Maine Business Deductions Checklist is a comprehensive document used by businesses in the state of Maine to assess and track tax deductions they are eligible for. This checklist includes a variety of relevant keywords such as Maine business deductions, tax deductions, business expenses, tax planning, tax forms, and tax filing. The Maine Business Deductions Checklist encompasses different types of deductions that businesses can claim in the state. These may include: 1. General Operating Expenses: This category covers regular business expenses like rent, utilities, insurance premiums, office supplies, advertising costs, professional fees, and employee salaries. 2. Travel and Entertainment Expenses: Maine businesses can deduct certain travel and entertainment expenses related to business meetings, conferences, client entertainment, and employee travel. 3. Vehicle Expenses: Any expenses related to business vehicles, such as fuel, maintenance, repairs, insurance, and depreciation, can be claimed as deductions. 4. Home Office Expenses: If a business operates from a home office, certain home-related expenses like rent, mortgage interest, property taxes, utilities, and home office equipment may be eligible for deductions. 5. Employee Benefit Plans: Deductions may be available for contributions to qualified employee benefit plans, including retirement plans, health insurance plans, and other employee welfare programs. 6. Independent Contractor Expenses: Businesses often hire independent contractors for various services. Maine's businesses can deduct payments made to independent contractors as business expenses. 7. Charitable Contributions: Donations made to qualified charitable organizations can be deducted as business expenses in Maine, subject to certain limitations and documentation requirements. 8. Specialized Industry Deductions: Certain industries may have unique deductions. For instance, if a business operates in agriculture, fishing, or maritime industries, there may be specific deductions available for expenses related to equipment, fuel, facilities, or marketing. It is essential for businesses in Maine to keep detailed records and consult the Maine Revenue Services (MRS) guidelines to ensure compliance with tax regulations and effective tax planning. The Maine Business Deductions Checklist serves as a valuable tool to identify and accurately track all eligible deductions, potentially leading to significant tax savings for businesses operating in the state.

Maine Business Deductions Checklist

Description

How to fill out Maine Business Deductions Checklist?

Discovering the right legitimate record format can be quite a have difficulties. Naturally, there are a variety of layouts available on the Internet, but how can you get the legitimate type you need? Utilize the US Legal Forms site. The service offers a large number of layouts, like the Maine Business Deductions Checklist, that you can use for enterprise and personal demands. All of the varieties are checked by experts and satisfy state and federal needs.

If you are presently signed up, log in to the accounts and then click the Obtain key to have the Maine Business Deductions Checklist. Make use of your accounts to look with the legitimate varieties you have purchased earlier. Proceed to the My Forms tab of your own accounts and acquire an additional copy of your record you need.

If you are a new end user of US Legal Forms, listed below are basic recommendations so that you can comply with:

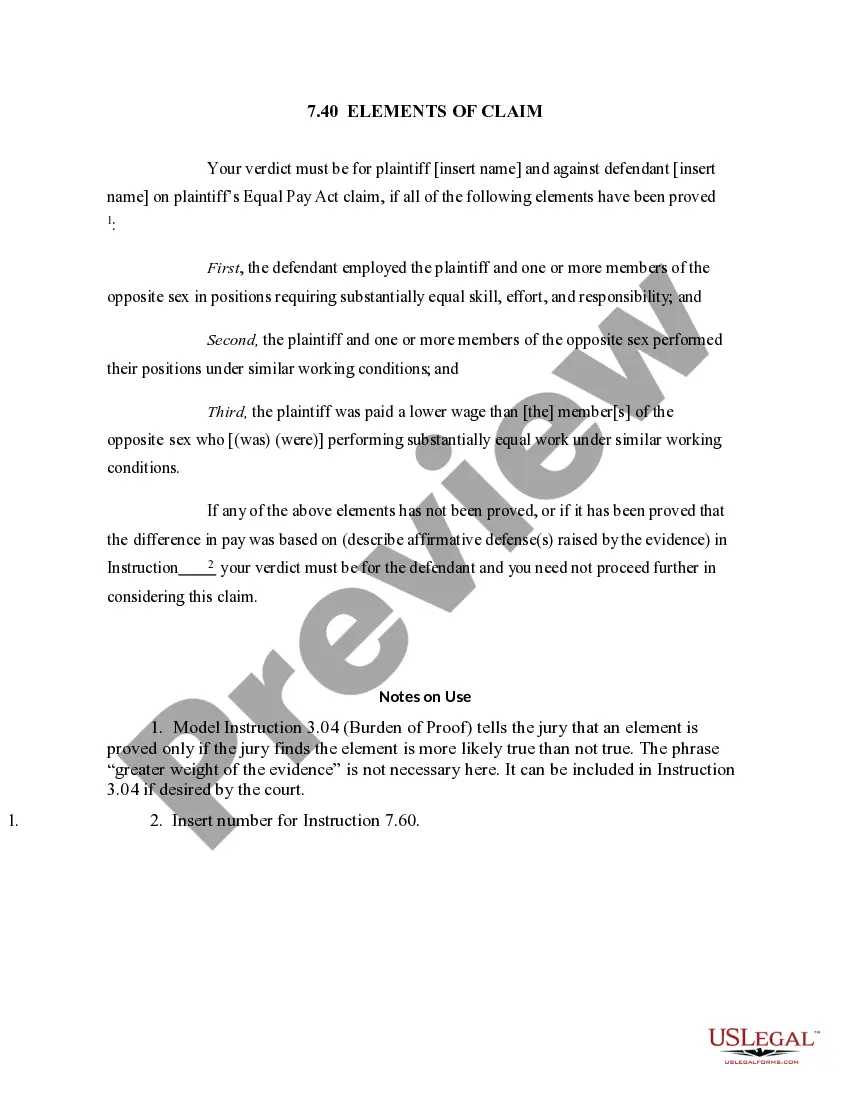

- Initially, make certain you have chosen the proper type for the area/state. You can examine the form making use of the Review key and read the form information to guarantee this is basically the best for you.

- In the event the type does not satisfy your preferences, make use of the Seach discipline to discover the proper type.

- When you are certain that the form is proper, go through the Get now key to have the type.

- Select the pricing strategy you would like and enter in the essential details. Design your accounts and buy your order utilizing your PayPal accounts or bank card.

- Pick the document file format and acquire the legitimate record format to the gadget.

- Full, revise and print out and indicator the received Maine Business Deductions Checklist.

US Legal Forms will be the greatest local library of legitimate varieties that you can find different record layouts. Utilize the company to acquire skillfully-made documents that comply with status needs.