This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

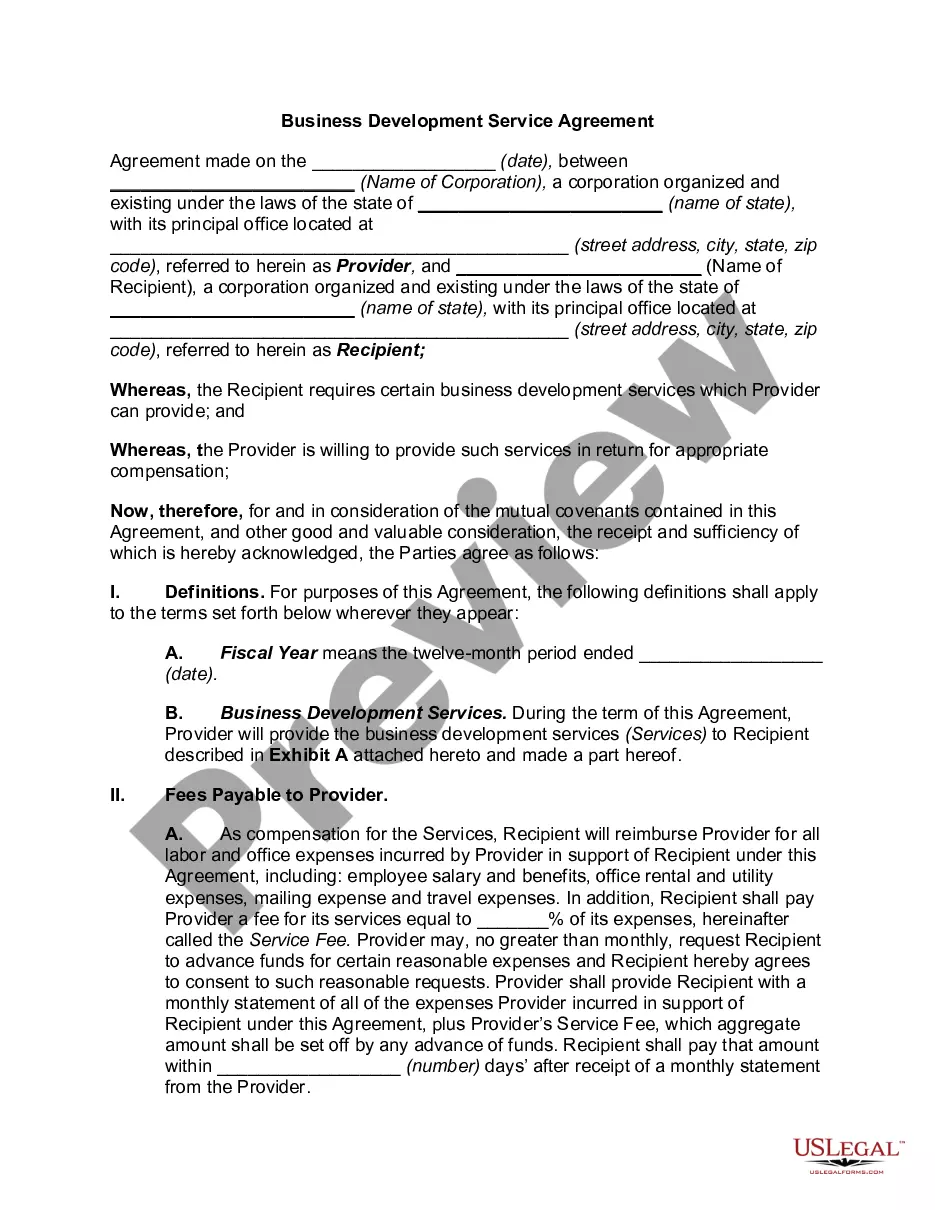

Maine Agreement to Extend Debt Payment Terms

Description

How to fill out Agreement To Extend Debt Payment Terms?

You can spend a few hours online searching for the valid document template that fulfills the state and federal requirements you need.

US Legal Forms provides thousands of legal documents that have been reviewed by professionals.

You can easily download or print the Maine Agreement to Extend Debt Payment Terms from the service.

If available, utilize the Preview button to view the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click the Acquire button.

- After that, you can complete, modify, print, or sign the Maine Agreement to Extend Debt Payment Terms.

- Every legal document template you purchase is yours permanently.

- To obtain another copy of a purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the state/city you choose.

- Review the form details to confirm that you have selected the right document.

Form popularity

FAQ

Maine does offer automatic extensions under certain conditions, but it's essential to confirm your eligibility. Automatic extensions can simplify the process of managing your Maine Agreement to Extend Debt Payment Terms, giving you more time to meet your obligations. Ensure you check the specific requirements and guidelines for these extensions to take full advantage of this opportunity.

The 183 day rule in Maine pertains to tax residency and stipulates that a person who spends 183 days or more in the state is considered a resident for tax purposes. Understanding this rule is important if you are seeking a Maine Agreement to Extend Debt Payment Terms and want to be aware of your tax obligations. This knowledge can help you make informed decisions about your debts and payments in Maine.

To file an extension in Maine, you need to fill out the appropriate form provided by the state. Once completed, submit the form to the required office before the deadline. This process ensures your Maine Agreement to Extend Debt Payment Terms is officially recognized. Consider using a trusted platform like US Legal Forms to find the right documents and guidance for your extension.

A debt collector can sue you any time before the statute of limitations expires, which is typically six years in Maine. If a collector initiates a lawsuit, it is important to respond promptly, as ignoring it can lead to a judgment against you. Understanding your rights and responsibilities regarding debt is essential. If communication with your creditors is overwhelming, a Maine Agreement to Extend Debt Payment Terms can help you find a fair solution.

The statute of limitations on debt collection in Maine is generally six years for most types of debt. This includes consumer loans, credit card debts, and personal loans. Understanding this timeframe is crucial for both consumers and creditors. When dealing with debt, utilizing a Maine Agreement to Extend Debt Payment Terms might help create a manageable repayment plan.

In Maine, most debts are considered uncollectible after six years, under the statute of limitations. This means that if the creditor has not initiated legal action within this timeframe, they often lose the right to collect the debt. It's beneficial to understand these timelines to manage your financial responsibilities effectively. If you're facing issues with uncollected debts, a Maine Agreement to Extend Debt Payment Terms can provide the flexibility you need.

Debts typically become uncollectible after a certain period defined by state statutes. This period usually ranges from three to six years, depending on the type of debt. Once the statute of limitations expires, collectors cannot legally enforce recovery of the debt. If you find yourself in this situation, consider using a Maine Agreement to Extend Debt Payment Terms to address outstanding obligations.

Yes, a debt that is ten years old can still be collected, depending on state laws. In many cases, the original creditor or a collection agency can pursue payment unless the statute of limitations has expired. It is essential to review the specific circumstances and consult a legal expert if necessary. Using a Maine Agreement to Extend Debt Payment Terms can help manage and negotiate older debts.

An agreement to temporarily suspend debt payments is a crucial understanding between a lender and borrower, often called a forbearance agreement. This arrangement allows the borrower to pause payments under certain circumstances, providing relief during challenging financial periods. The Maine Agreement to Extend Debt Payment Terms can support this process, ensuring that both parties maintain clear communication and adjusted payment plans.

A formal agreement regarding debt terms outlines the conditions between a lender and a borrower. This document specifies repayment amounts, interest rates, and payment schedules. The Maine Agreement to Extend Debt Payment Terms serves as an excellent tool for adjusting these conditions when necessary, allowing both parties to stay aligned and informed.