Maine Pledge of Personal Property as Collateral Security

Description

As the pledge is for the benefit of both parties, the pledgee is bound to exercise only ordinary care over the pledge. The pledgee has the right of selling the pledge if the pledgor make default in payment at the stipulated time. In the case of a wrongful sale by a pledgee, the pledgor cannot recover the value of the pledge without a tender of the amount due.

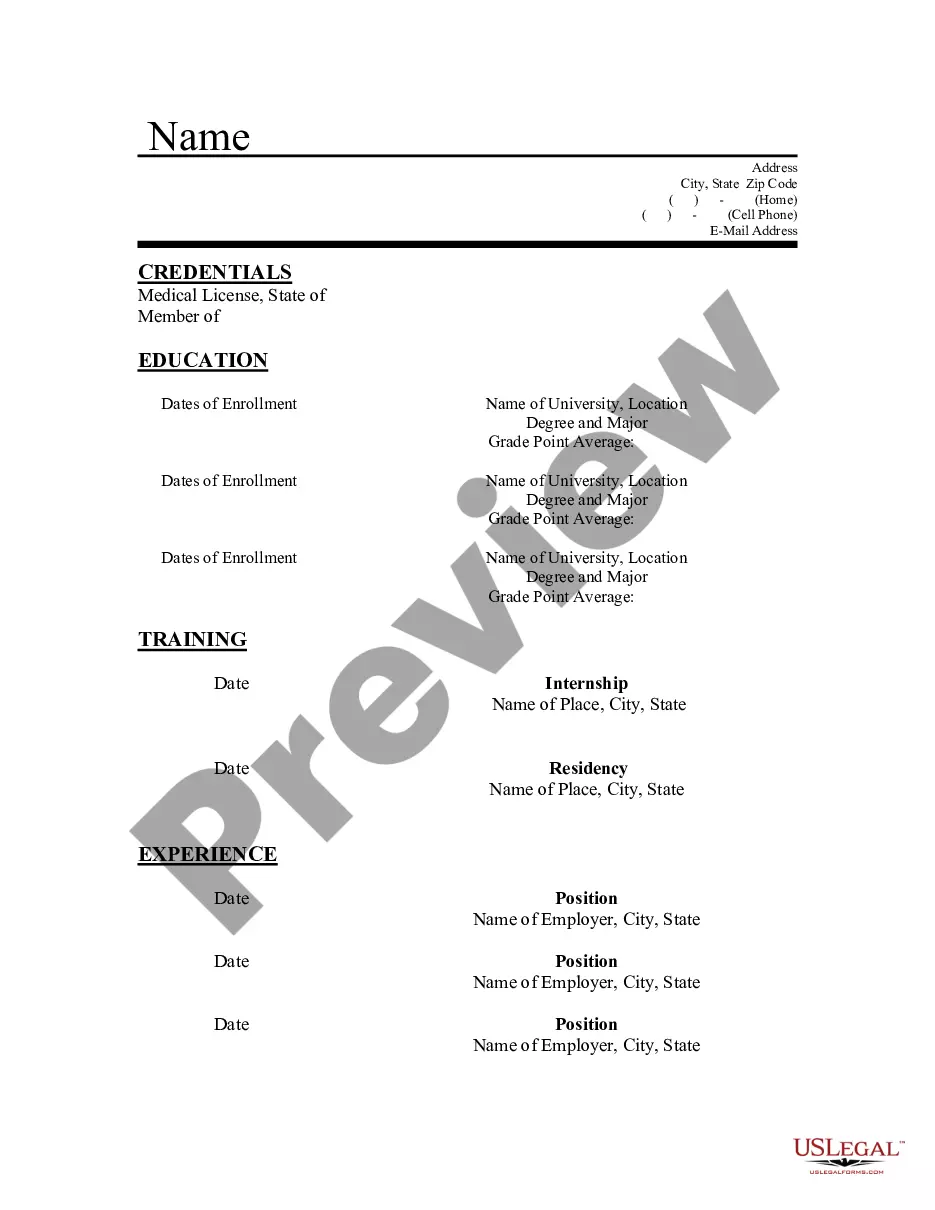

How to fill out Pledge Of Personal Property As Collateral Security?

You can dedicate hours online looking for the proper legal document template that meets the state and federal criteria you require.

US Legal Forms provides thousands of legal forms that have been vetted by experts.

You may easily obtain or create the Maine Pledge of Personal Property as Collateral Security through our service.

If available, use the Review button to examine the document template as well.

- If you currently have a US Legal Forms account, you can Log In and select the Download button.

- Afterward, you can complete, edit, print, or sign the Maine Pledge of Personal Property as Collateral Security.

- Every legal document template you purchase is yours to keep permanently.

- To retrieve an additional copy of a purchased form, visit the My documents section and click the appropriate button.

- If this is your first time using the US Legal Forms website, follow the straightforward instructions outlined below.

- First, ensure that you have selected the correct document template for the county/city of your choice.

- Review the form description to confirm you have chosen the right one.

Form popularity

FAQ

Yes, personal property can be used as collateral under certain conditions. The Maine Pledge of Personal Property as Collateral Security allows individuals to secure loans using their belongings as a promise to repay. This option can be advantageous, providing access to funds while retaining possession of the property. It's essential to understand the implications of using personal property in this manner.

Holding someone's personal property as collateral is not inherently illegal. However, the agreement must comply with state laws, including those in Maine regarding the Pledge of Personal Property as Collateral Security. It's crucial for both parties to understand their rights and responsibilities to avoid potential disputes. Always consult a legal expert to navigate these agreements properly.

A property offered as a security interest is called collateral. It plays a crucial role in lending, providing assurance to lenders about repayment. In the framework of the Maine Pledge of Personal Property as Collateral Security, recognizing the importance of collateral can lead to better lending practices.

To create a security interest in personal property, you must enter into a security agreement with clear terms specifying the collateral. After executing the agreement, you often need to perfect the interest by filing it with the appropriate state office. Utilizing the tools and guidance from USLegalForms can assist you in navigating the process of establishing a Maine Pledge of Personal Property as Collateral Security.

A security interest attaches to collateral when the borrower and lender have entered into an agreement, and the lender has given value and the borrower has rights to the collateral. This attachment is a key component in the process of borrowing. With the Maine Pledge of Personal Property as Collateral Security, having a clear understanding of this timing ensures smooth transactions.

Yes, property that is subject to a security interest is referred to as collateral. This term reflects that the property holds value for the lender in case of default. When utilizing the Maine Pledge of Personal Property as Collateral Security, understanding this term is crucial for both borrowers and lenders.

Yes, property can be used as collateral in various financial arrangements. When you pledge personal property, you provide assurance to lenders or creditors of repayment. In Maine, this is an important aspect of the Maine Pledge of Personal Property as Collateral Security, enhancing trust in financial transactions.

A pledge of personal property as collateral for a debt is commonly referred to as a security interest. This arrangement allows a lender to claim the property if the borrower fails to repay the debt. In the context of the Maine Pledge of Personal Property as Collateral Security, this means you can use your tangible assets to secure borrowing.

Personal property includes items that you own which are not fixed to land, such as furniture, electronics, and jewelry. These tangible assets can serve various purposes, including securing loans, through the Maine Pledge of Personal Property as Collateral Security. By recognizing these items as personal property, you can effectively leverage them for financial transactions.