Maine Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another

Description

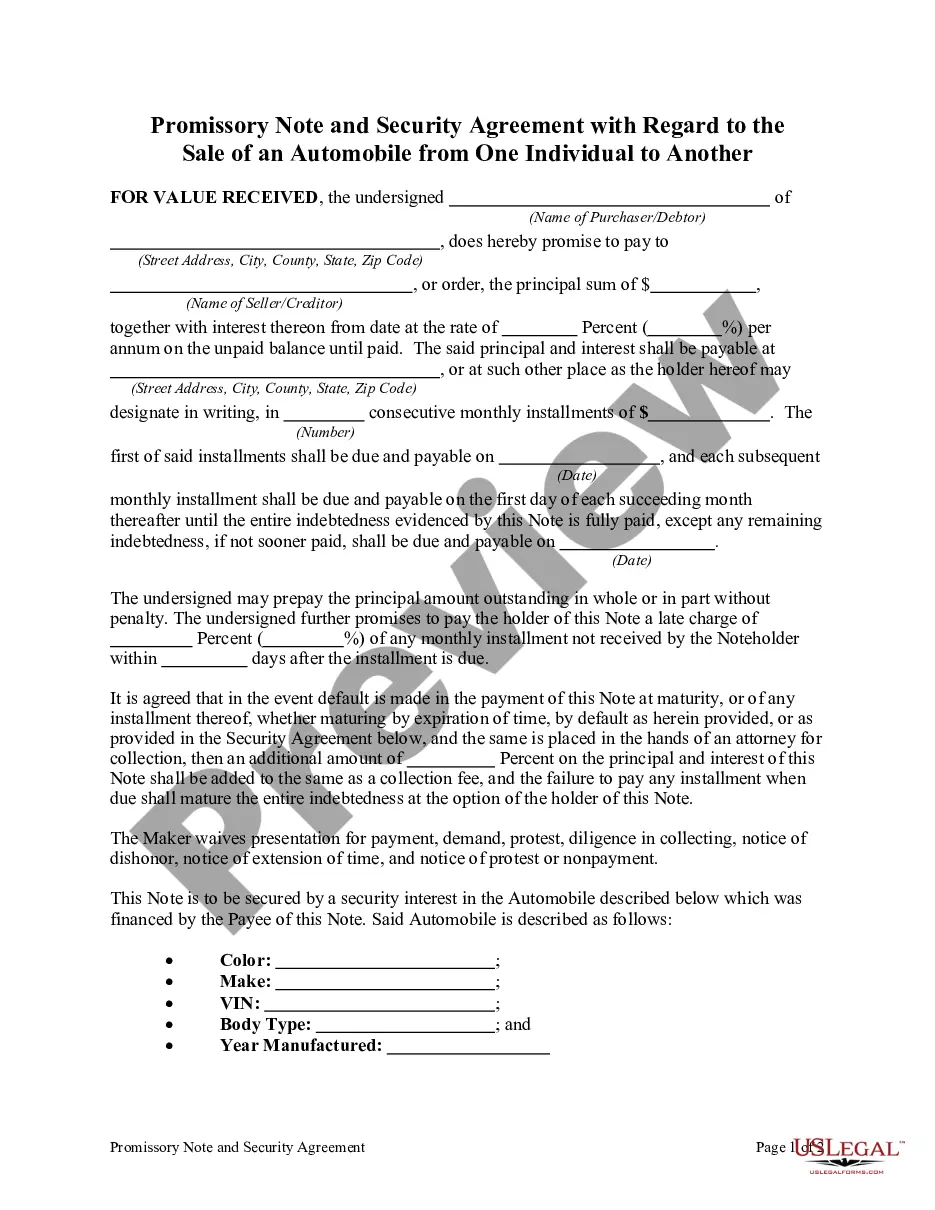

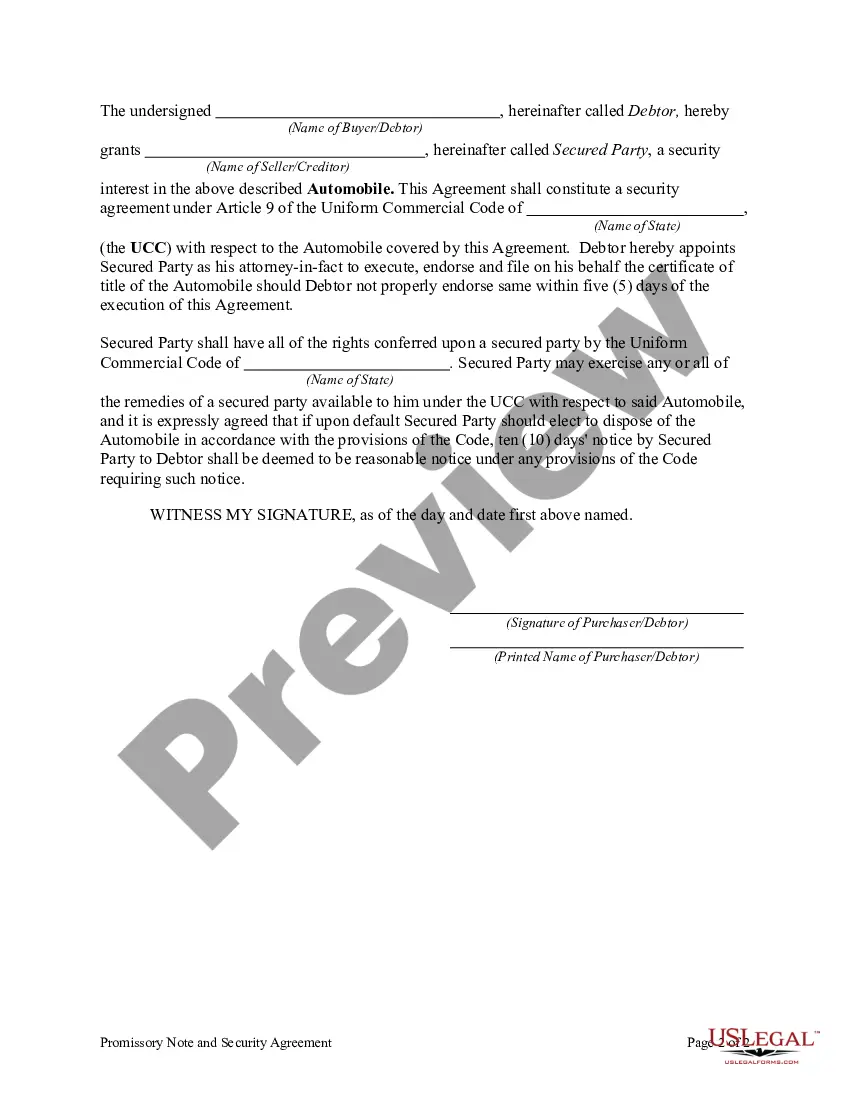

How to fill out Promissory Note And Security Agreement With Regard To The Sale Of An Automobile From One Individual To Another?

Have you found yourself in a circumstance that requires documents for potential organization or particular purposes almost every working day.

There are numerous legal paper templates accessible online, but locating reliable ones is not simple.

US Legal Forms offers thousands of form templates, including the Maine Promissory Note and Security Agreement with Respect to the Sale of an Automobile from One Person to Another, which are crafted to meet state and federal requirements.

Select the pricing plan you prefer, complete the necessary information to create your account, and pay for the order using your PayPal or credit card.

Choose a suitable file format and download your copy.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Maine Promissory Note and Security Agreement with Respect to the Sale of an Automobile from One Person to Another template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it corresponds to your specific city/county.

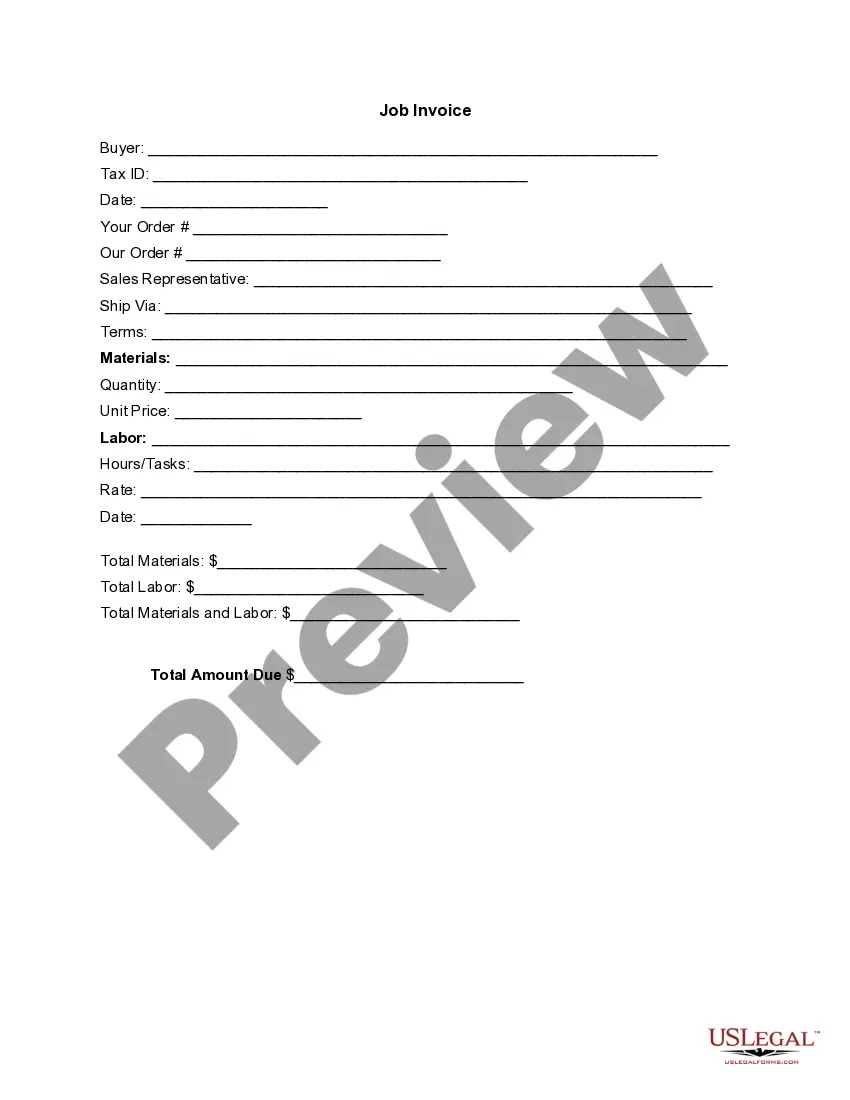

- Use the Preview button to review the form.

- Check the description to make sure you have selected the correct form.

- If the form is not what you are looking for, utilize the Search field to find the form that meets your needs and requirements.

- Once you find the correct form, click Purchase now.

Form popularity

FAQ

In Maine, the transfer of ownership form is the title itself, which needs to be signed by the seller. Additionally, you may want to fill out a bill of sale to accompany the title transfer. If you're using a Maine Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another, this form will help outline any obligations and interests associated with the sale.

The best way to gift a vehicle is to ensure all legal documents are in order, including a title transfer and a bill of sale. Consider drafting a Maine Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another to establish clear terms. This organized approach helps avoid potential disputes and ensures both parties understand the transaction.

To gift a car to a family member in Maine, gather the vehicle's title and complete a bill of sale. Both you and the recipient should sign these documents to establish ownership transfer. Utilizing a Maine Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another can help document any financial aspects, even if you are gifting the vehicle.

When gifting a car, the IRS allows you to gift up to $15,000 per recipient without incurring gift tax. If the value exceeds this limit, you may need to file a gift tax return. If you plan to document this transfer alongside a Maine Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another, it is essential to keep these rules in mind.

Yes, a bill of sale is necessary to transfer title in Maine. This document serves as a record of the sale and protects both the buyer and seller. When creating a Maine Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another, including a bill of sale is highly recommended for smooth processing at the DMV.

To transfer ownership of a car in Maine, you need to complete the appropriate paperwork. You will typically require a signed title, a bill of sale, and a Maine Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another, especially if financing is involved. After gathering these documents, visit your local DMV office to complete the transfer.

In Maine, the statute of limitations on a promissory note is six years. This means you have six years from the time the note becomes due to file a lawsuit for collection. It is essential to understand this time frame when dealing with a Maine Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another. Being aware of this limitation helps ensure you take the right actions within the allowable time.

While a promissory note provides a legal framework for securing debts, it does have limitations. For instance, a Maine Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another cannot enforce certain rights if the borrower declares bankruptcy. Additionally, the note requires clear terms regarding payment schedules, interest rates, and penalties to be enforceable. Utilizing uslegalforms can simplify creating precise and effective promissory notes to ensure compliance with Maine law.

In Maine, a creditor can generally pursue debt collection for six years after the debt is incurred. This timeline applies to debts documented under a Maine Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another. It is vital to understand this limitation, as debts older than this timeframe may become uncollectible, impacting your financial planning.

In Maine, vehicle owners must ensure that their license plate is illuminated by a working light, making it visible at night. Compliance with this regulation is crucial for all automobiles, including those sold under a Maine Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another. Ensuring that both the vehicle and its associated documentation meet state requirements can help smooth the transaction process.