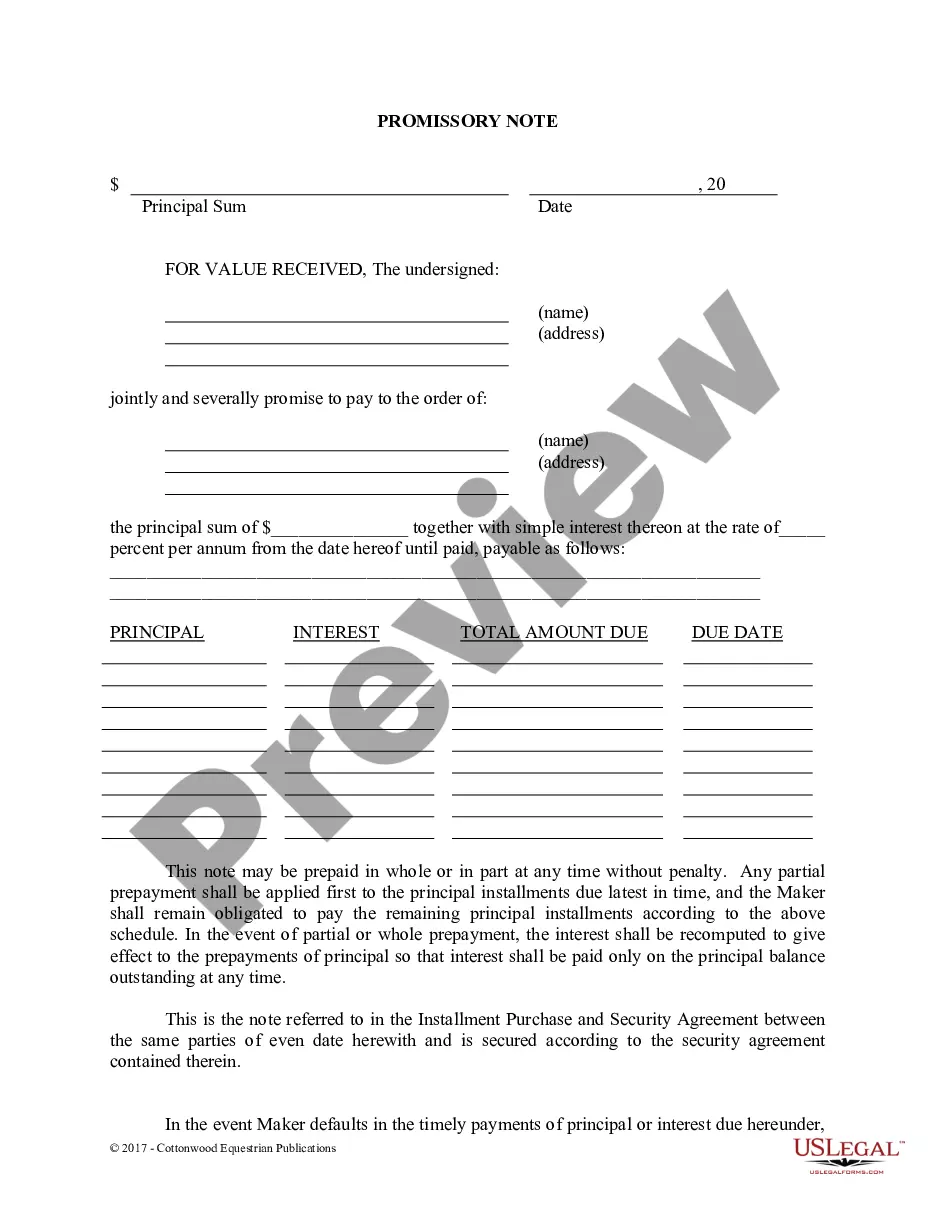

Maine Sale of Partnership to Corporation refers to the legal process where a partnership entity in the state of Maine is dissolved, and its assets and liabilities are transferred to a newly formed corporation. This transaction typically involves partners selling their interests in the partnership to the corporation in exchange for shares of stock or other consideration. One type of Maine Sale of Partnership to Corporation is when a general partnership decides to convert into a corporation. In this scenario, the partnership's partners agree to dissolve the partnership and transfer all its assets, contracts, and debts to the new corporation. This type of sale often occurs when partners wish to separate their personal liability from the business or start operating under a different legal structure. Another type of Maine Sale of Partnership to Corporation is when a limited partnership converts into a corporation. Limited partnerships have both general partners, who have unlimited personal liability, and limited partners, whose liability is limited to their investment. By converting to a corporation, the general partner(s) can reduce their personal liability and provide limited partners with enhanced protection. This conversion requires adherence to specific legal requirements and obtaining necessary approvals. To initiate a Maine Sale of Partnership to Corporation, partners must first draft a plan of conversion or a plan of merger, which outlines the terms, conditions, and process of the conversion. This plan must be approved by partners and, in some cases, shareholders. Additionally, all necessary legal filings, such as the conversion certificate and relevant tax forms, must be submitted to the Maine Secretary of State and other applicable government authorities to ensure the conversion is official and compliant. During the sale, partners typically receive consideration for their partnership interests, such as shares of stock in the newly formed corporation or cash. The specific terms of the sale are negotiated and outlined in legal documents such as a purchase agreement or a stock issuance agreement. It is advisable to consult with legal and financial professionals experienced in corporate transactions to ensure compliance with Maine state laws and to protect the interests of all parties involved. In conclusion, Maine Sale of Partnership to Corporation involves the dissolution of a partnership entity and the transfer of its assets and liabilities to a newly formed corporation. Whether it is a conversion of a general partnership or a limited partnership, this process requires careful planning, legal documentation, and compliance with Maine's regulations. Seeking professional guidance is crucial to ensure a smooth and legally sound transaction.

Maine Sale of Partnership to Corporation

Description

How to fill out Maine Sale Of Partnership To Corporation?

US Legal Forms - one of the largest libraries of lawful forms in the USA - offers a variety of lawful file themes you are able to acquire or print. Using the internet site, you can get 1000s of forms for organization and individual purposes, categorized by classes, states, or key phrases.You will discover the most recent variations of forms like the Maine Sale of Partnership to Corporation within minutes.

If you already have a membership, log in and acquire Maine Sale of Partnership to Corporation from your US Legal Forms collection. The Acquire switch can look on every form you perspective. You have accessibility to all earlier delivered electronically forms in the My Forms tab of your accounts.

If you would like use US Legal Forms the first time, listed below are straightforward directions to get you started:

- Be sure you have picked the proper form for your area/state. Click on the Preview switch to check the form`s content. Look at the form outline to actually have chosen the correct form.

- When the form doesn`t fit your specifications, take advantage of the Lookup area at the top of the display screen to obtain the the one that does.

- In case you are content with the form, confirm your choice by visiting the Acquire now switch. Then, pick the prices prepare you like and give your references to sign up for an accounts.

- Method the financial transaction. Utilize your credit card or PayPal accounts to finish the financial transaction.

- Find the formatting and acquire the form in your gadget.

- Make alterations. Fill out, edit and print and sign the delivered electronically Maine Sale of Partnership to Corporation.

Each and every design you included with your money lacks an expiration particular date which is yours forever. So, in order to acquire or print yet another version, just visit the My Forms segment and then click about the form you want.

Get access to the Maine Sale of Partnership to Corporation with US Legal Forms, by far the most comprehensive collection of lawful file themes. Use 1000s of specialist and condition-particular themes that satisfy your organization or individual demands and specifications.