A lactation consultant is a healthcare provider recognized as having expertise in the fields of human lactation and breastfeeding

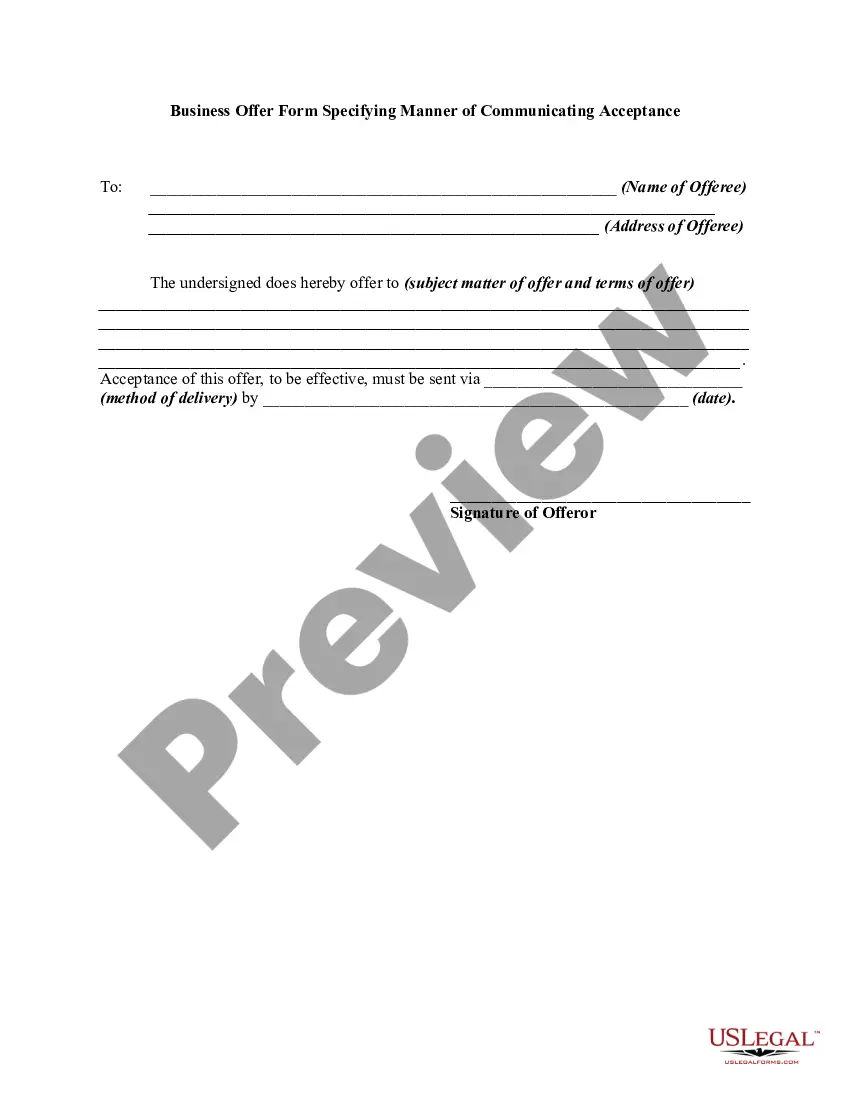

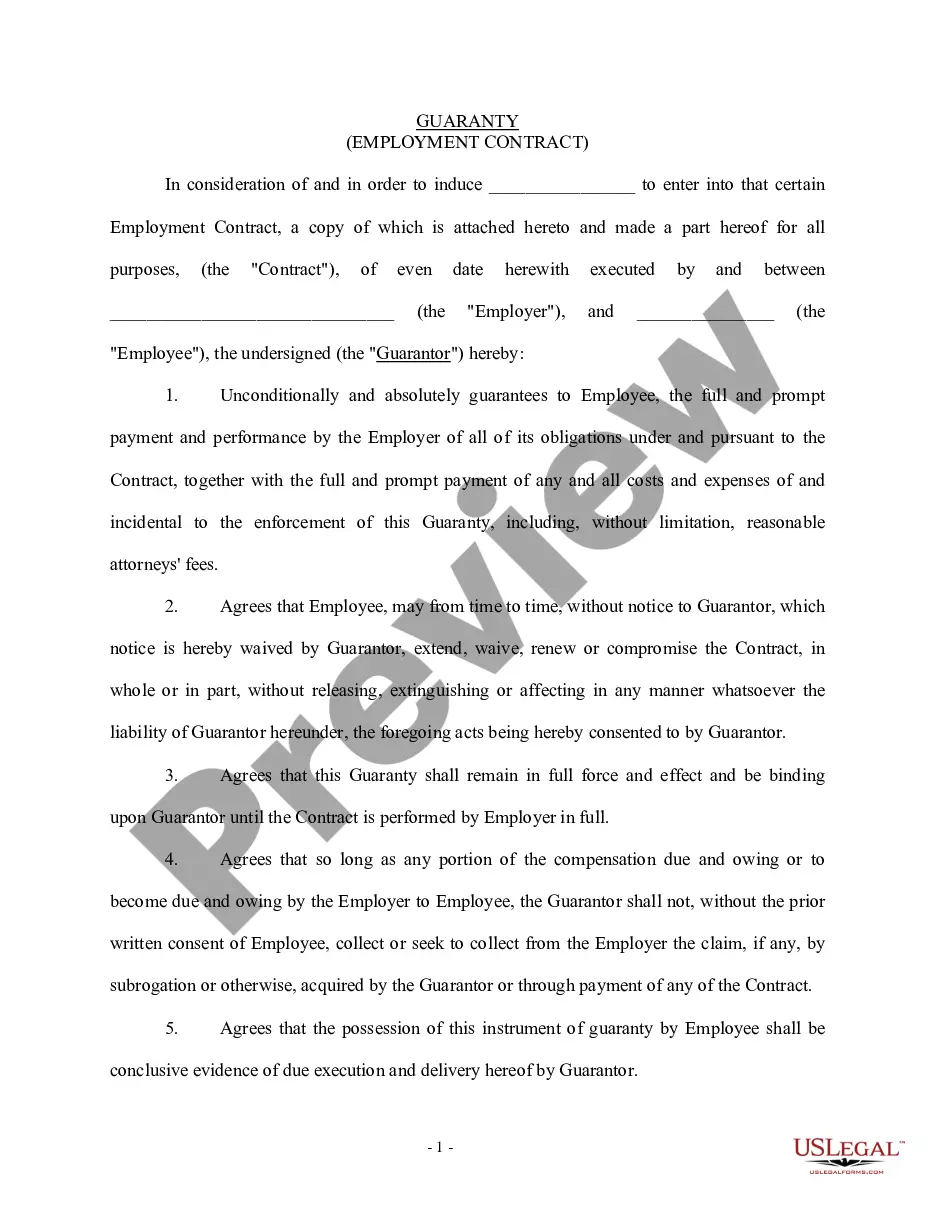

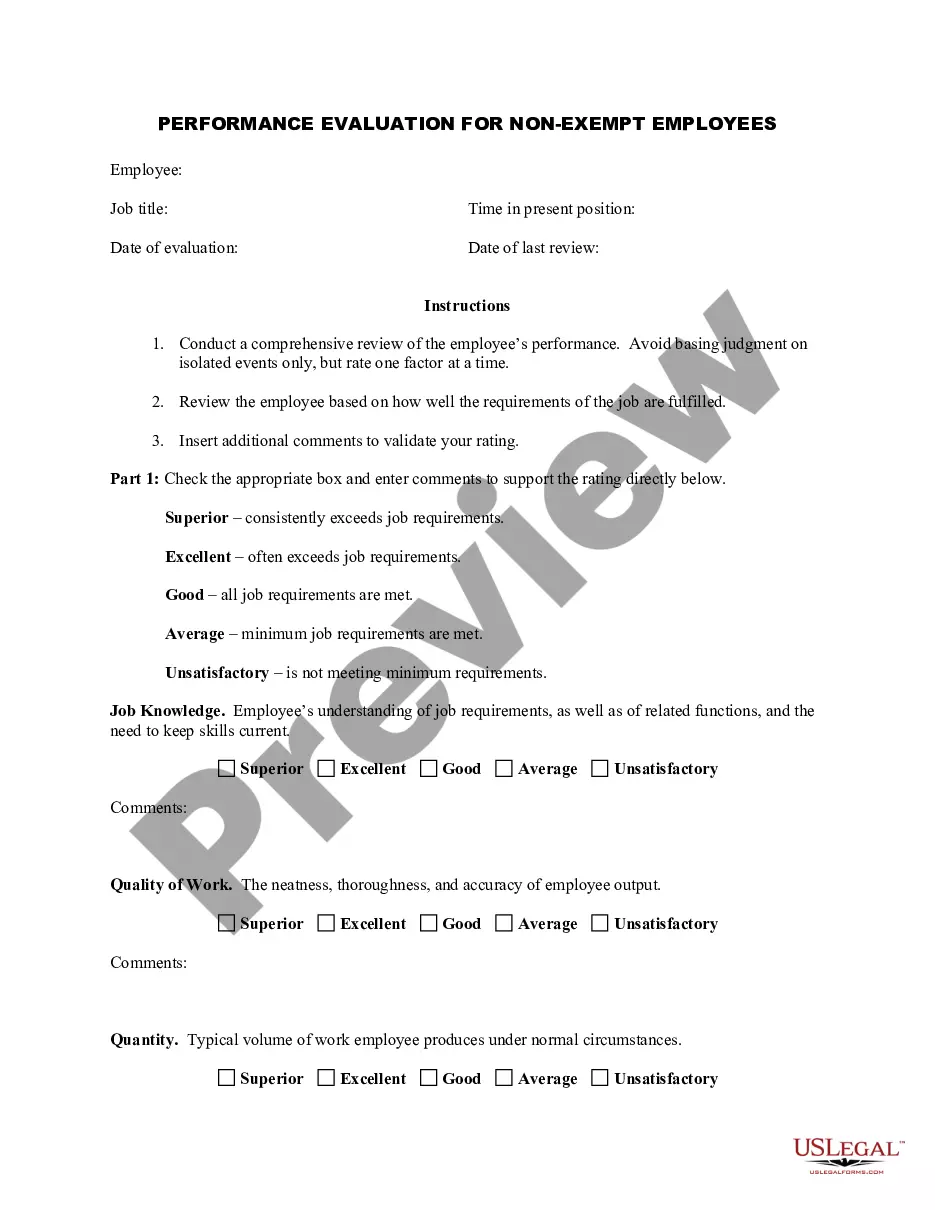

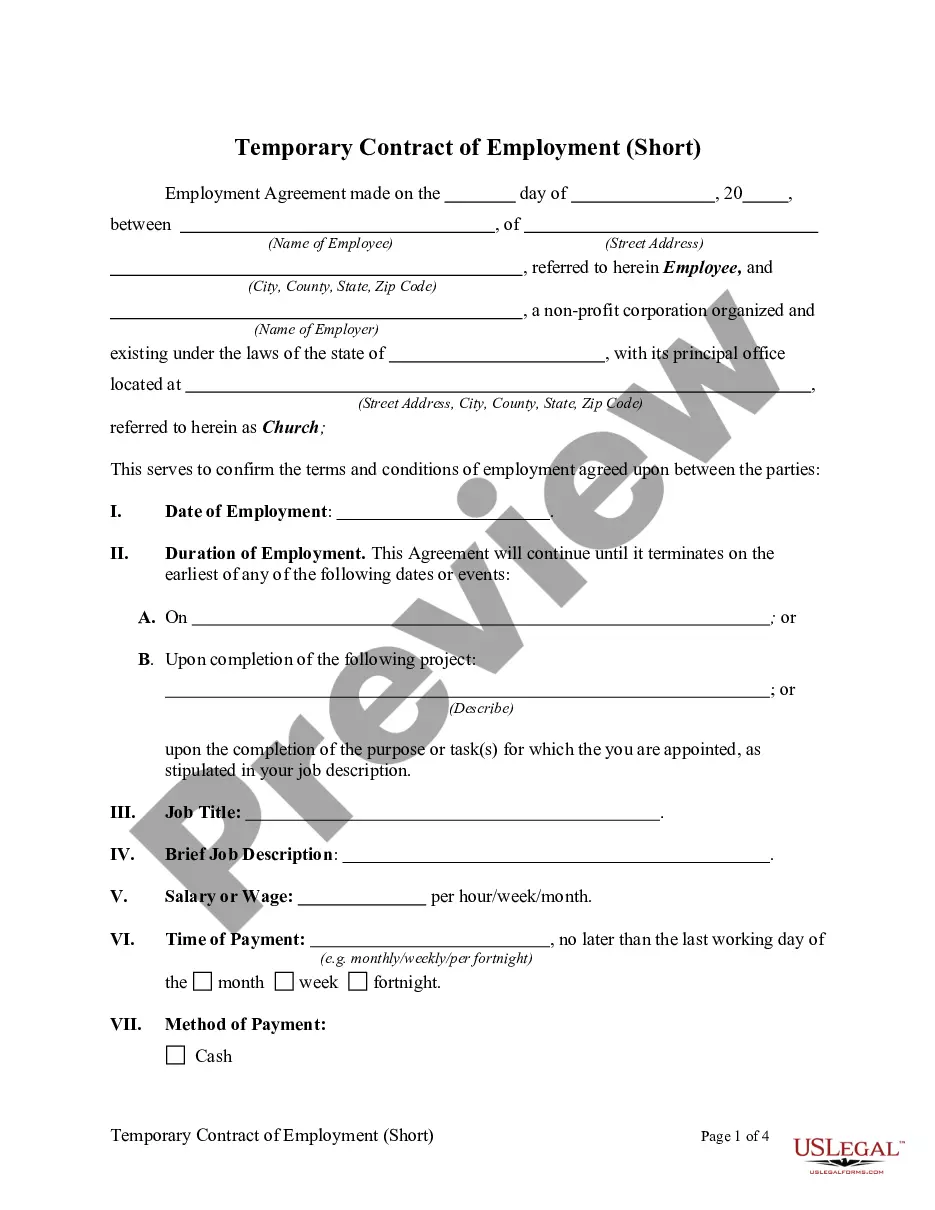

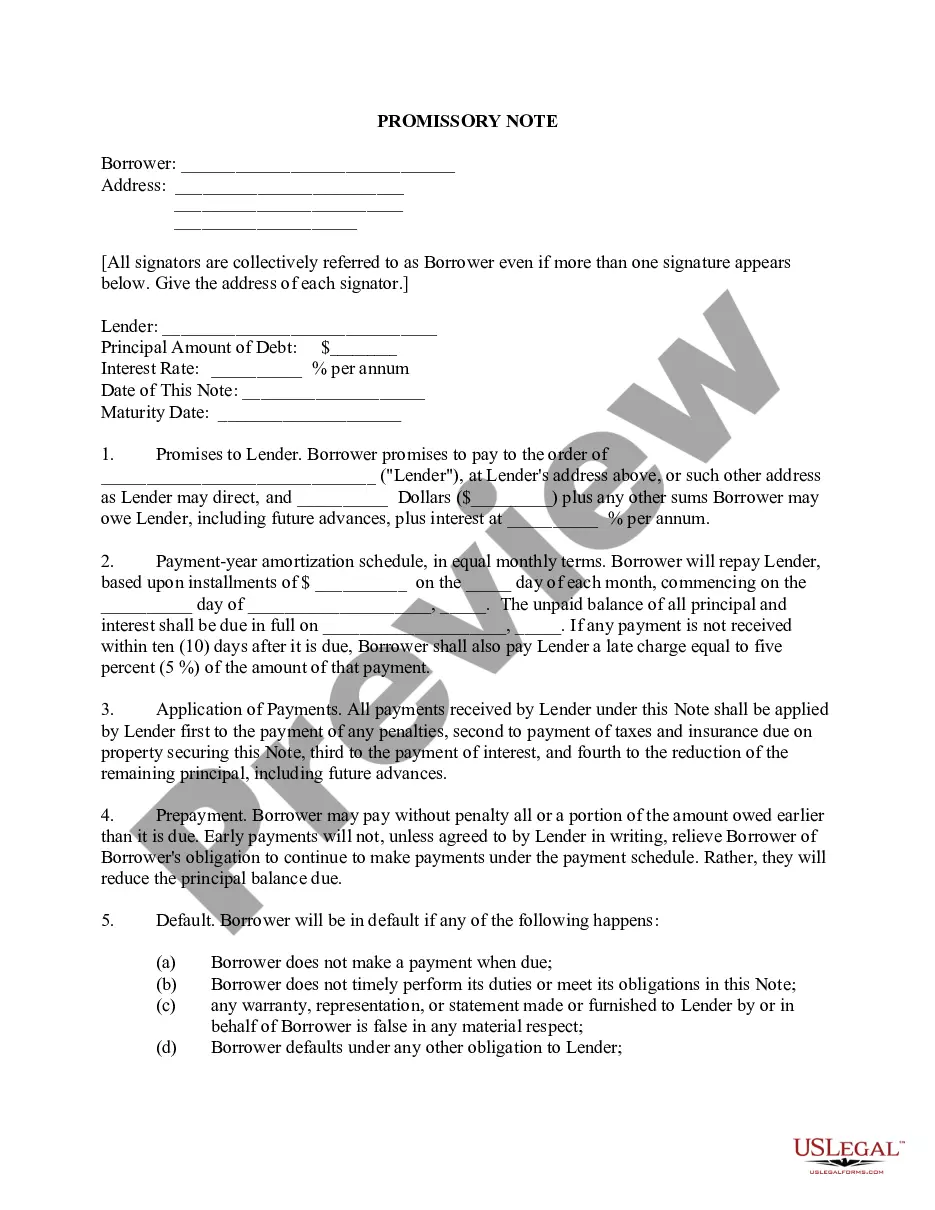

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Maine Irrevocable Trust Agreement for the Benefit of Spouse, Children and Grandchildren is a legally binding document that establishes a trust to safeguard and manage assets for the benefit of one's loved ones. This type of trust ensures that the granter's spouse, children, and grandchildren are financially protected and provided for according to their specific needs and circumstances. Key benefits of a Maine Irrevocable Trust Agreement for the Benefit of Spouse, Children and Grandchildren are asset protection, estate tax planning, and control over the distribution of assets. By designating property and funds to be held within the trust, the granter can shield these assets from potential creditors or legal claims. Additionally, this trust structure can help minimize estate taxes by removing the assets from the granter's taxable estate. There are several types of Irrevocable Trust Agreements within the Maine jurisdiction that can be tailored to a granter's unique goals and requirements. Some common variations include: 1. Testamentary Trust: This type of trust becomes effective upon the granter's death and allows for the distribution of assets to the spouse, children, and grandchildren according to the granter's predetermined instructions specified in the trust agreement. 2. Special Needs Trust: Created to provide for a disabled beneficiary, this trust ensures that individuals with special needs can receive financial support without jeopardizing their eligibility for government assistance. It allows the beneficiary to access funds while maintaining eligibility for programs such as Medicaid or Supplemental Security Income (SSI). 3. Generation-Skipping Trust: Also known as a dynasty trust, this type of trust enables the granter to transfer assets to multiple generations, providing for the spouse, children, and grandchildren in perpetuity. By bypassing the immediate children and distributing assets directly to grandchildren, this trust may benefit from certain tax advantages and protect assets from future estate taxes. 4. Discretionary Trust: This trust grants the trustee discretion over the distribution of assets to the beneficiaries. The trustee, who is often a trusted individual or professional entity, makes decisions based on the specific needs and circumstances of the beneficiaries. When considering a Maine Irrevocable Trust Agreement for the Benefit of Spouse, Children, and Grandchildren, it is crucial to consult with an experienced estate planning attorney to draft a comprehensive and legally sound trust agreement that aligns with the granter's intentions and protects their loved ones' financial well-being.