Maine Annual Expense Report

Description

How to fill out Annual Expense Report?

Are you currently in a situation where you need documents for either professional or personal purposes almost all the time.

There are numerous legal document templates accessible online, but finding ones you can trust is challenging.

US Legal Forms offers thousands of form templates, including the Maine Annual Expense Report, which are designed to comply with state and federal regulations.

Once you have the correct form, click Get now.

Choose your preferred pricing package, enter the necessary details to create your account, and finalize the purchase using your PayPal or Visa/Mastercard.

- If you're already acquainted with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Maine Annual Expense Report template.

- If you don’t have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it's for the correct city/region.

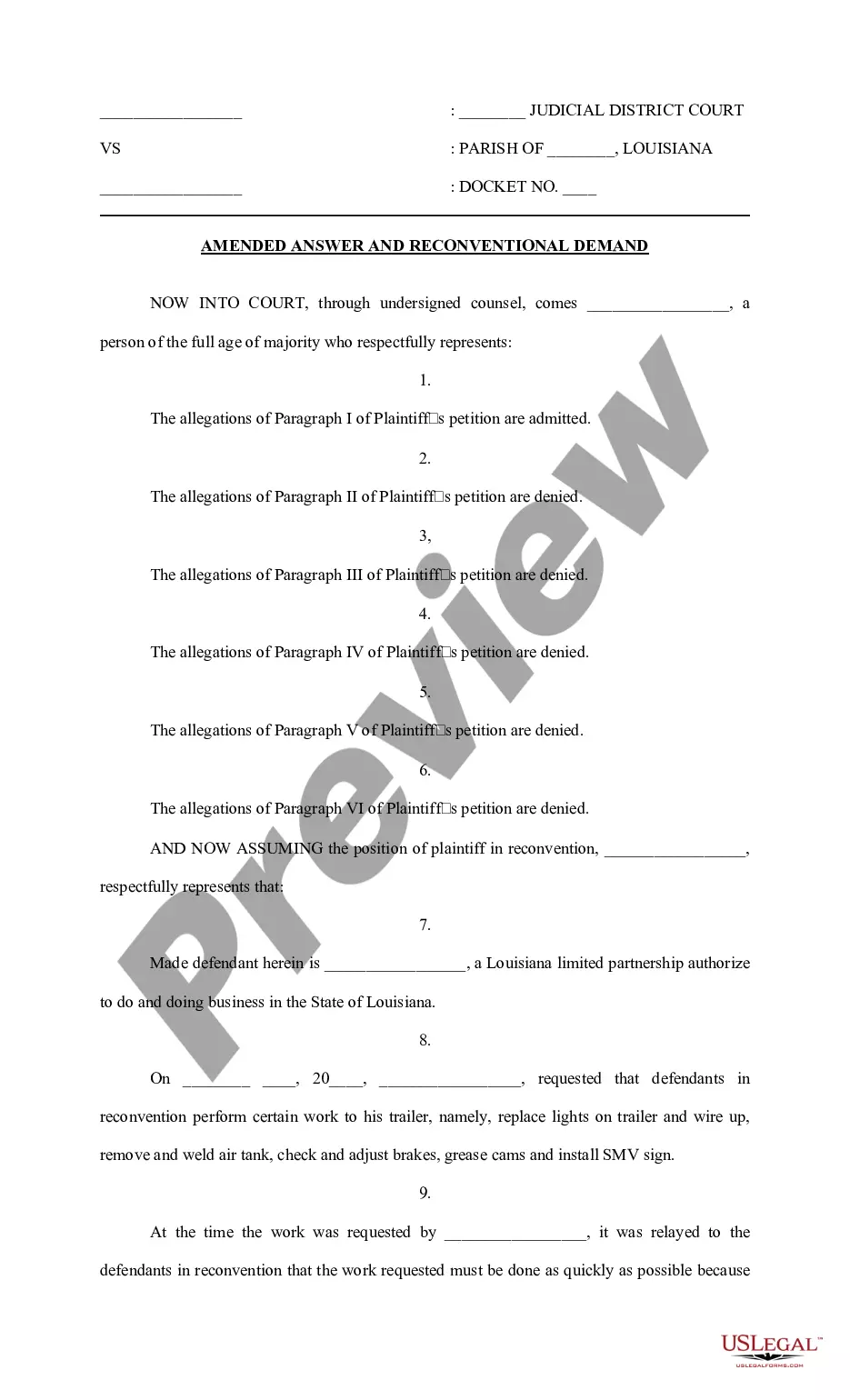

- Use the Preview button to review the form.

- Examine the details to confirm you've selected the right form.

- If the form isn't what you're looking for, utilize the Search section to find the form that matches your requirements.

Form popularity

FAQ

Several states require businesses to file an annual report, including Maine. In Maine, the Maine Annual Expense Report is a crucial document for maintaining your business's legal status and avoiding potential issues. Familiarizing yourself with your state's requirements can guide your business practices and keep you compliant.

No, not all states require businesses to file annual reports, but most do have some form of reporting requirement. In Maine, submitting a Maine Annual Expense Report is essential for compliance. Understanding the specific requirements for your state can help ensure that your business remains in good standing.

Not every business is required to file an annual report, but many do benefit from preparing one. In Maine, companies must submit a Maine Annual Expense Report to stay compliant and avoid penalties. It acts as a valuable tool for enhancing your business’s credibility in the marketplace.

Many states require businesses to file statements of information, but the specific requirements vary. While not all states have the same criteria, Maine mandates the filing of a Maine Annual Expense Report for certain entities. Using US Legal Forms can simplify the process of understanding and fulfilling these obligations.

Yes, preparing a Maine Annual Expense Report is mandatory for certain businesses operating in Maine. This report helps maintain compliance with state regulations and ensures transparency in financial matters. By preparing this report, you reflect your business's financial health and foster trust with stakeholders.

To file an annual report in Maine, you must first collect essential business details, including the names of your members and business address. Then, you can access the Maine Secretary of State’s online portal to complete your Maine Annual Expense Report. Don’t forget to review the filing guidelines, as missing information can lead to delays or penalties.

If you fail to file an annual report for your LLC in Maine, you risk incurring penalties and possible dissolution of your business entity. The state may impose fines and revoke your LLC’s good standing status, which can negatively affect your business operations. Staying compliant with the Maine Annual Expense Report requirements is crucial for maintaining your LLC's status and reputation.

Filing an annual report in Maine is straightforward. You can complete the process online through the Maine Secretary of State’s website or submit a paper form via mail. Make sure to include your company details and any required fees associated with the Maine Annual Expense Report. Many businesses benefit from using resources like US Legal Forms to simplify this process.

To set up an annual report in Maine, start by gathering your business information, such as your entity type and registered address. Next, visit the official state website for Maine Annual Expense Report guidelines. It's important to ensure all your information is accurate before submission, as this can help mitigate any future issues. Consider using platforms like US Legal Forms for streamlined assistance in preparing your report.

Forgetting to renew your LLC can lead to significant complications, such as the loss of your business's legal protections. The state may dissolve your LLC, which means you could lose your ability to operate legally. To remedy this, you can often reinstate your LLC by filing necessary documents and paying any outstanding fees. Utilizing uslegalforms can guide you through this process efficiently.