Maine Checklist - Key Employee Life Insurance

Description

Key-person insurance benefits are often used to buy out the insured person's shares or interest in the company. Buy-sell agreements, which require the deceased executive's estate to sell its stock to the remaining shareholders, legally facilitate this process. Proceeds from key-person insurance can also be used to recruit replacement management.

The following form contains some critical questions you should ask your agent or broker when considering this type of insurance.

How to fill out Checklist - Key Employee Life Insurance?

Have you encountered a scenario where you require documentation for business or personal purposes almost daily.

There are many legal document templates accessible online, but locating forms you can trust isn't simple.

US Legal Forms offers a multitude of template options, including the Maine Checklist - Key Employee Life Insurance, designed to meet federal and state requirements.

Once you find the appropriate form, click Purchase now.

Select your desired pricing plan, fill in the required information to set up your account, and complete the purchase using PayPal or a credit card.

- If you are familiar with the US Legal Forms website and own an account, just Log In.

- Afterward, you can download the Maine Checklist - Key Employee Life Insurance template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

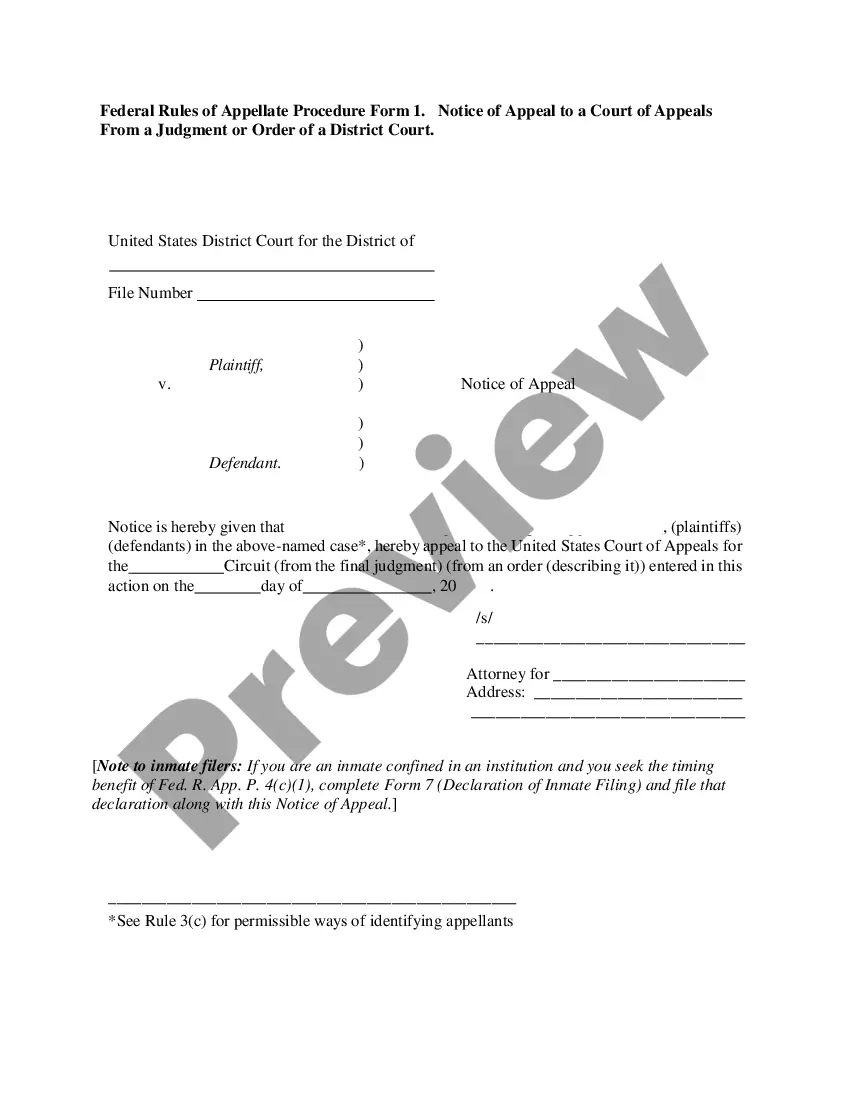

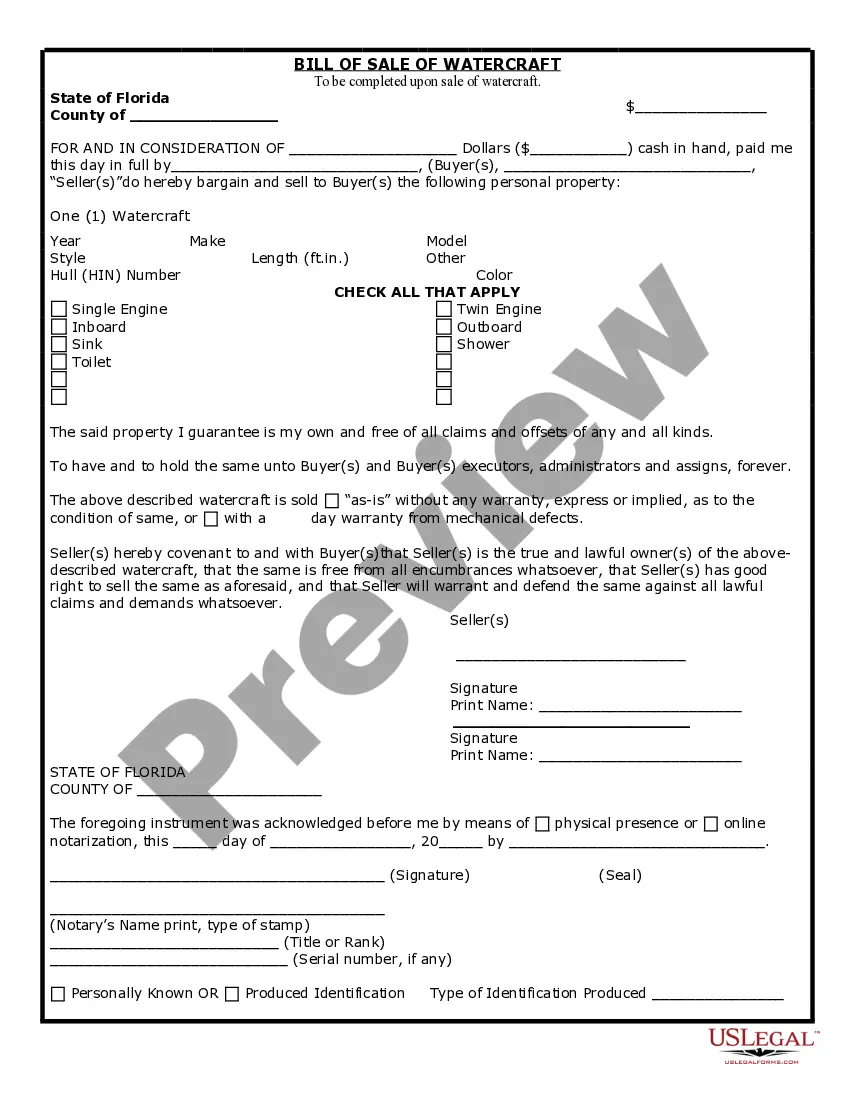

- Use the Preview button to review the document.

- Check the details to confirm you have selected the correct form.

- If the form isn’t what you’re searching for, use the Search field to locate the form that meets your needs.

Form popularity

FAQ

The payor on a life insurance policy refers to whoever is responsible for making the premium payments. In a key employee life insurance scenario, this is often the business that benefits from the coverage. It's vital to clarify the payor situation for your Maine Checklist - Key Employee Life Insurance to ensure financial planning aligns with your overall business strategy.

The beneficiary of a key employee policy is usually the business or a specified individual, depending on the terms of the policy. If the key employee passes away, the death benefit aids the company in managing financial burdens. This aspect is crucial to consider while preparing your Maine Checklist - Key Employee Life Insurance.

Life insurance is taken out on a key employee to protect the business from financial loss in case that employee dies. This coverage ensures that the company can hire and train a replacement, while also maintaining operations during a challenging time. Therefore, an effective Maine Checklist - Key Employee Life Insurance should include assessing key employees and their importance to your organization.

The payor on an insurance policy is the individual or entity responsible for paying the premiums. In the context of key employee life insurance, this is usually the business that stands to lose the most from the employee's untimely passing. Knowing who the payor is can help streamline your Maine Checklist - Key Employee Life Insurance efforts.

Life insurance for key employee indemnification provides financial support to a business if a key employee passes away. This type of insurance helps cover expenses or losses incurred due to the absence of that employee. By including this in your Maine Checklist - Key Employee Life Insurance, you enhance your company's stability during difficult times.

The payor under a key employee life policy is often the business itself. This arrangement allows the company to ensure that it is protected against the loss of a key employee. Understanding the role of the payor is essential when creating your Maine Checklist - Key Employee Life Insurance, as it dictates how premiums are managed.

For key employee identification, businesses commonly utilize term life and whole life insurance policies. These types of insurance offer the needed financial support to cover lost revenue and other costs associated with a key employee's death. Incorporating the Maine Checklist - Key Employee Life Insurance into your business plans enhances your ability to sustain operations after losing a critical team member. It's a proactive way to ensure your company's continuity and security.

Key employee life insurance is a specialized policy that protects a business from financial loss due to the death of a vital member of the team. This type of insurance ensures that the company can cover the costs associated with recruiting and training a replacement. By investing in a Maine Checklist - Key Employee Life Insurance, businesses safeguard their operations and financial stability. It's an essential risk management tool that every business should consider.

Assessing the value of a key person involves evaluating their contributions to the business, including revenue generation and strategic impact. You can analyze their role and the financial implications of losing them to estimate an appropriate coverage amount. Utilizing the Maine Checklist - Key Employee Life Insurance can guide you in this process and ensure you secure sufficient protection for your business.

When applying for life insurance, it's crucial to avoid exaggerating your health status or ignoring any pre-existing conditions. Such inconsistencies can lead to complications, or even denial of coverage. By staying transparent and following insights from the Maine Checklist - Key Employee Life Insurance, you can approach your application confidently.