Maine Petty Cash Vouchers

Description

How to fill out Petty Cash Vouchers?

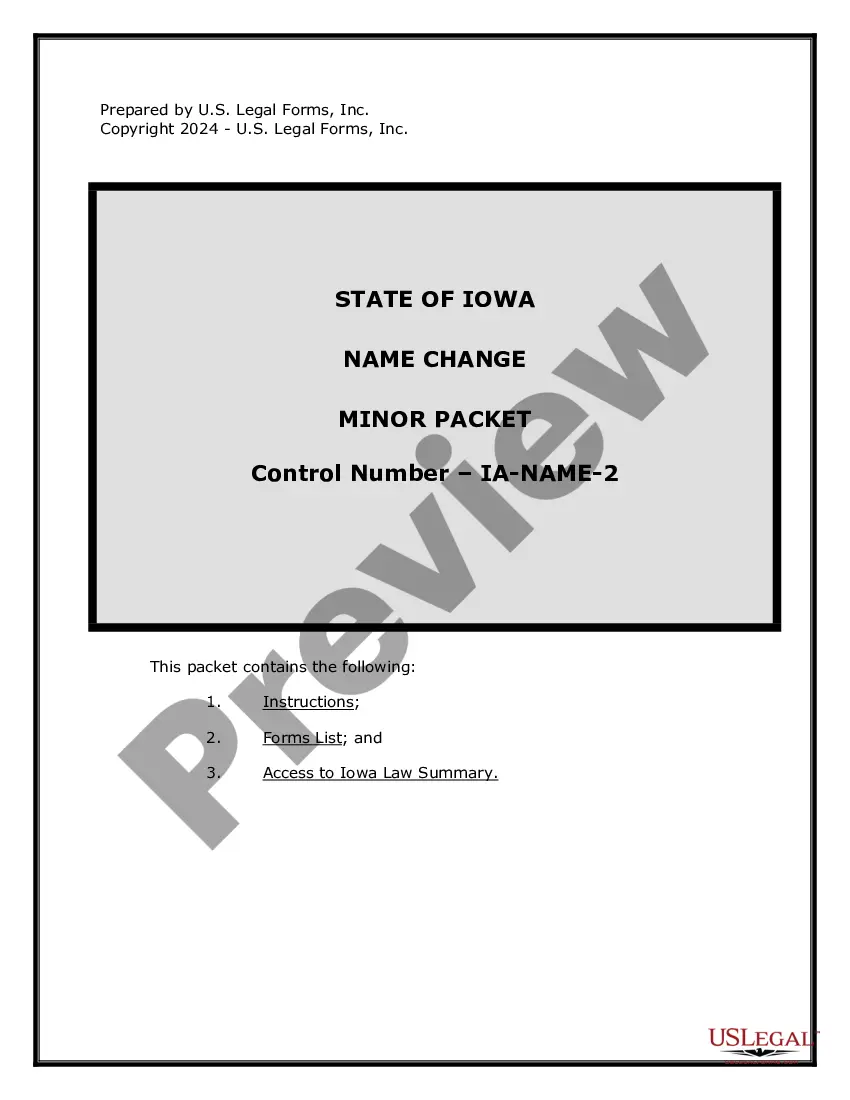

If you want to gather, retrieve, or print legal document templates, utilize US Legal Forms, the largest collection of legal documents available online.

Employ the site's straightforward and user-friendly search to find the documentation you require.

Numerous templates for business and personal use are organized by categories and states, or keywords.

Step 4. After identifying the document you need, click the Buy now button. Choose the payment plan that suits you and enter your details to register for an account.

Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the transaction.

- Utilize US Legal Forms to locate the Maine Petty Cash Vouchers in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and press the Download button to obtain the Maine Petty Cash Vouchers.

- You can also reach forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the document for your specific city/state.

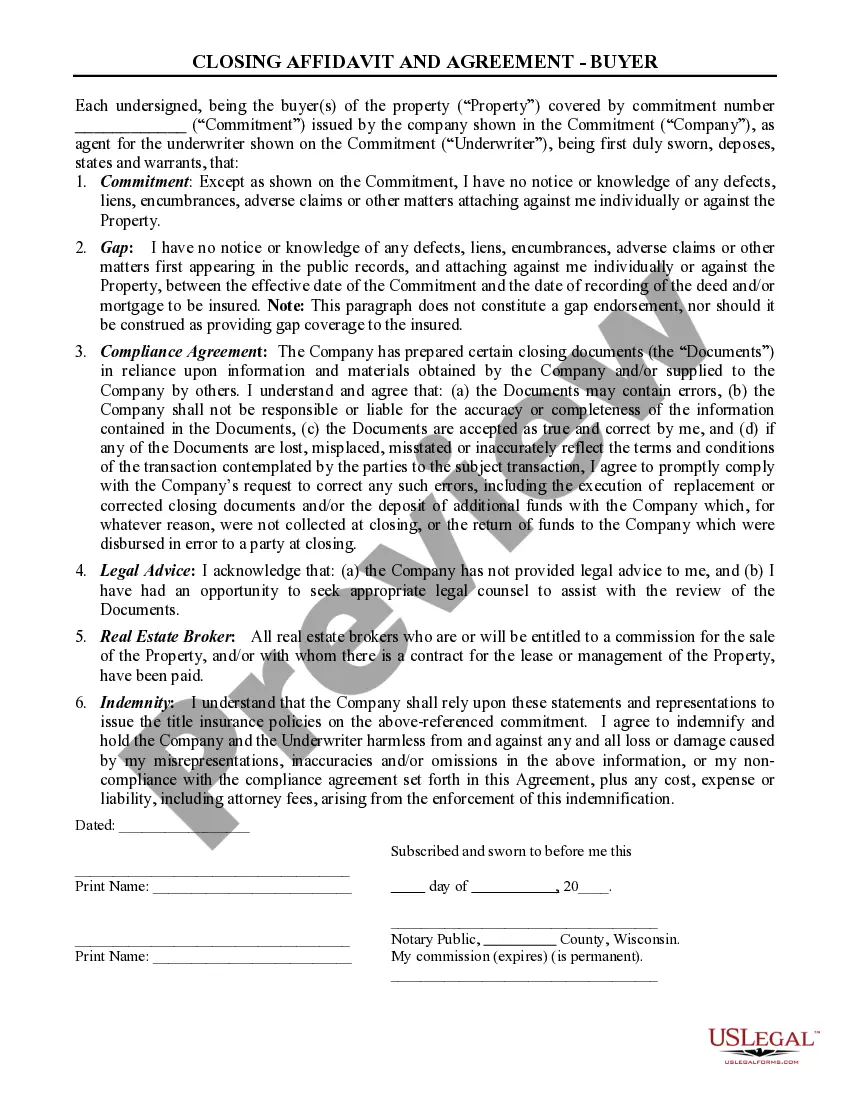

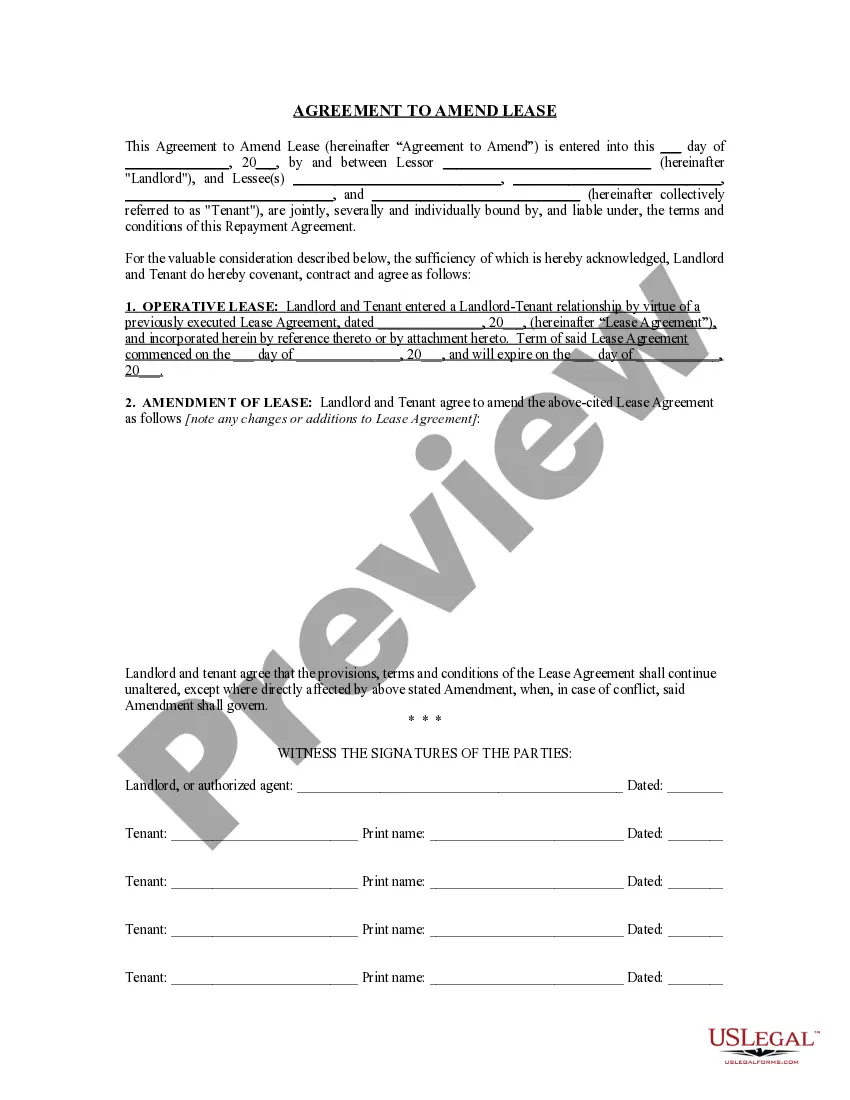

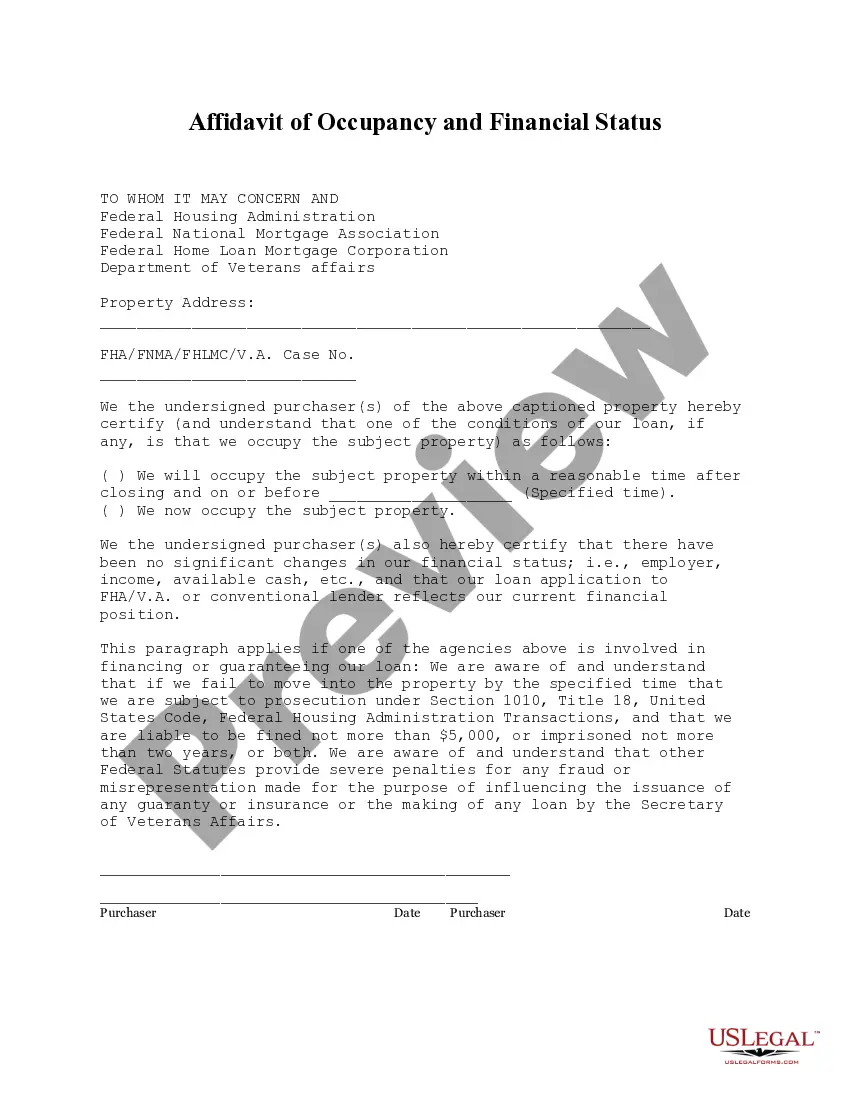

- Step 2. Utilize the Preview option to review the document’s details. Be sure to read the description.

- Step 3. If you are dissatisfied with the document, use the Search field at the top of the screen to find alternative versions of the legal document template.

Form popularity

FAQ

Cash Voucher These vouchers get prepared by a firm solely for cash transactions like receipts and payments. It can be a Debit Voucher that a firm prepares only for cash payments to suppliers or vendors to purchase raw materials and semi-finished goods for production, purchase of assets or payments of expenses.

Instructions for filling out the Revolving Fund Voucherf0b7 Date:f0b7 Name of Fund:f0b7 Number: Number assigned by department to identify the voucher, such as the check number.f0b7 Department: Department responsible for fund.f0b7 Budget Name to be Charged:f0b7 Budget Number:More items...

Helpful ToolsNo.Date Enter the date that the petty cash receipt is prepared.Pay To Enter the name of the payee who received the petty cash disbursement.$ (Dollar Amount) Enter the total amount of the payment.Description Enter a brief, but specific explanation of what the funds were used for.More items...

The petty cash voucher should provide space for the following:Date.Amount disbursed.Person receiving the money.Reason for the disbursement.General ledger account to be charged.Initials of the person disbursing the money from the petty cash fund.

How do I get reimbursed from Petty Cash?Complete the Petty Cash Voucher Form.Attach itemized receipt to Voucher.Attach approved Hospitality form if expense was for hospitality.Obtain signature of authorized delegated authority for financial transaction. (Submit to Petty Cash Custodian or Cashier.More items...

Information on a Petty Cash Voucher Given the uses just noted for the petty cash voucher, the information on it should contain the amount of cash taken, the date on which the cash was taken, the name of the person who took the cash, the initials of the person dispensing the cash, and the type of expense to be charged.

The custodian of petty cash should sign the receipt to indicate that he authorized the funds. However, you should also have the recipient sign the receipt. This makes it easier to follow the paper trail if there is a dispute about the amount dispensed from petty cash or the purpose for which it was used.

Given the uses just noted for the petty cash voucher, the information on it should contain the amount of cash taken, the date on which the cash was taken, the name of the person who took the cash, the initials of the person dispensing the cash, and the type of expense to be charged.

The name of the payer. The amount of cash received. The payment method (such as by cash or check) The signature of the receiving person.

The payment voucher must be serially numbered. Amount should be written both in figures and words. Proper account heads should be debited. Cash account should be credited if the payment is made by cash.