Maine Promissory Note in Connection with a Sale and Purchase of a Mobile Home

Description

How to fill out Promissory Note In Connection With A Sale And Purchase Of A Mobile Home?

You can dedicate hours online trying to locate the appropriate legal document template that meets both federal and state guidelines you require.

US Legal Forms offers countless legal forms that have been reviewed by professionals.

You can easily access or print the Maine Promissory Note related to the Sale and Purchase of a Mobile Home through my services.

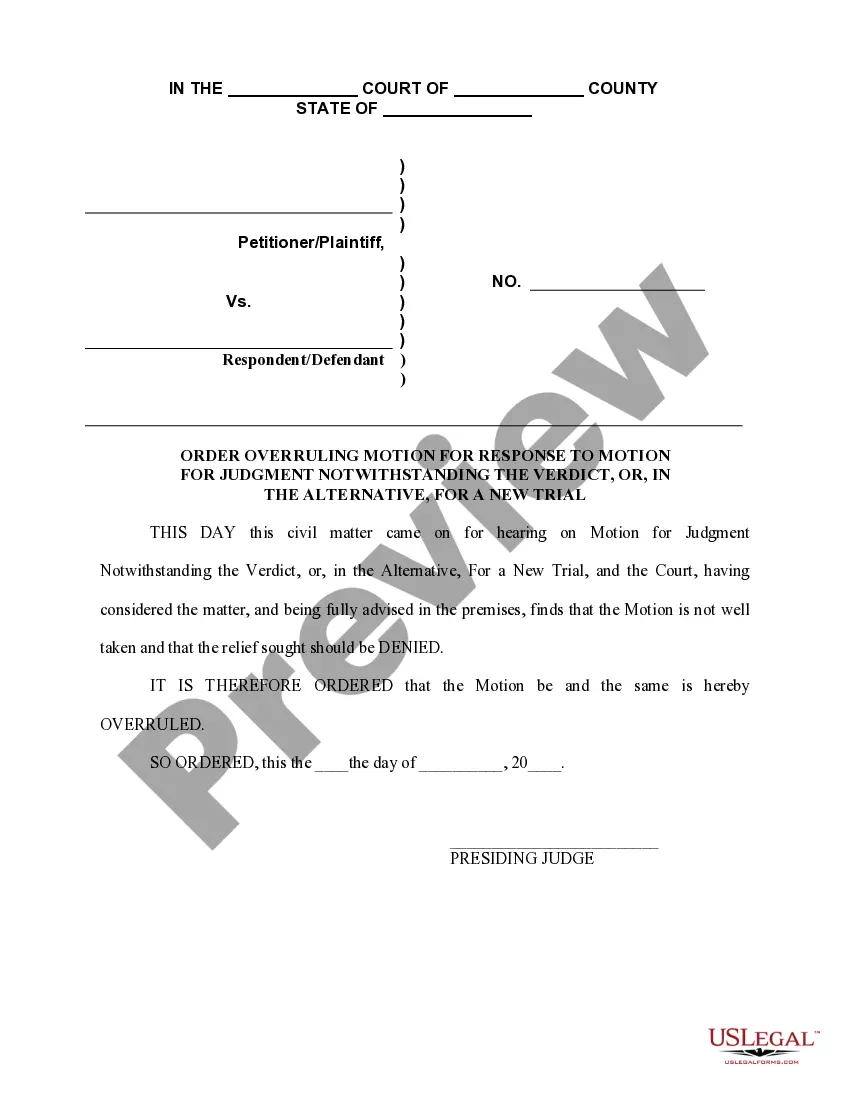

If available, utilize the Preview button to review the document template as well. If you want to find another version of the form, use the Search field to locate the template that meets your needs.

- If you already possess a US Legal Forms account, you can Log In and click the Acquire button.

- Then, you can complete, modify, print, or sign the Maine Promissory Note regarding the Sale and Purchase of a Mobile Home.

- Each legal document template you obtain is yours permanently.

- To get an additional copy of any purchased form, visit the My documents section and click the corresponding button.

- If you are accessing the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the region/city of your preference.

- Review the form description to confirm that you have chosen the right document.

Form popularity

FAQ

Texas Mobile Home PaperworkSale, transfer and current ownership of a manufactured home.Whether a home is titled as personal or real property.The home's physical location.Outstanding liens.

Promissory Notes Are Legal Contracts Contracts indicate the type and amount of payment for services or goods rendered. In the case of a legal promissory note, the contract will be shaped around the amount of money or capital loaned and the terms of repayment of the promissory note.

Under Section 1201.455(a) of the Occupations Code it states that a person may not sell or exchange a used manufactured home to a consumer for use as a dwelling without providing: (1) a written disclosure, on a form not to exceed two pages prescribed by the department, describing the condition of the home and of any

Bring forms (Title, Bill of sale, and Application of Maine Certificate of Title) to your local Motor Vehicle branch office in the county to pay transfer tax, fees, and transfer ownership.

A promissory note is a written agreement to pay someone essentially an IOU. But it's not something to be taken lightly. "It is a legally binding written document effectuating a promise to repay money," says Andrea Wheeler, a business attorney and owner of Wheeler Legal PLLC of Florida.

The bill is signed by both the buyer and the seller in a company of a notary witness. The reason is to have the document notarized, and once it has been, you will then stand as the owner since the bill is a legal binder.

A promissory note is not the same as a contract. A contract details all the terms of a legal agreement. A promissory note covers only the following: The date by when someone needs to be paid.

A Promissory note is a contract, which means that it is legally binding. However, it must include certain conditions to ensure it is enforceable.

To move a manufactured home, the state requires the owner to get a permit from the Department of Motor Vehicles (DMV). They must submit a copy of this permit when they apply for a new Statement of Ownership, showing the new location of the home.

In many ways, a promissory note functions as a kind of IOU document, although in practice it is more complex. However, it is also much more informal than a loan agreement and does not legally bind the lender in the same way, although the borrower is still bound to the promissory note.