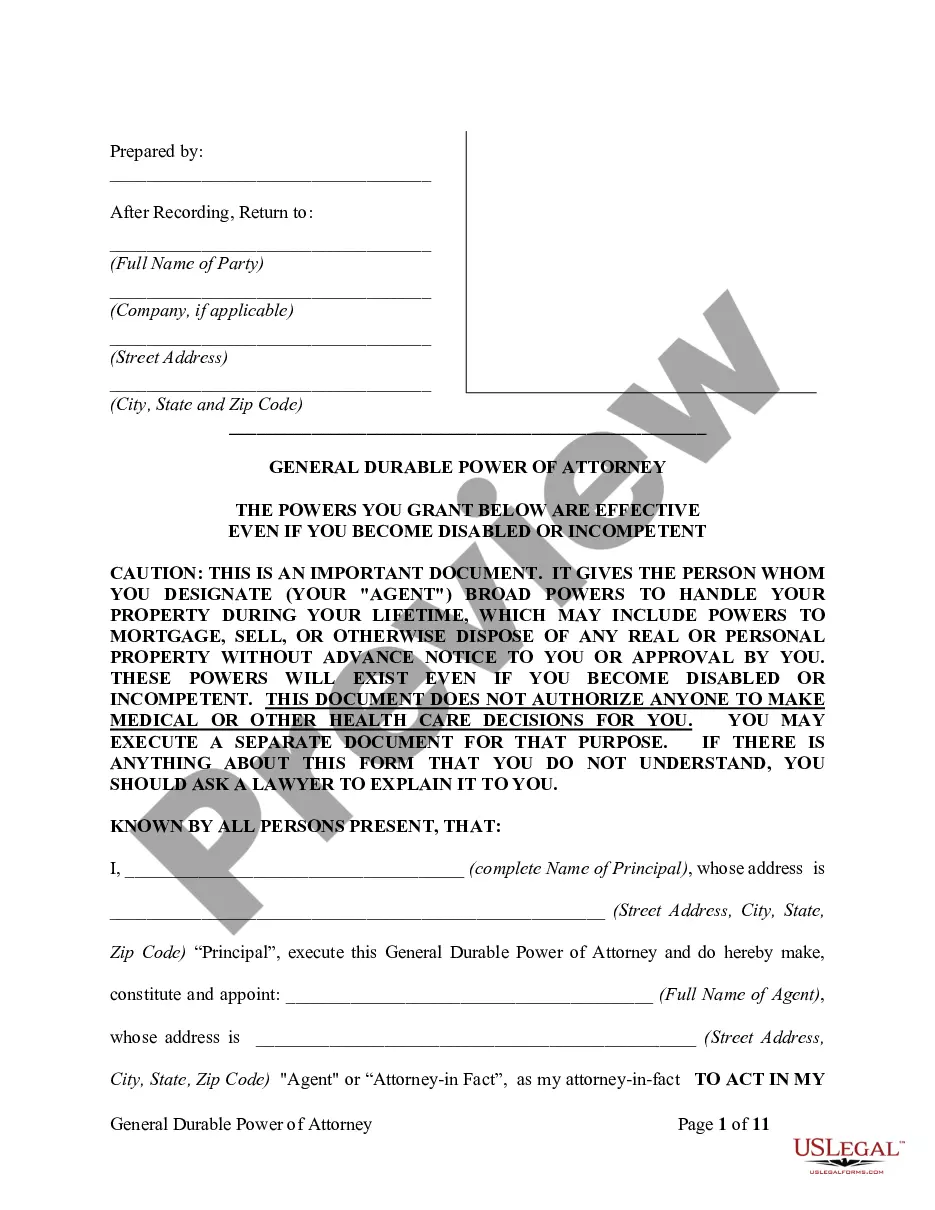

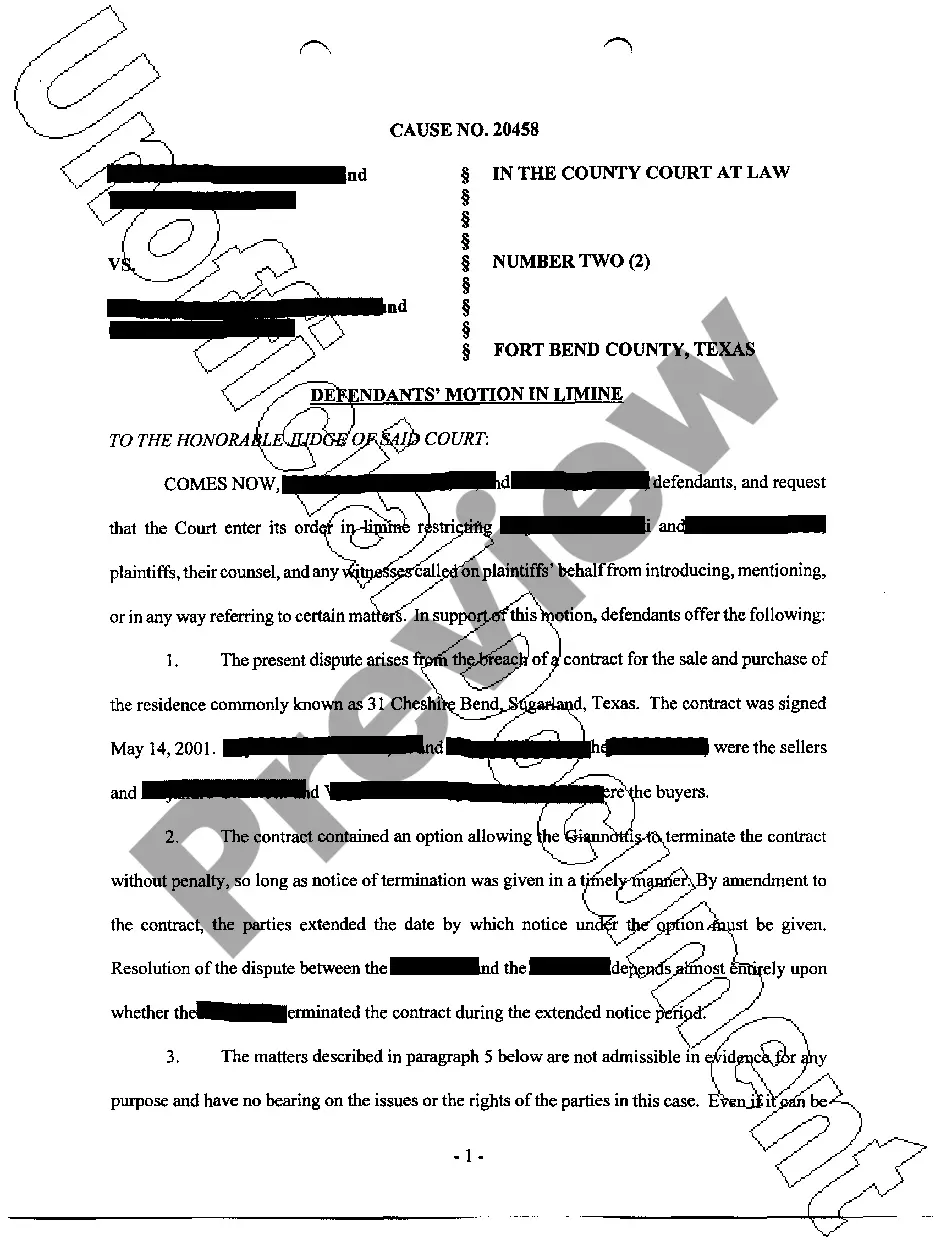

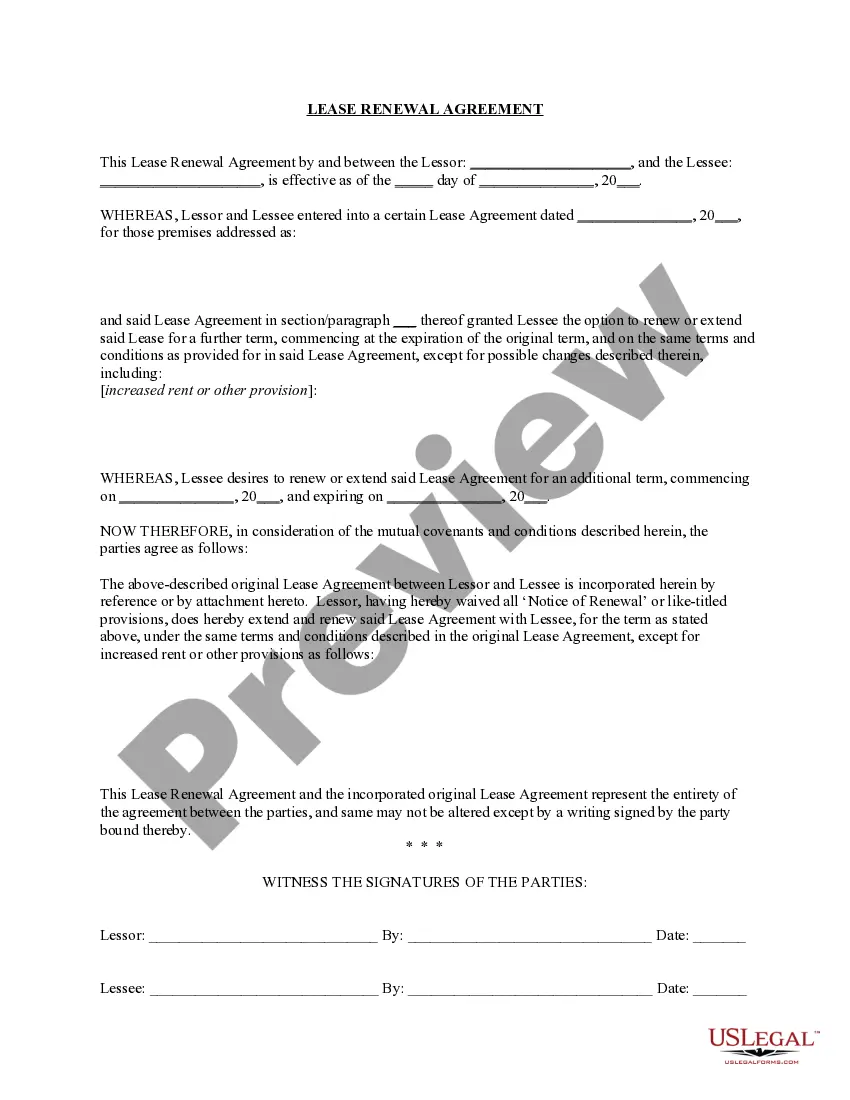

US Legal Forms offers a vast array of form templates, including the Maine Retirement Cash Flow, designed to comply with federal and state regulations.

Once you have the correct form, click Buy now.

Select the pricing plan you need, fill out the necessary information to create your account, and process your order using PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Maine Retirement Cash Flow template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/region.

- Use the Preview button to view the document.

- Check the description to confirm you have chosen the right form.

- If the form isn't what you seek, use the Search section to find the form that meets your needs.

Form popularity

FAQ

Maine. Our Ranking: Not tax-friendly. State Income Tax Range: 5.8% (on taxable income less than $22,450 for single filers; less than $44,950 for joint filers) 7.15% (on taxable income of $53,150 or more for single filers; $106,350 for joint filers). Average Combined State and Local Sales Tax Rate: 5.5%.

CON: High Property and Income Taxes The rates of property and income taxes in Maine tend to be on the higher side, which can be challenging for some individuals. Maine does not tax Social Security income. The good news is this may not impact you directly.

Maine residents enjoy a low sales tax rate. Maine does not combine state and local taxes to calculate its sales tax rate.

Maine generally imposes an income tax on all individuals that have Maine-source income. The income tax rates are graduated, with rates ranging from 5.8% to 7.15% for tax years beginning after 2015.

Maine Tax Return Begins with Federal AGI (Review the discussion about Differences with Federal taxes.) The deferred income that is in retirement accounts, like an IRA or a 401(k), will be taxed in the year the taxpayer accepts distributions from these accounts.

Maine is not tax-friendly toward retirees. Social Security income is not taxed. Withdrawals from retirement accounts are partially taxed. Wages are taxed at normal rates, and your marginal state tax rate is 5.90%.

As a place to retire, Maine ranks high for health care and quality of life but is the seventh-most expensive state for people to live out their golden years, according to new findings from personal finance website WalletHub.

Retiring in Maine means having a low cost of living, finding affordable housing, being around plenty of other retirees, getting amazing healthcare, being surrounded by gorgeous scenery, and having plenty to do in your free time. However, the state also gets fairly cold and has high income taxes.

Alaska is one of five states with no state sales tax. If you're heading north to Alaska, just remember that local sales taxes up to 7.5% might apply. But, according to the Tax Foundation, the statewide local sales tax average is only 1.76%. Property taxes are middle-of-the-road in Alaska.