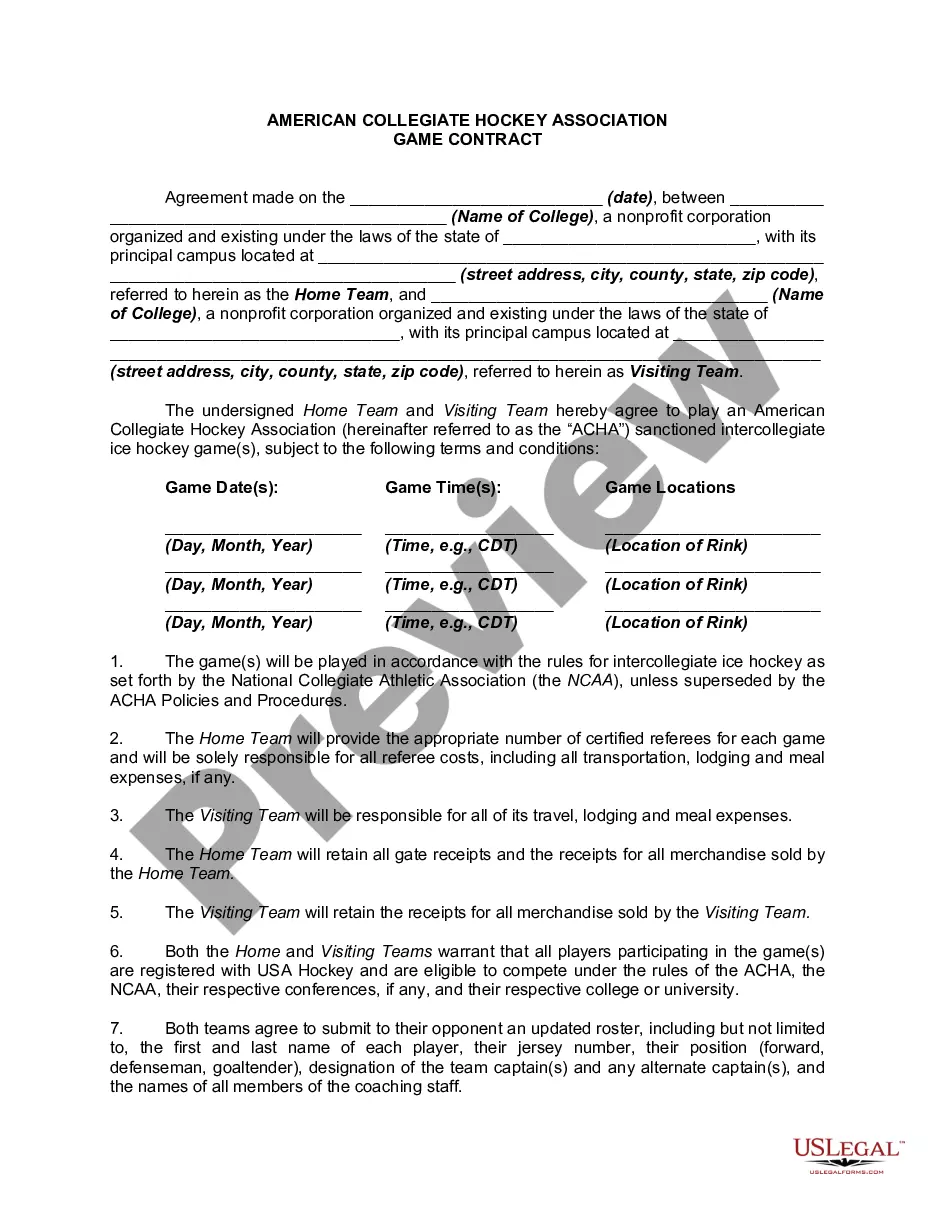

Maine Mortgage Deed: A Detailed Description of this Legal Document A Maine Mortgage Deed is a legal document used in the state of Maine's real estate transactions to transfer the title or ownership of a property from one party, the mortgagor, to another party, the mortgagee. This document acts as security for a loan or financial obligation, typically when a borrower obtains a loan to purchase a property or secure additional funds against an existing property. The Maine Mortgage Deed outlines the terms and conditions of the mortgage agreement, including the amount borrowed, interest rates, repayment terms, and any other specific agreements between the parties involved. It is typically accompanied by a promissory note, which is a written promise to repay the loan according to the agreed-upon terms. Different Types of Maine Mortgage Deeds: 1. Fixed-Rate Mortgage: This is the most common type of mortgage deed, where the interest rate remains the same throughout the loan term. Borrowers are assured of a consistent monthly payment amount, easing budgeting efforts. 2. Adjustable-Rate Mortgage (ARM): With an ARM, the interest rate can fluctuate after an initial fixed-rate period, usually ranging from three to ten years. The adjustment follows the changes in an underlying interest rate index, resulting in potential fluctuations in the monthly mortgage payment. 3. FHA Mortgage: The Federal Housing Administration (FHA) insures these mortgage loans, providing borrowers with a lower down payment option (as low as 3.5% of the purchase price) and more flexible credit requirements. These mortgages are easier to qualify for but may include additional insurance premiums. 4. VA Mortgage: Available to eligible veterans, active-duty service members, and select military spouses, VA mortgages are guaranteed by the Department of Veterans Affairs. These loans often offer competitive interest rates, require no down payment, and do not necessitate private mortgage insurance. 5. USDA Mortgage: The United States Department of Agriculture (USDA) offers mortgages designed for rural and suburban homebuyers who meet certain income and property eligibility criteria. These loans provide 100% financing options and often feature lower interest rates. 6. Balloon Mortgage: This type of mortgage usually offers lower interest rates and smaller monthly payments over a set period, typically five to seven years. However, at the end of this term, a balloon payment — the remaining balance – becomes due. Borrowers can either pay off the full amount or refinance the mortgage. 7. Reverse Mortgage: Aimed at homeowners aged 62 and older, a reverse mortgage allows borrowers to convert a portion of their home equity into cash. Unlike traditional mortgages, repayments are not required until the borrower moves out, sells the home, or passes away. Maine Mortgage Deeds play a vital role in the real estate industry, ensuring proper documentation and protecting the rights of both borrowers and lenders. It is essential to consult with legal professionals and mortgage experts to understand the specific terms, obligations, and legal implications associated with any type of mortgage deed before signing and entering into an agreement.

Maine Mortgage Deed

Description

How to fill out Maine Mortgage Deed?

Are you in the placement that you need documents for both enterprise or person functions almost every working day? There are plenty of lawful document layouts accessible on the Internet, but discovering ones you can trust isn`t straightforward. US Legal Forms delivers a huge number of type layouts, like the Maine Mortgage Deed, which are written to meet federal and state requirements.

In case you are already familiar with US Legal Forms web site and possess an account, merely log in. After that, you are able to down load the Maine Mortgage Deed format.

Unless you have an accounts and would like to begin using US Legal Forms, adopt these measures:

- Discover the type you require and ensure it is for your right city/region.

- Use the Review switch to examine the form.

- Look at the description to ensure that you have chosen the appropriate type.

- When the type isn`t what you are trying to find, make use of the Look for discipline to find the type that meets your requirements and requirements.

- Once you find the right type, click Get now.

- Choose the rates prepare you would like, fill out the specified information and facts to produce your bank account, and purchase an order making use of your PayPal or Visa or Mastercard.

- Decide on a practical file format and down load your duplicate.

Discover all of the document layouts you might have bought in the My Forms menus. You can aquire a additional duplicate of Maine Mortgage Deed anytime, if required. Just go through the necessary type to down load or print the document format.

Use US Legal Forms, by far the most substantial selection of lawful varieties, to save time and steer clear of faults. The assistance delivers appropriately created lawful document layouts which can be used for a variety of functions. Create an account on US Legal Forms and begin producing your lifestyle easier.

Form popularity

FAQ

A deed is a signed legal document that transfers ownership of an asset to a new owner. Deeds are most commonly used to transfer ownership of property or vehicles between two parties. The purpose of a deed is to transfer a title, the legal ownership of a property or asset, from one person or company to another.

One of the necessary parts is the granting clause, also known as the words of conveyance. They will describe exactly what rights the grantee is receiving in the deed, and whether the grantee is taking title to the property with another person.

Essential Elements of a Valid Deed Use of the proper statutory form of deed. Competent parties: grantor and grantee. Words of grant or operative words of conveyance. Sufficient description of the property to be conveyed. Proper execution. Delivery and acceptance.

Current Owner and New Owner Information. Maine deeds must identify by name the current property owner (the grantor) transferring real estate. A deed must also state the new owner's name and address?including street and number, municipality, and state.

A property deed is a legal document that transfers the ownership of real estate from a seller to a buyer. For a deed to be legal it must state the name of the buyer and the seller, describe the property that is being transferred, and include the signature of the party that is transferring the property.

Deeds also contain certain historical information and specialized legal clauses necessary to validate the deed. There are also several types of deeds, each providing the owner of the land with a particular type of interest. Commonly used deeds in Maine are the quitclaim deed, warranty deed, and release deed.

To put simply, the deed is the legal document that proves who holds title to a property, while a mortgage is an agreement between a financial lender and borrower to repay the amount borrowed to purchase a home.

The fee for recording a document is $22 for the first page -this includes a $3 surcharge (Maine Government & municipalities are exempt from surcharge, so the first page is $19) and $2 for each additional page.