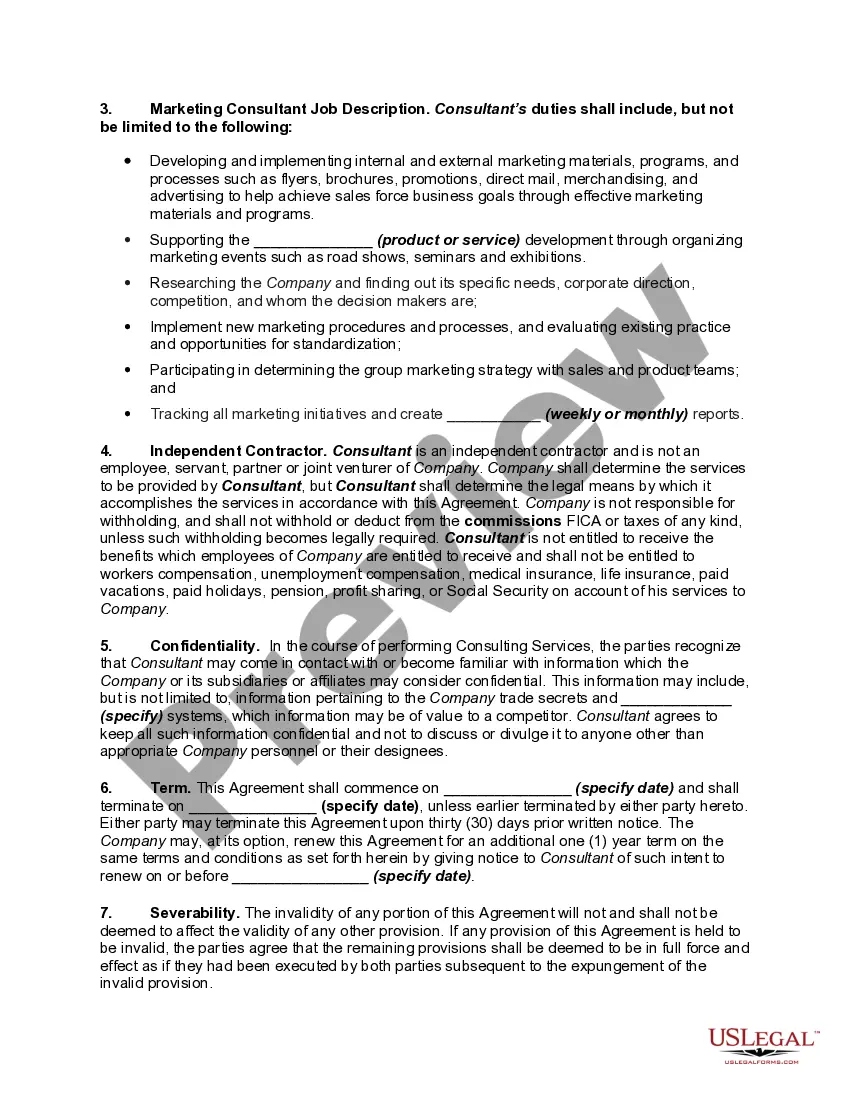

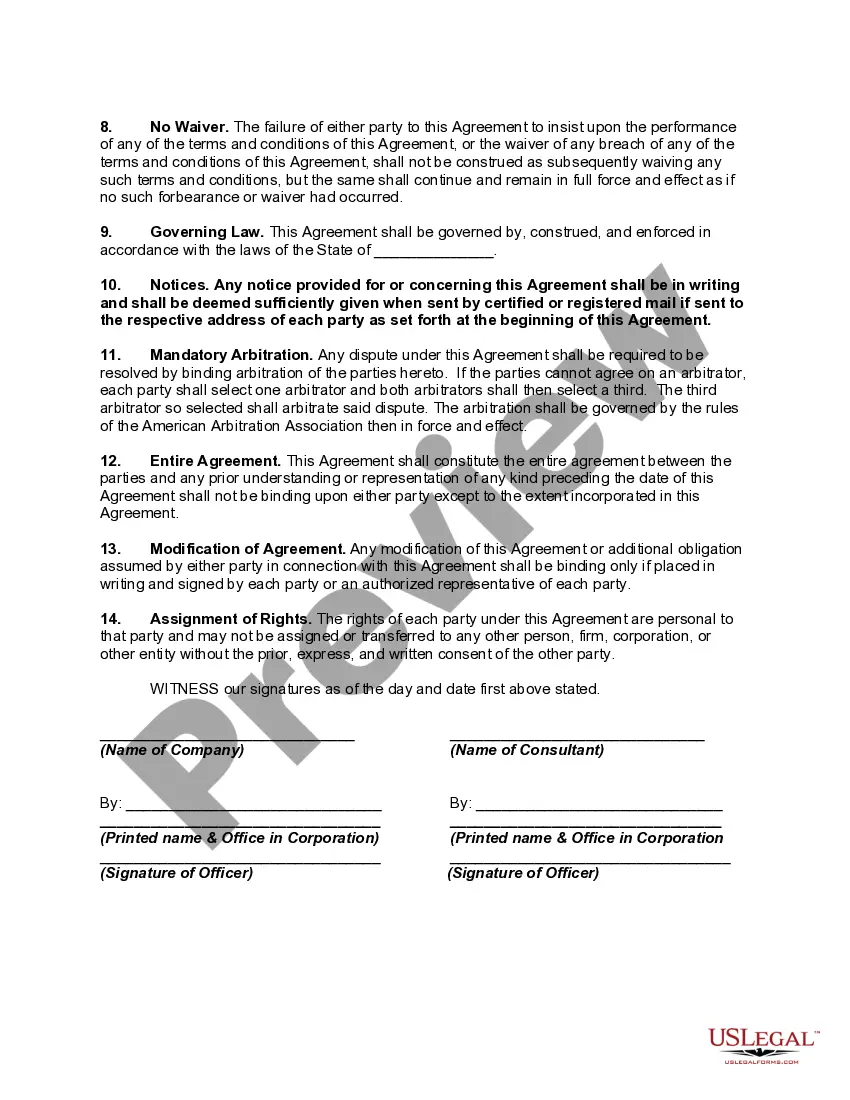

Maine Marketing Consultant Agreement — Self-Employed: A Comprehensive Guide In the vibrant world of marketing, businesses often seek the expertise of marketing consultants to develop effective strategies, improve brand awareness, and drive growth. However, when engaging a marketing consultant in the state of Maine, it is crucial to establish a formal agreement to protect the interests of both parties involved. This detailed description aims to shed light on the key aspects and different types of Maine Marketing Consultant Agreements for self-employed individuals. What is a Maine Marketing Consultant Agreement? A Maine Marketing Consultant Agreement serves as a legally binding document between a marketing consultant and a client, defining the terms and conditions of their professional relationship. It outlines the scope of work, payment structure, project timeline, confidentiality agreements, and other essential clauses required to ensure a successful collaboration. Key Clauses and Provisions: 1. Scope of Work: This clause clearly defines the services the marketing consultant will provide. It specifies the deliverables, such as market research, strategy development, campaign management, social media marketing, SEO optimization, or other specialized marketing services as agreed upon. 2. Payment Terms: The agreement outlines the compensation structure, including the consultant's fees, payment schedule, and any additional expenses like travel or materials reimbursements. It may also cover the consequences of late payments or disputed invoices. 3. Project Timeline: This provision establishes a specific schedule for project deliverables, key milestones, and deadlines. It fosters transparency and accountability, ensuring that the marketing consultant adheres to agreed-upon timelines. 4. Intellectual Property: Any intellectual property rights produced during the consultancy, such as marketing plans, branding materials, or content creations, must be clearly outlined to avoid future disputes. This section should specify who retains ownership and how it can be used by both parties. 5. Confidentiality and Non-Disclosure: Given the sensitive nature of marketing strategies and valuable business information, a confidentiality clause is crucial. It ensures that the consultant doesn't disclose or use the client's confidential data or trade secrets for personal gain or to the detriment of the client's business. Types of Maine Marketing Consultant Agreements: 1. General Marketing Consultant Agreement: This agreement covers a broad range of marketing services provided by a self-employed consultant to various clients. It is suitable for consultants with expertise in multiple marketing disciplines, such as market research, advertising, digital marketing, or public relations. 2. Social Media Marketing Consultant Agreement: This agreement is tailored for consultants specializing in social media marketing strategies, content creation, community management, influencer collaborations, and analytics. It focuses on the specific requirements and goals relating to social media platforms like Facebook, Instagram, Twitter, or LinkedIn. 3. SEO Consultant Agreement: This type of agreement is designed for consultants experienced in search engine optimization strategies. It outlines the consultant's responsibilities to improve search engine rankings, enhance website traffic, and optimize keywords, meta tags, and other SEO elements. 4. Digital Advertising Consultant Agreement: This agreement caters to consultants specializing in digital advertising campaigns, including pay-per-click (PPC) advertising, Google Ads, Facebook Ads, and other online advertising channels. It lays out the consultant's responsibilities to create, monitor, and optimize digital advertising campaigns for maximum ROI. It is important to note that these are just a few examples of Maine Marketing Consultant Agreement types. Agreements can be customized to meet specific business needs, combining different areas of expertise or focusing on a particular marketing channel. In conclusion, a well-drafted Maine Marketing Consultant Agreement is a vital tool for self-employed marketing professionals operating in the state. It ensures mutual understanding, protects intellectual property, establishes clear deliverables, and safeguards the interests of both the marketing consultant and the client.

Maine Marketing Consultant Agreement - Self-Employed

Description

How to fill out Maine Marketing Consultant Agreement - Self-Employed?

You can spend numerous hours online searching for the correct legal document template that meets the federal and state requirements you need.

US Legal Forms offers thousands of legal templates that have been reviewed by experts.

It is easy to obtain or print the Maine Marketing Consultant Agreement - Self-Employed from your service.

To find another version of the form, use the Search field to locate the template that suits your needs and requirements.

- If you already have a US Legal Forms account, you can Log In and select the Obtain option.

- Afterward, you can complete, modify, print, or sign the Maine Marketing Consultant Agreement - Self-Employed.

- Every legal document template you purchase is yours permanently.

- To get another copy of any purchased form, navigate to the My documents tab and choose the appropriate option.

- If you're visiting the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the state/city of your choice.

- Check the form details to confirm you have chosen the appropriate form.

Form popularity

FAQ

A consultant is typically someone who possesses specialized knowledge or skills in a particular field and offers advice to organizations or individuals. Essentially, if you provide expert insight and strategic recommendations, you may qualify as a consultant. Crafting a Maine Marketing Consultant Agreement - Self-Employed can help articulate your qualifications and services.

Absolutely, an independent contractor can also serve as a consultant. Many marketing professionals operate as independent contractors while providing consultancy services to clients. Using a Maine Marketing Consultant Agreement - Self-Employed can help clarify the scope of work and set expectations for both parties.

Yes, you can legally call yourself a consultant if you provide professional advice or services in a specific area. However, it's essential to ensure that your claims align with your expertise. For added credibility, consider utilizing a Maine Marketing Consultant Agreement - Self-Employed to outline your services, which can substantiate your title in the marketplace.

To become a self-employed marketing consultant, start by developing your expertise in marketing strategies and techniques. Build a portfolio showcasing your previous work and results. Finally, consider securing a Maine Marketing Consultant Agreement - Self-Employed to formalize your services and protect your business interest.

The main difference lies in the nature of the work relationship. A consultant typically provides expert advice and strategic direction, while a contractor often performs specific tasks or projects. Both roles can be offered under a Maine Marketing Consultant Agreement - Self-Employed, yet their focus and deliverables differ significantly.

Becoming a self-employed consultant involves assessing your skills and identifying your target market. You will need to set up a business structure, choose a name, and obtain any necessary licenses. Starting with a Maine Marketing Consultant Agreement - Self-Employed can provide you with a framework to establish your services professionally, which is essential for your new venture.

To market yourself as an independent consultant, start by establishing a professional online presence through a website and social media. Highlight your expertise and showcase your previous work to attract potential clients. Don’t underestimate the power of having a Maine Marketing Consultant Agreement - Self-Employed; having a solid foundation will boost your credibility and show clients you mean business.

A consulting agreement is a legal document that outlines the terms and conditions under which a consultant provides services to a client. It specifies the deliverables, payment arrangement, and responsibilities of both parties. Having a well-defined Maine Marketing Consultant Agreement - Self-Employed protects both you and your client by setting clear expectations.

Setting up a consulting agreement starts with identifying your services and target audience. Next, outline your terms clearly, including compensation and timelines. For a comprehensive approach, consider leveraging a Maine Marketing Consultant Agreement - Self-Employed template, which can guide you through the setup process and ensure legal compliance.

A consultancy contract should include key elements such as the scope of services, payment terms, duration of the agreement, and confidentiality clauses. Additionally, you should specify the obligations of both parties, termination conditions, and dispute resolution methods. Utilizing a Maine Marketing Consultant Agreement - Self-Employed can help ensure you address all necessary points and protect your interests.