Maine Credit Card Agreement and Disclosure Statement is a comprehensive document that outlines the terms, conditions, and regulations governing the use of credit cards issued by financial institutions in the state of Maine. This legally binding agreement is provided to cardholders to ensure transparency and establish a clear understanding of their rights and responsibilities. The Maine Credit Card Agreement and Disclosure Statement typically covers various important aspects, including interest rates, fees, payment terms, billing, credit limits, dispute resolution, and the cardholder's obligations. It serves as a guide for both the credit card issuer and the cardholder, promoting fair and responsible credit card usage. In Maine, there may be different types of Credit Card Agreement and Disclosure Statements offered by various financial institutions. Some key types include: 1. Consumer Credit Card Agreement: This is the most common credit card agreement designed for individual consumers. It outlines the terms and conditions for personal credit card usage, covering transaction details, interest rates, fees, and payment obligations applicable to the cardholder. 2. Business Credit Card Agreement: This type of agreement caters specifically to businesses and their credit card needs. It typically includes provisions related to expenses, reimbursements, credit limits, and other terms beneficial to businesses. 3. Student Credit Card Agreement: Geared towards students, this agreement is specifically tailored to meet the unique financial requirements and constraints faced by students. It may highlight provisions applicable to student credit card accounts, such as low credit limits, credit-building opportunities, and educational resources. 4. Secured Credit Card Agreement: In cases where individuals may have limited credit history or poor credit scores, secured credit cards offer a viable option. The agreement for a secured credit card discloses the collateral requirements, interest rates, and terms specific to these types of cards. Maine Credit Card Agreement and Disclosure Statements adhere to state and federal regulations, including the Truth in Lending Act, which ensures consistency, transparency, and consumer protection. Cardholders are strongly encouraged to carefully read and understand the agreement, including the associated disclosure statement, before using their credit cards to make informed financial decisions and effectively manage their credit.

Maine Credit Card Agreement and Disclosure Statement

Description

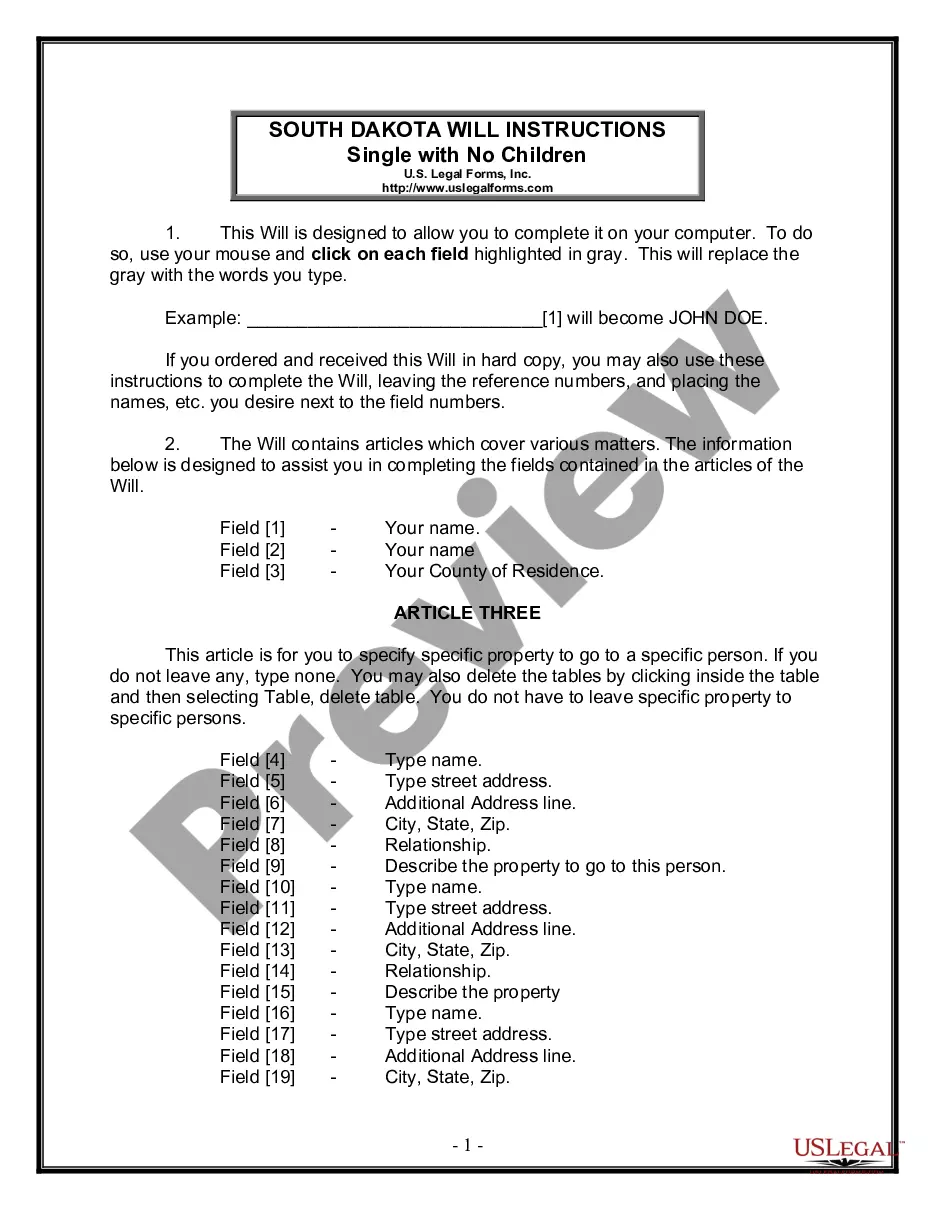

How to fill out Maine Credit Card Agreement And Disclosure Statement?

Are you inside a situation where you require files for possibly enterprise or specific functions virtually every day time? There are a variety of authorized file templates accessible on the Internet, but locating ones you can depend on isn`t effortless. US Legal Forms gives 1000s of develop templates, such as the Maine Credit Card Agreement and Disclosure Statement, that are composed to satisfy federal and state needs.

If you are previously acquainted with US Legal Forms website and have your account, basically log in. After that, you can down load the Maine Credit Card Agreement and Disclosure Statement design.

Unless you have an profile and need to begin to use US Legal Forms, follow these steps:

- Find the develop you require and make sure it is for the proper town/region.

- Use the Review key to check the shape.

- Browse the description to actually have selected the proper develop.

- When the develop isn`t what you are looking for, make use of the Look for discipline to obtain the develop that fits your needs and needs.

- When you get the proper develop, click Get now.

- Pick the costs prepare you need, fill out the required information and facts to produce your money, and pay for the transaction making use of your PayPal or bank card.

- Select a handy paper structure and down load your duplicate.

Find each of the file templates you have bought in the My Forms menus. You can obtain a more duplicate of Maine Credit Card Agreement and Disclosure Statement whenever, if required. Just click the required develop to down load or print out the file design.

Use US Legal Forms, the most considerable assortment of authorized forms, to save time and stay away from blunders. The support gives expertly produced authorized file templates that you can use for a range of functions. Produce your account on US Legal Forms and commence producing your daily life easier.

Form popularity

FAQ

Besides your physical card, you can usually find your card number on billing statements and in your profile online or in your bank's mobile app.

How do I find out my credit card benefits? Check your credit card website. While many consumers simply log on to their credit card company's site only to pay their bill, it pays to visit the website for your specific card to see the perks listed. ... Call customer service. ... Read the fine print. ... Visit a credit card compare site.

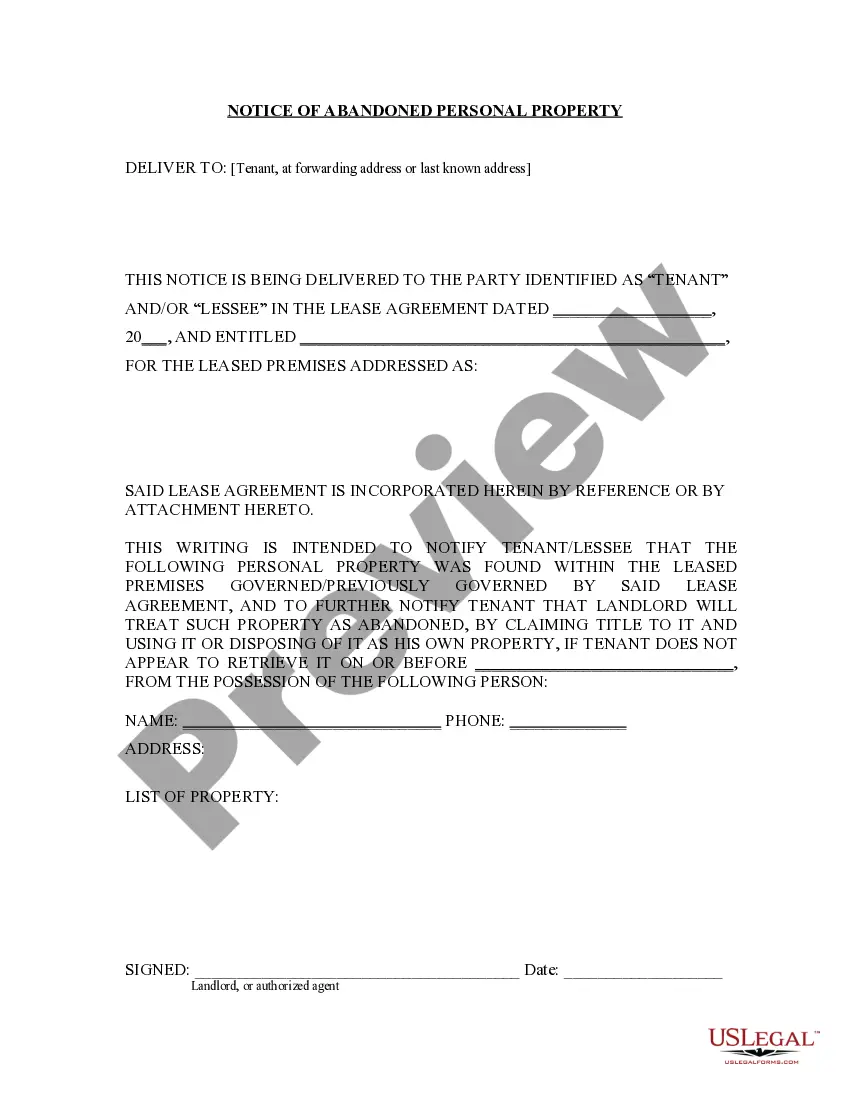

Section 1026.60 generally requires that credit disclosures be contained in application forms and solicitations initiated by a card issuer to open a credit or charge card account.

You should be able to find pricing and terms information adjacent to any credit card application. If you can't locate this information, contact the issuer directly and request it. They are required by law to give it to you.

Final rate and fee information depends on your credit history, so your actual rates and terms will be found on your Credit Card Agreement. You can find it online and enclosed with your credit card when it arrives in the mail.

A debt collector may not commence a collection action more than 6 years after the date of the consumer's last activity on the debt. This limitations period applies notwithstanding any other applicable statute of limitations, unless a shorter limitations period is provided under the laws of this State.

A credit card's terms and conditions officially document the rules and guidelines of the agreement between a credit card issuer and a cardholder. Common terms and conditions include the fees, interest rate, and annual percentage rate carried by the credit card.

Definition. A credit card disclosure is a document that outlines all of the fees, costs, interest rates, and terms that a customer could experience while using the credit card. Institutions that offer credit cards are required by law to disclose this information.