Maine Sample Letter for Policy on Vehicle Expense Reimbursement

Description

How to fill out Sample Letter For Policy On Vehicle Expense Reimbursement?

Are you presently in the situation where you require documents for both organizational or personal purposes almost every day? There are many authentic document templates available online, but finding reliable ones is not easy.

US Legal Forms provides a vast selection of form templates, such as the Maine Sample Letter for Policy on Vehicle Expense Reimbursement, which are designed to comply with state and federal regulations.

If you are already acquainted with the US Legal Forms website and have an account, simply Log In. After that, you can download the Maine Sample Letter for Policy on Vehicle Expense Reimbursement template.

- Locate the form you are looking for and confirm it is for the correct city/county.

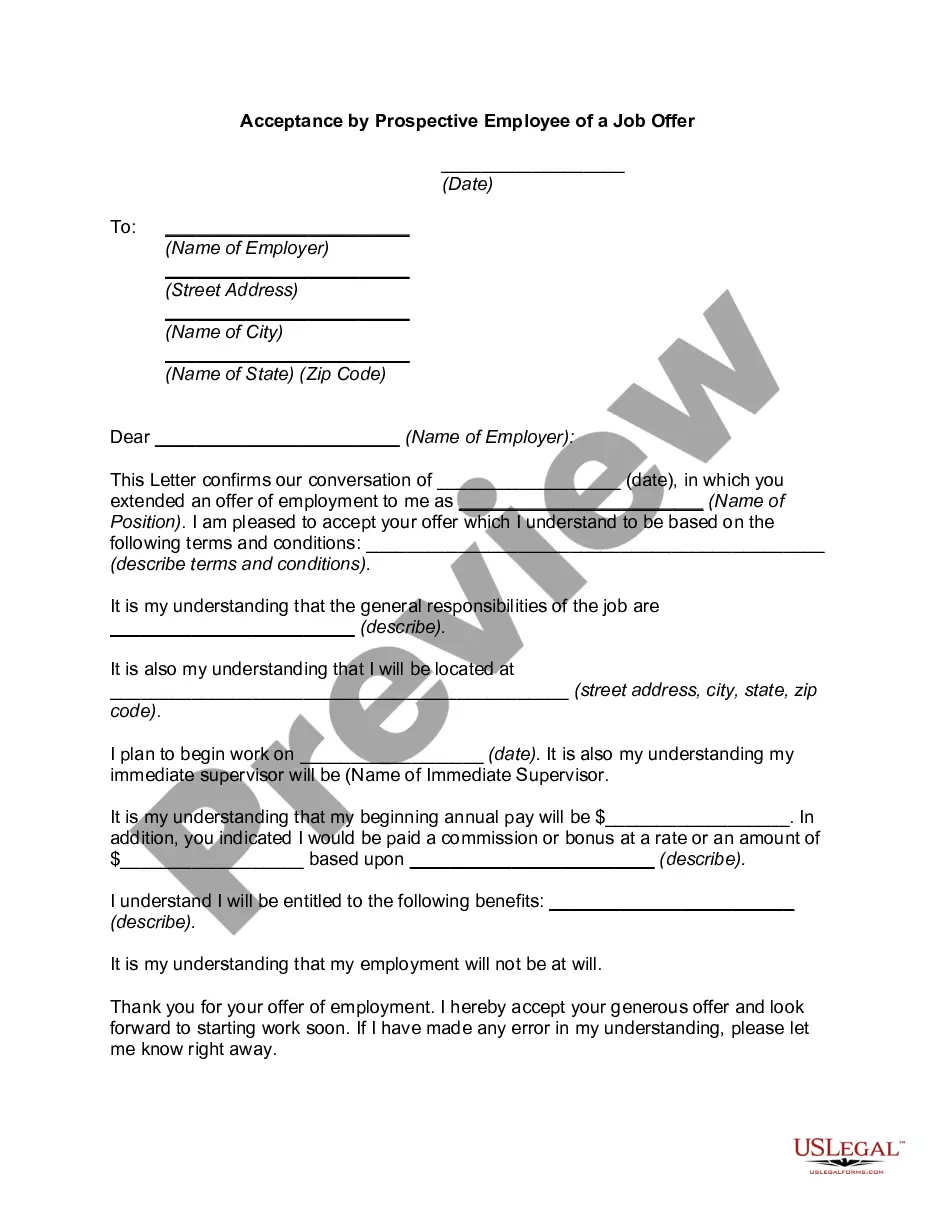

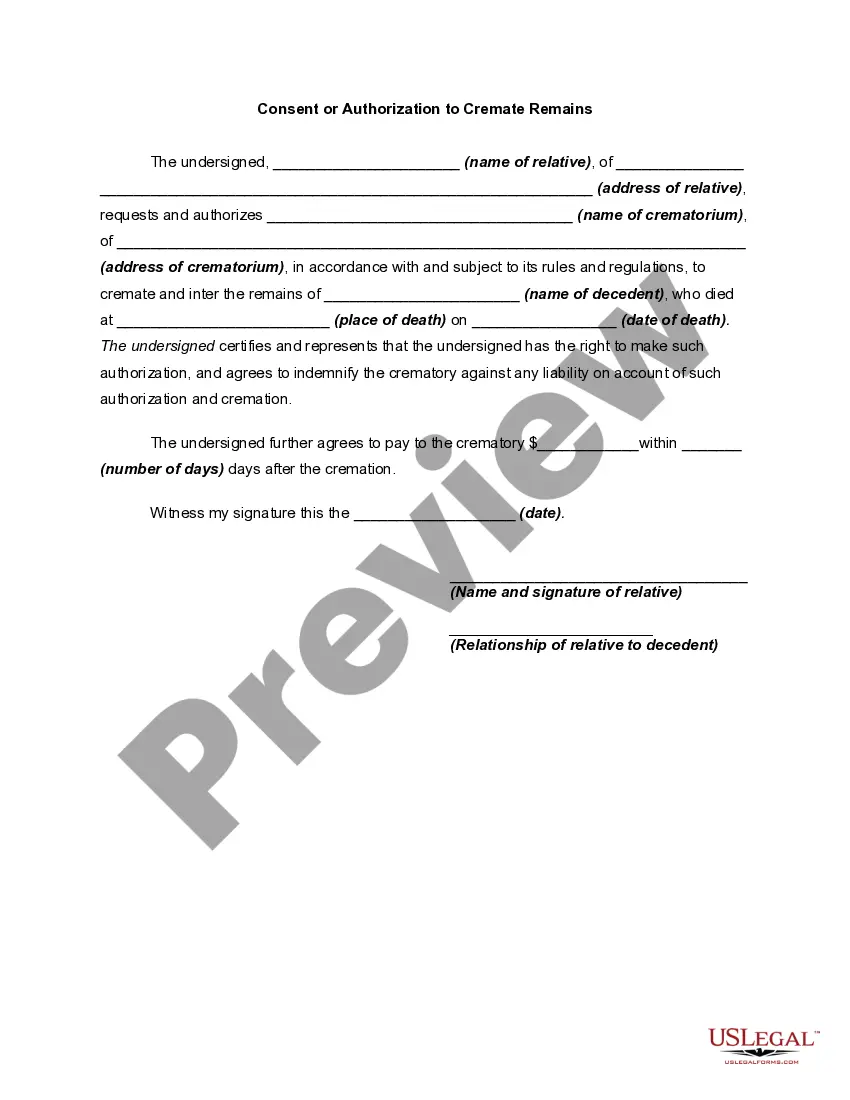

- Use the Preview button to inspect the form.

- Review the details to ensure you have selected the correct form.

- If the form isn’t what you seek, utilize the Search box to find the form that meets your needs and requirements.

- Once you obtain the right form, click Purchase now.

- Choose the pricing plan you prefer, provide the necessary information to create your account, and pay for the order using your PayPal or credit card.

- Select a convenient file format and download your copy.

Form popularity

FAQ

To write a reimbursement request, start with a clear subject line if it's an email or a formal salutation in a letter. Outline the expenses with supporting details and receipts, ensuring you follow any templates provided, such as the Maine Sample Letter for Policy on Vehicle Expense Reimbursement. Remember to thank the recipient for considering your request.

The short form of reimbursement is often represented simply as 'reimb.' This abbreviation can be useful in informal contexts or notes. However, always use the full term when submitting formal requests, like those guided by the Maine Sample Letter for Policy on Vehicle Expense Reimbursement, to maintain clarity.

An example of a reimbursement includes an employee requesting compensation for mileage driven for work-related purposes. In this case, you would detail the miles driven, the rates per mile, and submit the request following a procedure similar to the Maine Sample Letter for Policy on Vehicle Expense Reimbursement. This helps clarify what expenses should be reimbursed.

Writing a reimbursement form requires you to include fields for necessary information such as your name, address, and the details of the expenses. Clearly outline each expense with dates, amounts, and a brief description. You can refer to the Maine Sample Letter for Policy on Vehicle Expense Reimbursement for formatting tips and ensure your form complies with your company’s policies.

When writing a letter asking for reimbursement, begin by clearly stating your purpose in the introduction. Specify the amounts and dates of the expenses incurred, and mention any relevant policies, such as the Maine Sample Letter for Policy on Vehicle Expense Reimbursement. Close the letter by expressing appreciation for their consideration and include your contact information for any questions.

To write a letter for reimbursement of expenses, start by including your contact information and the date at the top. Follow with the recipient's details, and clearly state your request for reimbursement in the opening sentences. Be specific about the expenses, referencing the Maine Sample Letter for Policy on Vehicle Expense Reimbursement as a guide to ensure all necessary details are included.

Submitting expenses for reimbursement typically involves collecting all receipts and completing the necessary forms. Ensure that you double-check the figures and descriptions match your original expense reports. When you follow the Maine Sample Letter for Policy on Vehicle Expense Reimbursement as a guide, it simplifies your submission process and helps avoid potential rejections.

To fill out a reimbursement form effectively, start by entering your name and expense details accurately. List each expense separately, providing clear descriptions and dates. By following the guidelines in the Maine Sample Letter for Policy on Vehicle Expense Reimbursement, you will ensure that your form meets all requirements for approval.

Filling out a reimbursement form involves providing your name, the date of the expense, and a description of the costs incurred. Be precise about the amounts and include any necessary documentation, such as receipts. This process drastically improves when you refer to the Maine Sample Letter for Policy on Vehicle Expense Reimbursement for guidance on acceptable expenses.

To ask for reimbursement, draft a simple letter or email to your supervisor or the finance department. Clearly state the amount and purpose of the reimbursement, referring to your expenses in relation to the Maine Sample Letter for Policy on Vehicle Expense Reimbursement. Attach any supporting documents, such as receipts or forms, to strengthen your request.