Title: Understanding Maine Sample Letter for Debtor Examination & Its Types Introduction: Maine Sample Letters for Debtor Examination play a crucial role in the legal process of collecting outstanding debts. These letters are sent to debtors to summon them for an examination, during which their financial status and assets are assessed. This comprehensive guide will shed light on the importance and different types of Maine Sample Letters for Debtor Examination. 1. Key Elements of a Maine Sample Letter for Debtor Examination: — Purpose: The primary objective of this letter is to inform the debtor that they must appear for an examination to ascertain their ability to repay the debt or uncover any hidden assets. — Legal Authority: It should clearly state the applicable state laws entitling creditors to request a debtor's examination. — Information Requested: The letter should specify the documents and information the debtor needs to bring, such as financial records, bank statements, tax returns, and details of all assets and liabilities. — Examination Date, Time, and Venue: The letter must provide the debtor with specific details concerning the date, time, and location of the examination. — Consequences of Non-compliance: The consequences of failing to comply with the examination order, such as potential penalties or fines, should be clearly outlined. — Instructions and Contact Details: The letter should include guidance on how to confirm attendance, contact relevant parties, and seek further information or clarification. 2. Types of Maine Sample Letters for Debtor Examination: a) Initial Notice Letter: This letter serves as the first official communication sent to debtors, informing them about the upcoming examination process. It outlines the purpose, legal authority, and specifies the necessary documentation required for examination. b) Follow-up Reminder Letter: If a debtor fails to respond or attend the initial examination, a follow-up reminder letter is sent, urging them to comply within a designated timeframe. This letter should emphasize the potential ramifications of non-compliance. c) Subpoena Letter: In more complex cases, where a debtor may be intentionally withholding information, a subpoena letter is issued. This document carries legal weight, compelling the debtor's presence and cooperation during the examination. d) Notice of Rescheduled Examination: Sometimes, due to unforeseen circumstances, an examination may need to be rescheduled. In such cases, a notice is sent to inform the debtor of the updated date, time, and venue. e) Letter to Provide Additional Documentation: If the initial examination reveals incomplete or insufficient documentation, a letter requesting the debtor to provide supplementary records or details may be necessary. Conclusion: Maine Sample Letters for Debtor Examination play a vital role in ensuring fair and thorough debt collection procedures. By adhering to legal guidelines and utilizing the appropriate letter type, creditors can effectively compel debtors to attend examinations, leading to a better understanding of their financial status and ultimately enabling the collection of outstanding debts.

Maine Sample Letter for Debtor Examination

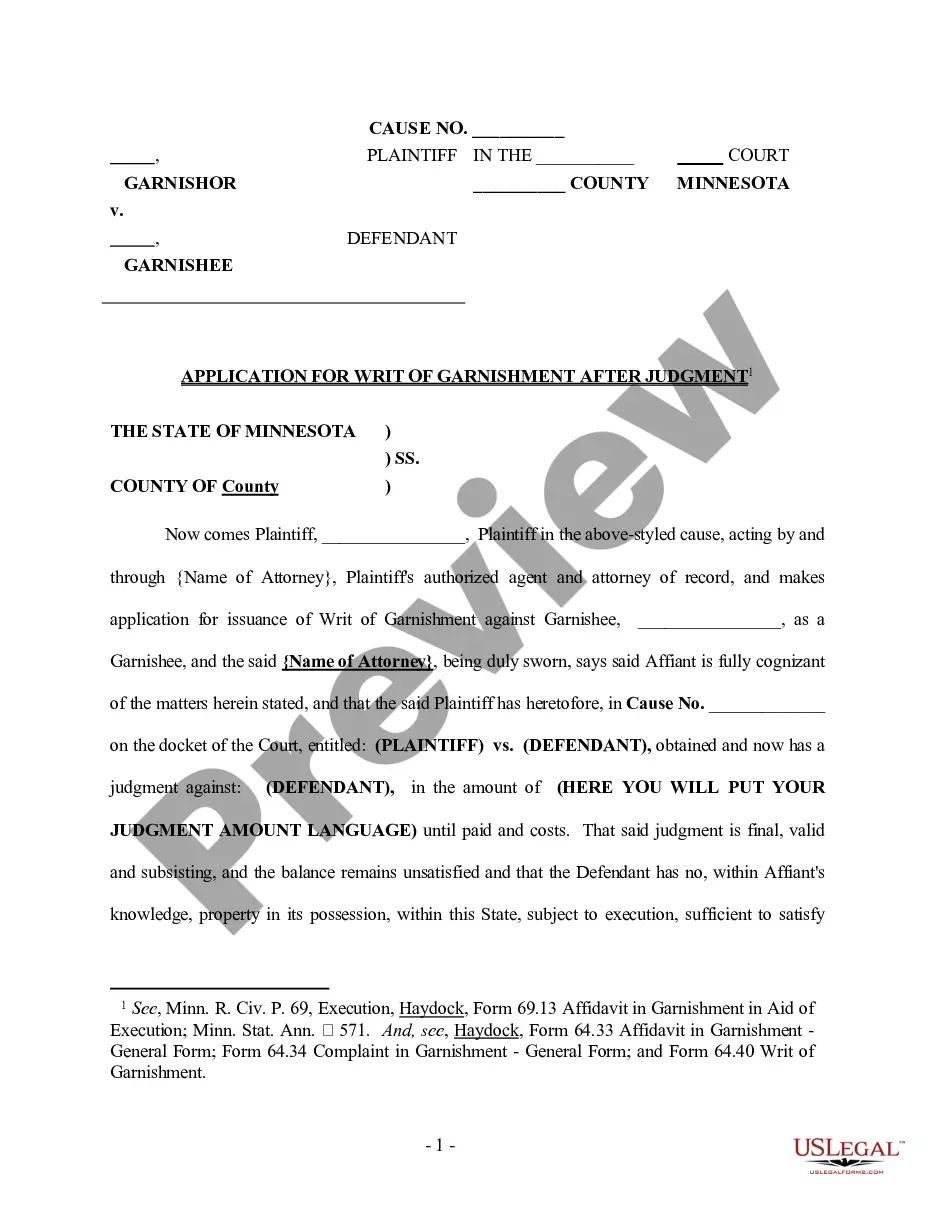

Description

How to fill out Maine Sample Letter For Debtor Examination?

Are you presently inside a situation where you need papers for both business or specific reasons just about every day time? There are tons of authorized record layouts available on the net, but finding types you can trust isn`t simple. US Legal Forms offers thousands of form layouts, like the Maine Sample Letter for Debtor Examination, that happen to be published to meet federal and state specifications.

In case you are previously familiar with US Legal Forms web site and get an account, simply log in. After that, you are able to download the Maine Sample Letter for Debtor Examination template.

If you do not come with an account and need to begin using US Legal Forms, adopt these measures:

- Discover the form you want and make sure it is for the right city/region.

- Make use of the Preview button to examine the shape.

- Read the outline to ensure that you have chosen the proper form.

- When the form isn`t what you`re trying to find, take advantage of the Search area to find the form that meets your needs and specifications.

- Whenever you discover the right form, click Get now.

- Choose the costs program you want, complete the necessary details to generate your money, and pay money for the transaction using your PayPal or charge card.

- Choose a practical data file format and download your duplicate.

Get every one of the record layouts you may have purchased in the My Forms food selection. You can get a more duplicate of Maine Sample Letter for Debtor Examination anytime, if needed. Just click on the necessary form to download or printing the record template.

Use US Legal Forms, one of the most substantial variety of authorized forms, to save time as well as steer clear of faults. The services offers professionally manufactured authorized record layouts which you can use for a selection of reasons. Produce an account on US Legal Forms and begin generating your life a little easier.