A promoter is a person who starts up a business, particularly a corporation, including the financing. The formation of a corporation starts with an idea. Preincorporation activities transform this idea into an actual corporation. The individual who carries on these preincorporation activities is called a promoter. Usually the promoter is the main shareholder or one of the management team and receives stock for his/her efforts in organization. Most states limit the amount of "promotional stock" since it is supported only by effort and not by assets or cash. If preincorporation contracts are executed by the promoter in his/her own name and there is no further action, the promoter is personally liable on them, and the corporation is not.

Under the Federal Securities Act of 1933, a pre-organization certificate or subscription is included in the definition of a security. Therefore, a contract to issue securities in the future is itself a contract for the sale of securities. In order to secure an exemption, all stock subscription agreements involving intrastate offerings should contain representations by the purchasers that they are bona fide residents of the state of which the issuer is a resident and that they are purchasing the securities for their own account and not with the view to reselling them to nonresidents. A stock transfer restriction running for a period of at least one year or for nine months after the last sale of the issue by the issuer is customarily included to insure that securities have not only been initially sold to residents, but have "come to rest" in the hands of residents.

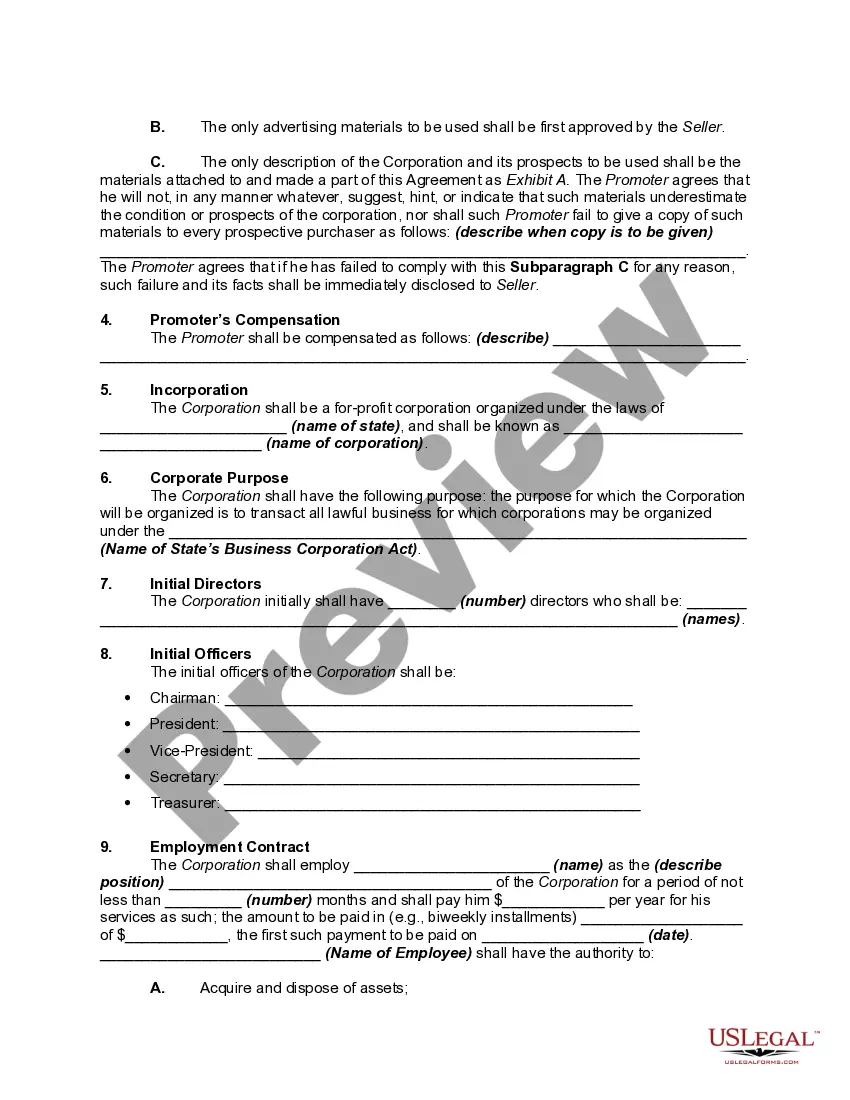

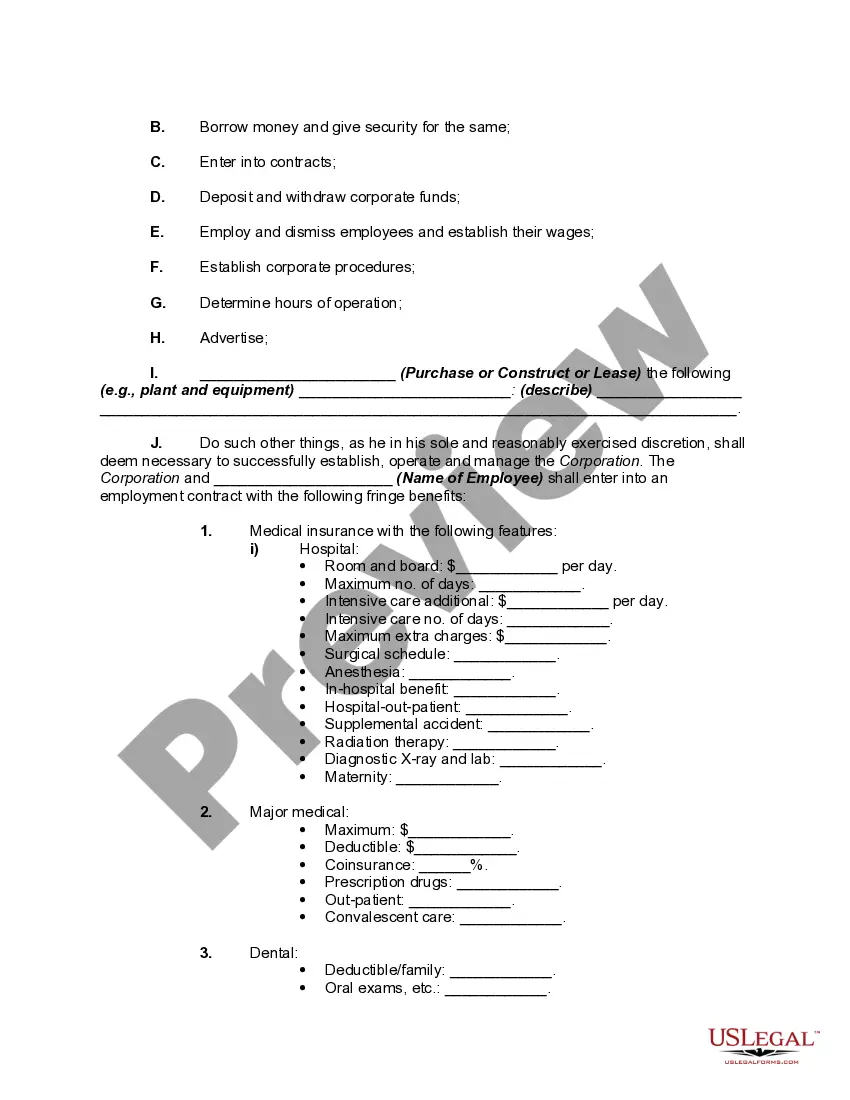

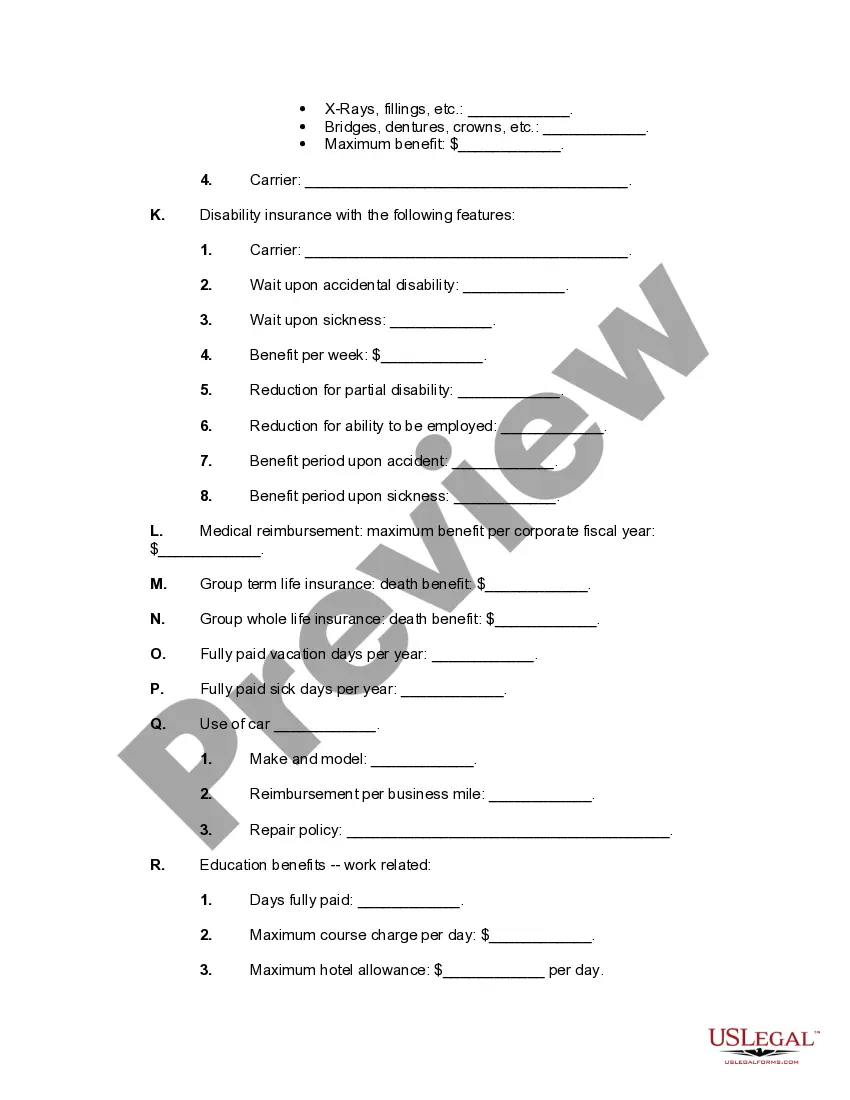

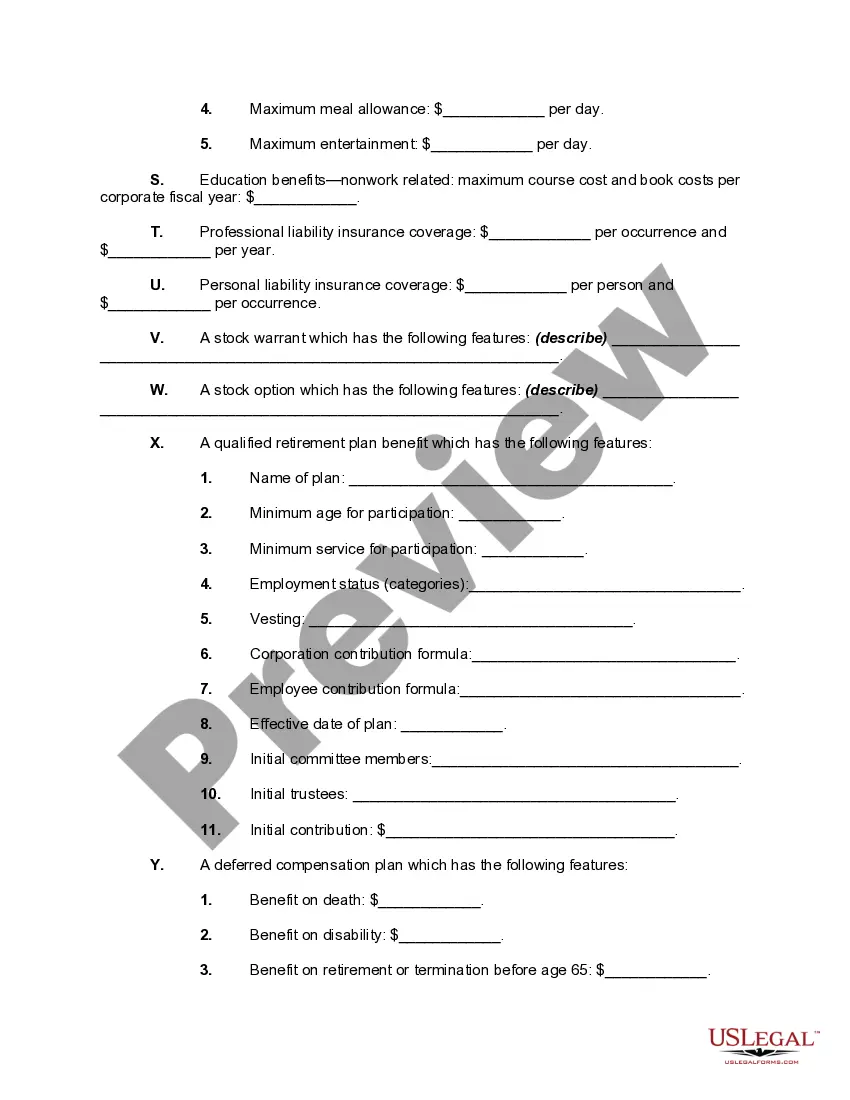

Maine Preincorporation Agreement between Incorporates and Promoters is a legally binding contract that outlines the terms and conditions agreed upon by the incorporates and promoters when forming a corporation in the state of Maine. This agreement serves as a crucial foundation for business operations and sets forth the framework for the corporation's formation process. The Maine Preincorporation Agreement addresses various aspects essential to the incorporation process, including the duties, responsibilities, and liabilities of both the incorporates and promoters involved. It establishes a mutual understanding between these parties regarding the corporation's purpose, objectives, management structure, and financial obligations. Key elements typically covered in a Maine Preincorporation Agreement include: 1. Incorporates' and Promoters' Information: Names, addresses, and contact details of all incorporates and promoters involved in the corporation's formation. 2. Corporation Name and Purpose: Details of the proposed corporation's name, as well as a clear statement of the purpose and activities it will engage in. 3. Share Structure: Specification of the authorized share capital and the division of shares among the incorporates and promoters, including the number of shares, their classes, and any restrictions or rights associated with them. 4. Incorporation Process: Detailed steps and procedures to be followed during the incorporation process, such as filing of the Articles of Incorporation with the Maine Secretary of State, obtaining necessary permits or licenses, and compliance with legal requirements. 5. Management and Decision-making: Establishment of rules and procedures for governance, election of directors, appointment of officers, and decision-making processes within the corporation. 6. Roles and Responsibilities: Clear delineation of the roles and responsibilities of incorporates, promoters, directors, officers, and other key individuals involved in the corporation's formation. 7. Financial Obligations: Explanation of each party's financial obligations, including the initial capital contributions required, future funding obligations, and potential share transfers or buyouts. Different types of Maine Preincorporation Agreement between Incorporates and Promoters may include variations based on the specific nature of the corporation being formed, industry-specific regulations, or the unique requirements of the parties involved. However, the overall purpose and core terms discussed above remain generally consistent across agreements. It is important for all parties involved in the formation of a corporation in Maine to carefully review, negotiate, and seek legal counsel when drafting a Preincorporation Agreement. By doing so, they can ensure that the agreement accurately reflects their intentions, protects their interests, and lays a solid foundation for the successful incorporation and future operation of the corporation.