Maine Checklist — Action to Improve Collection of Accounts is a comprehensive guide designed to enhance the efficiency and effectiveness of account collection processes. This checklist aims to assist businesses and organizations in Maine to streamline their operations, recover outstanding debts, and maintain healthy financial stability. By following this checklist, businesses can implement proactive strategies for successful debt recovery, avoid legal complications, and ensure their financial well-being. Key steps covered in the Maine Checklist — Action to Improve Collection of Accounts include: 1. Establishing Clear Policies: Developing well-defined policies for credit terms, account inquiries, payment reminders, and penalties can help prevent overdue accounts in the first place. This promotes transparency and sets expectations for both businesses and customers. 2. Effective Communication: Consistent and timely communication with customers is vital. This involves sending timely invoices, issuing payment reminders, and proactively reaching out to address any concerns or questions about outstanding balances. Utilizing various channels like email, phone calls, or letters can enhance the chances of prompt payment. 3. Early Intervention: Acting promptly when an account becomes overdue can prevent the escalation of debt. Regularly reviewing accounts receivable aging reports and swiftly implementing appropriate actions, such as sending demand letters or initiating phone calls, can increase the likelihood of successful recovery. 4. Utilizing Collection Tools: Employing technology and software to manage and organize accounts receivable can enhance efficiency and effectiveness. Tools like customer relationship management (CRM) systems, automated payment reminders, and tracking software enable businesses to monitor and track debts effectively. 5. Professional Debt Collection Agencies: In cases where in-house collection efforts have been exhausted, engaging professional debt collection agencies can be beneficial. These agencies have the expertise and resources to handle difficult debtors, negotiate settlements, and initiate legal actions, if required. 6. Legal Actions and Other Remedies: When necessary, pursuing legal actions like filing lawsuits, obtaining judgments, or garnishing wages can be implemented. It is essential to ensure compliance with all relevant laws and regulations throughout the legal process. Different types of Maine Checklists — Action to Improve Collection of Accounts may include industry-specific checklists tailored for specific businesses like retail, healthcare, finance, or construction. Each checklist may contain additional steps or considerations unique to that industry while still addressing the overarching goals of improving account collection processes. Implementing the Maine Checklist — Action to Improve Collection of Accounts can prove highly beneficial to businesses and organizations operating in Maine. It provides a systematic approach towards debt recovery, increased cash flow, and overall financial stability, reinforcing the foundation for sustainable growth and success.

Maine Checklist - Action to Improve Collection of Accounts

Description

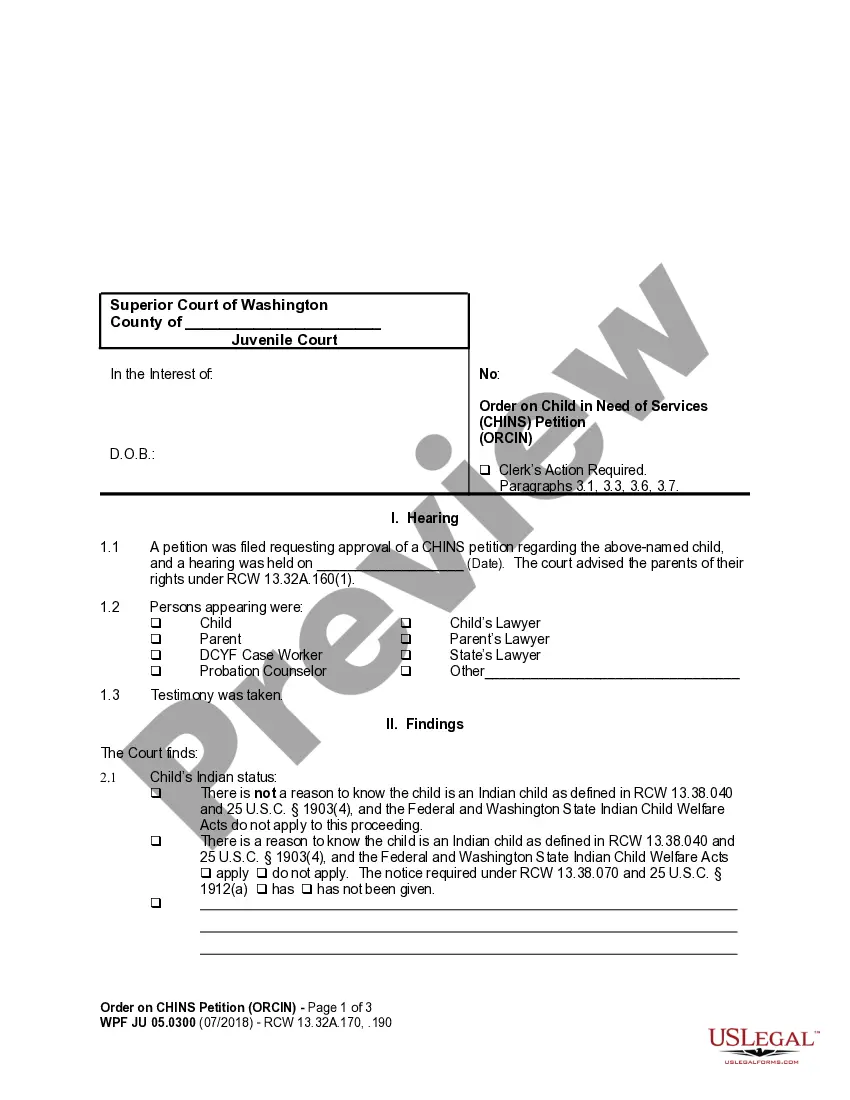

How to fill out Maine Checklist - Action To Improve Collection Of Accounts?

US Legal Forms - one of the greatest libraries of legal types in America - provides an array of legal file layouts you are able to download or print out. Using the site, you may get a huge number of types for business and personal purposes, sorted by categories, states, or keywords and phrases.You can get the most up-to-date variations of types just like the Maine Checklist - Action to Improve Collection of Accounts in seconds.

If you already possess a registration, log in and download Maine Checklist - Action to Improve Collection of Accounts through the US Legal Forms catalogue. The Acquire option will show up on every develop you see. You get access to all earlier downloaded types inside the My Forms tab of your accounts.

In order to use US Legal Forms the first time, listed below are easy directions to get you began:

- Make sure you have picked the correct develop for the town/county. Click on the Review option to check the form`s information. Browse the develop explanation to actually have selected the right develop.

- When the develop does not satisfy your specifications, use the Search industry at the top of the display to get the one who does.

- Should you be content with the form, affirm your choice by clicking the Purchase now option. Then, pick the pricing program you like and supply your credentials to register for the accounts.

- Process the purchase. Make use of your Visa or Mastercard or PayPal accounts to finish the purchase.

- Select the file format and download the form on your own product.

- Make adjustments. Complete, modify and print out and sign the downloaded Maine Checklist - Action to Improve Collection of Accounts.

Each design you added to your bank account does not have an expiry time and it is your own forever. So, in order to download or print out one more backup, just check out the My Forms portion and then click about the develop you will need.

Gain access to the Maine Checklist - Action to Improve Collection of Accounts with US Legal Forms, the most substantial catalogue of legal file layouts. Use a huge number of expert and status-specific layouts that meet your organization or personal requirements and specifications.